Discover more from Fintech Radar

Issue #115: Apple Unveils P2P "Tap To Cash", Another Year Of Profitability For Starling And eBay Adds Venmo As A Payment Option

👋 Welcome to another edition of Fintech Radar, your weekly go-to source for what’s happening in the fintech world.

If you’re new, here is a breakdown of what you can expect from each issue.

This weekly missive is written for founders, operators, and investors in fintech. I prioritise quality, depth, and provocation each week over just rehashing press releases and partnership announcements. Rather than simply covering news, I dig in and explore the implications of what’s happening in the industry — without all the fluff.

My goal is to spark discussion, highlight emerging trends in fintech that could become central themes in the coming years, and help you connect the dots.

If you missed our recent editions, you can catch up here. Some previous issues you might want to check out if you’re new include “A Deep Dive Into The Cash App's Growth Machine”, “The Future Of Payment Initiation”, and “Current: Doing It Differently”.

Your ad could be HERE!

Fintech Radar is a must-read for founders, operators and investors in fintech. If that’s your target audience, placing an ad right HERE is a cost-effective way to reach them.

If this sounds like a good fit for your brand head over to our sponsorship page for more details and to secure your advertising slot.

If you have any questions, simply reply to this email and ask away!

⤷ Apple Unveils New iPhone Touch And Pay Feature

🏃♂️ The Rundown: Apple last week announced a new feature, "Tap to Cash" allowing iPhone users to transfer money by touching their phones together. This capability will be available with the release of the iOS 18 operating system in the fall. According to Apple, Users will be able to transfer funds instantly via Apple Pay, Apple's digital wallet.

🥡 Takeaway: This announcement ignited the fintech meme machine, with many taking to Twitter to joke about the potential scamming opportunities it could provide to would-be card/phone skimmers.

In all seriousness, it’s a subtle yet intriguing move from Apple as it meticulously carves out a more fully-featured wallet experience. In classic Apple style, they continue to make incremental enhancements that increasingly integrate the wallet into a customer’s financial experience.

Although at first glance this may seem passé, it brings Apple closer to filling out all the subtle use cases customers might want from a wallet offering, edging them nearer to competitors like Venmo.

Additionally, Apple announced that Apple Pay will integrate Affirm's BNPL loans for U.S. users on iPhones and iPads later this year, further expanding the BNPL options with more flexible payback solutions via Affirm.

Unlike its competitors (such as Google Pay/Wallet or whatever it’s called this week), Apple continues to evolve its financial services offering incrementally and consistently. Consider the progression from the payment overlay with Apple Pay, to Apple Card, Apple BNPL, and their cleverly disguised embedded insurance offering, AppleCare (which has been an under-discussed insurtech hit product for them).

The next big question will be how Apple integrates Apple Intelligence into their wallet ecosystem. Leveraging advanced AI, you could imagine Apple offering (more) personalised financial insights, and predictive budgeting. Having said this, expect them to tread carefully with AI and financial data as they look to balance expanding their financial offerings while maintaining user privacy and data security.

⤷ Starling Reports Third Profitable Year

🏃♂️ The Rundown: UK neobank, Starling Bank, reported its third consecutive year of profitability, with pre-tax profits rising 55% to £301.1m and revenue increasing 51% to £682.2m.

Customer accounts grew from 3.6 million to 4.2 million, and card spending climbed from £16.5b to £19.9b. Fixed-term deposits reached £430.6m, contributing to a 4% increase in total deposits to £11b.

Interim CEO John Mountain noted the positive impact of higher base rates on the bank's net interest margin, which increased to 4.34%. Mountain will soon be succeeded by Raman Bhatia, who will oversee the firm’s IPO planning.

🥡 Takeaway: It’s almost getting boring talking about the neobank resurgence we’re seeing in 2024. It really does feel like all the ones that survived the last few turbulent years are now posting some seriously impressive numbers.

Although profitability is nothing new for Starling (this is year three!), it further highlights that the UK neobanks that persevered are now building substantial businesses. More broadly, results like these are (I think) a harbinger of what we’ll see in other countries from neobanks that have managed to carve out a niche in the market — and importantly build a more sustainable cost structure. It might be too early to call it, but 2024 could indeed be the year of the neobank resurgence in fintech.

⤷ eBay Brings Venmo As A Payment Option For Its US Buyers

🏃♂️ The Rundown: eBay has integrated Venmo as a payment option for its US buyers, offering more choice and flexibility at checkout. With nearly 90 million users, Venmo's inclusion aligns with eBay's goal to cater to modern, mobile-first consumers, especially as over 60% of eBay transactions stem from mobile devices. The move is expected to reduce cart abandonment rates for sellers and enhance the overall shopping experience.

🥡 Takeaway: While it might seem like just another instance of an “online retailer/marketplace adding a new payment option,” this move reflects a broader trend of retailers scrutinising their payment offerings more closely.

