Discover more from Fintech Radar

Issue #38: The Golden Age Of Fintech Infrastructure Is Just Beginning, Everyone Decides To Raise $300m And Affirm's IPO Pops Off

👋 Hi, FR fam. Welcome back to another issue of Fintech Radar. This week I dive into my second prediction for 2021, and as usual, I also provide the real talk on all the latest fintech news.

Ok, let’s get it!

🏗️ Prediction #2: The Golden Age Of Fintech Infrastructure Is Just Beginning

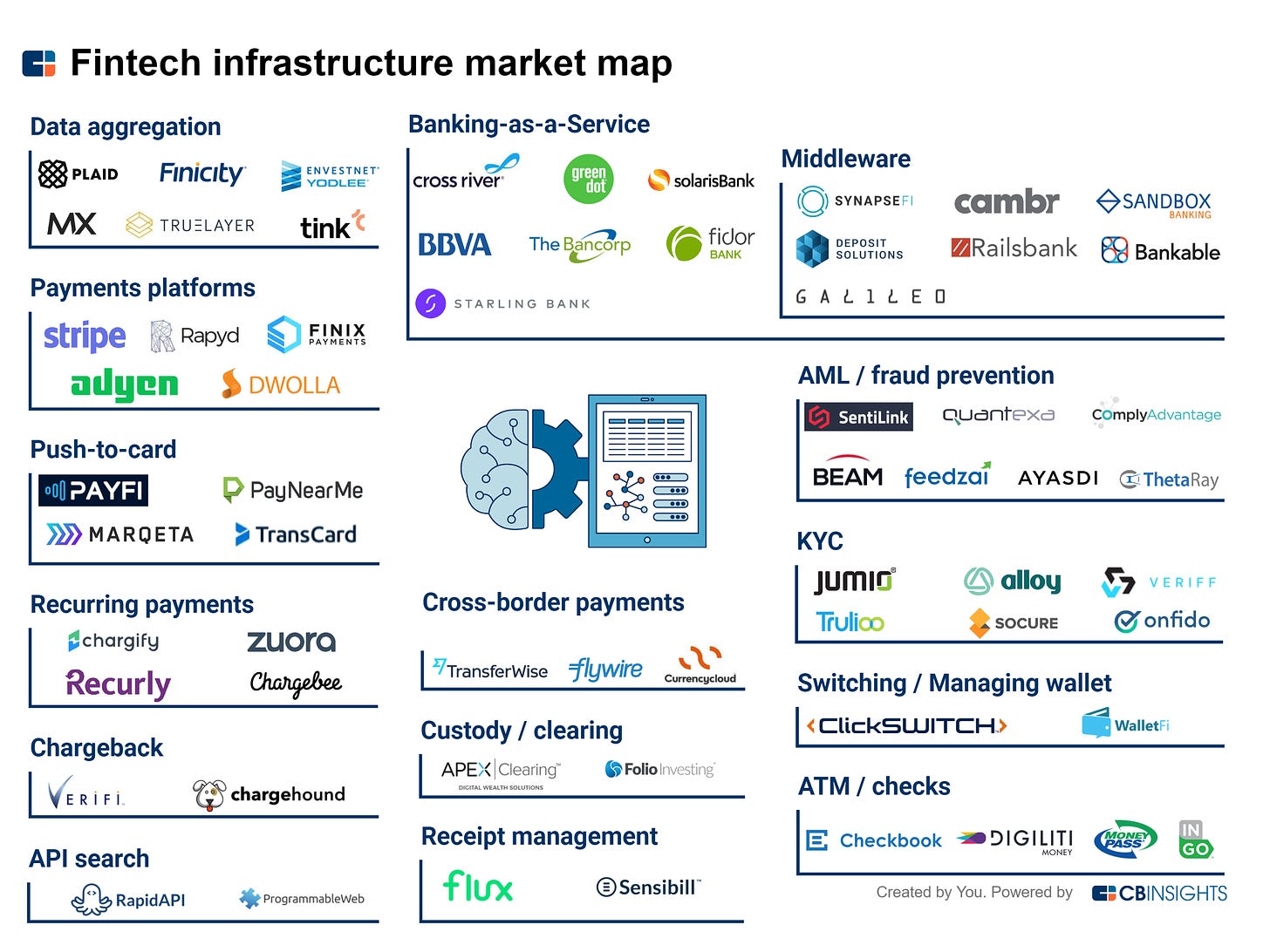

🥡 Takeaway: The fintech infrastructure segment went into overdrive in 2020. As we enter 2021, the space only seems to be getting hotter. In recent history, the segment has been driven by consumer banking moving from a teller interface to a web one. However, the current growth in the sector is being driven by a new wave of startups who are catering to a shift to contextual banking — think Shopify offering banking. As every company becomes a fintech, the demand for infrastructure will only grow, meaning 2021will be another breakout year for the segment.

It felt like everyone wanted a piece of the red hot fintech infrastructure segment in 2020. VCs were happy to throw money at the 25th BaaS company just getting off the ground, incumbent biz dev teams were on the hunt for their own Plaid acquisition (RIP that deal), and you couldn’t listen to a fintech podcast without the term “embedded fintech” being mentioned.

Yep, it was awesome to be a fintech plumbing company in 2020.

Obviously, this wasn’t a new theme. However, it felt like “X-as-a -Service” in fintech went into overdrive in 2020 as most horizontal segments in the BaaS stack were SaaS’ified and available for fintech startups to pick up and slot into their product — saving time and money for many early-stage companies.

Outside of pureplay fintech, companies were also becoming woke to the fact that ‘everything’ was becoming fintech — think Shopify and their soon to go live banking product, Balance (powered, by none other than Stripe). The emergence of fintech as its own platform was coming to fruition due to the pipes becoming easier to install and maintain. As Matt Harris of Bain Capital put’s it:

Financial functionality is becoming a native component of the stack (both technology stack and as a business model), which means there’s a growing opportunity for embedded fintech rather than pure fintech… Rather than constituting a segment on its own, fintech joins the internet, cloud and mobile as the fourth major platform technology.

It’s this change, from fintech being a standalone proposition to being a contextual one, that is going to mean that 2021 will be an even wilder year for the fintech infrastructure space.

🏦 → 🖥️ The Move From A Teller Interface To A Web Interface

If you jumped in the Hot Tube Time Machine and went back just 12 years, you’d be surprised at (or just reminded) how different retail banking was compared to today. The internet and the supercomputers we all now have in our pockets have profoundly impacted the way we interact with the financial services industry. The main difference being that we’ve moved from a teller interface world to a web-based one served up on our smartphones.

The OG fintech players took advantage of this and built digital propositions that leveraged the tectonic shift from on-prem to the web. Along with the rise of the neo banks and online lenders, we also saw banks needing to figure out how they continue to compete in a world where Brad the branch teller couldn’t sucker you into opening a new account or upping your credit limit.

Cue the fintech plumber companies who helped pioneer the space — GPS, Wirecard (RIP), Galileo. These companies were amongst the first to figure out that there was a growing demand for atomised parts of the banking stack. In so doing, they wrapped the old banking primitives in new wrappers and providing them as APIs.

To many in the world of tech, this doesn't sound very interesting — nonetheless, it’s been profound. This has allowed the current crop of challenger banks to move fast and make things their customer actually want vs. spending all their time connecting to the financial system's pipes.

Along the way, something interesting happened, fintech outsiders found out about the plumbing getting better and cheaper. Now everyone has caught on to this profound change in the way banking works and realised they too can become a fintech.

🖥️ →🧾 Shifting From Web Interface To A Contextual One

The astute reader will quickly point out that everyone from Saks through to Woolworths has offered financial products for years — everything from branded credit cards through to insurance. All true. So what’s changed? The answer is ‘who’ and ‘when’ a company can start offering financial services products.

It’s now easier than ever to provide financial services to your customer. The non-fintech company no longer needs to invest millions in setting up, for example, a card program. Instead, they can now jump online, choose from the plethora of infrastructure providers and spin up an FS product with nothing more than an API call.

This brings us to 2021. The companies who have distribution have the ability to provide FS products in the context that makes the most sense to their customers. The days of going to the bank for a loan if your business needs a little more cash to cover a lean patch is over — now you’ll do that through your PoS provider (probably powered by Stripe).

I know the map isn’t the terrain. However, it’s getting dramatically cheaper to spin up FS products and the scope of things the average SaaS company looking to get into FS can offer is getting broader.

As more companies venture into the world of fintech, expect more infrastructure companies to pop up, and with this the capital. Yep, 2021 is going to be another big year for all the fintech plumbers.

📣 The News Grab Bag

Jamie Dimon says JPMorgan Chase should be ‘scared s***less’ of fintech startups ◌ Kenya’s plans to modernise the country’s payments system ◌ Ouch, Capital One cops a $390m fine from FinCEN ◌ Goldman Sachs wants to be the custodian of your crypto ◌ Why investors are bullish about Indonesia’s fintech sector ◌ Is Chime the future of retail banking? ◌ Why Tusk Ventures thinks fintech is on fire ◌ Open Banking in the UK turns three years old ◌ Paypal wants to reach 1 billion DAUs ◌ Revolut gets around to applying for UK banking license ◌ According to Apptopia, Chime ended last year as the most downloaded banking app, Paypal was the most downloaded ‘remittance’ app and Coinbase was the most downloaded crypto app.

📈 Notable Funding Announcements

Fundraising announcements across the sector went into overdrive last week with a bunch of notable going public. In total, across 55 deals, a whopping $2.8b was raised. Wow!

💸 Blend Raises $300m In A Series G Round Of Funding →

Last week, digital lending platform Blend announced a monster $300m Series G round of funding. The round had participation from two new investors, Coatue and Tiger Global Management. The round came just 5 months after Blend’s last round of funding.

🤓 My Take: I remember speaking to the innovation team of an Aussie big 4 bank about how long they thought it would be before they could digitally complete a mortgage — from origination to close. I recall a senior member of the team telling me the bank was close to going “fully digital” with mortgages and should be done by the end of the year. That was almost 5 years ago, and they still aren’t there.

As of 2021, few banks have been able to go fully digital with their mortgages. Having said this, COVID really changed that game, and many banks were forced to move (at least in part) to a digital process. So it’s no surprise to see Blend be one of the beneficiaries of this. According to their press release on their latest round, they’ve been growing like wildfire.

“In 2020, Blend facilitated $1.4 trillion in loans — more than double what we facilitated in 2019 — for our more than 285 lender partners… our customers now represent approximately 30% of all mortgage volume in the U.S”

As Blend has figured out, this isn’t the only place most incumbent banks struggle with the ‘origination to close’ process (Blend has expanded out to personal loans and deposit accounts too). It’ll be interesting to see how far up the stack Blend can reach, ultimately this could be an interesting path to becoming the nervous system for a bank.

🏗️ MX Raise $300m In Their Latest Round Of Funding →

Last week MX announced they’d raised $300 million in a Series C funding round. TPG Growth tipped in $150m, which brings the company’s valuation to $1.9b. The round also had participation from new and existing investors including CapitalG, Geodesic Capital, Greycroft, Cota Capital, Canapi Ventures, Digital Garage, Point72 Ventures, and Pelion Venture Partners.

🤓 My Take: Well, $300m seems to be a popular number for fintechs in late-stage funding announcements last week (payments player Rapyd also raised $300m last week)

As noted above, fintech infrastructure is still on fire. In the US, the likes of Plaid and Finicity have shown that there is ample appetite for third-party data aggregators. MX was the other big name in the space that many thought someone would have a swing at acquiring — instead, they’ve been steadily raising capital and going about building what is clearly a sizable business.

A lot has been said about this segment, but one thing that goes under-discussed is how quickly we’ve seen many now move up the value chain into providing ‘enrichment services.’ For example, one of the ones that become a bit of a meme in 2020 was payroll data — more commonly stated in tweets as “what if Plaid for payroll was Plaid all along?” In fact, one of the things to keep an eye on this year in the segment is all the different data enrichment services these players are going to provide and the move into payment initiation services (PIS) 🌋

☝️ Things You Should Know About

📈 Affirm’s Stock Price Skyrockets At IPO →

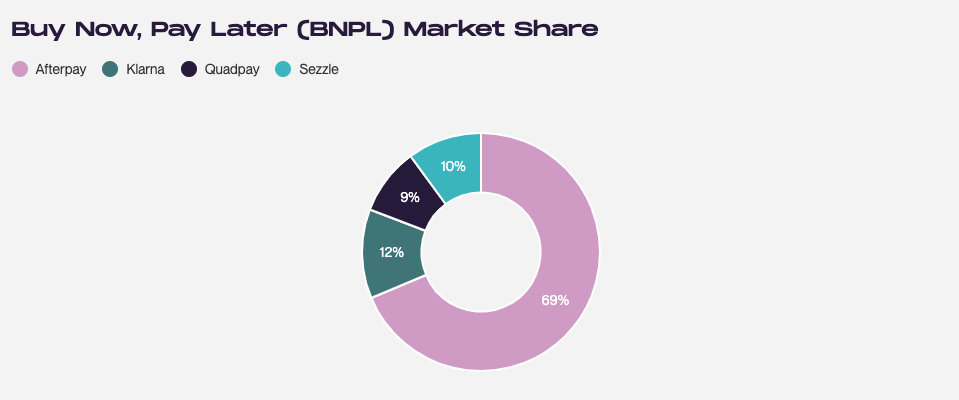

This was one almighty pop on day one for Affirm. At close, their stock price had nearly doubled, and it once again showed there is some serious public market hunger for BNPL stocks.

A range of things could be said about the listing and valuation (currently hovering around $25b). Still, it does signal the increased attention the segment is receiving in markets other than Australia (where Afterpay, ZIP, and Sezzle are all listed). The US is heating up with all the major players turning their attention to the market. It’ll be interesting to see who (and more importantly, why) wins this competitive market.

As a side note, there is no strong indication of when Klarna will list, but you can imagine that the Swedish BNPL OG must be getting really tempted to ring the bell at NASDAQ.

🤝 Marqeta Partners With Marcus →

In the latest installment of Goldman Sachs’ Marcus wheeling and dealing, the consumer bank struck a deal with Marqeta to power its digital checking accounts — which, they note in the press release, will be available later this year.

Although I usually don’t highlight things like this in FR, I think it’s notable as G.S’ Marcus continues to be one of the few incumbents that always seems willing to partner with fintech to have access to best in breed solutions.

Also, it’ll also be interesting to see what the Marcus team conjures up with Marqeta for their checking account later this year.

💔 Plaid Visa Acquisition Break Up →

When I heard this news, all I could imagine was the now infamous Plaid volcano rising out of the ocean ready to rain down PIS lava on the payment schemes. Ok, maybe that was a little too graphic.

Although the deal falling apart wasn’t a surprise to anyone, it did bring to an end this star-crossed acquisition. If you’re team Plaid, this was the New Year news you would have been waiting for, as the startup has likely doubled in value — with a 60% increase in customer growth, the addition of "hundreds" of banks to its customer base, and how hot space has become in the last 12 month that could actually be on the conservative side of estimates. As one might expect, investors are thrilled. One such happy GP is Index general partner Mark Goldberg, who noted in this Business Insider piece that:

"If you had to characterize the insider investment excitement level, it's 10 out of 10”

It’ll be interesting to see if (when?) Plaid decides to go public. This seems like the most logical path for them as they have quickly become too big to acquire by anyone else with a strategic interest in them. Onwards and upward for team Plaid.

🎧 Podcast Recommendations

A new week, a new set of podcasts for you to load up for your next run. Enjoy.

Plaid & Dropbox’s Jean-Denis Grèze’s playbook for building an engineering culture of ownership → Continuing the Plaid theme for this week’s first podcast recommendation, Brett Berson of First Round Capital interviews Plaid’s head of engineering, Jean-Denis Grèze. I highly recommend this one for tactical insights into running an engineering org and just for some sound advice on managing people. Well worth a listen.

Oliver Hughes – The Secret FinTech Giant → Tinkoff Bank is, in my opinion, one of the most interesting challenger banks in the world. In this podcast, Tinkoff’s CEO, Olive Hughes, chats about the sprawling business and, interestingly, how they’ve managed to build profitability into every aspect of the business. Fascinating and well worth listening to on your next afternoon walk.

Chris Dixon – The Future of Blockchain at a16z → Yes, crypto is on a tear (again) and I haven’t really talked about it in my newsletter. As a peace offering to all the ‘chain bois who subscribe to FR, I’m providing you with a link to this excellent podcast with Chris Dixon on where to next for the blockchain industry. Also, more broadly, it’s worth a listen for Chris’ always on point insights into the tech industry.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

📸 As always, our cover image is provided by Death To Stock Photos. You should get your stock images from them too.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌It’s Awful

Subscribe to Fintech Radar

Fintech Radar is a weekly missive about all that's happening in the world of fintech.