Issue #44: Anchorage Lands $80m In Fresh Funding, Coinbase's S-1 Drops And What It'll Take To Defeat TurboTax

👋 Hi, FR fam. I hope you’ve all had an awesome week.

Yet again, the fintech industry had a busy week. So without any further ado, let’s jump into things with this week’s news grab bag.

📣 The News Grab Bag

Affirm is launching a debit card (presumably vertical with a metal edition coming soon) ◌ APEX is getting ready to SPAC ◌ Aussie banking consolidation is happening ◌ Step hits 1m users ◌ Transferwise becomes Wise ◌ Fedwire goes down ◌ Stripe partners with Afterpay ◌ Intuit isn’t happy with Mastercard, and Visa ◌ Ripple gets kiboshed by MoneyGram ◌ The Kalifa review explains how the UK can remain the top dog in fintech.

🎯 The FR Jobs Board

A quick reminder that if you’re looking for extra exposure for that job opening at your fintech startup, the FR jobs board is a great place to get it.

We recently made it easier to manage multiple listings with a new employer dashboard. So go ahead and list those fintech jobs for FR the community to see!

☝️ Also, as an FR subscriber, you receive 25% off any job listing. To receive your discount, enter FRFAM25 at checkout.

📈 Notable Funding Announcements

It was another frenetic week for financings in the world of fintech. In total, 60 funding rounds were announced, totalling $1.3b.

⚓ Anchorage Raises $80m →

Crypto bank Anchorage last week announced a fresh round of funding. The $80m Series C round of funding was led by GIC and had participation from a16z, Blockchain Capital, Lux, and Indico.

🤓 My Take: Anchorage isn’t playing. This week’s announcement has pumped the crypto startup’s coffers with some fresh Benjamins to fund their ever-expanding ambitions.

You might recall, in January this year, Anchorage received conditional approval for a national trust charter from the U.S. Office of the Comptroller of the Currency (OCC). When the news was announced, it made Anchorage the first “digital asset bank” in the US or, as Anchorage President Diogo Mónica put it in a Coindesk interview:

We are a national bank. The only difference is our business line, that we’re doing crypto assets versus doing other assets. The benefit of having a federally chartered bank is that it preempts all the state laws. The clarity of being regulated by the oldest regulator for banks in the United States … sends a very clear message.

The institutional market for crypto is running hot at the moment, with many high profile purchases by NASDAQ listed companies — including Jack Dorsey’s Square. This increased interest has been a boon for custodial services like Anchorage, as institutions look to offload the security and custody issues to the professionals.

It’ll be interesting to see who else goes down the chartered route1 and how more traditional banks try to play in this space (given they can now hold crypto assets too). As more institutional investors jump into the fray, this will be another hot spot worth keeping an eye on.

🪡 Stich Raises A $4m Seed Round →

African fintech infrastructure startup Stitch last week announced a $4m seed round. Raba and Firstminute capital led the round, with participation from a range of investors, including Village Global and 500 Fintech.

🤓 My Take: As I discussed back in issue #41, fintech is flourishing outside the big 2 markets (the UK and US), and Stich is another great example of this trend.

As each market gains momentum, a similar pattern seems to emerge. Specifically, we see a flurry of activity in the infrastructure segment that supports the growing consumer-facing use cases being built — usually built by those who tried to start a challenger bank or PMF app and dealt with the plumbing problem first hand. As the flywheel starts to spin, and more B2C fintech products hit the market, companies' infrastructure needs become more sophisticated.2 This inevitably leads to new exciting opportunities for consumers, as products can be built faster and with better functionality.

It’s exciting observing (from afar) this flywheel of fintech growth spin in markets across the African continent, parts of Asia, and the sub-continent. I believe that we’ll see some of the largest players in the fintech infrastructure space emerge from these markets over the next decade as the demand for modern financial experiences dramatically increases. Watch this space.

☝️ Things You Should Know About

This is the S-1 we’ve all been waiting for, and it revealed a ton of interesting stuff about the crypto behemoth that is Coinbase.

