Break Down #2: A Deep Dive Into The Cash App's Growth Machine

In this issue, I look at the tactics Square's Cash App has used to rapidly grow its user base and why they've worked so well.

👋 Welcome to this week’s issue of the Break Down! In this weekly missive, I’ll dive into a topical/ interesting/ under-discussed area of fintech and provide you with a break down of what’s going on. There'll be lots of opinions and data, so get ready to nod in agreement, disagree, and in some instances comment in ALL-CAPS about how vehemently you disagree with me (which you can do below in the comments section 😀).

Don’t forget, if you enjoy this newsletter, make sure you share it with a friend - remember, sharing is caring!

Distribution IS EVERYTHING

In consumer fintech, distribution is everything.

This is a strong statement and it’s definitely going to be a divisive one. Don’t get me wrong; several other nuances will determine whether a product flies or dies. However, I’d argue, finding a channel to market in consumer fintech is way more important than “reimagining the banking experience.”

This flies in the face of what most people believe to be true. This is an especially common trap in consumer fintech, where many believe that if their product delivers a better experience than the incumbent banks’ product, people will flock to them. Unfortunately, this rarely ends up being true.

Obviously, this isn’t unique to consumer fintech, as Marc Andressen points out in the following extract from the High Growth Handbook:

… [T]he general model for successful tech companies, contrary to myth and legend, is that they become distribution-centric rather than product-centric. They become a distribution channel, so they can get to the world. And then they put many new products through that distribution channel. One of the things that’s most frustrating for a startup is that it will sometimes have a better product but get beaten by a company that has a better distribution channel. In the history of the tech industry, that’s actually been a more common pattern. That has led to the rise of these giant companies over the last fifty, sixty, seventy years, like IBM, Microsoft, Cisco, and many others.

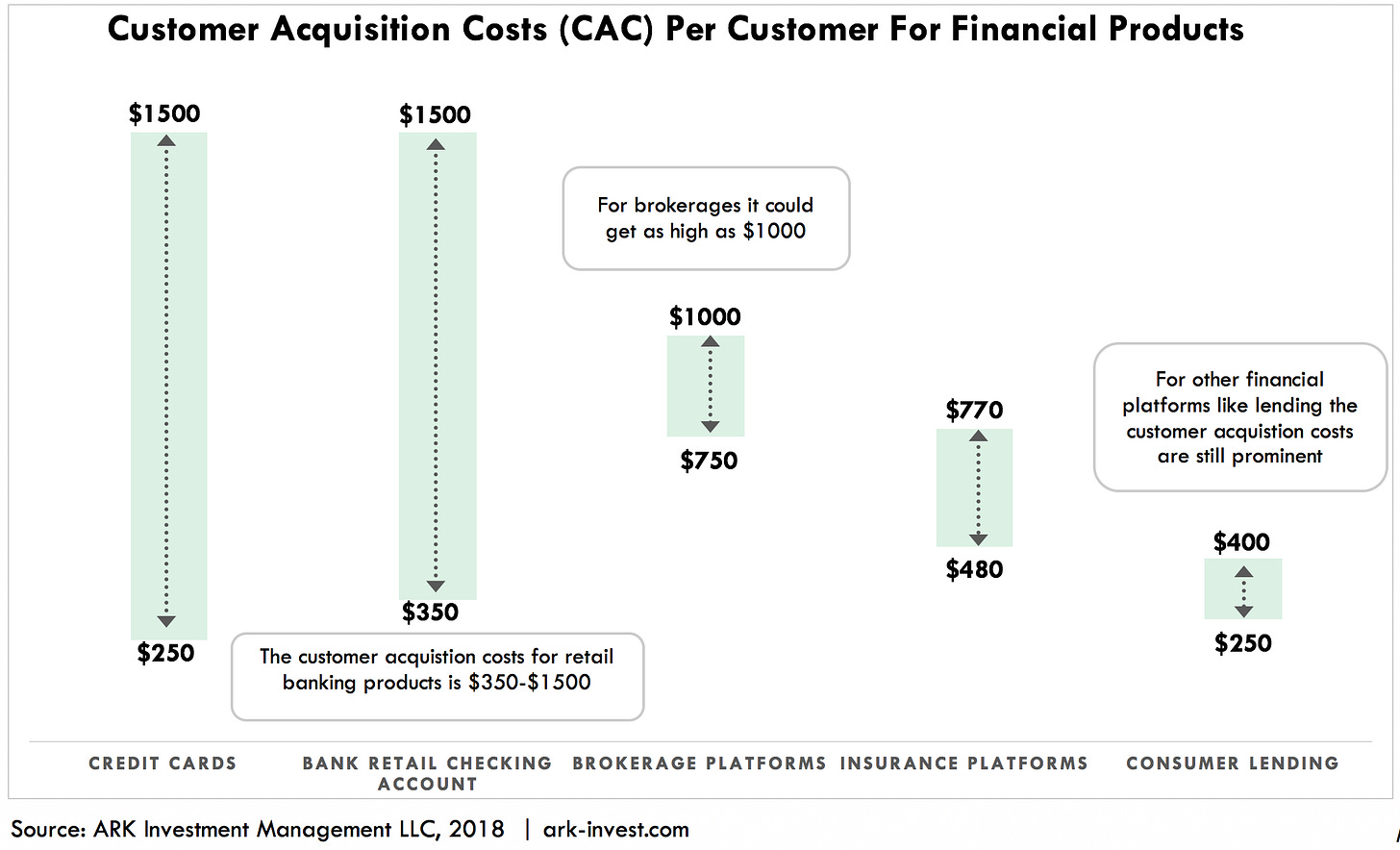

Yes, having a product that solves a ‘job to be done’ (or whatever framework you’re using) is important. However, it’s a necessary condition, not a sufficient one. The ability to get your product into the hands of your consumers at the lowest possible CAC IS the game in consumer fintech.

In the case of Square’s Cash App, they’ve not only been able to find a way to bring their CAC down to $20 per customer, but they’ve also been able to cut through the noise in a crowded market with a distribution machine that is consistently on point.

Cutting Through In A Crowded Market

It’s easy to forget, but when Square launched Square Cash (later renamed to Cash App), it entered an already crowded P2P payments market. The P2P market in the US was dominated by Venmo and Paypal, who both already allowed consumers to move money for free on a P2P basis. Add to this the fact that Google had just launched a similar email payment product, and the management consultant ‘two-by-two’ of market competitors was looking relatively well covered.

The challenges Square Cash would face were well reported, Mike Isaac captured the sentiment best when he wrote a short piece on the product’s launch for AllThingsD and noted:

While the site’s landing page is slick and the concept is cool enough, Square isn’t exactly re-inventing the wheel here. You can still send folks money using a PayPal account (and not incur a fee for it if you send it as a “gift”!), and Google’s commerce wing just added a money attachment feature to Gmail as well. And there’s no shortage of startups — Venmo, Stripe and more — doing similar things in micro-payments.

Beyond launching Square Cash into a crowded market, the initial implementation was incredibly rudimentary. When the Cash App was launched, there was no app or $Cashtags (the now ubiquitous customer identifier) instead the idea was that you’d email the person you wanted to send the money to and in the subject line of the email, you’d state the amount you wanted to send while CC’ing in ‘cash@square.com’. Then recipient would only receive the amount specified after they’d linked their debit card to Square by clicking on a link in the email.

Add to this the fact that, at the time, Square was trying to figure out what to do with their Square Wallet product - essentially a CoF product that connected to their PoS terminals (which they eventually killed off in 2014) - and you have all the ingredients for a what could’ve been/should’ve been a failed product.

Fast forward to 2020, and Cash App is growing like wildfire. From a financial perspective, Cash App has been a boon to Square. As of Q2 2020, it has 30m active monthly users who have collectively deposited $1.7bn into their accounts, and the product brings in $1.2 billion in revenue.

What makes this even more impressive is that the strategies they used to build awareness about Cash App aren’t all that unique, but the tactics and execution have been almost flawless.

Old Strategies, New Tactics

If you’ve tuned into an episode of the Joe Rogan Experience podcast or Pod Save America, you’ve probably heard a Cash App ad. If you’re on Twitter, you might have been lucky enough to win $500 on a “Cash App Friday.” While if you’re an avid Animal Crossing: New Horizons player, you may have received a visit from the Cash App dude (I’m sure he probably has a name) and received a few Bells. If you’re a millennial or a Zoomer, it probably feels like Cash App advertising is everywhere.

The Cash App has been able to penetrate US popular culture like few fintech brands have been able to do. It’s rare for a fintech product to gain such cultural relevance amongst mainstream America. I mean, what other consumer fintech product can you think of that has been able to get over 200 hip-hop artists to name drop their product in a song?

It’s easy to discount the marketing tactics that Cash App has used as nothing more than a combination of spraying free money on Twitter and ‘influencer marketing’, but what differentiates the Cash App from others who have used this tactic is how efficiently they’ve used these tactics as a low-cost growth machine.

Let’s take Cash App’s popular Friday give away “Cash App Friday” as an example.

The idea of giving away money ahead of the weekend was community-generated. As this passage from a Money.com article notes:

Until late 2017, Cash App Friday tweets were mostly comprised of women encouraging men to Cash App them to get their nails done, and men telling women to Cash App them for fresh haircuts. That’s when Cash App itself got in on the trend. The verified Cash App account first posted the #CashAppFriday hashtag on Aug. 11, 2017. Days later, it confirmed the gimmick wasn’t a company creation, writing, “You invented it, we made a gif of it. It’s #CashAppFriday.”

Since this weekly giveaway took off, Cash App has leaned in and turned cash giveaways into a low-cost lead-gen machine. For example, here is a break down of the economics of a campaign they ran with Travis Scott from ArkInvest:

Square has run similar campaigns [referencing a seperate Burger King campaign] with rappers like Travis Scott and Lil B and other influencers, triggering a network effect for the Cash App. With 120,000 replies, Travis Scott’s tweet gained more momentum than Burger King’s. If only 129 of the 120,000 who commented on his tweet were new to Cash App, then Square’s cost of customer acquisition would have been less than the $925 per user that banks pay on average, according to our research, and 6,000 comments, only 5% of the total, would have dropped it to $20. Moreover, as the converted users appear to spread the word on social media, the Cash App can acquire additional users from just one.

Although this probably oversimplifies the CAC calculation for these customers (i.e., presumably, there was a cost to having Travis Scott involved in the campaign - but also maybe there wasn’t), the point is that they’ve been able to efficiently acquire customers through partnerships through culturally relevant campaigns. Moreover, they’ve been able to do so in an authentic way - which is a lot harder than it sounds.

For most of us, when we think of financial services and influencer marketing, it’s usually some cringe-worthy ad featuring a Hollywood star awkwardly holding up a credit card telling us how much they love double rewards points - like this banger from Capital One featuring Samual L. Jackson.

Although this part of the Cash App playbook isn’t exactly groundbreaking in its originality, they’ve been able to execute it in a way that is authentic to the celebrities they partner with and the culture they represent. What makes this tactic even more compelling is that it has allowed the product to find customers outside of the usual SF/NYC fintech bubbles - where a lot of fintech products end up being stuck. In a world where ‘velvet roping’ is the go-to tactics for growth teams, the Cash App has gone in a different direction and tried to build a more traditional high street brand for the next wave of high-value consumers - Millenials and Zoomers.

The Cash App marketing machine hasn’t only focused on hip-hop but has also been eyeing off emerging subcultures relevant to their target demographic. For example, last year, they penned a deal with gaming team 100 Thieves. Interestingly, as part of the agreement, they’ll also be a sponsor of the 100 Thieves content house.

Cash App is not the first to invest in partnerships with professional gaming teams. Still, in a sector where the state of creative marketing is TV ads with celebrities in suits, the approach Cash App is taking with content producers in gaming could prove to be another low CAC acquisition channel.

Spin That Wheel (Again)

The challenge with any distribution tactic is ensuring you continue to find new ways to keep the flywheel spinning. More specifically, the major challenge comes when the channels that worked so well for you become saturated.

In the case of the Cash App, Square has been able to maneuver their marketing machine into underutilised channels deftly and efficiently acquire customers at a CAC that is industry-leading.

It’s also worth acknowledging that the Cash App has been ahead of the game on several product features - for example, crypto, fractional stock trading, and Cash Boost (its instant discount program) - and the execution for all of them has been phenomenal. However, the distribution machine that has driven the brand forward is what has, at the moment, created a sustained advantage against other challenger banks who have been jockeying for the hearts and wallets of Millenials and Zoomers demographic. The question is whether they’ll be able to continue winning customers over using these tactics.