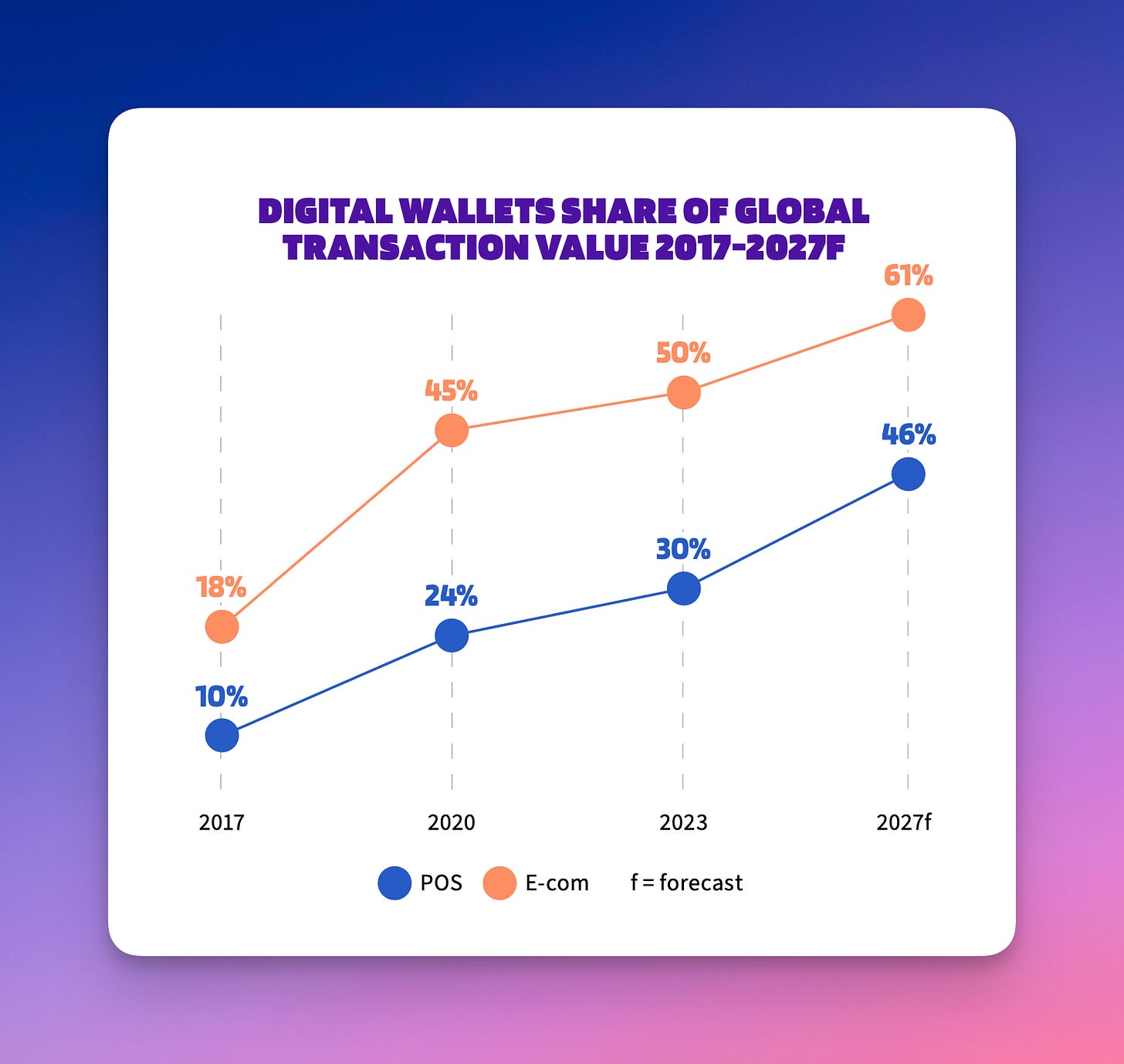

This decision also underscores a significant trend in e-commerce: the rise of digital wallets. According to the recent Worldpay Global Payments Report for 2024, digital wallets are now the leading e-commerce payment method in APAC, Europe, and North America, and are expected to dominate globally by 2027.

Moreover, eBay’s press release highlighted their intent to tap into a younger demographic, given Venmo’s heavy adoption among Gen Z and Millennials, who are digital wallet-centric users. They also emphasised their acceptance of BNPL for payments, reinforcing their strategy to stay ahead in the evolving payment landscape.

⤷ CBA introduces leading AI technology to protect more customers from scams

🏃♂️ The Rundown: Australian “Big 4” bank, Commonwealth Bank has introduced AI technology to combat scams, tracking unusual behaviour on digital platforms to protect customers. The bank aims to prevent scams by identifying irregularities and enhancing scam protection measures.

The article notes that in 2021, Australians lost over $2b to scams. CBA is also increasing resources, doubling its scam protection team, and implementing two-way push notifications for customers.

🥡 Takeaway: It’s always interesting to see what the incumbents are up to on the AI front. This announcement from Aussie Bank, CBA is a great example of where most are thinking the low-hanging fruit lies. Namely, fraud and compliance.

In this first set of tentative explorations into AI, I anticipate that most incumbents will keep their forays into the space aligned with compliance/fraud prevention and process improvement (likely customer support). The more interesting question will be where they head after this.

⤷ Mastercard To Phase Out Manual Card Entry For Online Payments In Europe By 2030

🏃♂️ The Rundown: Mastercard plans to eliminate manual card entry for online payments in Europe by 2030, replacing card numbers with randomly generated tokens for enhanced security. This move aims to streamline e-commerce transactions and reduce fraud rates.

🥡 Takeaway: I think most would agree that entering your card details when purchasing something online feels arcane. This might be a step closer to that being a thing of the past.

Although tokenisation has been a major change in online payments that many PSPs have leveraged to enhance the checkout process, the reality is that Mastercard’s 2030 goal still feels optimistic. As Mastercard noted in their press release announcing the “commitment” that their tokenisation service released in 2014, today “…secures 25% of all e-commerce transactions globally”. However, with adoption accelerating 50% year-over-year, there’s hope for the long road ahead.

The CFO segment has been running hot with several products launching to simplify and streamline the finance function in companies — with many turning to AI as the new catalyst for innovation. This week, two companies raised rounds in this segment, so I thought I’d delve into their approaches and the potential impact they could have on the industry.

⤷ Dublin-Based AccountsIQ Bags $65M To Bring More AI-Powered Products To Accountants

🏃♂️ The Rundown: Dublin-based cloud accounting platform AccountsIQ has secured $65m in Series C funding led by Axiom Equity to enhance its AI-powered products for small, medium-sized, and nonprofit businesses.

Launched in 2008, AccountsIQ offers financial management software with automation and collaboration tools, catering to businesses outgrowing traditional systems. With over 1,000 customers and 20,000 users globally, AccountsIQ aims to leverage AI to streamline finance processes. Founder Tony Connolly plans to expand the team to more than 200 workers and invest in AI research with the funding.

⤷ Let There Be Light! Danish Startup Exits Stealth With $13M Seed Funding To Bring AI To General Ledgers

🏃♂️ The Rundown: Danish startup Light emerged from stealth last week, announcing a $13m seed funding round led by Atomico, with participation from Cherry Ventures, Entrée Capital, and Seedcamp. Co-founded by CEO Jonathan Sanders and CTO Filip Kozjak, Light aims to modernise general ledger software using AI to streamline financial data management and enhance query capabilities for CFOs and finance teams.

The platform integrates with various CRM and HRM tools, offering features like accounts receivable and payable, and VAT reporting. Early adopters include companies like Worksome and Lenus.

🥡 Takeaways: It’s an interesting time for accounting software. In the last decade, the segment has been defined by one trend: the move to the cloud.

The success of Xero’s cloud-native software acted as a forcing function for the industry, pushing every player to transition from desktop-based software to the cloud. Fast forward to 2024, and the segment is facing new challenges.

The reduction in the accounting workforce, combined with more stringent reporting requirements, has put the industry under pressure to modernise. Enter stage right, AI. In many ways, the current wave of AI has been exactly what the industry needs, and companies are clamouring to integrate AI into every element of the accounting process.

I think the “office of the CFO” presents a significant opportunity and will be hugely impacted by AI. Much like Xero emerged to become a new name in accounting software, the next QuickBooks, Intuit, and perhaps even SAP will be born from this generation of AI-centric accounting startups. Expect to see more massive rounds of financing as investors chase this opportunity.

⤷ Robinhood's Big Bet on Crypto: Crypto GM Johann Kerbrat Explains

Last week I discussed Robinhood’s acquisition of Bitstamp and their clear doubling down on crypto space. That sentiment is reflected in this discussion with Johann Kerbrat, the company's Crypto General Manager.

During this discussion, Kerbrat talks about how they’re focusing on making crypto accessible and user-friendly, leveraging blockchain technology to streamline financial transactions for their customers. This interview provides some great insight into the company’s strategy in crypto and is well worth a listen!

⤷ An African Tech Exit - Selling Sendwave For $500 Million

There are a ton of great insights packed into this short 10-minute interview with Sid Sridhar, former Head of Business at Sendwave. In it, he shares valuable lessons from Sendwave’s sale to Worldremit. This is definitely one to add to your playlist this week.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect. I'm @alantsen on Twitter, or you can DM me directly by clicking the button below ↴

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful