Issue #82: Apple Explores Open Banking In The UK, Ant Group Launches A Pan-Asian Mobile Wallet, And Nova Credit & HSBC Collaborate on Cross-Border Credit Sharing

👋 Hey, FR Family! I trust you all had a fantastic weekend!

As always, a hearty salute to our steadfast subscribers and a warm welcome to the newcomers — we're thrilled to have you on board!

A quick ask: Do you know someone who shares your passion for fintech? Don't hesitate to share this with them. It's a gesture that I’m sure they'll appreciate!

It’s been another big week for fintech, so without further ado, let's delve into the major happenings from last week.

📣 The News Grab Bag

Apple’s Next Big Play: Personal Finance Management Meets Payments

Apple last week launched a new feature in the UK that allows users to view their bank account balance through their Apple Wallet, powered by Open Banking APIs — likely using Credit Kudos’ technology (which they acquired last year)

While the initial excitement may not be about the balance view itself, the article notes there are three significant "firsts" that make this feature noteworthy: (i) a big tech company using open banking APIs, (ii) Apple soft-launching a feature outside of the US first (with the UK being a natural place to launch it), and (iii) the ability for users to view their account balance at the point of payment.

There are obviously lots of potential enhancements to the user experience that Apple could offer on the back of open banking in the UK. As highlighted in the article, the spectrum of possibilities ranges from providing personalised suggestions based on geolocation optimising loyalty rewards to aiding customers in refining their spending behaviour. It’ll be interesting to see if they continue to enhance the customer experience via Open Banking or if this was just a pet project of an Apple Wallet PM. If I were betting, I’d guess it’s the latter.

Apple and Goldman were planning stock-trading feature for iPhones until markets turned last year

In other Apple fintech-related news, according to this article, Apple and Goldman Sachs had plans to develop a stock-trading feature for iPhones in response to the surge in equities and the popularity of trading apps like Robinhood.

This feature would’ve added to Apple's suite of financial products powered by Goldman, which includes a credit card, BNPL loans, and a high-yield savings account. However, the project was shelved as the markets turned south, and the companies switched focus to launch savings accounts instead.

The status of the stock-trading project and its infrastructure is unclear after Goldman decided to retrench from nearly all of its consumer efforts. The article notes that the infrastructure for the feature is mostly built and ready to go should Apple decide to move forward.

The thing that jumps out at me, in juxtaposition to the balance feature Apple unveiled, is the expansive outlook Apple might hold for their financial services offering. If they did indeed build the product with the hope of a general release, I think it speaks volumes about the potential arc we might see from Apple's offerings over time — which could be much more extensive than most would think.

Ant Group creates an everywhere Asia mobile wallet

Ant Group, the parent company of Alipay, is expanding its payment ecosystem for Asian e-wallets. Through the "Alipay+-in-China" (A+China) Program, users of 10 leading mobile wallets in countries such as Malaysia, Singapore, South Korea, and Thailand can now use their home e-wallets in the Chinese mainland.

This expansion allows for seamless mobile payments across Alipay's vast merchant network and aims to tap into the mass merchant network of China. Ant Group plans to continue growing its global merchant network and investing in payment and digital marketing technologies to support its partners and merchants.

South Africa's MTN fintech arm pushes into remittances and business payments

South African mobile phone operator MTN is expanding its fintech services by launching an app that enables users to send cash abroad and businesses to accept payments. With a focus on the unbanked population in South Africa, MTN aims to provide financial services to those who do not have easy access to traditional banking. The company also introduced a virtual wallet for business owners and cheaper-to-rent point-of-sale devices to facilitate payments and other services.

Additionally, MTN is reaching into the insurtech space with the launch of (checks notes), a funeral insurance product that offers cover for six or twelve months with a single payment.

Kraken secures money license registrations in Spain and Ireland

Cryptocurrency exchange Kraken has obtained an Electronic Money Institution (EMI) license from the Central Bank of Ireland and a virtual asset service provider (VASP) registration from the Bank of Spain.

The EMI license allows Kraken to expand its euro-to-crypto trading services across 27 European Union member states and European Economic Area countries. With the VASP registration in Spain, Kraken can now provide exchange and wallet custodial services to Spanish residents.

In contrast to the regulatory sh** show that is the US when it comes to crypto, companies continue to seek licenses in the EU. This is partly driven by the developing (emphasis on ‘developing’) regulatory clarity around crypto, as exemplified by the EU's Markets in Crypto Assets regulation (MiCa) set to be enforced in 2024. The proactive regulatory environment has (re)accelerated interest from the large players left standing in the exchange space — like Coinbase and now Kraken — to seek licensing in markets like Spain.

Nova Credit partners with HSBC for cross-border credit sharing

Nova Credit has partnered with HSBC UK to offer a new credit card specifically designed for immigrants who want to use their international credit history. This partnership allows HSBC to be the first UK bank to consider international customers' entire credit history when applying for a credit card. Initially, credit history from 12 countries will be accepted.

