Discover more from Fintech Radar

Issue #107: Mercury Gets Into Personal Banking, Canada Gets Closer To Open Banking Legislation And Ramp Raises Another $150m

👋 Hi all, I hope you’ve had a great week.

A big shout-out to our loyal subscribers and a hearty welcome to the new faces — we're ecstatic to have you here!

If you’re new to Fintech Radar, this is what you can expect from each issue:

A curated round-up of the most interesting and relevant news from the world of fintech. In each issue, I focus on what caught my eye from the previous week — so don’t expect a weekly smorgasbord of press releases and partnership announcements. The aim is to serve the meaty bits in a neat, nibble-worthy package. It's all about spotlighting the head-turners and giving you the nitty-gritty without the fluff.

Also, if you enjoy this issue, please share it with a friend. I’m sure they'll appreciate it!

As always, it’s been a busy week for fintech, so without further ado, let's delve into the major happenings from last week.

📣 The News Grab Bag

⤷ Mercury Launches Personal Banking

🏃♂️ The Rundown: Mercury is venturing into personal banking with the launch of Mercury Personal. The new accounts will offer features like free wire transfers, multiple debit cards with controls, and a 5% APY on savings.

Mercury aims to target entrepreneurs and investors with advanced banking tools, setting it apart from traditional digital banks.

The service will cost $240 annually and offer benefits like fee-free transfers and ATM reimbursements. Choice Financial Group will act as the sponsor bank for the product.

🥡 Takeaway: Last week, this product announcement was plastered all over my X feed. It was a combination of early users talking about how much they loved the product and Mercury investors trumpeting its features and polish.

One trend we’ve seen gain momentum over the last few months is the launch of ‘premium’ consumer offerings. Think Robinhood Gold or even the newly launched Klarna card (more on that below).

Checking out the online demo — which is super cool — it looks like a well-designed product. Slick, intuitive and every bit as detailed as their business offering. The bigger question here is whether they’ll be able to build this into a big enough business, even just compared to their business offering.

Consumer fintech is a very different beast to business banking — consumers are expensive to acquire, fickle, and generally aren’t all that keen to pay for a barebones account whose main selling point is that it’s a slick design. Frankly, the market for a $240 debit account whose main selling point is 5% APY isn’t all that big. I mean, most don’t even pay $240 for their credit card, let alone a debit account. Looking outside the SF (where I’m sure it’ll do just fine), I can’t see this being a mass-market product like Cash App.

Mercury’s success (or failure) in consumers will likely be something the likes of Brex and Ramp will be watching very keenly to weigh up whether they want to dip their toe into consumer fintech. My guess is they stay clear of what has traditionally been a challenging segment for most.

⤷ India scrambles to curb PhonePe and Google’s dominance in mobile payments

🏃♂️ The Rundown: India is attempting to address PhonePe and Google Pay's market dominance in the UPI ecosystem. NPCI plans to engage with fintech startups like CRED, Flipkart, and Amazon to boost UPI transactions.

Google Pay and PhonePe hold 86% market share, prompting concerns from regulators and the industry. NPCI aims to limit individual market share to 30% by December 2024. The RBI is considering incentives for emerging UPI players as part of its action plan.

🥡 Takeaway: In many ways, India has been a success story for Google Pay. In a sea of fintech failures for the search giant, this has been one that has worked pretty much from day 1. Where other efforts have stalled on the fintech front for Google, the India-based payment product has benefited from a solid strategy and partnerships that are less common in other fintech products they’ve launched. I’m sure the fact that Android is the dominant platform in India has also helped.

This is one of those exogenous factors that are hard to control for, and I anticipate their market share (along with PhonePe) will continue to drop — as the article notes, Paytm's market share declined to 9.1% due to regulatory changes.

⤷ Uber Eats and Forage to Enable SNAP EBT Payments

🏃♂️ The Rundown: Forage and Uber Eats are collaborating to enable Supplemental Nutrition Assistance Program (SNAP) Electronic Benefit Transfer (EBT) payments, targeting launch in late 2024.

The partnership seeks to expand online purchasing options for SNAP recipients, benefiting millions of Americans.

🥡 Takeaway: I wrote about Instacart's launch of EBT and SNAP payments back in 2022, and I thought I’d do the same with this announcement.

I love seeing fintech offerings like this. Every week, there’s at least one story about how a fintech is being fined or doing something in breach of law x or y, so it’s great to see fintech products directly offered to help those who need them the most. Nicely played, Uber.

⤷ Canada set for open banking legislation

🏃♂️ The Rundown: Canada is poised for open banking legislation by year-end, and the Financial Consumer Agency of Canada (FCAC) will oversee the new system.

After a three-year investigation, the government is progressing towards establishing an open banking framework, initially targeting two legislative pieces in 2022. Key elements include governance, scope, accreditation, common rules, national security, and technical standards.

The FCAC will receive C$1m to manage and enforce the framework. Over three years, an additional C$4.1m will fund policy work for a consumer-driven banking oversight entity. While a specific implementation date is pending, pressure from Canada's fintech sector has urged swift action to prevent falling behind.

🥡 Takeaway: I thought it took forever for Australia to get its act together with the Consumer Data Right (our broader Open Banking regime), but Canada seems to be dragging its heels even more.

When I worked on a fintech offering in Canada, one thing that struck me was how similar the Canadian financial services market was to the Australian one — a highly concentrated market with few options from a fintech infrastructure perspective. In some ways, Open Banking would open up opportunities for new products and could be a boon to the fintech segment. Let’s hope this continues to progress towards a finalised framework.

⤷ Klarna to launch credit card offering in the US “over the next few months”

🏃♂️ The Rundown: Swedish fintech firm Klarna is set to introduce its card offering in the US after successful launches in Europe. The Klarna Card, issued by WebBank, will provide flexible payment options for both online and in-store purchases with no monthly, annual, or foreign transaction fees.

The card offers 10% cashback through the associated app. To access the card, new users must undergo a credit assessment and have previously repaid a Klarna instalment. Klarna's CEO, Sebastian Siemiatkowski, highlights the card's transparency and benefits, emphasising consumer financial control.

🥡 Takeaway: I’m sure many reacted with a “What? A credit card?!?!” Isn’t Klarna a staunch anti-credit card advocate? One of their most recent campaign, Wikipink, broke down the difference between BNPL and credit cards. So what’s going on here?

To start with, it’s a card—not a credit card in the traditional sense. In the same way that the Apple Card offers a ‘pay in four’ feature for card-present transactions, Klarna’s card offering in the US is doing the same.

If you live outside the US, you’ve probably already seen the move by BNPL players to become more universally available (Afterpay Plus is another example). The original playbook pioneered by Afterpay, which went door to door (or, more accurately, merchant to merchant), has long ago moved to try to incentivise customers to use a card form factor for card present transactions.

So, in many ways, this is Klarna simply filling out the product offering in the US and not a move into the world of credit cards. What’s worth keeping an eye on here is how they evolve the product to compete with credit card offerings in the US market. Yes, 10% cash back is a great start, but whether it’s enough to motivate consumers to get a Klarna card out for IRL purchases is the bigger question.

💸 Notable Funding Announcements

Last week was a more active week for fintech financing, with 71 funding rounds completed and companies collectively securing $651m in investment.

⤷ PayPal Ventures leads €18 million series A extension in Pliant

🏃♂️ The Rundown: PayPal Ventures spearheaded an €18m Series A extension for Pliant, a Berlin-based corporate card platform venturing into the UK market. Pliant's platform supports various credit card types and integrates with ERP systems, catering to fintech firms like Candis and Circula.

The article notes that in 2023, the company doubled revenues and expanded its EMI license to 25 EEA countries. CEO Malte Rau mentions in the article that they hope their multi-currency capabilities will help with their UK market entry.

🥡 Takeaway: European embedded fintech startups continue to secure the bag. This week, both Pliant and Finmid announced notable fundraises, the latter announcing a $35m round, and a few weeks ago, Solaris bagged $96m.

So what’s going on? The obvious answer is that embedded continues to run hot as a segment. More broadly, I think the thesis of offering embedded financial services (e.g., offering financial products when and where a customer needs them) might finally be bearing fruit in the EU. This, combined with a glaring gap in availability of a unified offering across the European continent is driving a run on players aiming to fill the void.

In many ways, I’m much more bullish on embedded fintech in the EU than in the US. When you combine the fact that the regulatory hurdles aren’t as high to set up an offering across the EU (which feels wild to say) with the fact that there’s still a bunch of headroom to embed offerings with the low-hanging fruit plays (e.g. e-commerce), it could be a golden opportunity for a well capitalised and hungry player.

⤷ Ramp announces Series D-2 capital raise

🏃♂️ The Rundown: Spend management startup Ramp last week announced they’d raised $150m at a $7.65b valuation, co-led by Khosla Ventures and Founders Fund, with Sequoia Capital, Greylock, and 8VC participating.

This round brings their total equity financing to $1.2b and debt funding to $700m since 2019. Ramp plans to continue to innovate with AI, enhance spending insights, and make acquisitions like their recent ones of Venue and Buyer.

🥡 Takeaway: It wasn’t that long ago that many had preordained Brex as the likely winner in this segment, but that’s now moved to a highly competitive three-horse race for the hearts and minds of high-growth SMEs (yes, primarily coastal tech companies).

It’s easy to do a market sizing on the SME banking space and come up with a significant number. However, the reality is that most businesses open up an account with one of the SIPs in the US or with their local community bank. Outside of chequing accounts, most companies will come to their bank for an overdraft facility (i.e. lending). What I’m getting at is that business banking is rarely where a bank makes money outside of lending (which can be a significant but risky business) and a nominal account fee.

That’s why I think most (including me) thought Brex’s model — business credit cards, functionally lending — was the one that would win out. After all, taking on AmEX is where the opportunity is, right?

When you consider that everyone from Shopify to Amazon is trying to lure SMEs into their fintech ecosystem, the question of how a chequing account and spend management are meant to make money comes into sharp focus.

My guess is that most will converge on some form of lending product/overdraft facility/credit card offering to bring in the big bucks. Regardless, it’s sure going to be a fascinating segment over the coming years.

🎧 Resources & Recommendations

⤷ Emily Man: Navigating Fintech Frontiers at Primary Ventures

I enjoyed this episode of Venture with Grace, where she interviewed Emily Man of Primary Ventures. Emily shares her journey into VC and what she’s currently thinking about in fintech. Ps. She also drops some great fintech resources during the episode.

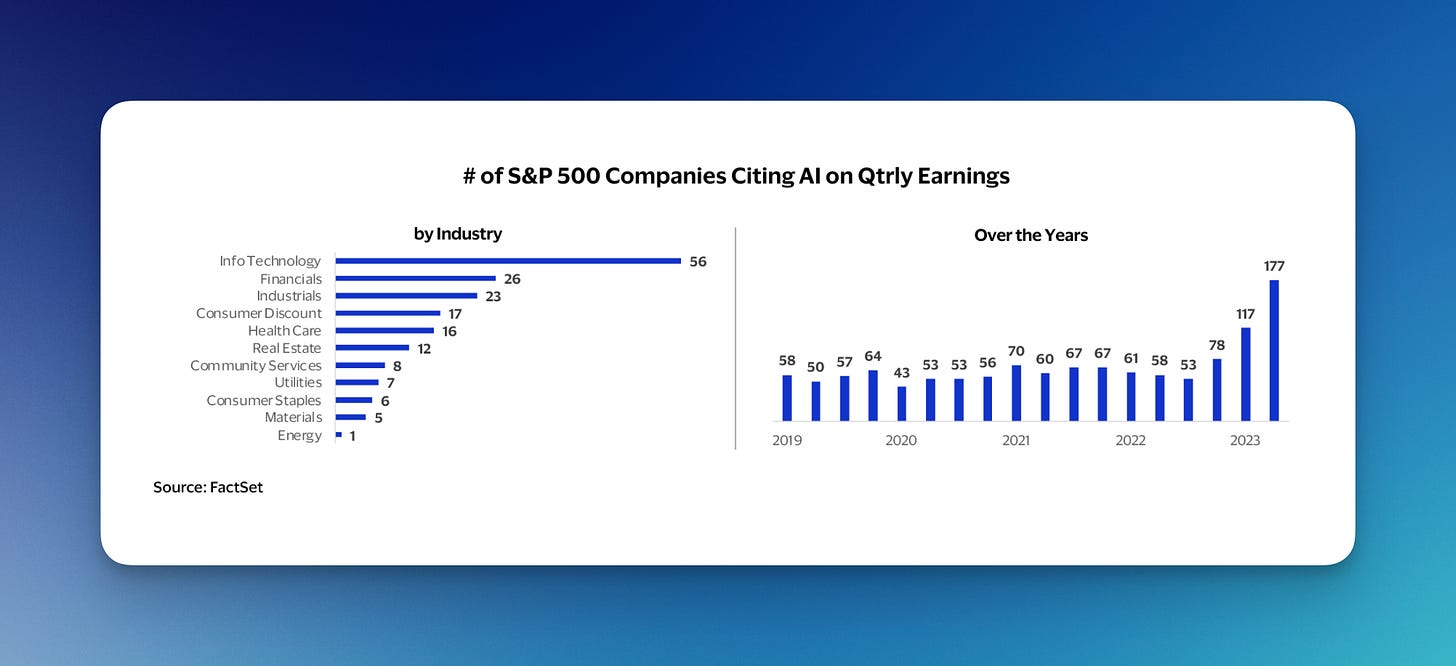

⤷ Opportunities For Generative AI in Financial Services

Last week Visa in collaboration with This Week In Fintech dropped a great report into the state of Gen AI in FS. Everyone loves a report and this one is jam packed with insight into where the hot spots currently are in the segment. Well worth a read — even if just for the industry stats.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect. I'm @alantsen on Twitter, or you can DM me directly by clicking the button below ↴

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful