Issue #73: B2B BNPL Continues To Run Hot, Flutterwave Eyes Railsr As An Acquisition Target, And Butter Secures The Bag.

👋 Hi, FR fam. I hope you’ve all had a great start to the week.

Thanks as always for being a subscriber 🙌 Also, welcome to all the new subscribers— glad to have you here and welcome to the FR fold.

We’re always trying to grow the FR community, so please forward this issue to a friend or colleague. I’d appreciate it!

Also, don’t forget to join the 🆕 FR group chat! Download the Substack app — it’s even available on Android for all you green bubblers — and follow this link to enter the conversation. See you there!

Ok, without any further ado, let’s get into last week’s news from the world of fintech.

📣 The News Grab Bag

Stripe cuts its internal valuation by 11% ⚬ Has every app been built? ⚬ What is a Super App? ⚬ The hunt for FTX’s missing riches ⚬ Crypto inside trader sentenced to 10 years ⚬ Genesis owes creditors more than $3bn ⚬ Nuvei buys Paya for $1.3b ⚬ Fidelity buys fintech Shoobx ⚬ Robinhood gets into the retirement space ⚬ Ride now, pay later comes to Nigeria.

📈 Notable Funding Announcements

The new year kicked off with a flurry of funding announcements across the fintech landscape. In total, 45 funding rounds were announced, totalling $645m.

⤷ Mondu tops up their Series A with a further $13m

Mondu, a B2B BNPL start-up based in Berlin, announced a $13m extension to their Series A last week. This brings the total size of the round to $56m. Valar Ventures and FinTech Collective led the extension to the round.

🤓 My Take: “BNPL for X” was a funding hotspot in 2021. As you’ll probably recall, every investor (and rapper) was hunting for a unicorn in the segment. As a result, we saw $11b in capital flood into the BNPL in 2021, and thus the great BNPL’ification of everything moved into overdrive.

As we start 2023, the market has turned, and BNPL has lost its lustre as a segment — Klarna has seen its valuation cut by 85% and publicly listed Affirm now trades at around $12 mark after hitting $164 at the height of the 2021 bull run. Yes, markets globally are down (big time), and many other startups have been hit hard by valuation resets, but it’s also fair to say that BNPL isn’t the fintech darling it once was.

However, even amongst the BNPL carnage, B2B remains a bright spot. Even during this downturn, we’re seeing B2B BNPL players continue to be funded (here’s another example from this week). So what’s going on?

First, let’s zoom out a little.

At a broader level, B2B payments didn’t feel the funding pinch as much as other segments in fintech last year. In 2022, the sector saw a ton of activity on all fronts as businesses looked to find new ways to streamline their processes and bring cash forward in an ever-tightening economic environment. This meant business was up and to the right for a range of players. For example, B2B cross-border payments company Payoneer saw its B2B AP/AR business grow volumes by 58% year-over-year. While specialist payments orchestrator, Flywire, saw a noticeable pick up in business, growing revenues by 40% year-over-year.

I’ve written previously about the size of the B2B payments market and the numerous opportunities in the space. One of these is the modernisation of the consumer journey. If you’ve ever had to pay an invoice through a portal that looks like it was designed in the 80s, you know exactly what I’m talking about. The opportunity to modernise every element of the experience — including the payment timing options are still a huge opportunity.

The B2B BNPL segment falls squarely into the modernisation narrative. After all, trade finance has existed for aeons, and this is just another version. However, this rebranding, in combination with a tech uplift, means that businesses can move away from offering small discounts for early payment (e.g. 2/10 net 30) to “pay in four” style structures — resulting in significant upside through improved cash flow while providing for a consumer experience many have become accustomed to in their consumer lives.

In a year where we’re likely to see VCs retreating from the once-hot fintech segment, B2B BNPL might buck the trend and be a bright spot that continues to attract investor dollars.

⤷ Butter Payments raises a $22m series A

San Fransisco-based Butter Payments last week announced a $22m series A. The company had its round led by Norwest Venture Partners, with Atomic and Transpose Platform also participating.

🤓 My Take: As complexity in the payments space continues to rise, so too does the number of players looking to plug the holes left by PSPs.

In the case of Butter, they do something seemingly simple — they help companies reduce their “accidental churn” rates. Sounds simple, right? In some ways, it is. But the issue resides in the fact that optimising the payments flow to ensure error codes are handled correctly, dunning is continuously being optimised, and false declines are monitored (and remediated) is a massive undertaking.

In part, this is being driven by the payments industry as it tries to tighten its grip around fraudulent transactions. The downside is that merchants continue to see an increase in false decline rates.

Moreover, the business of payments is just becoming more complex, and what customers expect from their payment infrastructure providers is only rising.

Once upon a time, all a payments company needed to do was facilitate a way for a merchant to collect money online and deposit it into a bank account in a reasonable timeframe, which was traditional days later. However, as the race to differentiate has intensified, so too have the features that big payment providers have had to start offering.

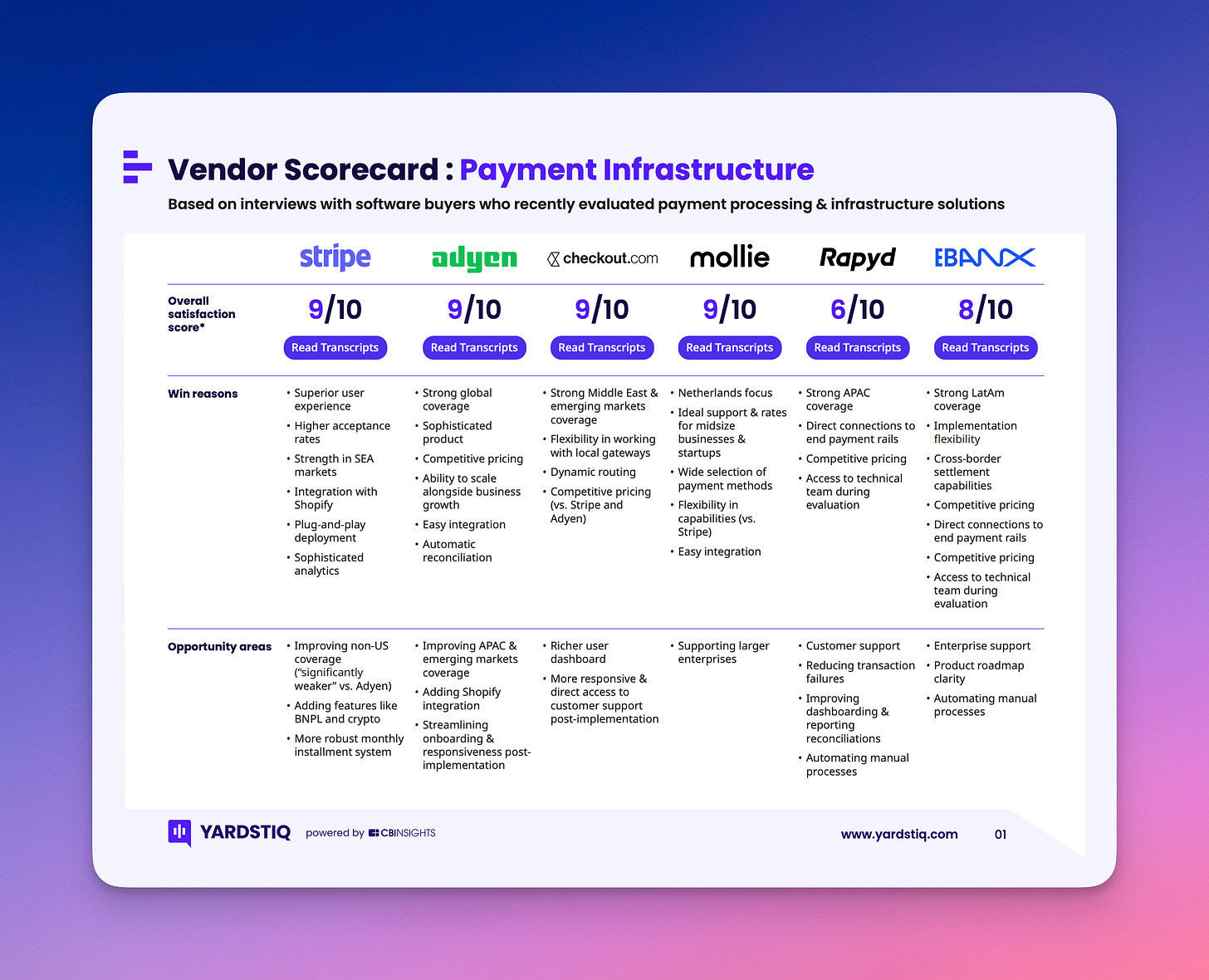

For example, when looking at Yardstiq’s vendor scorecard for payment infrastructure companies, it’s almost striking that the ‘win reasons’ row predominantly references global coverage and value-added services. Long gone are the days of collection and disbursement as the only thing a provider needs to do.

The proliferation of ‘value-added’ services offered by payment infrastructure providers means that white space has been created for players to come along and specialise in a thin slither of the value chain — for example, in Butter’s case, it’s ‘accidental churn’ — that they can build a better solution for.

It’ll be interesting to see how these niche players work in a market where CFOs are undoubtedly looking to tighten their belts. In the case of Butter, I’m sure the value proposition of uplifting ARR resonates, but this won’t be the case for the multitudes of others in the ever-growing payments supply chain — who knows, 2023 might be a year where we see further consolidation in this segment.

☝️ Things You Should Know About

According to reports, African payments company Flutterwave is eyeing Railsr as an acquisition target. Sky News reported that there’s a fair amount of competition for Railsr and other suitors, including a consortium of current investors, are also interested. The report also noted that the sale would likely be at a discount to the previous round.

One of the most striking things when surveying the BaaS landscape is no provider has been able to build a truly global offering. Don’t get me wrong, a few are trying, but it’s tough. Creating a well-rounded solution across multiple markets means offering a range of pay-in options, connecting to local payment networks, being able to settle card transactions, having a local relationship with a card scheme… and the list goes on. The pattern has tended to be the opposite of what we see in pure play payments, the vast majority of players in BaaS have tended to stick to their knitting and build a single market offering.

In the case of Railsr, they were one of the few operators stretching themselves outside of their home market. I’d imagine likely suitors are eying off Railsr vast operations and looking to see which parts they can leverage in their quest for global domination.

In the case of Flutterwave, this sits neatly with their aspirations to expand their issuing solution, which might include new markets. It’ll be interesting to see how they leverage the assets if they successfully acquire Railsr.

⤷ Santander, Allianz Trade and Two Debut BNPL for Large Businesses

Santander, Allianz Trade and fintech start-up Two have partnered to offer a trade finance-focused BNPL offering. In this tripartite partnership, Allianz Trade will provide credit insurance to protect sellers against the risk of non-payment, Santander will provide capital to fund the trade loans, and Two will be the technology provider.

Yes, I know, it’s another B2B BNPL news item. However, this is an interesting spin on some of the abovementioned BNPL themes. Beyond being a bank partnering with a fintech start-up to offer a BNPL solution, it also loops in an essential element of trade finance, insurance.

Although nothing new (many others offer a similar solution), the ability to enhance the overall customer journey and provide a more holistic (and thus convenient) offering is an interesting spin on what we’ve seen in the B2B BNPL space. More specifically, by providing a modern payment experience, offering a convenient credit arrangement and bundling that with a fit-for-purpose insurance offering, all three partners are likely hoping that this enhances the overall customer experience.

I predict we’ll see more plays like this in 2023. As the bar around what customers expect from financial service providers increases, more will see opportunities to enhance their overall payments solution through adjacent embedded offerings.

🎧 Podcast Recommendations

Here are this week’s podcast recommendations. Enjoy👂

⤷Flutterwave vies for Railsr and NALA expands into Europe: It’s always hard to go past the excellent Fintech Insider podcast, and this episode is no exception. This week’s ep gets extra credit for having as a guest my former colleague and African fintech guru Wiza Jalakasi. As always, he provides insightful commentary. Well worth a listen to get his insights into why Flutterwave might be eyeing Railsr as an acquisition target.

⤷ The Ins and Outs of Angel Investing: This is a great podcast I discovered this week, and I’ve quickly devoured all four episodes of the back catalogue. For context, “Beyond Two Percent analyses the critical questions, issues, and dynamics that affect people differently by gender - and the intersection of those dynamics with finance”.

In this episode, the hosts talk to Monica Murthy, FinTech Sales & Partnerships Lead at Alloy, and Jenny Johnston, Venture Partner at Better Tomorrow Ventures, about their respective journeys to becoming investors in early-stage companies in the fintech space. It’s a great ep, and well worth a listen.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful