Discover more from Fintech Radar

Fintech Predictions For 2023

Fintech Radar is back, and I'm kicking off the year with my predictions for 2023.

👋 Hi, FR fam and Happy New Year!

Wow, it’s been a long time since I last wrote those words! In fact, more than 12 months have passed since the last issue of FR hit inboxes 🤯

A lot has been going on from my end. I moved on from my role as director of revenue strategy at Chipper Cash to helming a corporate accelerator program for Australia’s largest general insurer. A big move that has me working with early-stage companies again— something I’ve sorely missed over the last two years as the time I had to spend with founders rounded down to zero.

I’ve also missed writing this weekly missive. The process of putting my thoughts to ‘paper’ was one of the main reasons I started writing FR, and I’ve missed that weekly practice. Also, I’m looking forward to reconnecting with the FR community (close to 3,500 subs strong 🦾). You’ve always been a major reason I hit send every week on this newsletter 🫶

So let’s get back into it with the first issues for 2023!

One last thing, some quick housekeeping — just in case you’re new to FR

If you’re new here, FR is a weekly newsletter about the fintech industry that parses the signal from the noise and provides insights into the most important news with thought-provoking commentary (i.e. some occasional hot takes)— no copy-pasting press releases here!

If you’d like to read more about FR’s origins, check out issue #0.

Finally, I’m always trying to grow the FR community, so please forward it to a friend or colleague. I’d appreciate it!

Fintech Predictions For 2023

Without any further ado, let’s jump into my five predictions for 2023.

Ps. there are a few bonus ones at the end for those who are clamouring for more predictions 😉

1. Yeah, it’s going to be a challenging year for the fintech sector — but it’s not all doom and gloom

I’m probably not telling you anything you don’t already know, but 2023 will be challenging for the sector. Capital markets have seized up, inflation is up, interest rates are up, and economic growth is down. The days of VCs raining money down on founders at ridiculous valuation is over, and the ‘grow at all costs’ mantra will (if it hasn’t already) make way for ‘get profitable at all costs’.

The worst part of the pullback is how it impacted the space’s builders. Forget the founders, I’m talking about the employees who push code, close sales and are the lifeblood of every successful startup — they’re the ones who’ve been hurt the most. Thousands have been laid-off, down rounds and company shutdowns mean those hard-earned option grants for most in the sector are underwater or, worse yet, worthless.

So what’s the silver lining?

It’s quickly becoming a cliche, but companies will emerge out the other side of 2023 (or whenever this financial Winter ends) having gone through their crucible moment and forging a new identity built around resilience that will carry them for years to come.

This will be the year we see who the real generational fintech start-ups are vs those who got fat on cheap capital.

As was the case back during the last economic meltdown, some of those laid off will go on to found companies. They’ll solve that burning problem they had while working at their previous start-ups, they’ll finally get around to working on that opportunity that the company they worked at kept passing on, or they’ll bring a unique insight to a customer problem — 2023 will be the year of the builder in fintech.

Lastly, it’ll be worth trying to read the tea leaves this year as the sprouts of second and third-order effects start to show themselves. As we’ve seen during previous economic downturns, new opportunities are always born out of the ashes of financial turmoil. For example, you’ll probably recall that the erosion in trust banks suffered during the 2008 financial meltdown was what spawned bitcoin and gave rise to the wave of listed fintech unicorns we identify with as being the vanguard of today’s industry. It also introduced a wave of financial regulation that propelled fintech to the main steam.

A new wave of fintech is coming in 2023 — it’ll just be hard to see as it’ll look more like a trickle than a tsunami.

2. What’s old will be new this year

If there is a ‘vibe shift’ this year, which segments will lead the way?

First, let’s consider the economic climate we’re facing in 2023. An overall tighter economy means making every dollar go further. This, combined with lethargic public markets, means attention will shift from ‘risk on’ areas to more stable — dare I say, boring — asset classes. If 2022 was about buying speculative assets, 2023 will be about bonds, renegotiating loans and streamlining costs.

If you’re an OG, you’ll remember most of these as being the original use cases fintech startups pitched back in the stone ages of the sector… like around 2010. Specifically, think of the first wave of start-ups that stirred the imagination and launched a thousand corporate innovation labs. If you cast your mind back, you’ll remember that every fintech startup was either a Robo-advisor, a PFM app or a comparison site for financial products.