The aim is to help newcomers to the UK overcome the difficulties they face in accessing financial services due to a lack of local credit history. More specifically, leveraging Nova Credit's offering, HSBC UK customers can now share their credit history from 12 eligible countries, including India, the US, and the Philippines.

Notable Funding Announcements

Last week was a quiet week for fintech financing, with 50 funding rounds completed and companies collectively securing $621m in investment.

Slope brings on new CFO, customers, capital as it rises to offer businesses buy now, pay later

Slope, a startup focused on BNPL services for businesses, last week announced they’d secured $24m in a Series A funding round after its $8 million seed round last November. Union Square Ventures and Monashees jointly led the recent investment round, with contributions from Tiger Global Management, Global Founders Capital, and a collective of angel investors. This round raised the company's total funding to $32m. Slope will use the funding to expand its team, enabling more enterprises to access its BNPL service.

Slope focuses on easing and speeding up the underwriting process for businesses, positioning it uniquely in the traditionally clunky B2B payments landscape, and it seems to be working. The article notes that, over a span of six months, Slope has grown 121% growth month on month and has onboarded over 2,500 businesses in the U.S. and Mexico.

In previous editions of FR, I've highlighted the breadth of opportunities in the B2B payments space, specifically around B2B BNPL. Bridging the divide between B2B and B2C payment experiences — by rendering a service more reminiscent of what consumers encounter daily — continues to provide many opportunities for B2B-focused fintech startups, as companies like Slope are showing.

WealthTech firm Farther last week announced that they’d raised $15m in a Series A funding round led by Bessemer Venture Partners, with participation from Khosla Ventures and MassMutual Ventures.

Farther is a full-stack, technology-first platform for wealth management that combines the benefits of traditional wealth management with modern technology. More specifically, they provide advisors with a modern tech stack, integrated partner institutions and features aimed at streamlining their day-to-day work. According to the press release announcing the funding round, Farther has nearly quadrupled its assets under management in the first half of 2022.

While numerous products have emerged to challenge the conventional advisor role at the consumer level, it's refreshing to see companies like Farther creating tools to enhance a wealth advisor's capabilities. This not only enriches the overall client experience for those who still want to interact with an advisor but also empowers them to provide better service and, importantly, is still very much an untapped opportunity.

Traydstream Secures $21 Million in Series B Funding

Traydstream last week announced a $21m Series B financing round led by Pivot Investment Partners and e& Capital. According to their press release announcing the round, the funding will help accelerate its AI-powered platform, expand its technology stack, and enhance its efficiency, accuracy, and agility for its growing global clientele.

Traydstream focuses on digitising and securely storing all Trade Finance documentation for its customers. The company utilises a cloud-based platform with intelligent data extraction and validation techniques supported by machine learning. These techniques validate transaction data against an extensive, regularly updated library of Trade Rules and Compliance checks.

🎧 Resources & Recommendations

The $4 Trillion Business of Financial Crime with Natasha Vernier, Co-founder and CEO of Cable

In this recent episode of The Peel podcast, Natasha Vernier, co-founder and CEO of Cable, discusses a wide range of topics related to financial crime with Turner Novak. It’s a fascinating deep dive into the world of financial services compliance and is well worth a listen.

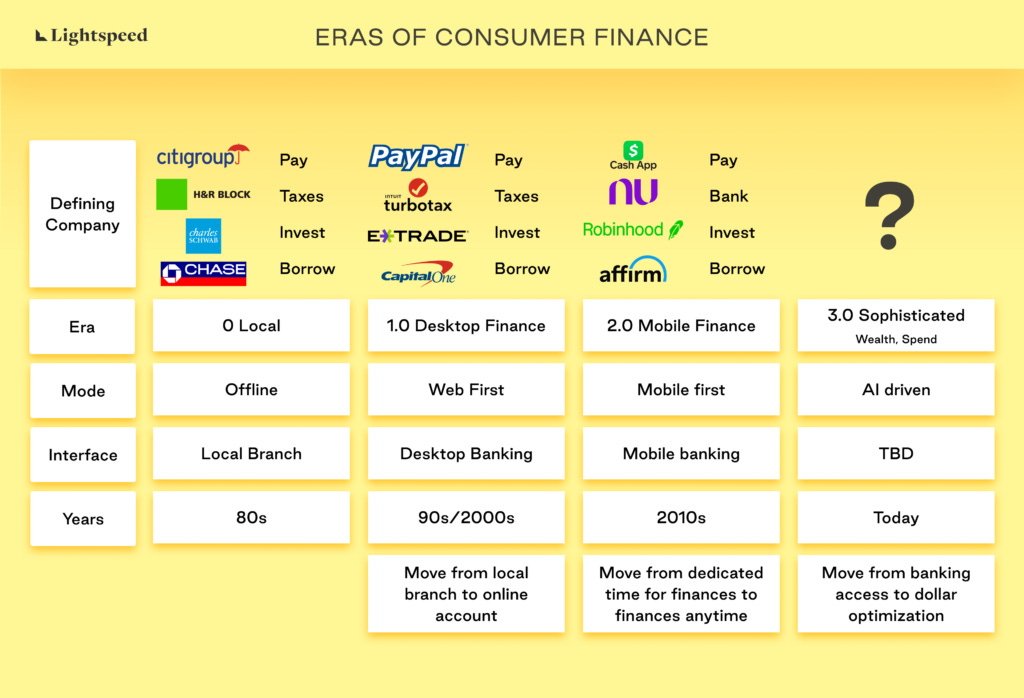

The Sophistication Era of Consumer Fintech

This post from the Lightspeed team delves into what they predict will be a new era in consumer fintech — marked by consolidation, optimised intelligent software, and the rise of vertical super-apps. In it, they discuss the transition towards personalised finance facilitated by AI and the macro trends driving wealth management and consumer spending. Well worth a read.

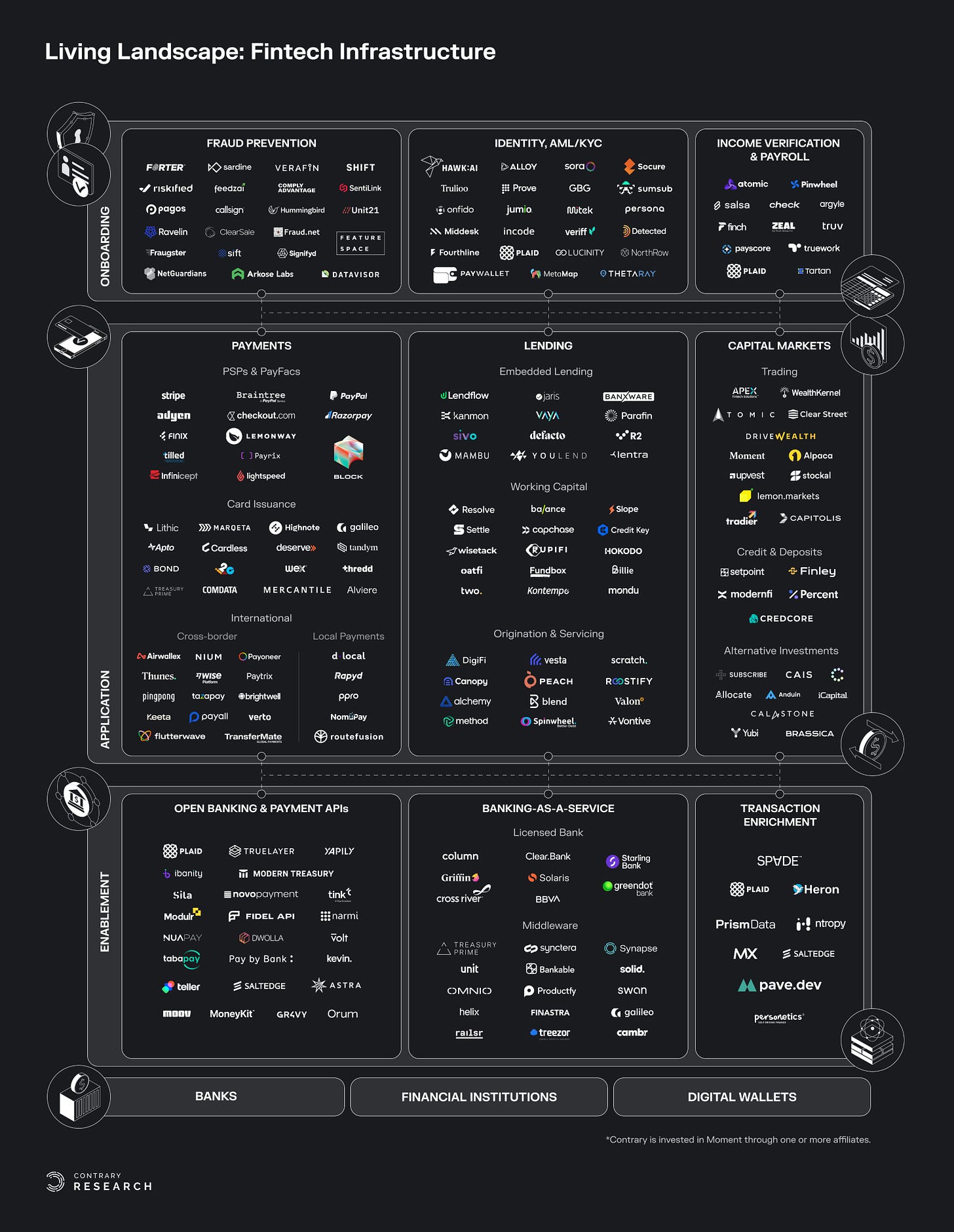

Living Landscape: Fintech Infrastructure

This is a great “living” market map of the fintech infrastructure landscape from the Contrary Research blog. It’s well worth bookmarking for all your fintech infrastructure thought leadership needs.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect — I'm @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful