Issue #74: Losses Mount For Goldman Sachs' Fintech Unit, It's Another Big Week For Fintech Funding Announcements, and Have UK High Street Banks Caught Up To The Challengers?

👋 Hi, FR fam. I hope you’ve all had a great start to the week.

Thanks as always for being a subscriber 🙌 Also, welcome to all the new subscribers— glad to have you here and welcome to the FR fold.

We’re always trying to grow the FR community, so please forward this issue to a friend or colleague. I’d appreciate it!

Also, don’t forget to join the 🆕 FR group chat! Download the Substack app — it’s even available on Android for all you green bubblers — and follow this link to enter the conversation. See you there!

Ok, without any further ado, let’s get into last week’s news from the world of fintech.

📣 The News Grab Bag

The Indian government spends big to boost the adoption of digital payments ⚬ AMEX partners up with Airwallex ⚬ Which fintech segments will VCs be focused on in 2023? ⚬ Why is Apple Pay so safe? ⚬ Introducing the new BOLT ⚬ Welcome to Sherwood ⚬ Openmarkets looks to SPAC ⚬AMEX gobbles up Nipendo ⚬ Lightspeed provides their Fintech Trends for 2023 and Beyond ⚬ Nubank tops the list as the most downloaded mobile banking app of 2022 ⚬ N26 rolls out crypto trading ⚬ The state of fintech in 2022 ⚬

📈 Notable Funding Announcements

It was a massive week in fintech financing as 48 funding rounds were announced, totalling $725m. At this pace, 2023 might not be the slow funding year we’re all expecting!

⤷ Tabby bags $58M at a $660M valuation

Last week, MENA-based BNPL startup, Tabby, announced a $58m series C round of funding that values the company at $660m. To date, Tabby has raised $491m in debt and equity to fuel its growth. Sequoia Capital India, Paypal Ventures and STV led the most recent round. The round also had participation from Endeavor Catalyst, Arbor Ventures and Mubadala Investment Capital.

🤓 My Take: Yes, I know I’m writing about another BNPL company. I promise this newsletter isn’t turning into “BNPL Radar” — rest assured, this section will be less about BNPL and more about why you should be paying attention to what’s happening in the North of Africa.

Africa has been on the radar of fintech pundits for a while, and for a good reason. From a geographical perspective, the continent still represents some of the most significant opportunities in financial services. For the most part, the narrative around fintech in Africa has revolved around “banking the unbanked”1, yet what goes under-discussed is the ever-growing demand for access to all the financial services that have become commonplace in other parts of the world. Whether it's the ability to "pay in 4" for that new handbag on Shien, the choice to use a credit card to pay for a Netflix subscription or buying crypto to hedge against a rapidly inflating local currency, young internet native consumers on the continent are keen to access all the same financial products their contemporaries in the West have access to.

It should be said Africa is not a monolith, and the 50-plus countries that make up the continent all present different opportunities. Having said this, the discourse around African fintech tends to focus on a handful of markets. Specifically, the big three of Nigeria, Kenya and South Africa tend to dominate headlines. However, what goes under-discussed is the fintech story quietly unfolding in the north of Africa.

To be fair, fintech in MENA has been on a tear for a while. In fact, for most of 2022, it was ‘up and to the right’ for the region as it hit an H1 all-time high for fintech fundraising — which was almost 2x the previous record.

Much like many other markets on the continent, MENA has seen similar tailwinds push the region’s fintech sector forward — a young population (60% are under the age of 30) who are digitally connected (77% smartphone penetration), with many willing to try new alternative digital payment methods — like BNPL. When you combine this with an emergent regulatory framework that caters to fintech startups — there are sandbox regimes across the region — you start to see an emerging region that is primed for growth.

This year will challenge the narrative, especially for the much-vaunted BNPL sector (which raised north of $500m across 2021 and 2022) as the impending credit crunch looms and consumer demand looks to be tailing off. Interestingly, Co-founder and CEO Hosam Arab of Tabby noted in a recent Techcrunch article that this might play out slightly differently in MENA than in other regions.

“Now, the economy’s structure is different for some of the markets we [Tabby] are in today. Credit penetration in the MENA region is significantly lower than in other developed markets. From a credit risk perspective, consumers are not overstretched as they don’t have two or three credit cards. So from a demand perspective, there’s a real gap and opportunity that we are filling.”

You might recall in my predictions for 2023 piece, I noted that as the capital markets tighten in 2023, we’re likely to see many fintech startups reign in their global ambitions. This contraction will be a tailwind for the locally focused fintech startups looking to solve real problems for customers in their geography. This is the year we’ll see more fintech become hyperlocal, with many homegrown players expanding their market dominance, and MENA certainly feels like one of those regions.

⤷ Goldenset Collective raises a $10m seed round

Goldenset Collective last week announced they’d come out of stealth and, along with that, their $10m seed round. The round was led by A.Capital and Lerer Hippeau with participation from 35 Ventures, among others.

🤓 My Take: According to HubSpot’s 2022 State of Consumer Trends report, 30% of those surveyed between the ages of 18 -24 consider themselves content creators — and that number rose to 40% for people between 25-34 years of age. Yes, I’m sure you know everyone has a newsletter, podcast or Youtube channel these days.

This proliferation of creators has meant that tools have been popping up left, right and centre to support their ever-growing needs. Everything from products designed to streamline the creation process to distribution tooling to grow a creator’s reach have been hitting the market. Investment in the segment has also been running hot. In 2021, VC ploughed $939m into creator economy tools (double what was invested in the segment in 2020).

As you might expect, the sector has also seen an influx of fintech solutions designed to cater to the growing financial needs of the segment.

The insight that many fintech startups have had around the creator economy is that it reflects many of the challenges other SME business owners face — but just with slightly different workflows.

Like the bakery owner, creators want to focus on their craft and what they’re passionate about — not monotonous tasks like accounting and payroll. This has led to several companies focusing on building tooling that allows these tasks to be streamlined and fit with the workflows you commonly see, for example, amongst collaborating content creators (see, for instance, Stir).

We’ve also seen a second wave of startups emerge to serve creators, focusing on providing capital. For example, startups like Spotter focuses on allowing creators to turn their YouTuber back catalogues into a financial asset. Basically, Bowie Bonds-as-a-service.

As these revenue streams become more established (and expansive), many are looking to fill the gap left by financial institutions still trying to wrap their heads around this rapidly evolving market. Interestingly, most in the segment are building some version of revenue-based financing (RBF) products — with the goal being to provide flexible growth capital for creators without feeling like they're taking on “debt”.

It’ll be interesting to see where this lands as a model for fintech lenders serving this segment, especially if brands slow advertising spending and, thus revenues fall for creators. Also, from a creator perspective, I’m sure some will be caught out by the protective provisions lenders have embedded in their RBF agreements.

☝️ Things You Should Know About

⤷ Goldman Sachs fintech unit makes $1.2bn loss in nine months

Last week, Goldman Sachs announced that its "Platform Solutions" unit — the home to their bank’s fintech, credit card and transaction banking operations — had made a pre-tax loss of $1.2b for the first nine months of 2022. Most outlets reported that the losses were mainly attributed to loan-loss provisions.

Ouch. Being the infrastructure provider to Apple’s growing suite of fintech products isn’t all it’s cracked up to be.

The step into consumer banking for the storied investment bank has proved challenging. Back in August of 2022, CNBC reported on the challenges Goldman Sachs faced in servicing the massive inflow of new customers Apple was providing. Further, with news about the size of the hole their Platform Solutions business has created in the P&L, a bleak picture is being painted for the BaaS offering. If, in fact, the economy does tighten and we do experience a credit crunch, it might become more complicated for them to sustain the product.

It’ll be interesting to see if Goldman Sachs stays the course and continues to build an offering that feels like the correct strategic play or whether they quietly wind down the offering.

⤷ The Future of Payments…is Red?

Ok, this is less a news piece than a great Twitter thread on Account to Account (A2A) payments by A16Z partner Alex Rampell.

The question of “how do you disrupt the incumbent payment schemes?” is one of the most complex strategic questions in fintech land. The schemes are truly pantheon-level examples of network effects in financial services.

Most discussion of strategy in this space revolves around two core ideas (i) finding large existing distribution channels where payments are additive to jump-start the network effect and (ii) using a different payment rail that allows for some value capture (i.e. a non-scheme payment rail).

In this thread, Alex Rampell outlines how these ideas work in the context of Target’s Debit card offering in the US.

The credit card schemes aren’t blind to this strategic threat and have been on a buying spree trying to hoover up open banking players who could make this work through A2A payments (via, for example, a PIS offering) or other native payment rail (e.g. PayTo here in Australia).

If you missed the original series, make sure you start there.

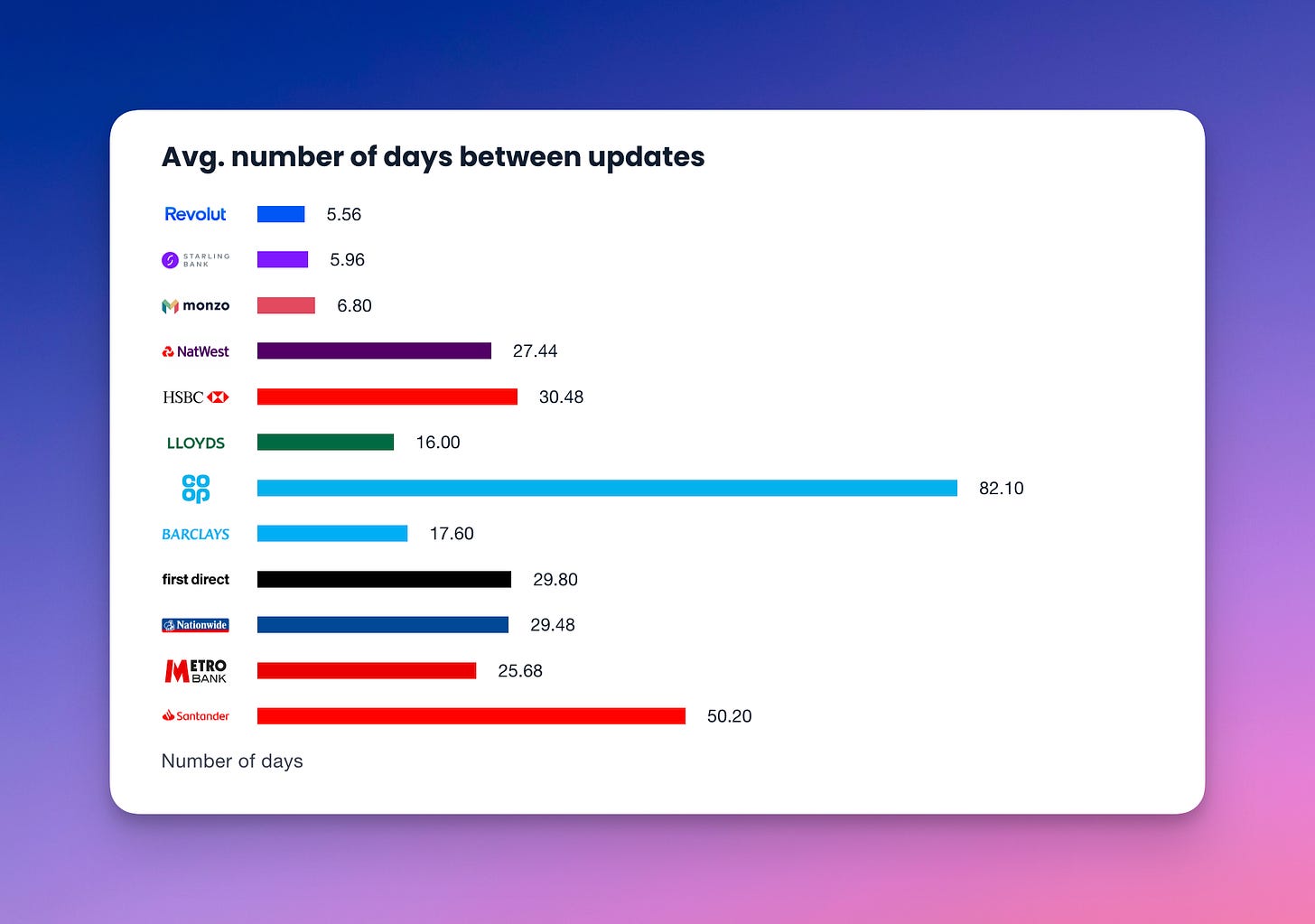

In this follow-up piece, Peter Ramsey revisits the digital experience of interacting with a range of UK banks 900 days after his original series to see if the incumbents had caught up to the challenger banks.

Drum roll, please… and the answer is no, they haven’t.

Unsurprisingly, most of the High Street banks remained stagnant. For example, in the 900 days since the original series, only one of the majors (Natwest) added the “groundbreaking” feature of being able to open a bank account through their app.

Moreover, the shipping cadence of updates remained… well you can see for yourself the difference between the neobanks and incumbents in the graph above.

Maybe the incumbents need another 900 days to catch up to the functionality of the challenger banks? 🤷♂️ To be honest, I wouldn’t hold my breath.

🎧 Podcast Recommendations

Here are this week’s podcast recommendations. Enjoy👂

⤷ StrictlyVC Presents: From Innovation to Fraud, the State of Fintech: Ok, this isn’t a podcast, but it is an interesting panel from the recent StrictlyVC conference on the current state of fintech. Get ready for some real talk as VCs call out the economic models they helped fund through the 2021 bull market. Regardless, well worth watching.

⤷News: How Apple Card cost Goldman Sachs billions: Another great episode from the Fintech Insider crew as they discuss Goldman Sach’s struggling fintech infrastructure business and a range of other news from last week. As always, well worth a listen.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful

World Bank data suggests around 45% of people who reside in Sub-Saharan Africa don’t have access to a bank account or mobile money — which equates to almost 500m people.