Issue #134: Western Union Acquires Dash, Morgan Stanley’s AI Push, And Finix’s New Funding Round

Your Weekly Fintech Briefing: Major Moves and Industry Trends

👋 Welcome back to another edition of Fintech Radar!

If you’re new, here is a breakdown of what you can expect from each issue.

If you missed our recent editions, you can catch up here. Some previous issues you might want to check out if you’re new include “A Deep Dive Into The Cash App's Growth Machine”, “The Future Of Payment Initiation”, and “Current: Doing It Differently”.

Your ad could be HERE!

Fintech Radar is a must-read for fintech founders, operators, and investors. If that’s your target audience, placing an ad right HERE is a cost-effective way to reach them.

If this sounds like a good fit for your brand, head to our sponsorship page for more details and to secure your advertising slot. Prices start at $100 per issue!

If you have any questions, reply to this email and ask away!

Western Union to Acquire Dash Mobile Wallet From Singtel, Pymnts

🏃♂️ The Rundown: Western Union announced plans to acquire Singtel’s Dash, a mobile wallet service with over 1.4m users in Singapore, expanding its digital and mobile footprint in Asia. Dash enables users to transfer funds, make purchases, and pay bills. The deal, pending regulatory approvals, is expected to close soon.

🥡 Takeaway: A fascinating move from the 171-year-old Western Union, showing just how much the remittance game has evolved with players like Wise, Airwallex, and Revolut entering the scene.

Once upon a time, the remittance game was all about endpoints—the race to establish the most corridors and dominate them with competitive pricing, simplicity, and a trusted brand. Western Union led the pack for years. But then came the internet in everyone’s pocket and, along with it, a new breed of remittance companies—the game changed from having the largest agent network to having the most app installs.

These companies focused on building a network anchored in cross-border money movement and supercharged by offering a suite of products that allowed them to deepen their customer relationships.

Fast-forward to 2024, and it’s clear Western Union wants its own wallet to springboard into the cross-border-anchored super app race. It’s game on, and Western Union is looking to score some points; getting acquisition-happy makes a lot of sense.

Acquiring Dash provides a strong starting point for this strategy in Singapore. The real test will be scaling Dash’s offerings to Western Union’s global customer base, capitalising on mobile-first features to engage customers worldwide.

Goldman, Apple to pay CFPB $89.8M over Apple Card issues, Payments Dive

🏃♂️ The Rundown: Goldman Sachs and Apple are to pay a combined $89.8m to the CFPB due to failures in the Apple Card programme, which included not forwarding consumer disputes and improper investigations, leading to delays in refunds and negative credit report impacts. Goldman is liable for $19.8m in redress and a $45m civil penalty, while Apple faces a $25m penalty, with Goldman also restricted from launching new credit cards without compliance assurance.

🥡 Takeaway: Ouch. After burning through heaps of cash on its consumer fintech adventures, Goldman is now slapped with ~$64 million in fines tied to the Apple partnership—a relationship it’s apparently keen to offload.

Goldman’s foray into consumer banking has been a bruising experience, and this penalty adds another scar as they retreat to their investment banking roots. Plus, I imagine these fines aren’t helping them find a buyer for that Apple book of business.

Morgan Stanley Research Announces AskResearchGPT Powered by OpenAI, Morgan Stanely

🏃♂️ The Rundown: Morgan Stanley has launched AskResearchGPT, a generative AI-powered assistant that enables its investment banking, sales, and trading staff to efficiently extract and summarize insights from the firm’s extensive research reports. The assistant uses GPT-4 to draw on more than 70,000 proprietary reports produced annually, offering quick access and integration into the team’s workflow.

🥡 Takeaway: In this week’s episode of incumbent GenAI watch, Morgan Stanely is dropping another AI bot. Sorry, I should say, “AI-powered assistant”.

As I’ve said in previous issues of FR, GenAI applications are still in their early days. Having said this, the bot-side RAG-powered use cases are still coming thick and fast. It’ll be interesting to see how traditional players leverage their unique data sets to drive these early use cases — or whether proprietary data even matters.

My guess is that most will follow Morgan Stanley’s lead, tapping proprietary reports and internal data to fuel targeted internal solutions to get their feet wet before they roll out serious prod-ready products to their customers.

Igloo Launches D2C Insurance Platform to Expand Accessibility in Indonesia, Fintech Global

🏃♂️ The Rundown: Igloo, a Singapore-based InsurTech startup, has launched a D2C insurance platform in Indonesia aimed at improving insurance accessibility for underserved consumers. Their D2C model is designed to simplify the insurance-buying process, letting customers purchase policies directly through Igloo’s digital platform without intermediaries.

🥡 Takeaway: Insurtech in Southeast Asia (SEA) has been on a surge, rebounding from a post-ZIRP activity dip. Deal values soared in 2023, reaching $2.35b across 27 deals, compared to just $538m from 39 deals in 2022. This nearly rivals the sector’s 2020 peak of $2.36b from 32 deals. For those paying attention, this has partly been driven by some mega deals. But the real story lies in what is changing in SEA.

Post-pandemic, the region has seen a transformation in attitudes towards insurance. Insurance is now viewed as a necessity rather than a luxury, and there is growing demand from emerging customer segments like millennials, gig workers, and SMEs. With super apps also eyeing the space, SEA insurtech is poised for continued growth in customer demand and, as a result, VC funding.

HSBC unveils virtual account to simplify cross-border payments, Payment Expert

🏃♂️ The Rundown: HSBC has rolled out a new cross-border virtual account solution aimed at making it easier for businesses, especially those in e-commerce, to manage payments internationally. Announced at the Sibos 2024 conference, this solution allows merchant clients of banks to accept payments in EUR and GBP directly through local bank accounts without needing foreign bank accounts.

🥡 Takeaway: Cross-border virtual accounts have become a staple on the roadmap for globally ambitious fintechs, and now incumbents like HSBC are jumping in too. As demand grows for seamless cross-border transactions, it’s clear that both challengers and traditional banks see these accounts as essential to staying competitive in global payments.

HSBC’s new solution, announced at Sibos 2024, allows merchants to accept EUR and GBP payments through local accounts, sidestepping the usual need for foreign accounts. If this sounds familiar, that’s because it’s a product that players like Airwallex have been using as their wedge into the lucrative international trade market.

This solution, targeted first at Chinese businesses, fits right into HSBC’s Asia-focused strategy. It could be a clever way for them to thwart the hard-charging challengers as they continue to grow across the region.

Finix raises $75M to take on Stripe as a payment processor, Techcrunch

🏃♂️ The Rundown: Finix, a U.S.-based payments infrastructure provider, has raised $75m in a Series C round co-led by Acrew Capital, Leap Global, and Lightspeed Venture Partners, with additional participation from Citi Ventures and several existing investors. This funding brings Finix’s total raised to over $200m and will support product development and expansion into new markets.

🥡 Takeaway: It’s an interesting time for the payments segment. As much as people like to frame the market as being won by Stripe (or maybe Adyen, depending on your perspective), it’s probably more competitive than ever.

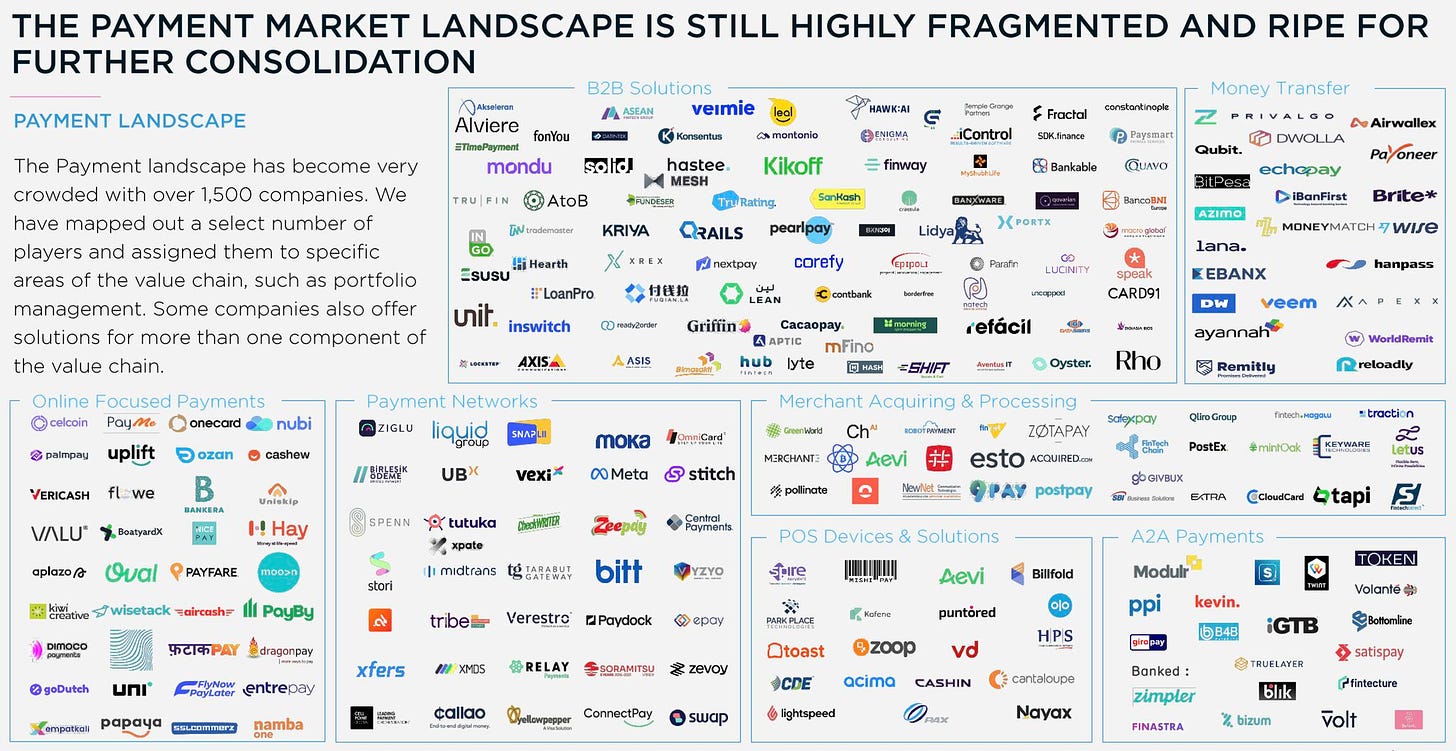

Players like Finix aim to provide more bespoke solutions for companies, while others, like Ansa, offer a full-stack wallet solution — just to name a few (see below for a market map). Although it may seem like consolidation is happening, the market is becoming more fragmented, with novel use cases and increasingly verticalized payment players launching.

If you believe the reports that Stripe might go public in the not-too-distant future, this could bring more attention to the payments space and give investors greater confidence to back even more companies looking to take on this still largely incumbent-dominated space.

Obligo Raises $35M to Expand Its Security Deposit Solutions Across Millions of U.S. Homes, Obligo

🏃♂️ The Rundown: Obligo has raised $35m in Series B funding to expand its deposit-free rental platform. Led by investors including 83North and HighSage Ventures, this funding will help Obligo grow its presence and develop new products. The platform provides a deposit-free solution by assessing tenants’ creditworthiness, allowing them to avoid upfront security deposits while giving landlords financial assurance.

🥡 Takeaway: This is a fascinating take on the rental security deposit and a great example of verticalised payments in the property space. Obligo provides landlords a secure billing authorisation instead of a traditional security deposit, allowing them to bill tenants only for actual damage caused rather than holding a large upfront sum.

Landlords have limited withdrawal amounts, and tenants can dispute unfair charges, keeping it similar to a regular security deposit. Since Obligo manages the funds, they can offer flexible payment terms if a tenant needs time to cover damages while keeping the arrangement binding until both parties agree to close it—an interesting twist on what’s usually packaged as a loan and a great way to bend a payments product to work in a different context.

Crash course on Sponsor Bank MSAs (Master Services Agreements) with Andrew Grant, Fintech Layer Cakes

In this episode of Fintech Layer Cake, Reggie Young sits down with Andrew Grant, co-founder of The Runway Group, to break down Sponsor Bank Master Services Agreements (MSAs). They chat about the intricacies of these crucial contracts, touching on regulatory shifts and evolving industry expectations. With some in-the-weeds tactical advice on negotiating and managing MSAs, it’s well worth adding to this week’s podcast playlist.

State of Crypto Report 2024: New data on swing states, stablecoins, AI, builder energy, and more, A16Z

Everyone loves a crypto report, and this one is from one of the crypto hype masters, A16Z. The 2024 State of Crypto Report offers an interesting look at how crypto is steadily moving past the experimental phase and heading towards some real-world use cases. As you might expect, the report calls out all the usual use cases — decentralised finance, stablecoins, and Web3 gaming. The report is well worth a read for those looking to load up on data points on where crypto is currently at.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect. I'm @alantsen on Twitter, or you can D.M. me directly by clicking the button below ↴

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I Love It! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful

Western Union's agent network and "trust-brand" are strategic moats for migrant workers that (I believe) Wise and Revolute will not bother penetrating with high CAC/LTV. Dash has impressive numbers but probably very low activation rates (I haven't used mine since early 2019 when Dash had the best SGD:THB on Thai QR; best edge use case for the most discerning fintech geek at that time). I have had really good discussions with Singapore peers on how to "disrupt" this space...the business plan is shelved for the time being and I really hope time is on my side to take a punt at this in the future.

One call out on Finix is that they highlighted they have already built cloud end points for acquirer processing. This is a game changer since being able to vertically integrate removes friction and cost. Some fintech startups are doing this at series A-C stages now...impressive and shows how quickly things are evolving. The next batch of cloud native infra-platform-fintechs will be able to offer attractive price points because they have a significantly lower cost base.