Issue #23: FINIX Bags Another $30m From Investors, Ant Financial Releases Their Prospectus And The Origin Story You Need To Read

👋 Hi, FR peeps. I hope you’re all staying safe and sane during these crazy times.

Welcome to this week’s installment of FR, and as usual, there is a ton of stuff happening in the sector. But before we dive in, a quick shoutout to all the new subscribers who have joined this week as a result of FR being included in Ron Shevlin’s article, 7 New Fintech Newsletters You Should Be Reading. Welcome to the FR fam and thanks for subscribing - I appreciate you letting me into your inbox 🙏

If you enjoy this newsletter, make sure you share it with a friend - remember, sharing is caring!

Banks aren’t as stupid as fintech startup founders think. This week the UK’s competition authority, CMA, allowed Visa’s acquisition of Plaid to go through - worth noting CMA’s focus on PIS as the ‘market’ in their analysis. Consumer fintechs have taken the lion’s share of the $3bn raised by European fintechs since lockdown began. A quick reminder that stock exchanges are a huge business. The SME lender firesale continues with accounting software provider, Xero, acquiring Waddle for $80m. Goldman Sachs has its own a font. According to Wix, 8/10 users are choosing to roll Wix’s payment option on their e-commerce sites - another stat to add to your embedded fintech whitepaper. Wirecard UK officially announces Railsbank are acquiring their assets and team. Lastly, these are the top ten most valuable challenger banks in the world.

Fintech financings were a little down on last week’s numbers, with 27 deals raising $361m in total.

💸 FINIX Raises Another $30m From Existing Investors

This week PayFac-as-a-service provider, FINIX, announced they’d raised an additional $30m as an extension to their series B. The round was led by Lightspeed Venture Partners and included participation from American Express Ventures. FINIX has raised a total of $96m to date.

The deck that FINIX used to raise their series B (care of Business Insider)

🤓 My Take: I think it’s fair to say that FINIX is the darling of embedded fintech at the moment. I mean, it’s hard to say embedded fintech without quickly following up with FINIX as the example. So what’s with all the excitement around what FINIX is doing and is it justified.

Let’s start with why you’d want to be your own PayFac. The reason is actually fairly simple, cost savings. Having said this, a neccessary condition for this to make sense is that you have enough volume to switch up stream of using a payment gateway.

FINIX’s main value propostion is that it does the heavy lifting around allowing you to become a PayFac (to give you a sense of how expensive and time consuming this is check the following breakdown of costs). Cost savings are a major part of why you’d want to make the switch, however flexibility is also a factor. For example, at some point, an international platform will outgrow a single gateway provider (like Stripe) in terms of countries they’re available in (e.g., Stripe is only available in 31 countries. While, for example, Airbnb is available across 191 countries). This means that they’ll then need to stitch together solutions with regional players, resulting in potnetial issues around everything from customer data to vendor lock in (for example, see this post from Airbnb to see how they stich their payments infrastructure together).

Coming back to the economics of becoming a PayFac, you do need a fair amount of payment volume running through your platform for the switch from, say, Stripe to FINIX to make any sense. According to FINIX’s website, that number is >$50m in GMV - which is a non-trivial amount. So who is this really for?

In the case of platforms who are in competitive markets and would find it hard to increase their take rate, switching over to FINIX could be a smart way to increase their overall revenue. To use the oft-quoted example of Shopify, they’re merchant solutions revenue (payments) now account for 60% of total revenue. While if you’re a vertical SaaS provider, according to A16Z, embedded fintech can increase revenue per customer by 2-5x.

However, what goes under discussed, is that the opportunity for FINIX really centres around converting high volume platforms over to their plug-and-play solution. The more challenging question will be how willing these players be to switch over to them once they’ve built out a payment stack that is deeply integrated with a gateway that has been with them from day 0. In other words, a bet on FINIX is really a bet against Stripe, Adyen et al., being able to keep the top end of their customer base.

Personally, I’d take that bet everyday of the week.

The reality is the payments business is, no matter how you dress it up, is a commodity business - savings basis points are what it’s all about. As you can imagine, it’s a compelling proposition to a platform that is doing hundred of millions in GMV to say they can add millions to their top line with ‘minimal work’.

There is no doubt that FINIX is riding the embedded fintech wave perfect, and the numbers they’ve released have been really impressive - according to the company they’ve seen, “..transaction volume grow 4.5x from Q2 2019 to Q2 2020”. What I think will be interesting to see is if the likes of Stripe can hold on to their top-end clients from the likes of FINIX - and whether they can do that without eroding their own margin.

💹 Commonstock Raises A $9.7m Seed Round From Floodgate And QED

Social stock trading platform, Commonstock, this week announced they’d raised a $9.7m seed round led by Floodgate and QED with participation from Upside, Resolute, and a range of angel investors.

🤓 My Take: Commonstock describes itself as “an investing community built for signal over noise to improve the next generation of great investors.” In other words, a more social version of e-Toro.

As I discussed back in issue #13, I definitely think there is space for a social network that is investment focused. The explosion of informal channels for the new breed of Robinhood YOLO investors to share their exploits shows the demand is there (see, for example, r/wallstreetbets). However, the delivery and ‘voice of the platform’ is what presents the biggest challenger. Personally, I think the winner will likely be more ‘Buffet on the streets and memes in the sheets’ in its style than just a stream of trading data.

