Discover more from Fintech Radar

Break Down #6: The Future Of Payment Initiation

Payment initiation hasn't been the game-changer many thought it'd be. So what's the future look like for it?

Hi, FR fam! I hope you’ve all had a great start to the week.

Yes, we’re back with another ‘break down’ for you all. This week, I’ll be going deep down into the fintech rabbit hole that is payment invitations services (PIS). So hold on to your pen protectors because this is going to be some serious fintech nerd talk.

As always, if you like what I’m doing here at Fintech Radar, don’t forget to share it with a fellow fintech nerd 🤓 Remember, sharing is caring.

Volcanos And Open Banking

When the news of Visa’s plan to acquire Plaid was announced back in early 2020 (yes, it really was that long ago), the fintech thinkboi industrial complex went into overdrive. In the space of a few short days, you couldn’t throw a proverbial stone without hitting a newsletter that broken down why Visa was diving into the world of open banking.

The conventional wisdom that emerged from the plethora of coverage about the acquisition was that this was Visa playing some clever defence. Specifically, by acquiring the company that was emerging as a leader in the highly competitive US open banking segment, they’d be able to neutralise a looming existential threat.

However, the threat that open banking poses to the card schemes is not centred around data, but instead, it hits much closer to home. As the now-infamous volcano drawing in the DOJ’s antitrust lawsuit that ended up scuttling the acquisition illustrated, when you look below the surface, there is a range of other services that open banking providers could offer (and already do in some markets) that go well beyond data aggregation. In the case of the card schemes, the real threat comes from the potential these open banking players have to disintermediate them by offering a payment rail that bypasses them completely and works on an account-to-account basis.

Obviously, this isn’t a new idea. Payment initiation services (PIS) have been around for a while. If you’re a fintech nerd in the UK, you’ve likely initiated a payment (or at least been exposed to it) in a fintech app. While in other markets, you can use a screen scrapping version that allows you to initiate a transaction directly from your bank account.1 In many ways, the future of payments that schemes are concerned about is already here.

“So when disintermediation?” I hear you as ask.

The better question is — “why not yet?” After all, PIS has been available in the UK for over two years via open banking. While in other markets, it’s available through screen scraping. One answer might be that it’s just a matter of time before we see more use cases emerge and consumers shifting in droves to PIS. Another view might be that it’ll be the method used for a narrow set of use cases — much like a direct debit is currently used. Both might be correct.

Having said this, it might be the case that we’re thinking about PIS in the wrong way. Maybe, trying to build a payment rail on a data rail isn’t the best way to go about it — but I’ll come back to this point a little further in the piece — or it’s just not a great way to pay.

Is PIS An Existential Risk Or Just a Crap Way To Send Money?

If you’re a reader of FR, you’ll probably know I’m a PIS bear. To be honest, the current iterations of PIS are underwhelming from both a consumer (“Are they really asking me to log into my bank account?”) and developer perspective. To understand why it’s such a bad experience, it’s worth us taking a minute to understand how PIS works.

Regardless of whether you’re in a market where PIS is offered natively through an open banking regime or a whether it’s done through screen scraping, the flow is usually the same. It usually goes something like this: the customer starts by authenticating their banking credentials in a third-party app’s environment, and they then punch in the amount they want to send. A transaction is queued up at the bank, and off it goes through the local payment pipe to its recipient. In markets like the UK, this is done on a real-time payment rail (Faster Payments).

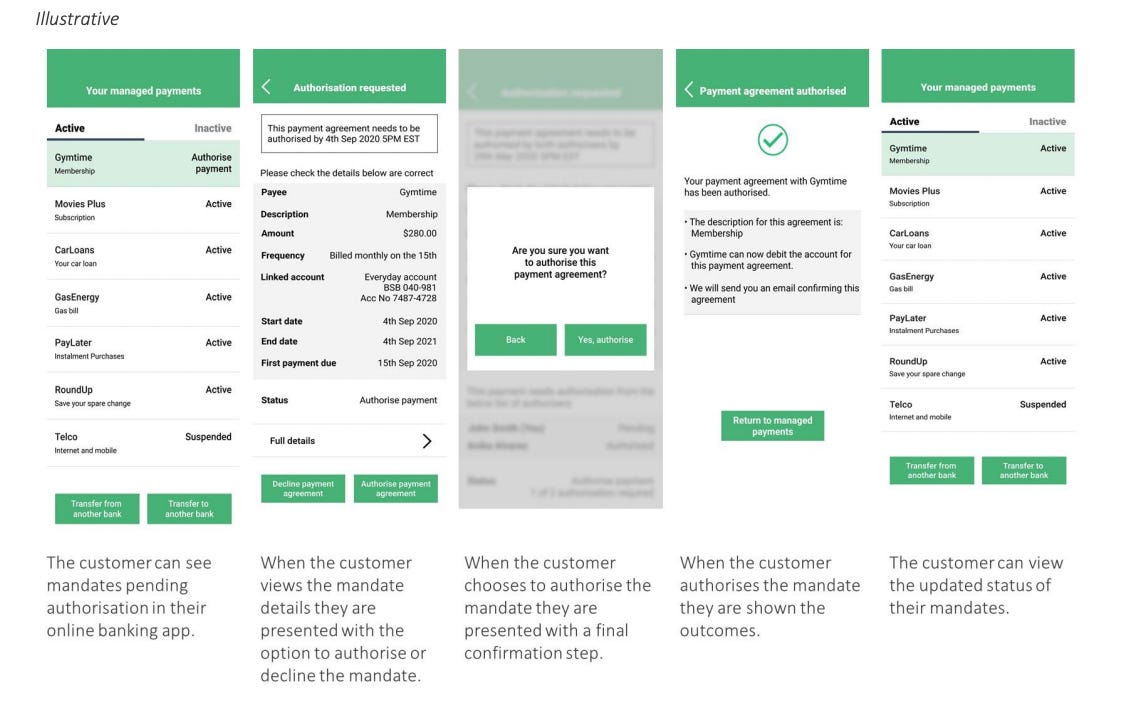

To get a better sense of how this looks from a consumer’s perspective, here’s an example of a user journey using Tink’s PIS product.2

It doesn’t take much to tell this isn’t exactly the best user experience. The issue isn’t with the infrastructure providers; they’re just working with what they have access to. The real issue here is that, fundamentally, PIS is a messaging layer that sits on a payment layer.

So what’s the issue? In theory, this is a great way to open up access to payments in a contextual way — after all, customers just want to move money from their bank account to a merchant or fintech app, and PIS allows you to do this. Inelegantly, but it does the job.

However, if you’ve ever used a PIS service, the experience feels janky and, well, just a little out of place. The typical reaction to this is that “it’s just a UX/UI issue that’ll be solved”. However, I think it’s a more fundamental issue that comes back to PIS trying to be a payment layer that sits on what is fundamentally a data layer.

The obvious question is, why is PIS being done via open banking and not natively on a payment rail? Great question! The answer being… well, there really isn’t a great answer.

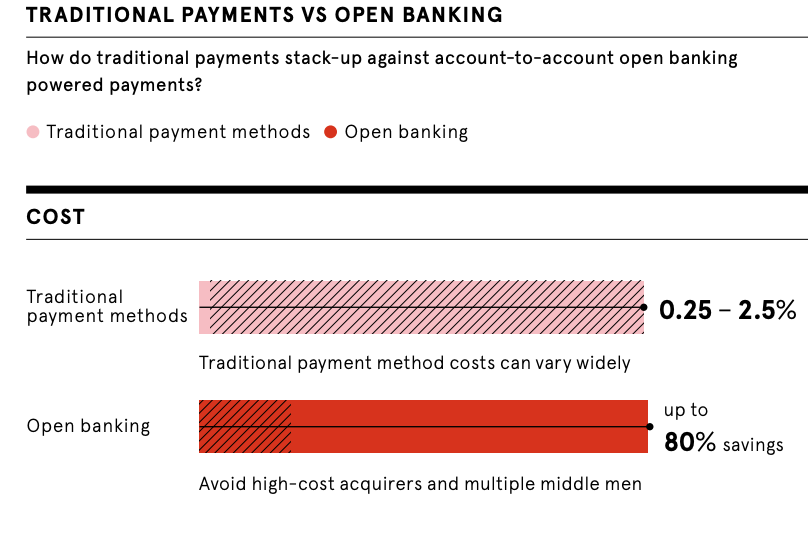

If you look at markets where PIS is mandated via a regulation-driven open banking regime (most notably the UK and EU), the answer tends to be symmetry. More specifically, if you can ‘read’ data, you should be able to ‘write’ data too. While if you read any of the collateral provided by the PIS providers, it usually is geared around savings. For example, according to Vyne (an account-to-account payment provider), it’s up to 80% cheaper for a retailer to receive a payment via account-to-account open banking.

To be fair, the issue here isn’t that payment initiation doesn't work or that it isn’t cheaper — it works (well, sort of), and it is cheaper — it’s that building it on a data layer doesn’t make a lot of sense. It makes for a bad experience that, in my opinion, diminishes trust in open banking. Yes, it’s actually that bad an experience.

Now before you accuse me of being an anti-open banking truther, the issue I’m really pointing out is a design flaw that is inherent when you try to make payments indirectly. At the end of the day, PIS is just a ‘hack’ that, in some jurisdictions, has been turned into a mandated system for value movement.

So why not do open banking on a payment rail? Well, that’s a great idea, and Australia might end up being a great example of how PIS might look in the future.

