In another $1bn+ acquisition in the white-hot fintech infrastructure space, SoFi announced the acquisition of Galileo for $1.2bn in a cash and stock deal this week.

The deal has left many scratching their heads as they try to figure out why a company that has predominately been in the lending and wealth management space would acquire a payment processor.

The reason most are miffed is that, on the face of it, there doesn’t seem to be any real overt synergies between the companies. There is an argument to be made that the deal could be value-destroying to the target, as Galileo powers several of SoFi’s competitors in the US - including the likes of Chime, Robinhood, TransferWise, Varo and Monzo. In their press release announcing the transaction, SoFi did do it’s best to try to quash concerns regarding this by noting that Galileo will operate as an independent subsidiary of SoFi. Regardless, you could see how Galileo’s customers might not take kindly to a competitor owning a pivotal part of their banking stack.

The real challenge in understanding this deal is that many have traditionally seen the business of B2C fintech as distinctly different from the infrastructure layer. For the most part, this has been true - there hasn’t been any desire for a B2C fintech to own the pipes they use. However, this (and Visa’s acquisition of Plaid - although done for slightly different reasons) highlights that this is rapidly changing. The smart operators in the space (or those with deep pockets) are realising that owning the infrastructure can (i) be a lucrative diversification strategy (ii) a smart deposits/customer acquisition strategy for those with aspirations on becoming a bank and (iii) a strategic moat that can be used to block competitors.

But what does Galileo even do?

Galileo is well known for their payment processing services, in part due to an “operational incident” in October last year that brought well known US challenger bank, Chime, down. However, they also provide several services in the payments adjacent space and have been rapidly expanding their offering further down into the banking stack. In fact, the SoFi relationship was built on the back of work they did together on SoFi Money - a cash management account that charges no account fees on savings and provides cashback rewards.

Having said this, payment processing is still what Galileo is best known for in the market. Processors play a critical part in many challenger banks’ infrastructure stacks (or any company that has to interface with a card scheme). The simplest way to think about a payment processor is as an intermediary between payment schemes (i.e. Visa or Mastercard) and a fintech’s internal systems.

Startups tend to use a third party processor to help expedite the process of spinning up cards for their customers. In practice, it means they don’t have to build complex infrastructure that has to talk to payment schemes and thus allows them to go to market much quicker than would otherwise be the case. As Monzo noted in a blog post back in 2017, after GPS (their payment processing provider) went down:

Using a third-party processor made a lot of sense when we first started our alpha program – connecting directly to payment networks like Mastercard is a long, costly, and complex process, and at the time it didn't seem like there would be any benefit to our customers from doing this.

It’s worth noting that payment processing has been the bain of many challenger banks existence. Most challenger banks have elected to build payment processors due to outages that have, in many instances, resulted in their customers not being able to make payments. For example, Revolut built RevP to avoid the disruptions and to allow them “…to release better products faster”. This trend is worth noting, as it is a reason I think we’ve seen Galileo move further down the payments stack.

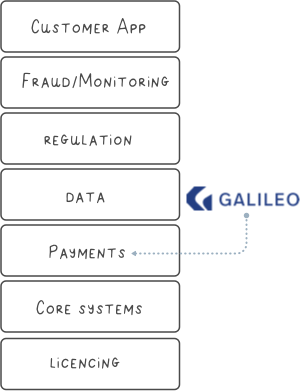

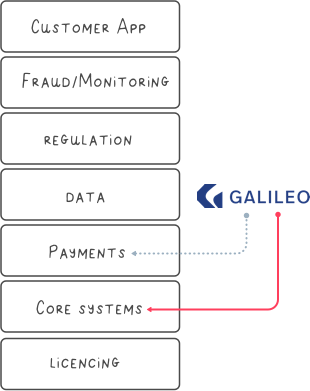

Below I illustrate where Galileo’s payment processor solution sits in the banking infrastructure stack using the stylised description Angela Strange used in her presentation “Every Company Will Be a Fintech Company”.

The payment processing business has proved to be an excellent one for Galileo. According to the press release announcing the deal, SoFi noted that Galileo processed over $53 billion in annualised payments in March 2020, which was 2x up on September 2019 ($26 billion) and they also crossed $100m ARR in March last year. What’s even more interesting is that they’ve been able to do this in a relatively capital-efficient manner. In fact, they raised their first round of funding last October, in a $77 million Series A led by Accel. This alone makes it an attractive business to acquire - and even more so if you can do it in predominantly equity.

Diversification, moats and the becoming a bank

When looking at the deal, it’s easy to fixate on what Galileo has been doing in the payment processing space - which has miffed most trying to work out why SoFi did the deal. Why acquire a company that is just a part of the payment pipeline?

However, what most have failed to acknowledge is Galileo’s rapidly expanding API product offering. This product set includes; account set-up, funding, direct deposit, ACH transfer, IVR, early paycheck direct deposit, bill pay, transaction notifications, check balance, and point of sale authorisation. These offerings are quickly moving Galileo further down to the banking stack and allowing them to control more of the vital infrastructure that powers most modern fintech startups. Over time, it’s not hard to imagine them becoming a legitimate banking-as-a-service (BaaS) option - which could be accelerated by the SoFi acquisition.

Strategically, this deal makes sense for SoFi on three fronts. Firstly, the ability to diversify their revenue streams through having a horse in the highly lucrative banking infrastructure race - should they ever want to offer a BaaS solution (subject to them navigating the potential optics issues associated with this). Secondly, it could provide them with a source of deposits if (when?) they chose to become a bank. Thirdly, it provides a moat in the event they want to compete further down the stack with their products.

The ability to find new growth levers in a consumer lending business today is becoming more challenging. Most fintechs playing in the lending space have realised that they need to look at other ways to earn revenue - which SoFi has done very effectively. With what could be a tight market in the coming years, the option of having a ‘plug and play’ BaaS product seems like a smart strategic play for SoFi - especially if they do become a bank.

What next?

In spite of all the uncertainty at the moment, I think we’ll continue to see the fintech infrastructure space run hot in 2020. The value of owning the rails fitechs (and eventually all FSIs) sit on is becoming a more commonly held belief. In a depressed market for fundraising - allowing for better priced deals - this could be just the accelerant savvy buyers need. I wouldn’t be surprised if we saw another $1bn+ acquisition in the payment processor space in this year (I’m looking at you Marqeta 👀).