So why now? Beyond the moment being (feeling?) right, the stack has radically changed. Don’t forget in the ‘stone ages’, there was no open banking, PIS or BaaS. The ability to monetise was way harder, and the cost structure most built proved unsustainable. On a slight tangent, but this is one of the most under-appreciated things in fintech — your business is your cost structure.

So will this be the year that we see PFM apps come back? Probably not, but some variation on the tune of helping people better stretch each dollar will be an important theme this year.

3. Expect fewer “new” ideas to be funded in 2023

This prediction is less about net “new” ideas and more about pointing out that 2023 will be the year investment consolidates around the perennial problems of the sector — which tend to be at the infrastructure layer.

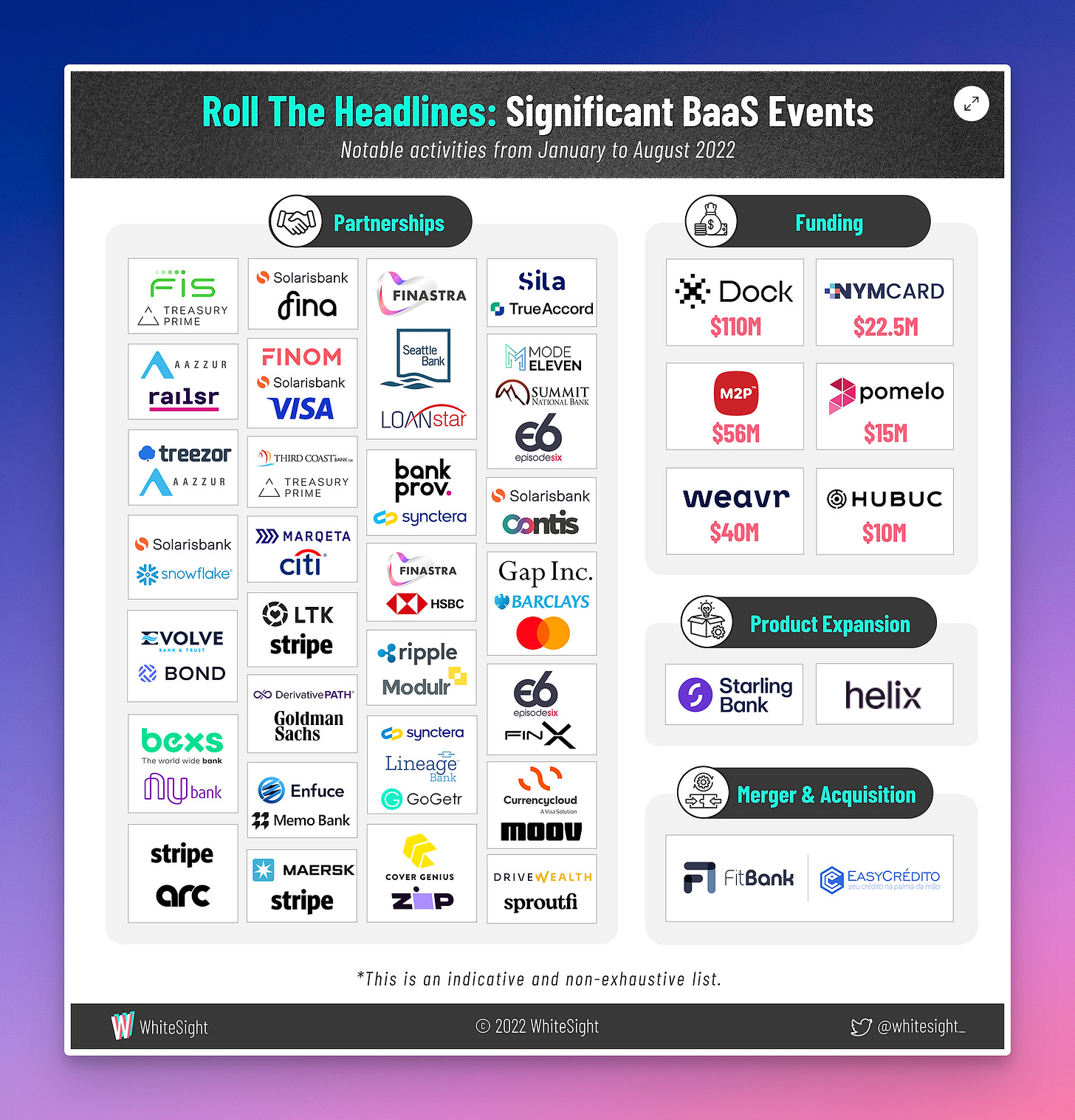

Over the last few years, we’ve gradually seen investor excitement wain around consumer fintech and interest shift to the infrastructure layer. Investment dollars have increasingly been funnelled to modernise the ageing financial pipes and away from funding acquisition cost intensive front-end fintech start-ups. When you combine this with a heightened M&A interest from incumbents looking to further secure access to vital strategic segments of the financial stack — like Visa’s acquisition of Tink (after its failed attempt a buying Plaid) — fintech infrastructure has continued to run white-hot.

Although we’re headed for a financial deep freeze, the fact that “every company is becoming a fintech” will not slow down anytime soon — in fact, I expect this trend will only accelerate in 2023.

4. Global reverts to local in 2023

I have to admit this is one I’ve done a 180 on in the last 12 months.

If you’d asked at the start of 2022 whether we’d see more or less global/multimarket fintech startups, I would have said across the board more. I’ve generally tended to be expansionary regarding the global opportunity for the sector, and this is the first year I’ve tempered my expectations.

As capital availability in private markets dries up, the dry powder required for global expansion will be in short supply. As you might expect, going global takes a lot of money to execute well. I’d stress the word ‘well’ here — it’s easy to start but hard to scale. More specifically, it’s hard to get the appropriate licensing, build a competent team on the ground, and to compound the challenge, it’s hard to generate economies of scale when going global.

In a market where VC dollars will be hard to come by, I expect most (especially on the consumer-facing side) to get (re)focused on their home market. This year will be about local consolidation as most pull back from their global aspirations.

5. ‘AI Summer’ will impact the fintech sector… but not in the way you think

Apply your sunblock, ‘AI summer’ is here. Much like we saw the best and brightest in tech move across to crypto in 2022, the same will be true of AI in 2023. But what about fintech? What use cases are going to pop off in 2023?

Most see the opportunity to use ChatGPT (and all the other variations) to solve operations-based problems, like customer support. That’s right, Chatbots are back, and corporate innovation lab teams are licking their lips.

However, I predict we’ll see more havoc caused by this wave of GPT-based products on the financial services industry than viable use cases. Think about the quality of phishing emails and the sophistication around social engineering attacks that we’ll see as it goes mainstream. This is the year script kiddies make way for the GPT kiddies. And we all know which industry bears the brunt of new cyber attack vectors.

Having said all this, after the dust settles and we move from a defensive posture to an offensive one, I think the long tale impact on the fintech industry for this wave of AI products will be in compliance — after all, they’ll be the first to deal with it. A little know fact, but compliance at most consumer-facing fintech start-ups is an absolute body shop — people are thrown at problems, and little automation is generally used. This year we’ll start to see more regtech players embrace this wave of AI and adapt it to make it easier for front-line compliance teams to deal with the deluge of reviews they deal with daily.

Only five predictions? Got any more hot takes?

Ok, since you asked nicely, here are a few more in short form :)

Compliance will become (more) important in 2023

I was thinking of sending all my friends who work in compliance a “Thanks, SBF” t-shirt. But thought better of it. In all seriousness, expect regulators to overcorrect and tighten the screws on all fintech start-ups that touch consumer funds. This might turn out to be fintech’s Sarbanes–Oxley moment.

Embedded finance moves from buzzword to primetime, but you’ll hardly notice it.

Driven by more and more companies looking for new revenue streams in a frosty economy, we’ll see momentum increase for embedded offerings.

Having said this, it’ll be more subtle than you expect. It’ll be less about new extensive financial offerings and more about subtle upsells and enhancements of the customer journey — it’ll be focused on where a financial offering makes sense and not just offering a co-branded card for the sake of offering one.

Crypto gets boring (in the best possible way)

Arguably, the most important thing that happened this year in crypto was also the most boring. I’m obviously talking about the Ethereum merge. It went off without a hitch and moved the whole chain to a new economic paradigm. All very ‘boring’ stuff.

Expect more slow progress in 2023 as the dust settles after a tumultuous 2022. Expect more activity on L2s and general technical progress in the space — all things you likely won’t notice unless you’re a builder… that is, until the next bull run 😉

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful

Great to see you back writing!

welcome back! Happy New Year!