A Glimpse Of How PIS Might Look In The Future

Australia has been going through a long and arduous process of creating an open data regime (called the Consumer Data Right — or CDR for short) that’s, as you might guess, starting with financial services. Although it’s far from fully implemented — very far in fact3 — the question of payment initiation has been a much-discussed topic from day 1. As we approach a point where most of the initial heavy lifting has been completed, thinking has begun on the future direction of the regime, which obviously incorporates payment initiation.4

As you might expect, the push to extend the CDR to incorporate PIS (or as it’ll likely be called in Australia, ‘action initiation’) it’s very much a case of ‘what’s the point of being able to read data if you can’t write?’ However, unlike in the EU and UK, alongside the formation of the CDR, something equally interesting has been happening from a payments perspective around PIS.

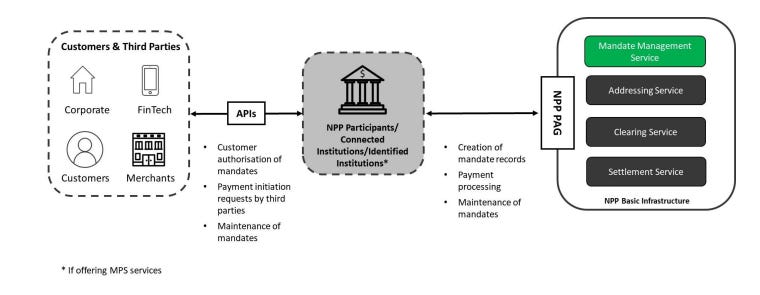

As is the case in most parts of the world, Australia has a real-time payments (RPT) network creatively named the New Payments Platform (NPP). Rolled out in February 2018, the NPP was designed to be a fast retail payments system. The 13 bank consortium (along with the Australian Reserve Bank) set out to build a fast retail payments system that would allow households, businesses and government to make fast, versatile and data-rich payments on a 24/7 basis.

In other markets, we’ve seen RTP networks really focus on the ‘fast’ part. Which totally makes sense; after all, that’s what customers want. Beyond the ‘fast’ part, the NPP in Australia has also begun to stretch beyond this and has been working on ways to expand its utility beyond just offering faster payments. This is where PIS comes into the picture.

The core of the offering, called PayTo (formerly known as Mandated Payments Services), will create a PIS that actually sits natively on a payment rail. It’s a fascinating take on PIS that goes well beyond what we’ve seen in other markets. Not only does this approach natively allow payments to be initiated on an RTP network it also provides for a regime that already has a rules framework, liability and governance model — meaning it all doesn’t need to be reinvented in an open banking environment.5

More importantly, it also provides a better user experience that doesn’t push the UI to the edges but instead unifies the experience. Practically, this will mean customers won’t have to log into their bank account in third-party apps; they need to tick a box to indicate they agree to the payment initiation being begun — and more importantly, this will be the same experience across all payment platforms.

Cool Story, Bro. So What?

PayTo isn’t launching in Australia until 2022, but in many ways, it provides an alternative view on how PIS can be done at an economy-wide level. To be clear, Australia is still working through how ‘action initiation’ will look — meaning we still may end up with some form of PIS that looks like what we’ve seen play out in the UK. Having said this, my guess is that common sense will prevail, and we’ll end up in a world where ‘read access’ is done on one rail (CDR) and ‘write access’ is done on another (PayTo).

Interestingly, beyond being a more efficient, logical and consumer-friendly approach, it also has some interesting strategic implications for open banking data providers. It means being a CDR Accredited Data Recipient (the local nomenclature for being the primary entity accessing data) may not translate into having a distinct advantage in payment initiation — which is what many open banking players have been trying to edge towards in the EU and UK. In the Australian context, it might mean that if you’re hoping to backdoor your way into being a payments company through CDR, that might not work.

More broadly, if you believe Australia is the new baseline for how regulation-led open banking (or, more correctly, CDR) will be done in other markets, the approach being taken with PIS is worth keeping an eye on. After all, the big bet everyone in the open banking space is making is on it being a better way to make payments.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful

For example, in Australia POLi Payments has offered PIS for over 15 years via screen scraping.

Also worth checking out is this blog post from TrueLayer on how they implemented their PIS based payment product, PayDirect.

As of 1 July 2021, all banks were required to be registered as Data Holders. This basically meant they had to provide API endpoints to Accredited Data Recipients (i.e. providers looking to gain access to data). Unfortunately, the list of exemptions granted by the Aussie regulator in charge of accreditation, the ACCC, to the banks is greater than the list of approvals.

The ‘Inquiry into Future Directions for the Consumer Data Right’ final report was recently released and it covers this in detail.

Subscribe to Fintech Radar

Fintech Radar is a weekly missive about all that's happening in the world of fintech.

Maybe you should have a look at BankiFi (https://www.bankifi.com/ ) and their SME focussed solution, that has been deployed by Coop Bank - https://www.incomeing.co.uk/

QUOTE from the Incomeing website>> Reviews "I can bill my customers by text or email promptly, and get paid without fuss direct to my bank. Customers think it's great too, they don't have the faff of entering my bank details. Once I'd registered, billing customers is so easy. Just a text from me, and a couple of clicks from them and the money is already in my bank"

PS - yes, I work for BankiFi in Australia. And you're quite right with your Aussie commentary - well done!