Here are some highlights:

Coinbase currently holds $90b of assets on its platform and has facilitated $456B of lifetime trading volume.

They currently have 43m retail users, 7,000 institutional investors, and 115,000 ecosystem partners and operate across 100 countries.

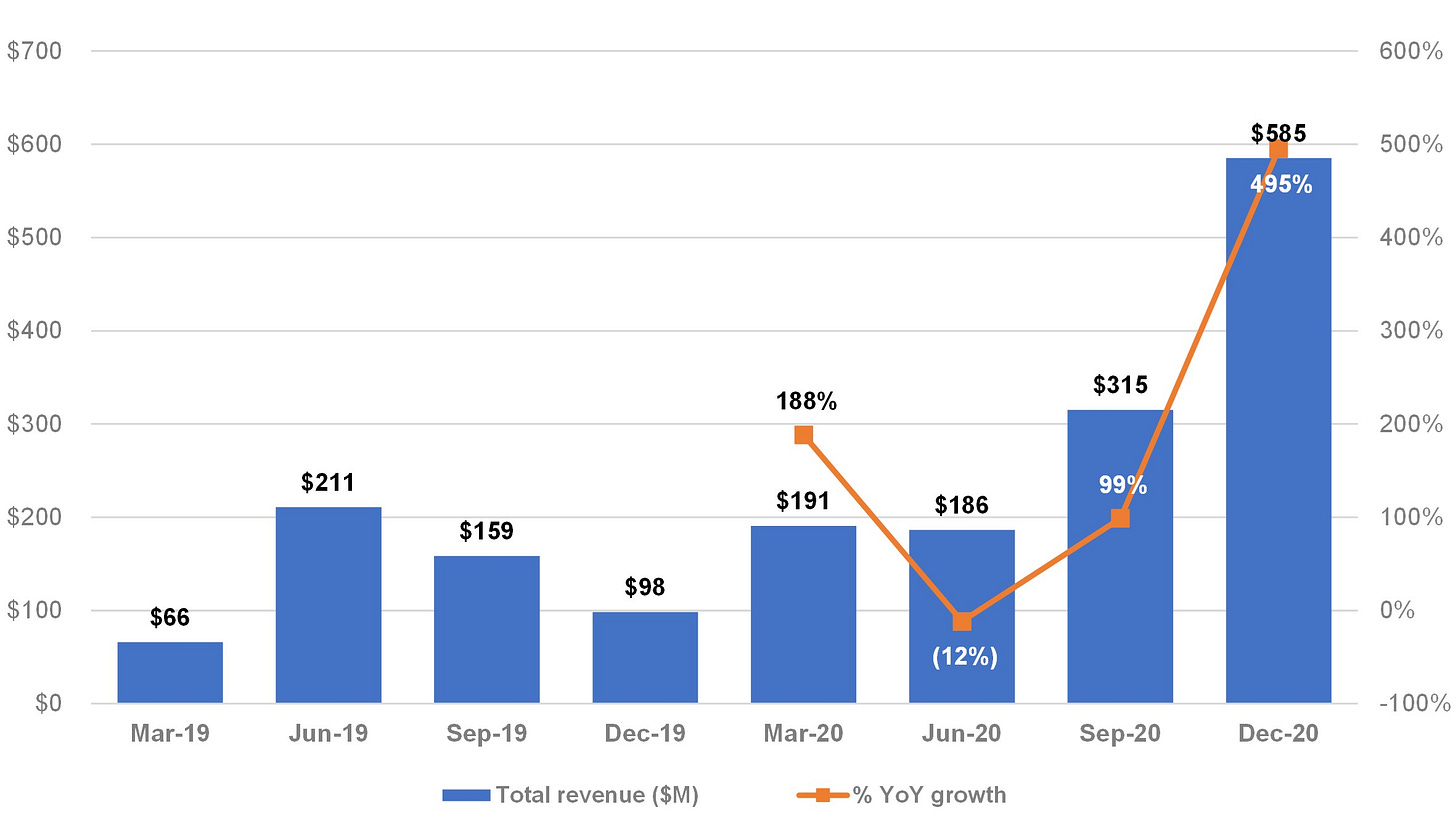

In 2020, Coinbase did $1.3b in revenue and grew at a lazy 139% YoY and all while generating 41% margins (adjusted EBITDA).

During the craziness that was 2020 in crypto markets, Coinbase had ~30 outages, with each on average lasting ~64 minutes.

Since its inception, word of mouth has been a strong driver of customer growth for Coinbase, with 90% of retail users having found them through word-of-mouth or organically.

The market from cryptocurrencies, NFTs and Defi, have all been running hot through the first few months of 2021, almost as if aligning perfectly for Coinbase’s run at a public market listing. There’s no doubt this will be one of the biggest IPOs of 2021, and it’ll provide a template for all the other exchanges thinking through if/how they go public.

📝 What It Will Take To Defeat TurboTax →

TurboTax is the Jira of fintech, it’s hard to believe it’s still being used, but anyone you ask is still punching data into it on the regular. As Ayo Omojola notes in this post, this is driven by TurboTax getting every part of the game right:

In taxes, there’s no clear second player with near the level of distribution, automation, community, trustworthiness, brand recognition and regulatory capture that they have.

I’m not going to spoil this piece, as I think you should definitely read it. Having said this, I will say that although the post is a great breakdown of how a company could take on TurboTax, I think you can easily extend many of the insights to other segments of fintech.

For example, I’m often asked how (or if) a challenger bank can take on the big 4 banks here in Australia. I obviously think they can, but not head-on.

What’s obvious is that entrenched players in a given segment of FS are hard to beat if you take them on head-to-head — after all, they’ve been at it in most cases for decades and have managed to win at the game they helped create. The trick is always formulating a new game and playing that to perfection instead. A great case in point locally is BNPL, banks have no answer for it, and it’s slowly eating away at their next wave of high-value customers — GenZ.

🧑🎨 NFTs And A Thousand True Fans →

There is currently nothing hotter in startup land than NFTs. After astonishing breakout drops from artists like Beeple, the market is becoming woke to NFTs.

In this post from Chris Dixon, he dives into how NFTs change creator economics in three important ways (i) by removing rent-seeking intermediaries, (ii) by enabling granular price tiering and (iii) by making users owners — thereby reducing customer acquisition costs to near zero.

It’s clear that the cat is out of the bag on NFTs, and we’re seeing the use case start to flow — everything from art, a new generation of sports cards and even music albums being distributed as NFTs. I’m sure this won’t be the end of the use cases either, as Dixon notes in the piece:

Someday every internet community might have its own micro-economy, including NFTs and fungible tokens that users can use, own, and collect.

Scarcity is everything in the world of asset values, and we now have a way to make digitally abundant assets scarce again. It’s going to be a wild ride. Let’s hope NFTs don’t leave an ICO size crater as their values gyrate over the coming months and years.

🎧 Podcast Recommendations

Ok, its time for some podcast recommendations for you to rock out to this weekend.

Max Levchin of Affirm: Why I Built Affirm after PayPal → This is an awesome podcast with Affirm, Max Levchin. In this episode, he discusses his passion for spy novels, why he built Affirm and why Keith Rabois called him Square’s secret weapon against fraud. Well worth a listen.

The Product Expansion Strategy of Marcus by Goldman Sachs → Marcus is far and away the best example of an incumbent bank doing fintech right. In this episode of Banking Transformed, Jim Marous talks to Sonali Divilek, head of product for consumer business at Goldman Sachs, about the product development strategy at Marcus and how they’ve built a partnership mentality while building their own consumer brand.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

📸 As always, our cover image is provided by Death To Stock Photos. You should get your stock images from them too.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful

For example, Kraken was granted a restricted state banking charter in Wyoming → https://www.finextra.com/newsarticle/36582/crypto-exchange-kraken-gets-wyoming-bank-license

This need is also shaped by regulatory change, with the classic example being Open Banking in the UK.