Discover more from Fintech Radar

Issue #42: The Dollhouse Fallacy, BharatPe Secures The Bag And Atomico's State Of European Tech Shows Fintech Is Still On Top

👋 Hi, FR fam. I hope you’ve all had a great week.

As always, the fintech industry has been keeping busy with more funding rounds and all the usual craziness. So let’s get straight to it.

🚨 Don’t forget about the FR Jobs Board. If you have a job opening at your company you’d like listed, this is the last week you'll be able to have it added for FREE. As always, respond to this email with a link to the role/s and I'll add them to the site for you.

Here are some new roles added to the FR Jobs Board this week you should check out:

The Preezze team are hiring here, there and everywhere. Check out all their job openings HERE.

Team Chipper Cash are looking for some engineering talent. You can find the roles they're hiring for HERE.

🏦 The Dollhouse Fallacy

It’s interesting speaking to people who work at banks (or other financial services institutions, for that matter) and hearing how they conceptualise fintech startups. In many cases, I’ve found that they come to the conversation with the mental model that fintech startups are smaller versions of banks. This naturally leads them down the path of talking about the issues banks face, their business model, and why fintech startup X will never reach the scale of a bank.

In many ways, I understand the logic. It looks like and feels like what a bank does. After all, the bank has an app, the startup has an app… and so the logic builds up into fintech startup = smaller version of a bank. Having said this, in many instances, it totally misunderstands what a fintech startup is trying to do.

In Eric Ries’ book, The Lean Startup, he refers to this as the ‘Dollhouse Fallacy.’ Put simply; it’s the idea that a startup is not simply a ‘dollhouse’ version of a big company — in fact, a startup is a completely different beast altogether. In the Lean Startup context, Ries illustrates how this fallacy can impacts what a startup optimises for in the early days. However, the same thinking applies equally in the context of how we should be thinking about fintech startups vs. incumbent FSIs.

Let me illustrate with a tweet I posted last week about the huge discrepancy in headcount between Chime and Australia’s largest bank, CBA.

It was interesting seeing how people reacted to what was clearly an unfair (but relevant) comparison. A few people noted how this was an apples and oranges comparison — which it clearly was. It was meant to be an “unfair” comparison to illustrate how different the fundamental starting point between fintech startups and incumbent banks really is. More specifically, whether that’s abstracting the licensing part away through partnering, dramatically lowering the cost to serve, or finding more cost-effective ways to acquire customers, it’s evident we’re not seeing a miniaturized version of a bank develop as the model. Instead, we see something new emerge.

It’s intellectually easier to adopt the dollhouse approach to categorize fintech startups because they feel so very similar. In many ways, the best fintech products feel familiar, not in a skeuomorphic way, but in the sense that they bring some level of familiarity to the interaction. However, to say that Transferwise is just a smaller version of Western Union or Robinhood is just a shrunk-down version of TD Ameritrade clearly misunderstands how these businesses have disrupted their respective industries. The difference can, in fact, feel subtle, but it’s clearly resulting in a new way of interacting with the financial system.

📣 The News Grab Bag

Marcus is back in the UK ◌ Apparently, MAS is thinking about how they regulate BNPL ◌ Bitcoin secured ($1.5bn worth to be exact) ◌ The billion-dollar plan to kill credit cards ◌ US data aggregators want to be regulated by the CFPB ◌ FT Partners is looking to launch a $400m SPAC ◌ AmazonCoin? ◌ The rise and spectacular fall of Arthur Hayes ◌ Robinhood: a UX crisis management case study ◌ The top fintech startups in China are…

📈 Notable Funding Announcements

Last was a super slow week for fintech funding announcements with ‘only’ $1.1bn in funding announcements across 43 deals.

🛒 BharatPe Lands $108m In Fresh Funding →

Indian fintech startup, BharatPe last week announced their $108m Series D round of funding (which they actually closed out in December of last year). Coatue Management led the latest round with participation from a who’s who of fintech investors — Ribbit Capital, Insight Partners, Steadview Capital, Beenext, Amplo, and Sequoia Capital.

🤓 My Take: When describing the Chinese fintech market to those who have never been before, I commonly invoke the term “China Scale.” This refers to how you always have to reset your reference point of what being a successful fintech actually means in China.

“Wow, you have 1m customers a week after launch?!!?” — whoops, forgot that’s a mediocre launch in China. That’s China Scale.

The same thing is becoming the case in India. Soonacron, BharatPe, is a great example of the rapidly changing dynamics in India — as all merchants move to accept online payments and embrace the wholesale move by consumers to digital payment methods.

For context, BharatPe offers a push to pay QR code product. They offer it for free to merchants so they can accept digital payments in ‘meat space.’ They monetise through the provision of a lending product to merchants which, as you may have guessed, uses transaction data to determine how much to lend. It’s a ‘come for the payments, stay for the loans’ model.

They currently serve more than 6 million merchants and their monthly TPV is ~$123 million. According to their press release, their payments business has grown 5x, and their lending business has grown 10x in the last 12 months. Also worth noting is that they only 3-year-old as a company. Yep, they’re moving fast, real fast.

India is booming, and fintech is one of the many emerging stories out of the country and one I’ll be continuing to watch in 2021.

💸 Monzo Picks up £60m In Fresh Funding. →

Last week Monzo announced they’d raised £60m in fresh funding. According to Techcrunch, the funding is an extension of their previous funding round in June of last year. The round included participation from Novator, Kaiser, TED Global, and existing investor Goodwater.

🤓 My Take: By all accounts, as an organisation, Monzo had a tumultuous year in 2020. Founding CEO, Tom Blomfield, stepped down and was replaced by TS Anil and they laid off 120 staff. Also, they took a haircut on their once lofty valuation and all this while navigating a pandemic that seemingly put pressure on their business model.

It was pretty clear 2020 started to ask some tough questions of the UK challenger bank sector. Although it seemed some players in the market turned the corner and became profitable, the challenges around business models in a lean interchange market started to show for a few players.

Monzo moved quickly in 2020 to bring back its paid premium offering as a means to bring in more revenue — and it seems to be showing signs of paying off. In fact, according to the Techcrunch article, Monzo is now at 100,000 customers across their paid account offerings — Monzo Plus and Monzo Premium. Beyond this, the same article notes that they’re now approaching 5 million customers in total.

It’ll be interesting to see what 2021 holds for Monzo. I’m sure many are rotting for this OG challenger bank as it steadies the ship for what we’re all hoping will be calmer seas this year.

☝️ Things You Should Know About

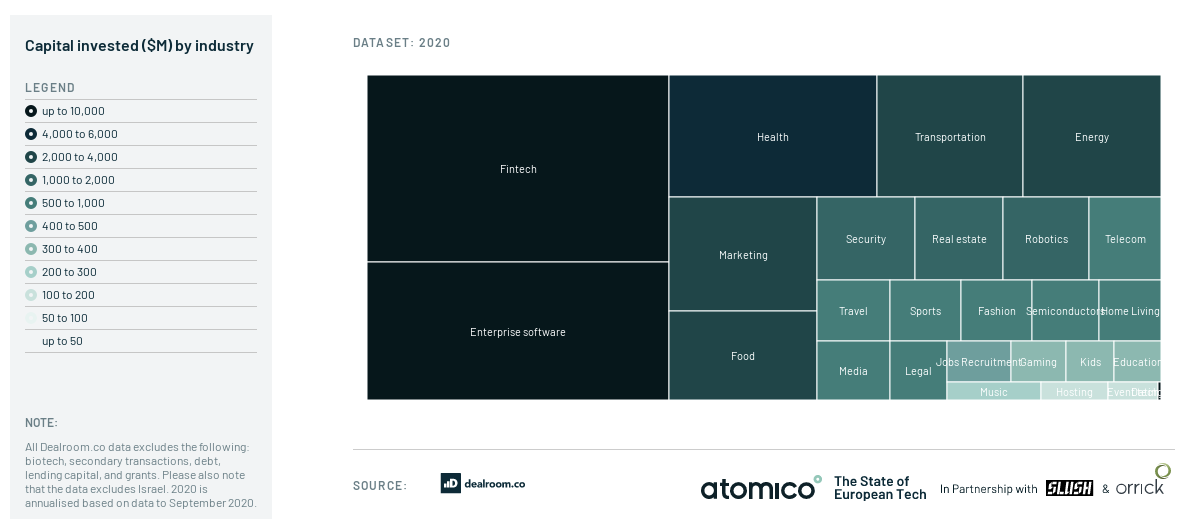

🇪🇺 Atomico’s State Of European Tech →

Last week Atomico released their 2020 State of Europen tech report, and as usual, it was chock full of interesting data about what’s going on in the European tech scene.

Before I dive into the fintech-related data, I need to note how well presented it is. Bravo team Atomico for creating one of the most delightful reports on the tech scene going around 👏

Ok, now that I’ve said that, let’s get back to the report.

As you’d probably expect, fintech led the pack in terms of capital invested. It beat out “enterprise tech” (which seems like a really broad description of a sector). As you might have guessed, most of that was related to the neo bank and BNPL super rounds we saw last year from the likes of Revolut, Monzo, and Klarna.

Even though we saw another blockbuster year for fintech, it was actually a little off the 2019 pace — which feels insane given what a massive year 2020 was for fintech.

Going through the European data is a great reminder of just how much fintech activity is actually coming out of Europe. As I noted last week, we’re slowly seeing the locus of activity shift to emerging markets like Brazil, Nigeria, and India, to name a few.

It’ll be interesting to see if the ‘20s will be another growth decade for the region or whether we do see a steady decline in the home of fintech.

🚄 Building A New Payment Method→

In issue #40 I touched on TrueLayer’s new payment product — PayDirect. The product they announced is an interesting riff on their payment initiation offering (PIS).

I’ve always been somewhat of a PIS bear. To be honest, the implementations I’ve seen have been uninspiring and have been narrow in their usability. Having said this, it’s worth acknowledging that it was essentially PIS that blew up the Plaid/Visa deal. The now infamous volcano diagram (which I still find hilarious was the ‘smoking gun’ in the antitrust suit) illustrated how Plaid could, given it had established many banking partnerships, eventually move into the payment space with a PIS style product.

It goes without saying that PIS in Europe was always an existential risk to schemes. However, given the generally lackluster products, it really wasn’t hitting its stride.

It’s actually really interesting reading the TrueLayer post on how they engineered the product, as it highlights some of the issues with the structure of PIS. One of the most obvious being in the context of e-commerce, where it’s impossible to provide refunds without more infrastructure overhead (remember, PIS is essentially a wire transfer/direct debit).

It’s a long road if you’re trying to displace the card schemes (and massive moat to cross), but this is a genuinely interesting play, and I’d be surprised if we didn’t see more payment companies try to launch similar products.

🎧 Podcast Recommendations

Get set ready, go… here are this week’s podcast for your listening pleasure.

Assets to Appreciate with Rob Petrozzo @ Rally → Rally are doing some super cool stuff in the fractional ownership space with the collectibles their “IPO’ing,” This pod was an interesting insight into where the fractional ownership segment is going. Also, listen in for how they nabbed an investor after they did a popup in Brooklyn.

A History of Mobile Money In Ghana → This was a great podcast on how mobile money became a thing in Ghana. As is commonly the case with fintech innovation, it started with government reform and changes to what was possible from a regulatory perspective. I highly recommend this for your next run or powerwalk — it’s a great story.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

📸 As always, our cover image is provided by Death To Stock Photos. You should get your stock images from them too.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌It’s Awful

Subscribe to Fintech Radar

Fintech Radar is a weekly missive about all that's happening in the world of fintech.