Break Down #4: The Link-In-Bio Land Grab Is Coming To Fintech

The 'link-in-bio' has become hot property. So why haven't fintech startups taken advantage of this distribution channel?

It’s been a while since I last wrote a long(ish) form piece, so to mix things up, I’ve decided to devote this week’s issue to what I think is an under-discussed distribution channel in fintech — the now ubiquitous ‘link-in-bio’.

Apologies if you’re receiving this email expecting this week’s news from the world of fintech. We’ll return to regular programming next week :)

If you like what I’m serving up, feel free to let the world know by sharing this post on your favourite social media platform of disinformation. I’d appreciate it.

The Changing Creator Landscape

The creator economy went into overdrive this year. Not only did we see more people join the ranks of the Passion Economy1, but we also saw a subtle yet significant shift in the way many creators chose to play the game.

What was once a business driven by views, clicks, and listens turned into one that was all about limited edition merch lines, burger pop-ups and coffee. Many creators realised that concentrating their monetisation efforts on one platform was too risky and the world of opportunity went well beyond the walls of a single social media channel.

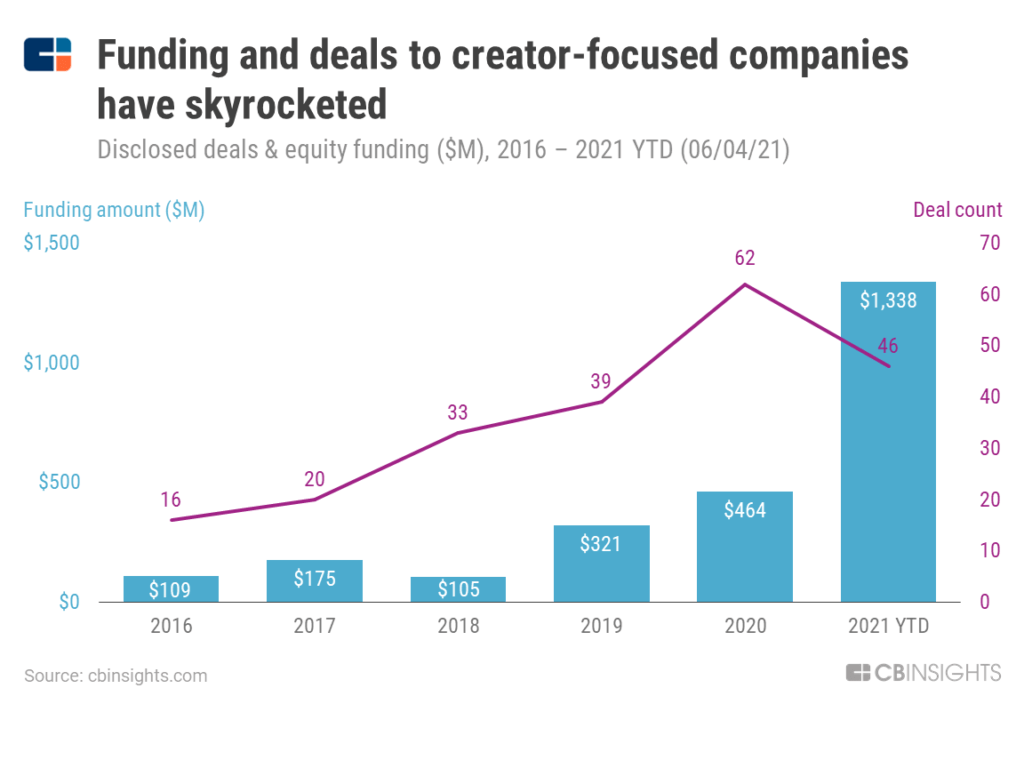

Along with the growth of the creative class came a plethora of new companies ready to provide the picks and shovels to power the Passion Economy — and as you might expect the investors came rushing in.

One of the shovels (or maybe it’s a pick? Not sure) that investors have all become enamoured with is the ‘link-in-bio’ segment.2 For those who aren’t au fait with the link-in-bio industrial complex that has emerged, think of microsites that aggregate up all the links a person wants to point you to. This could include links to other social media properties, their website, or the channels they monetise through (e.g. their online merch store or maybe a tipping platform). What started as a way to hack the problem of Instagram not allowing creators to drop links into posts has turned into big business.

Valuable Digital Real Estate

At first blush, these seem like nothing more than mobile optimised landing pages, with little strategic value to anyone — least of all the link-in-bio companies. However, as the rising tide of the Passion Economy brought with it strategic importance to every piece of digital real estate creators chooses to live on, some of the most valuable plots of land became the links that reside in their bios.

Yep, these links have quickly become beachside property, but with the key difference being it isn’t the waterfront views investors are betting on; it’s the path to the monetisation they provide for creators.

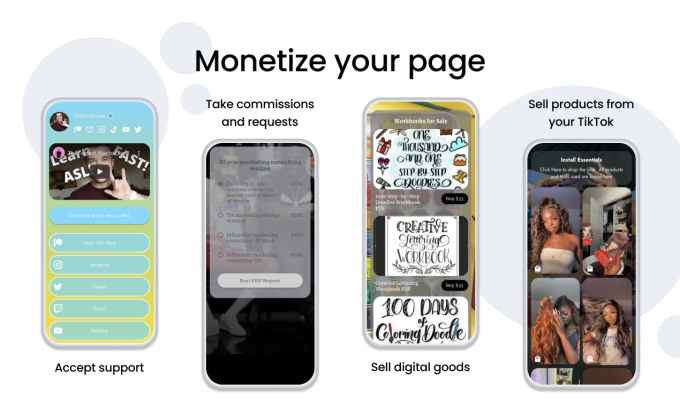

Despite the value these links provide, what their owners really want is help to generate yield on these plots of valuable digital land. This is why most link-in-bio companies are wisely leaning into providing a way for their users to aggregate their monetisation channels all on one platform. In some ways, they’re the new digital storefronts for creators.

From Link Aggregators To Monetisation Aggregators

As this segment has evolved from being focused on link aggregation to the aggregation of monetisation platforms, it squarely puts it in the crosshairs of fintech startups.

As Cash App has shown, injecting your brand into the zeitgeist by partnering with culturally relevant influencers can be a powerful growth strategy. However, this has its limits. How many “this video is sponsored by” clips can consumers watch before influencer marketing loses its cut through? In many ways, being the portal into a creators world is the next logical step for fintech brands to take, as they try to shift from using influencers as props to engaging with them as value additive partners.

This is where the link-in-bio page comes in. It serves as the perfect portal into a creator’s world. It’s become the foyer that fans are using to directly step into their favourite influencer’s universe3 and it’s filled with numerous opportunities for fintechs to not only associate themselves with influencers but also monetise that connection.

As a thought experiment, imagine if instead of giving away money on Twitter, Travis Scott dropped his next album on his link-in-bio page and gave away $5 to each person who streamed his new album via a link on the page. Now imagine that it was Cash App’s link-in-bio page and the streaming platform was Tidal. It feels subtle, but it shifts Travis Scott’s engagement from being an ‘influencer’ for a brand to a customer who’s generating direct value from the product.

Interestingly, nearly every consumer-facing fintech startup has basically built the link-in-bio feature natively into their offering but is grossly underutilising it.

Again, let’s take Square’s Cash App as an example. As part of creating a unique identifier for their customers to receive money ($cashtags), Cash App also spins up individual web pages for each customer. This makes it easier for customers to share their $cashtag with those outside the Cash App ecosystem. The page each user has created for them looks like this.

The most striking thing about this is that it looks like the team who made it just forgot to add the ability for Cash App customers to place links on the page. It doesn’t take much to imagine a world where Cash App decides to leverage this underutilised real estate, allowing their customers to insert links and, more importantly, providing them with the tools to monetise — all while keeping them in the Square ecosystem.

Why Does This Matter to Fintech Startups?

Distribution is everything in consumer fintech. Finding new channels to acquire customers to your platform matters more today than ever.

What many consumer-facing fintech startups have figured out is that just flooding social media channels with ads for their product is not only a costly endeavour but more importantly, it just doesn’t get cut-through.

The last big distribution strategy that every consumer fintech adopted centred around influencers. At this point, if you don’t have someone who is internet-famous spruiking your product on TikTok or Youtube, are you even a consumer fintech startup? It’s clear that the next evolution of this strategy will involve a more direct relationship between a fintech’s product and the influencer.

Although Square’s majority stake purchase of Tidal is a bit of a headscratcher, I’d be surprised if the first product that comes out of that partnership isn’t a link-in-bio offering aimed at musicians. Allowing musicians to better monetise by more closely coupling their Cashtag with their link-in-bio makes total sense. It also makes distribution easier when you can ask board member and rap royalty Jay-Z to help with the initial marketing push. Beyond this, I’d be surprised if we don’t see others in the consumer fintech space also start to utilise their Cashtag page equivalents better.

Maybe the real winners actually end up being the current crop of link-in-bio companies, as they help to aggregate up all these payment links. Having said this, I think consumer-facing fintech startups paying close attention to this space will go after this prized plot of land in a way that goes well beyond just offering a pretty landing page. Watch out, here come the fintech startups to gobble up this valuable real estate.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful

According to a report by Signalfire, around 50m people around the world consider themselves creators, with approximately 2m doing it professionally.

See, for example, Linktree’s $45m Series B co-led by Index Ventures and Coatue or Beacons’ recent $6m raise led by A16z.

For example, according to this Techcrunch article, nearly 25% of Linktree’s link-in-bio traffic now comes from direct visitors.