Discover more from Fintech Radar

Issue #53: Punks Classic: The Rock Musical, Robo-Advisors Secure The Bag And A Core Banking Primer

👋 Hi, FR fam. I hope you’ve all had a great week.

Before we get into this week’s news from the world of fintech, here’s a great little ditty about the often forgotten ‘punk fork.’

📣 The News Grab Bag

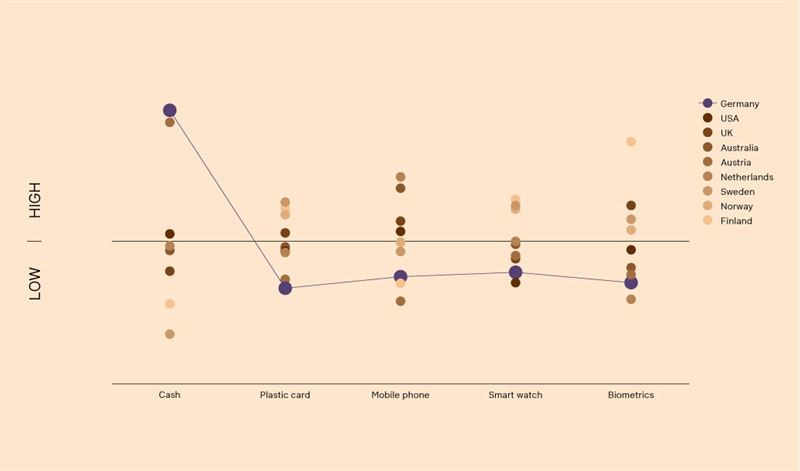

According to Klarna, Germans aren’t all that into digital payments ◌ Coinbase plans to close their HQ and go remote only ◌ Afterpay partners with Marqeta ◌ Revolut launches a public beta for bitcoin withdrawals ◌ What is Monzo planning next? ◌ Under the hood at Stripe ◌ MoneyLion is growing quickly ◌ An overview of insurtech in Africa ◌ Chime is forced to ditch the world ‘bank’ ◌ Data shows e-wallets are flourishing in LATAM.

📈 Notable Funding Announcements

It was another bumper week of financing announcements in fintech. In total, 58 funding rounds were announced, totalling $2.9b.

This week I thought I’d dive into the world of robo-advice to highlight two big fundraises that occurred and to provide some commentary on what’s going on in this sometimes forgotten about fintech segment.

Wealthsimple raises $610M at a $4B valuation →

Candian wealth tech startup, Wealthsimple last week announced a $610m funding round. Meritech and Greylock led the round. Alongside the leads, there was participation from a fair few famous Canucks, including Drake, Ryan Reynolds, and Michael J. Fox.

🤓 My Take: Firstly, big shoutout to the team over at Welathsimple on the raise. It’s great to see companies commanding big valuations in markets that are sometimes overlooked in the fintech industry.

According to the company, Welathsimple serves over two million Canadians and has over $10b in AUM. Which is impressive no matter where they’re located.

Wealthsimple started life off as a company very much cast in the mould of Wealthfront, offering smart investment options for savvy professionals looking for a way to invest their savings in a diversified way — obviously powered by tech and not armies of advisers. But, much like Wealthfront, they figured out that only offering a cheap robo-advisory platform really wasn’t enough. Subsequently, they’ve diversified their offering and jumped into the world of commission-free trading, crypto and will soon be releasing the Wealthsimple cash card.

For those who have been kicking around the fintech industry for a while, you’ll probably remember when robo-advisory was a super hot segment. Everyone was bullish on it, and VCs were rushing in to invest. It was the example de jour in fintech of ‘software eating finance.’ The idea was that because of their low-cost structure, robo-advisors would eat the stoggy world of wealth advisory for breakfast. Essentially, by using a combination of tech to reduce costs on the advice side, along with smarter portfolio structuring and offering things like tax-loss harvesting, they’d be able to provide better advice for less.

The story is still being written as to whether this bears out, but in many ways, the companies who were meant to eat the incumbents for breakfast have stayed relatively small and ended up managing middling amounts of AUMs — not necessarily the big outcome many predicted. To understand why it’s probably worth looking at the likes of Betterment, Wealthfront, and Welathsimple to see why they’re thriving.

It’s actually fairly clear that when you look at the haves and have nots in the segment, the winners tend to have figured out a really important less in banking — you need to cross-sell to grow.

Yes, I know, but this is the promise of tech. It’s meant to change the cost structure such that you can operate a niche offering and still build a meaningful business — after all, the wealth management segment is massive! However, what those who have gone on to build massive businesses in this space figured out is that you need to offer customers more. Notably, Wealthfront who really built the ‘land and expand’ playbook in robo-advice, showed that you need to go deeper into a customer’s financial life to not only be able to help them build better investing habits but also to build a significant business. In the case of Wealthfront, they’ve gone into all the classic banking lines of business — namely savings, lending and investment.

Although it’s great to stick to your knitting, it’s hard to find a way around the fact that in fintech, being mono-line ends up being a cap on the business's potential. Don’t get me wrong, it’s hard to continually roll out new products, expand geographically and maintain an edge in your core offering. However, the robo-advice segment is a great reminder that upselling IS the game for financial services.

🤖 Bibit Raises A $65m Growth Round →

Indonesian robo-advisor app, Bibit this week announced they’d raised a $65m growth round led by Sequoia India. The round also had participation from, Prosus Ventures, Tencent, Harvard Management Company, and returning investors AC Ventures and East Ventures.

🤓 My Take: In emerging fintech markets, like Indonesia, it’s interesting to observe the rapid rise in interest in investment products. According to the Techcrunch article about Bibit’s raise, the number of retail investors in Indonesia grew 56% year-over-year in 2020. According to Bibit in the same article, the number of investors who invested in mutual funds grew 78% year-over-year.

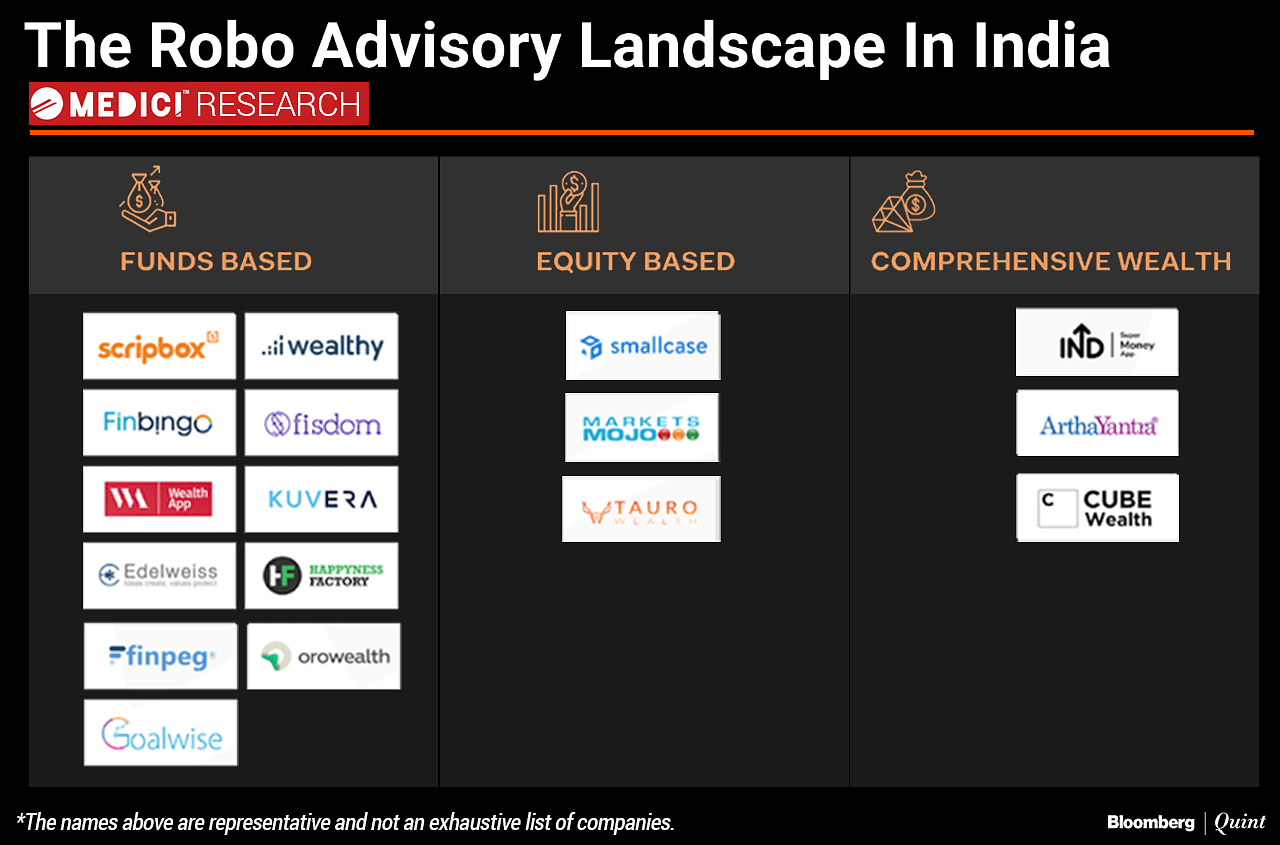

In many Western markets, the Millenial H.E.N.R.Ys segment was the first to dip its toes into the robo-advice space. The growing middle class helped drive the demand for better, cheaper, and more convenient investment advice. This same is starting to play out in emerging markets. In fact, growth markets in the Continent and sub-continent are proving to ripe for wealth-tech players.

As we saw in the US, UK, Australia and Canada, the demand for digital advice products is there. The same will be true in markets like Nigeria, India, and Indonesia as the growing middle-class looks for ways to expand their growing wealth.

☝️ Things You Should Know About

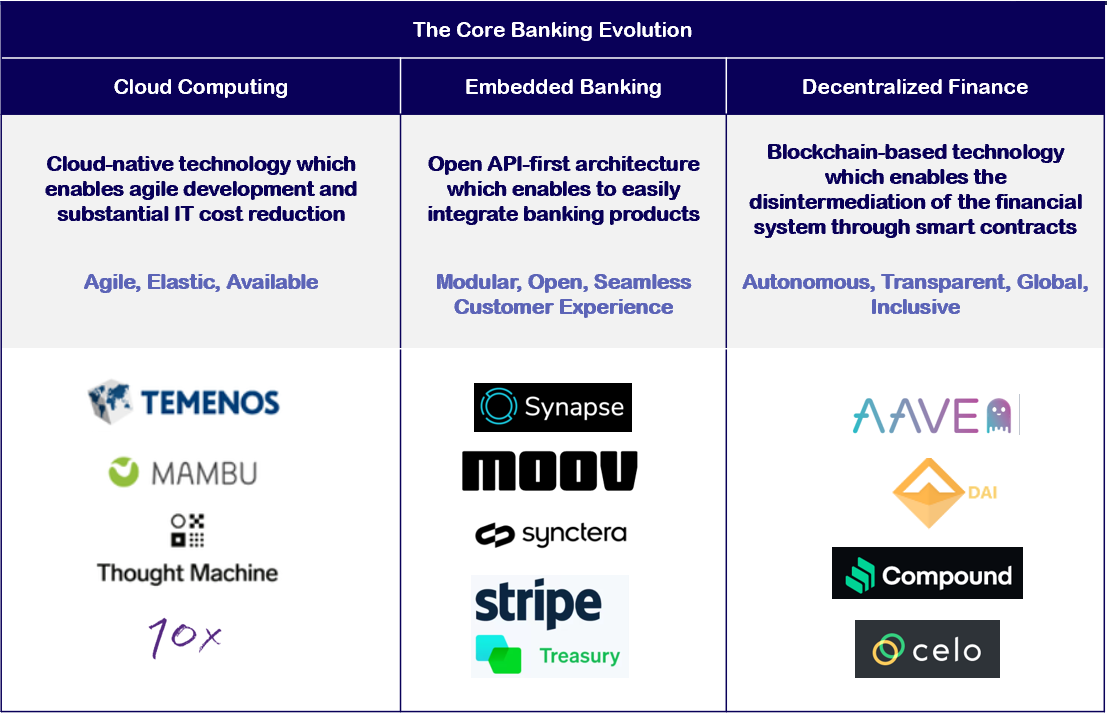

If you’ve ever wanted to know more about the core banking industry, this is a great primer from Eight Roads Ventures. There’s some really good coverage in the piece of how core systems operate in the context of multi-line FSIs and how the approach to running a core has evolved (the article even covers how the future might look in a world of Defi).

This is a really detailed piece, and if you ever wanted a primer on the market landscape of core banking this is for you.

In this week’s edition of “everything is fintech,” Twitter opens up tipping on their platform. As you might expect, the feature allows users to set up a tipping jar, allowing other users to drop them a small financial token of their appreciation.

This feature from Twitter is definitely a harbinger of things to comes in the world of social media. Although it might be a bit premature to be talking about “fintech eating advertising,” it’s a sign that we’re slowly starting to see a shift in the way platforms think about monetising. As you may recall, a few weeks ago, Clubhouse announced they’d be offering hosts the ability to monetise through tips too. Yep, the ability to pay creators directly is coming in hot, and Twitter is the latest to get behind it.

Interestingly, Twitter is not taking a vig on the tips. Instead, it seems they’re giving all the bps on the transaction to the payment providers. Although this feels altruistic, I’m sure part of the plan down the road is to offer up their own payment method. In fact, I’m sure there’s someone deep in the bowels of Twitter working on TwitterPay — now that would be something.

💸 Bill.com Set To Acquire Divvy For $2.5b →

In what was probably the biggest news item in the world of fintech this week, Bill.com has entered into a definitive agreement to acquire Divvy for a $2.5b.

This feels like a brilliant play from bill.com. In a world where the word ‘synergies’ gets thrown around a fair bit, this really feels like a good fit for them. As a reminder, Divvy is expense management software, and corporate credit all rolled into one. The genius of this approach is that Divvy (i) have better data about each transaction (because they more directly receive the data) and (ii) earn some tasty revenue on the interchange. Although it’s not a new model, the execution is incredibly slick and has resulted in them having 9,000 customers across America and spinning up 108,998 virtual cards in 2020. This feels like a great extension of bill.com’s back-office financial operations business.

Although the sticker price on this deal might feel a bit on the high side, the reality is that bill.com has a fair bit of market cap to play with. As you might recall, bill.com listed at around $38 per share back in 2019 and is now sitting at $154 per share, which values them at $12.6b.

One of the key advantages of being a public company is having liquid scrip that you can throw around as consideration in M&A. Given bill.com has put a fair few billion on in value since listing, it makes sense that they’re looking for a big play to grow their top-line revenue. It’ll be interesting to see which other listed fintech companies take a leaf out of this playbook and uses their market cap to buy up some of the many privately held unicorns.

🎧 Podcast Recommendations

It’s earning season! This week I thought I’d highlight some of the fintech earnings calls you’ll want to listen to.

→ PayPal Holdings, Inc., Q1 2021 Earnings Call

→ Square, Inc., Q1 2021 Earnings Call

→ Root, Inc., Q1 2021 Earnings Call

→ Shift4 Payments Q1 2021 Earnings Call

Ps. if you’re an earnings call junkie like me, you should subscribe to the Earnings Season podcast.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

📸 As always, our cover image is provided by Death To Stock Photos. You should get your stock images from them too.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌It’s Awful

Subscribe to Fintech Radar

Fintech Radar is a weekly missive about all that's happening in the world of fintech.