Issue #41: The Rise Of The Rest (Continues), Fintech Goes To The Super Bowl And The FCA Will Be Regulating BNPL

👋 Hi, FR fam. I hope you’ve all had a great week.

To kick things off, here’s a little video illustrating how awesome it is to work in investment banking (narrator: the video was a poor representation of what it’s actually like working as an investment banker).

🚨 Also, don’t forget about the FR Jobs Board. If you have a job opening at your company you’d like listed, you have two weeks left to have it added for FREE. As always, respond to this email with a link to the role/s and I'll add them to the site.Ok, I know it’s been quite the journey, but the time has come for my last prediction for 2021 — and this one is less about ‘what’ and all about ‘where.’

🌎 Prediction #5: Rise Of The Rest (Continues)

🥡 Takeaway: The most interesting things happening in fintech are all occurring outside of the US and UK. The emerging fintech ecosystems will have a breakout year in 2021. This will be led by ‘homegrown’ fintech startups who understand their local market and take advantage of the factors that make their market unique.

Go to any country, and you’ll, surprisingly, find that the financial services sector is very much a local sport. I say surprisingly because, in a world where the physical exchange of value has been abstracted away to now be zeros and ones moving over the internet, we still have an incredibly regional industry. More interestingly, this same pattern has been repeated in fintech.

Outside of cross-border payments, it’s actually fascinating to observe how few consumer fintech companies have successfully been able to venture outside of their home market. For example, the UK challenger banks that have made the trip across the pond have struggled to make a dent in the US market.1 Interestingly, the same can be said for fintech infrastructure plays. Specifically, if you look at one of the hottest segments in the space, Banking-a-a-Service, few have been able to set up outside their initial market, let alone thrive in multiple markets.

Yes, there are some notable exceptions — Stripe and Square in the payments space, and more recently, the BNPL players have expanded into other markets fairly successfully. But even Stripe really only offers payment processing in markets outside the US, and Square is only available in five countries, with the latter still deriving nearly all of its revenue from the US.2

Although this might read as a somewhat cynical take, it’s not meant to be. Instead, I say this to highlight the huge opportunities to build consumer fintech products that are indigenous to a particular geography.

During 2020 we saw emerging fintech markets across Africa, Asia, and South America really come into their own, with exits and funding coming thick and fast. Unlike in other sectors, fintech is developing in its own unique way in each region. The products that are resonating in each market are different, and the infrastructure required to operate in say Vietnam is very different from that required to service customers in the UK.

Although it’s now a fintech cliche to mention M-Pesa when talking about regional differences, it still stands as the conical example of a fintech product that met the needs of a market in a way that a fintech inbounder into Kenya would never have been able to come up with.

Regional market differences are not the only factor driving the ‘rise of the rest.’ We also see many of these countries invest in financial infrastructure and policy that is world-leading in many cases. A great example of this is India.

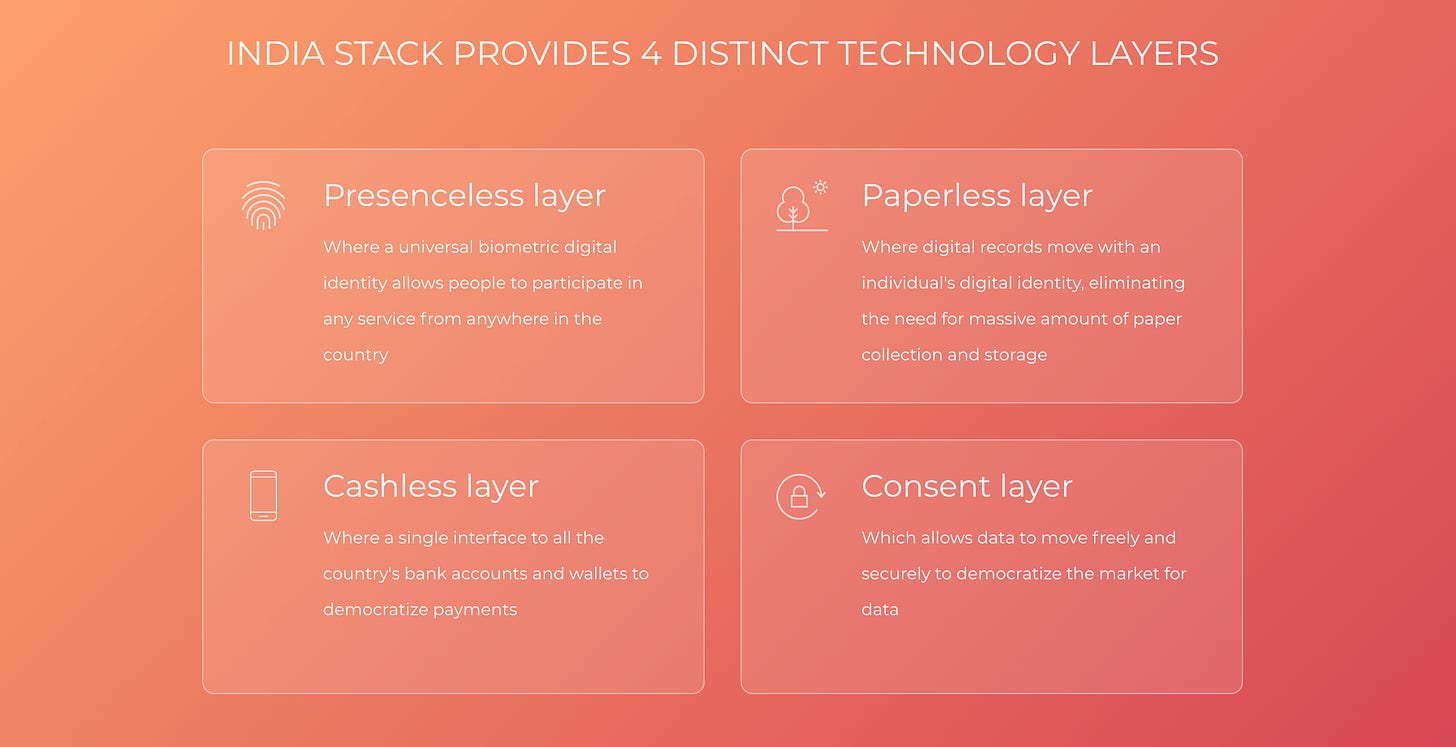

You’ve probably heard of India’s amazingly successful real-time payments network, UPI. Still, you might not have heard of the India Stack — an ambitious project designed to transform the country into a “presence-less, paperless, and cashless service economy.” It’s a huge undertaking and will change the way business is done in the country. Beyond this, it’s a project that will create a huge tailwind for Indian fintech startups and mint the next set of fintech unicorns.

It’s easy to get caught up in the US focused fintech narrative. The story that the US is where fintech lives is rapidly changing and people are becoming woke to the fact that the vast majority of fintech startup opportunities will be in the emerging markets — where the financial access problems are real. The fintech revolution is only just getting started. More importantly, the startups that will be best positioned to take advantage will be the ones who live and breathe the local market.

📣 The News Grab Bag

Chime hits 12m customers ◌ Ant makes amends with the Chinese regulators ◌ Anomyous challenger bank raises millions and then proceeds to give it away on Twitter ◌ Visa reveals their crypto roadmap ◌ FTC (unsurprisingly) sees a spike in Robinhood complaints ◌ Gemini gets further into banking ◌ BBVA sells Holvi (acquired in 2016) back to the founder ◌ The US Federal Reserve now wants to launch RTP one year earlier in 2023 ◌ Payoneer is SPAC’ing ◌ The fintech genie is out of the bottle. 🧞♂️

📈 Notable Funding Announcements

In another big week, $4.4bn was raised across 41 deals.

☝️It should be noted, most of that was made up of Robinhood’s monster ‘emergency’ $3.4bn raise led by Ribbit Capital.

💰 Stash Bag $125m In Fresh Funding →

Stash, US challenger bank, announced they’d raised $125m in their Series G funding round. Eldridge led the round with participation from previous investors, including Owl Ventures.

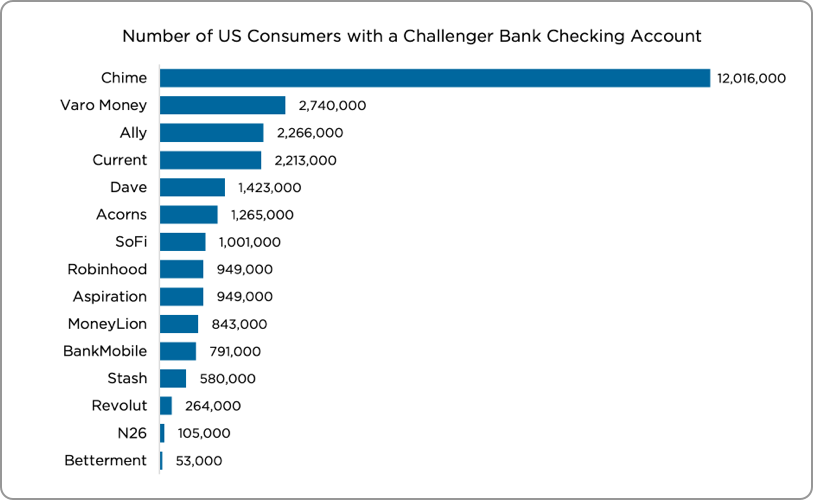

🤓 My Take: In 2020, the world went fully digital, and a big winner was the challenger bank segment. In fact, it seems like it’s now a weekly occurrence that we’re hearing about challenger banks in the US announcing record growth. As noted above, it looks like Chime has crossed the 12m customer mark and we’re also seeing more people considering their neo bank account as their primary account.3

Stash, much like its contemporaries, seems to have seen a major bump in customer numbers. According to the press release announcing the raise, Stash saw a 100% increase in account openings in 2020 and now has $2.5b in AUM. Interestingly, in a year when YOLO stonk trading went gangbusters, Stash saw a 50% increase in the number of customers automating their investments.

The US challenger bank market feels like it’s playing out differently compared to other markets. The combination of underbanked (or maybe more correctly, very poorly banked) along with the accidental interchange model created by the Durbin Amendments seems to have produced fertile ground for neo banks.

This feels very different from what we see play out in markets like the UK and Australia — where the challengers seem to be struggling on both fronts.

🇮🇩 Indonesian Fintech, GajiGesa Raises $2.5m Seed Round →

Indonesian fintech startup, GajiGesa, which provides earned wage access (EWA), last week announced they’d raised a $2.5m seed round co-led by Defy.vc and Quest Ventures.

🤓 My Take: The EWA segment has been gaining a fair bit of steam as of late. For those who are unfamiliar with it, EWA products (sometimes referred to as earned income access or payroll advances) essentially provide people access to their earned wages before their next payday. The structure of repayments and who pays for the service (employer or employee) varies. Still, many of the more recent entrants into the segment offer fixed fee early access to earned wages.

To be fair, this isn’t all that new a segment with OG companies like PayActiv having been around since 2011. However, recently, the segment has received more attention, with early access to wages being offered as a feature by several US challenger banks. Although the offering from the likes of Chime around early access to pay is different from what many of the EWA providers offer, it has helped to popularise the practice.

Beyond this, the rise in popularity of BNPL (with some EWA providers structuring their repayments similarly) feels like it may have created some positive spillover effects for the EWA players. For example, this trend has been very apparent here in Australia, with several entrants marketing their product to piggyback off the rapid growth of the sector — with some company names even sounding eerily similar to companies operating in the BNPL segment.

Interestingly, this is quickly developing into a global trend, with companies popping up everywhere from Australia to Indonesia. This is definitely a space worth keeping an eye on in 2021, but personally, I hope this segment doesn’t become the new frontier for payday lending.

☝️ Things You Should Know About

🛍️ FCA To Regulate BNPL →

Surprise, surprise, the UK’s FCA will now be tasked with monitoring the BNPL sector. The announcement doesn’t specify what shape the regulations will take. Still, it notes that we’re likely to see new legislation introduced that will require lenders to “…carry out affordability checks on customers and ensure the vulnerable are treated fairly.”

As I noted in issue #37, this is the year of fintech regulation making a sharp turn. We’ll likely see more regulatory pressure applied to fintech companies as they transition from being upstarts to the establishment.

It’ll be interesting to see the form of the UK regulation take and the second-order impacts it has on BNPL players and, more broadly, on short-term unsecured credit providers.

🏈 Super Bowl Ads Are Still A Thing →

The American sports spectacular that is the Super Bowl this year was the platform for fintech startups venturing into the world of TV ads.

In particular, two of the biggest names in fintech decided to drop some serious coin to get their brand out to the millions of viewers watching the game — around $5.5m apparently for a 30sec slot, is what it cost this year. In case you missed them, here they are in all their glory, along with some FR commentary (obvs).

🫂 Robinhood, “We are all investors”

For their 30 sec slot, Robinhood went with the message that we’re all investors. In fact, apparently, you don’t need to become an investor because “we’re all born” one. I’m not sure about that, but good on them for normalising that YOLO lifestyle with the cutaway at the end of a Zoomer having a coffee at a diner (maybe after a big night out on the White Claws?) and trading some stonks.

🤠 Klarna, “The Four Quarter-Sixed Cowboys”

This fun little ad felt really on-brand for the quirky Swedish BNPL company. It stars Maya Rudolph (of SNL fame) as a miniature cowgirl (x4) riding into town to buy some very unique cowboy boots. It was fun and all, but I felt like it was missing the Klarna Big Dogg, Snopp.

☝️ Bonus: StateFarm, “Drake from State Farm”

Ok, this ad isn’t from a fintech startup, but it was properly hilarious and it had Drake in it. Well worth a watch.

Sadly in the FS segment this year, the best ad goes to… an incumbent. Well played State Farm. 👏

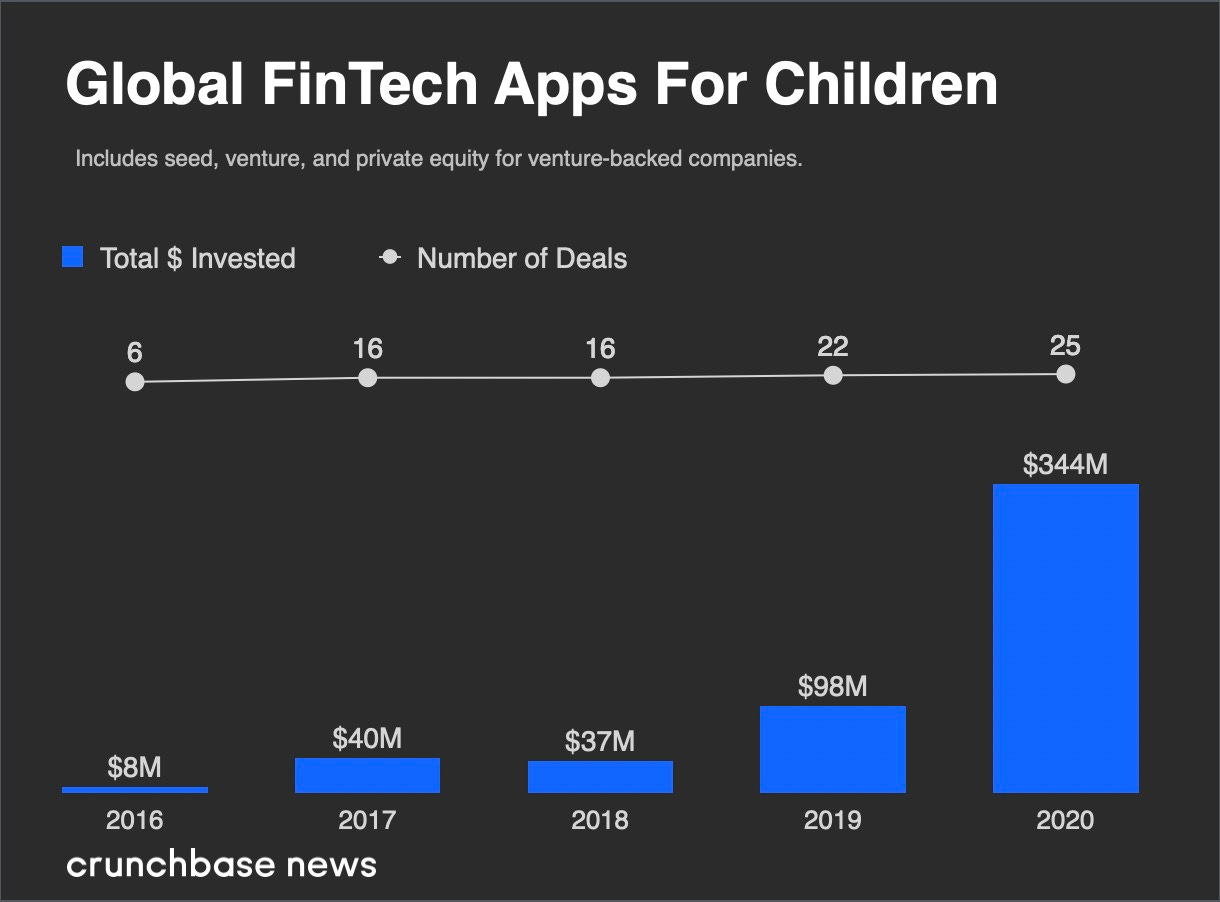

In previous issues of FR, I’ve spoken about the teen banking market and the growth we’ve seen in the space over the last 18 months.

The segment is clearly maturing with many early players now raising serious rounds of capital. As I’ve noted previously, the real question many now face is how they transition their customer base into lifelong customers — and along with this, whether they expand their offering into a fully-fledged challenger bank proposition.

🎧 Podcast Recommendations

Ok, here we go with another pair of podcasts to keep you going during your next fintech powerwalk.

Behind Klarna's massive growth in the US with David Sykes → By all reports, Klarna is gearing up for an IPO this year. Buoyed by stellar growth in the US (where they’ve ticked over 15m customers!), the Swedish BNPL player is looking to build their US presence even further. During the podcast, Klarna's president of North America, David Sykes, discusses their growth in North America, their rewards program, and how Klarna is going beyond DTC.

This is a highly recommended listen for all those who are BNPL curious.

Yoshi Yokokawa from Alpaca → This is a fun podcast with the founder of Alpaca, Yoshi Yokokawa. He talks about the company's genesis and some of the challenges they faced in establishing an API based brokerage.

Ps. Ever wondered how this API for stock trading company ended up being named after a spitting animal (I did)? If so, make sure you add this episode of Bank On It to your playlist.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

📸 As always, our cover image is provided by Death To Stock Photos. You should get your stock images from them too.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌It’s Awful

Revolut is leading the charge, and it’s only been able to accumulate a meager ~250,000 customers in the US (compared to Chime’s ~12m).

Square’s geographical revenue mix in 2020 was 95% from the US and 5% from the other 4 international markets.