Issue #37: Fintech Prediction #1 For 2021, Mambu Secures The Bag And What Domestic Payment Schemes Can Teach Us

👋 Hi, FR fam. Firstly, happy (belated) New Year! I trust you all had a chance to down some fine french champagne to usher in the New Year and have also been able to take some well-deserved time off to recharge — after 2020 we all needed some downtime.

The start of a new year means it’s time to open up Co-Star and look to the sky for guidance on what the year will hold for the sector. So let’s check our composite charts to make sure the stars are aligned for fintech in 2021 and dive into some predictions for the year ahead (I promise, no more Astrology talk, I’ll be leaving that to @marenaltman).

Before we jump into this year’s predictions, just a quick explainer on how I’ve structured things this year. Instead of just doing a big dump of predictions, I thought instead I’d spread them out over the coming weeks to ensure I don’t give you prediction indigestion. Think of it as a set of well spaced Door Dash deliveries to your inbox.

So let’s get into it with prediction #1 for 2021.

👮♂️ Prediction 1: We’re Going To See A Change In The Regulatory Tide In 2021

🥡 Takeaway: The changing sentiment towards the tech sector will impact fintechs, and could result in 2021 being the first year in a while where we see governments and regulators make a hard left turn on loosening the reigns with respect to regulating early-stage companies operating in the financial services sector.

In the wake of the last financial crises in 2008, governments in many parts of the world took stock of what had gone wrong, and a number came to a similar conclusion. There was something farily fundamental that wasn’t working with the way financial services incumbent were regulated (I know, massive understatement).

This was the genesis of the school of thinking on how a broadening of the FSI base could improve innovation and thus customer outcomes. Moreover, it paved the way for sector’s explosion over the last decade. For example, the Durbin Amendments in the US created (let’s be honest, by accident) a viable interchange based business model for challenger banks. While across the pond, the UK empowered the Financial Conduct Authority (FCA) to pursue a competition focused agenda that has created one of the most vibrant fintech ecosystems in the world and here in Australia the rise of a Consumer Data Right (CDR) and a financial services sandbox regime have both stimulated the growth of fintech scene.

I think it’s hard to argue that the fintech sector would be as vibrant as it is today without the pro-competition and pro-innovation based policy changes we’ve seen introduced in many parts of the world. It’s also fair to say that, overall, the winners have been customers — with more choice, better accessibility, and lower prices being the benefits that have accrued to the average consumer. This narrative has been one that many politicians and regulators have been able to run with, which in turn has created a flywheel of sorts that’s stimulated further regulatory change. In fact, across the globe regulatory sandboxes, open banking, and improvements/amendments to banking licensing, to name a few regulatory initiatives, have become the standard policy playbook when it comes to promoting innovation in the financial services industry (read as: promoting fintech).

However, in 2020 we started to see cracks in this narrative as governments and regulators began to change their posture towards regulation. For example, in markets like China, there was a sudden tightening of regulations related to lending by CBIRC, while in India concerns over risks related to market concentration of the UPI ecosystem resulted in plans to introduce volume caps for third party app providers. In Brazil, regulators kiboshed WhatsApp’s payment product in the same week it hit the market.

The astute reader may well question some of the above examples and note that we’re still likely to see governments push on with their pro-fintech policy programs in many parts of the world. Don’t get me wrong, I don’t think we’ll see financial infrastructure modernisation projects get axed — I mean some highly developed markets still don’t have faster payments (😉 ). However, 2021 is likely the year we start to see many of the bold changes to licensing and relaxing of regulatory requirements for early-stage companies slow or even reverse. I think the changing sentiment towards tech companies will be a catalyst for this shift.

Let’s be honest, it’s now politically convenient to rag on big tech for every problem in the world and fintech startups are likely to be lumped in with this shift in narratives. The days of tech optimism are coming to a close (if they ever existed) and as a result, the golden age of pro-fintech regulation is likely also coming to an end.

📣 The Weekly News Grab Bag

◌ RIP to the OG Challenger Bank, Simple ◌ Oops, the Reserve Bank of New Zealand got hacked ◌ Walmart plans to do some fintech innovation theatre ◌ Federally chartered banks in the US can now become node verifiers and use stable coins for payment activities ◌ Affirm could be worth more than $10bn ◌ Here are a few ways institutional investors are hiding their bitcoin order sizes ◌ The year in fintech that was 2020 in just 50 words ◌ Domain launch Afterpay for property purchases ◌ Alibaba and Jack Ma — a tweetstorm worth reading ◌ And the 10 fastest fintechs to reach billion-dollar valuations are…

📈 Notable Funding Announcements

2021 kicked off with a big first week of funding announcements. Fintech startups globally raised $971m across 24 deals.

🏗️ Mambu Raises €110m In A Series D Financing. →

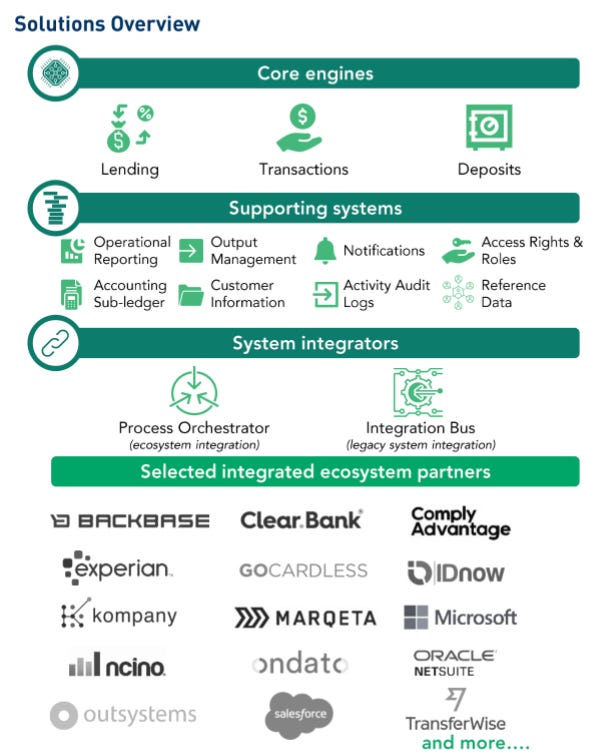

Core banking provider, Mambu announced they’d closed a €110m series D financing that values the company at $2b. TCV led the round with participation from Tiger Global and Arena Holdings, while existing investors Bessemer Venture Partners, Runa Capital, and Acton Capital Partners followed on in the round.

🤓 My Take: Core banking isn’t a sexy topic. Even in the esoteric world of fintech infrastructure, it’s one that doesn’t get a lot of attention. However, in a time of compressed NIMs and increased competition keeping the cost of account opening and maintenance as low as possible is becoming vital for challenger banks and incumbents alike.

Mambu is one of the OG modern composable core banking providers. In fact, when they launched back in 2011, the idea that your core could be cloud-based was laughable. Fast forward to today and microservices, cloud migrations and containerisation are all the rage in legacy bank planning meetings — or at least discussions about them is. In all seriousness, the appetite for legacy players to move to a more modern core stack is increasing, and the likes of Mambu are the reaping the rewards. According to their press release announcing the round, they’ve grown by 100% YoY which is impressive for a company that measures sales cycles in years.

There is still a ton of growth left in the segment as banks continue to run expensive ‘cloud transformation projects’ in an attempt to bring their cost base down. When you combine this with fintech’ification of every business (e.g. Orange is a Mambu customer), there still seems to be headroom in this deeply unsexy corner of fintech.

💳 Divvy Raises $165m →

Corporate card and spend management startup, Divvy (not to be confused with Divi, Divipay or Divy — yep, it’s a popular name for fintechs), last week announced they’d closed a $165m Series D round of funding. The round had participation from Hanaco, PayPal Ventures, Whale Rock and Schonfeld.

🤓 My Take: The SME challenger banking space ran white-hot in 2020. As a result, there is a growing pack of well-funded players all vying for the corporate accounts of companies in the US.

Interestingly, the vast majority (e.g. Brex, Ramp, Airbase and Mercury) have been going hard at the startup/early-stage company demographic — meaning there is a ton of competition for the startup bank account. In a crowded market (and one that has proven to be fairly undifferentiated) it’ll be interesting to see who comes out on top — or more likely who tries to escape the startup banking demographic and chases a more lucrative segment.

☝️ Things You Should Read About

🏦 N26 Secures A Banking License In Brazil →

Last week it was reported that N26 had secured a form of restricted banking license (specifically a Sociedade de Crédito Direto) in Brazil.

The South American fintech market has been on a tear lately led by the region’s poster child, Nubank. More specifically, Brazil has been getting a fair bit of attention from the international challenger banks with Revolut also eyeing off the market. Many see what Nubank saw when they launched — a growing middle class, high levels of smartphone penetration and tightly held market for banking which has been underdelivering for its customer base.

It’ll be interesting to see how N26 fairs in Brazil, as it not only battles Nubank and it’s already hefty footprint (25m customers!), but also the other inbound challenger banks. Let’s hope it’s not another N’exit for the German neo bank.

💳 Domestic Card Schemes (Still) Matter →

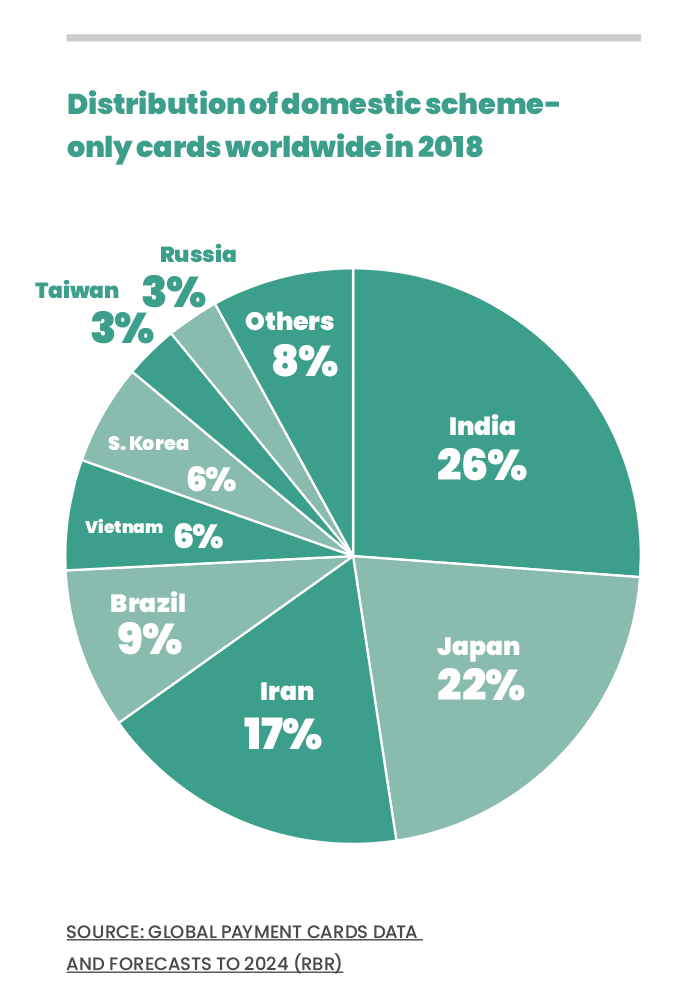

In much of the Western payments world when you reference a payments scheme, we’re basically talking about Visa or Mastercard. Yes, the ‘big two’ process a vast majority of the world’s credit card payments. However, it never ceases to amaze me how many different schemes there are around the world and how many actually have a sizable share in their home market.

There is the obvious lessons one should take away from this, namely not to ignore them if you’re a PSP entering the market. However, I also think a number of other lessons can be gleamed from them when thinking about a market entry strategy. Specifcially, many of them have have been able to survive (and thrive in some cases) due to highly regionalised distribution strategies.

For example, the article highlights that in Russia MIR (a scheme operated by the Russian National Card Payment System — a wholly-owned subsidiary of the Central Bank of Russia) has grown on the back of public sector employees receiving their salary payments via the scheme, which is not a distro staregy many in other parts of the world would think to utilise.

🎧 Podcast Recommendations

As usual, the world of fintech podcasts has throw off some absolute gems for your auditory enjoyment. Here are few that I really enjoyed recently.

An Interview With Frank Rotman From QED Investors → I think this might be the 3rd podcast that I’ve recommended with Frank Rotman from QED as the guest, but they’re always bangers so I feel compelled to share them with the FR fam.

As usual, he provides some deep insights into the game that is investing in early-stage fintech startups and he also digs in on a few lessons from some of his biggest wins (and QED has had some massive ones). Also, worth listening out for is the story of his time at Capital One.

Fintech, Growth-Stage Investing, and GTM Advice with Yasmin Razavi → Speaking of repeat recommendations, here’s another one from the Village Global podcast. This time Eric chats with Yasmin Razavi of Spark Capital. I particularly liked Yasmin’s break down of why the payroll space continues to be a great wedge for startups (which I totally agree with) and her take on GTM for late-stage companies.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

📸 As always, our cover image is provided by Death To Stock Photos. You should get your stock images from them too.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌It’s Awful