According to reports, already around 10,000 investors are using Commonstock and $300 million was traded through the platform while it was in beta - which is impressive for a platform this early on its life. So the signs of life are there.

There are several other platforms currently in beta (see, for example, Tendies.af, Positions and Ban) trying to capture this market. As noted above, it’ll be interesting to see whether the current crop of investors is looking for more insights or entertainment from their share trading social network.

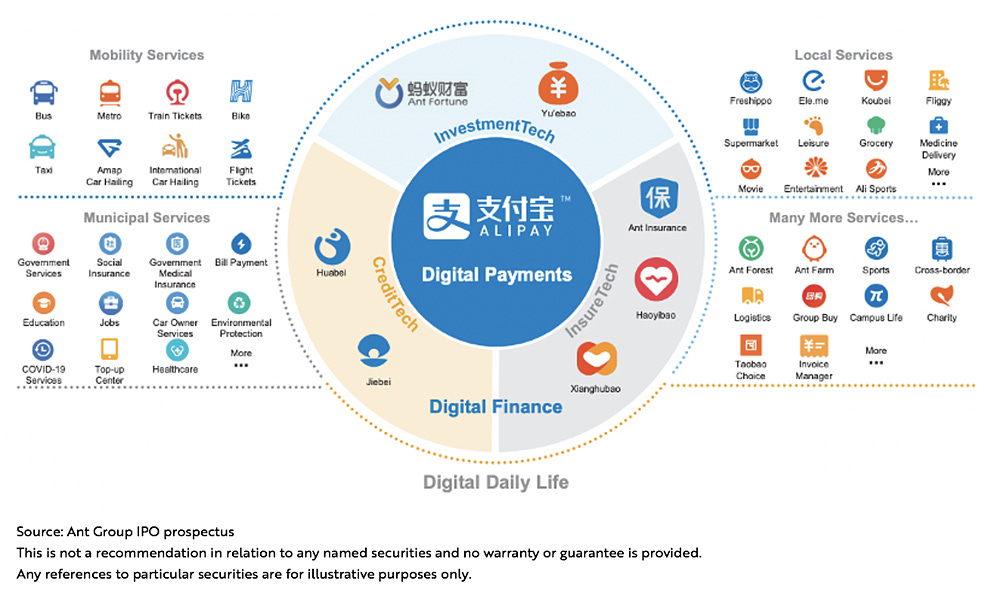

🐜 The Transformation of Ant Financial →

The most highly valued fintech in the world, Ant Financial, released their much-awaited prospectus this week, and it didn’t disappoint.

Let’s start with the actual listing. The Chinese financial giant is dual listing in Hong Kong and Shanghai with a valuation that could exceed $220bn - making it a top 5 financial services company in the world.

The thing that struck me about the prospectus was the company’s incredible scale.

Currently, the Alibaba offshoot has 711m active users who have generated more than $17t in payments over the last 12 months. That’s right, $17t! Add to this crazy number their lending business, which has made loans to 500m people over the previous 12 months, their wealth management platform which has $173b in assets, and their insurance business that has ~$7bn in premiums and contributions - and you get a sense of the genuinely crazy scale of this fintech. Insane.

🏦 The U.S. Needs Banking-As-A-Public-Service →

I thought this was a great piece from Nik Milanović on why the US needs a public utility bank

Coming from a country where we are well and truly overbanked, it’s sometimes easy to forget that the US isn’t quite the same. As Milanović points out in his article, there “…are 55 million unbanked and underbanked American adults, per the Federal Reserve, representing 22% of all households,” which is a crazy statistic. I highly recommend this piece, and I’m looking forward to the next two installments.

🛍️ Klarna, Europe’s $5.5 Billion Fintech, Sees Losses Rise Sevenfold In The First Half →

Klarna this week released its first-half 2020 report, and it painted an interesting picture of the BNPL unicorn. During the January - June 2020 period, Klarna showed some impressive growth. Specifically, they:

Grew GMV by 51% and net operating income by 41% YoY respectively;

Added 35,000 new retail parters (that’s ~200 per day); and

Added 14m new customers (with 12m monthly actives for the period).

However, despite these strong numbers, the company reported a $59m loss for the period - a seven-fold increase from the same time last year. This was partly driven by the Swedish BNPL’s aggressive international expansion (they’re now in 20 markets) and also its increased provisions for credit losses - which went up almost two-fold.

The BNPL space has been on fire recently, with money being pumped into the main players in both private and public markets. However, the core challenge these companies face is around how they differentiate in a crowded market. I think much like we’ve seen Klarna move upstream and become a bank, others will follow and this maybe where we start to see some level of differentiation. Regardless, there are some interesting times ahead for this part of the fintech sector.

Everyone loves a great origin story, and there are few better than Venmo’s one. So this week, I’ve pulled out of cold storage THIS POST from Andrew Kortina’s blog on the origins of Venmo.

For context, Andrew is the co-founder of Venmo, and this is a rare peek behind the scenes of the founding of one of the most important fintech startups of the last decade. This is a highly recommended read.

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to flick me an email if you have any exciting news you'd like me to share with the FR community. I'm me@alantsen.com and @alantsen on the Twitters.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. Also, I'd appreciate it if you forwarded this newsletter to a friend you think might enjoy it.