Issue #87: Mint Is Shutting Down, Klarna Might Be Listing And Tabby Secures $200m In Fresh Funding

👋 Hi all, I hope you’ve had a great start to the week.

A big shout-out to our loyal subscribers and a hearty welcome to the new faces — we're ecstatic to have you here!

If you are new to Fintech Radar, this is what you can expect from each issue:

A curated round-up of the most interesting and relevant news from the world of fintech. In each issue, I focus on what caught my eye from the previous week — so don’t expect a weekly smorgasbord of press releases and partnership announcements. The aim is to serve the meaty bits in a neat, nibble-worthy package. It's all about spotlighting the head-turners and giving you the nitty-gritty without the fluff.

Also, if you enjoy this issue, please share it with a friend. I’m sure they'll appreciate it!

It’s been another busy week for fintech, so without further ado, let's delve into the major happenings from last week.

📣 The News Grab Bag

Mint is shutting down, and it’s pushing users toward Credit Karma

PFM OG, Mint, will shut down on January 1, 2024*, after being acquired by Intuit back in 2009. Despite Mint's 3.6m users, Intuit struggled to monetise the platform and will encourage users to migrate to Credit Karma — which the company acquired three years ago.

This has caused a bit of an uproar in Mint’s Reddit community, as many users have many years of financial history stored in the app. While Credit Karma offers similar features, it does not include the same budget tracking tool that many people specifically use Mint for, and it is unclear whether Credit Karma will ever adopt these as part of the transition.

🥡 Takeaway: Fintech

TwitterX went off this week, with people shocked that Intuit would shut down a business with 3.6m users. Yet if you asked the same people what segment is a fintech ‘no-go zone’ in 2023, they’d also tell you it’s a PFM apps. Having said this, things might be changing.The trajectory of the PFM app market has been a rollercoaster of high expectations — one early high point being Mint’s acquisition by Intuit ~36 months post-launch — followed by a descent into the trough of disillusionment as numerous imitators emerged and subsequently faded away. The lessons learnt by many being that it’s expensive to acquire customers and the business model of spruiking them financial services products for a few Shekels doesn’t work.

Of late, however, we’ve seen a resurgence in the segment with the emergence of a fresh cohort of PFM startups. These startups are (generally) more conservatively capitalised and focused not on upselling you into an insurance policy or payday loan but (gasp) charging you a monthly subscription fee to use them instead.

But it's not just about the changing business model. With how we're all diversifying our assets these days—think crypto, NFTs, stocks, vintage sneaker collections — there's a growing need to see everything in one place. And that need might be the magic ingredient PFM apps were missing. It's like, suddenly, everyone's looking for a financial dashboard, and these new apps are stepping up to the plate. Oh, and I haven’t even mentioned AI yet….

I wrote a more detailed piece about the segment a while back (I think it still holds up well in 2023), where I discuss this evolution. If you’re interested in reading about the Curious Case of PFM Apps, you should check it out.

Plaid and Adyen Partner to Power Pay by Bank

Plaid has partnered with Adyen to bring Pay by Bank, an alternative to traditional card payments, to North America. Pay by Bank allows consumers to pay directly from their bank accounts, avoiding the fees associated with card payments.

According to the announcement, the partnership will allow Plaid's customers to link their bank details and make payments with Plaid's software, checking balances and authenticating transactions. This move aims to lower payment costs, increase conversion rates, reduce fraud, and provide more payment options for businesses in North America

🥡 Takeaway: Plaid and Adyen partnered on an A2A payments play isn’t all that interesting, but it highlights where open banking is headed in the US.

If you live in a market that has already gone through the lift of implementing a regulatory-led open banking regime (or a broader Consumer Data Right, as we have here in Australia), you’ll know that data has turned out to be the entrée to the main meal of payment.

It turns out data portability is useful, but payments are essential to a larger swath of consumer offerings. Choose your data point, whether it’s the UK’s rapidly growing usage of PIS vs AIS, or the global projected growth in open banking payments (projected to exceed $330b globally by 2027, up from $57b in 2023). Open banking’s killer use case is proving to be A2A payments.

As players in the EU, like Tink and True Layer (check out their websites — it’s hard to distinguish the messaging on their websites from that of Stripe at this point), have realised that PIS opens a new vector of attack against the schemes while providing a cheaper and faster payment option for merchants.

Now, let’s see how long the North American market will take to realise the most significant update to s1033 will be in relation to PIS.

European Payments Initiative closes acquisition of iDeal and Payconiq

The European Payments Initiative (EPI) has completed its acquisition of the Dutch payment scheme iDeal and Luxembourg's Payconiq.

This acquisition marks a significant milestone for EPI's goal of building a unified instant payment scheme and platform for Europe. With the deals closed, EPI will prepare to deploy its payment solution in Belgium, France, Germany, and the Netherlands before expanding to other European countries. The initiative has also selected 'wero' (🤔) as the commercial name for its forthcoming digital wallet.

🥡 Takeaway: My bold prediction (not actually that bold) is that the way the Schemes get disintermediated is not going to be via a consortium of banks setting up a new network, but technology — led by the inflection point that A2A payments will prove to be (enabled by PIS).

As the article notes, a big plan backed by the European Central Bank was supposed to kick off last year, aiming to shake up the payments scene. But money issues started brewing among the members, and they had to look for cash injections from outside sources. Here’s where it gets rocky: they couldn’t get on the same page about the terms, which caused a bit of a stir and led to 20 banks walking away. And that flashy idea of rolling out their own payment card? Put on ice, as the company had to scale back and tighten the reins on their grand plans.

I’m fascinated to see where this goes, as it could prove to be the making of an important new payment network — unlikely, but you never know….

Travelers to Acquire Corvus Insurance

Travelers last week announced its agreement to acquire Corvus Insurance for approximately $435m. Corvus is a cyber insurance managing general underwriter with a strong presence in the middle-market excess and surplus cyber insurance marketplace.

According to the press release announcing the acquisition, the acquisition will provide Travelers with cutting-edge cyber capabilities, including underwriting algorithms, advanced cyber vulnerability scanning and digital connectivity to customers and distribution partners. The transaction is expected to close in Q1 2024.

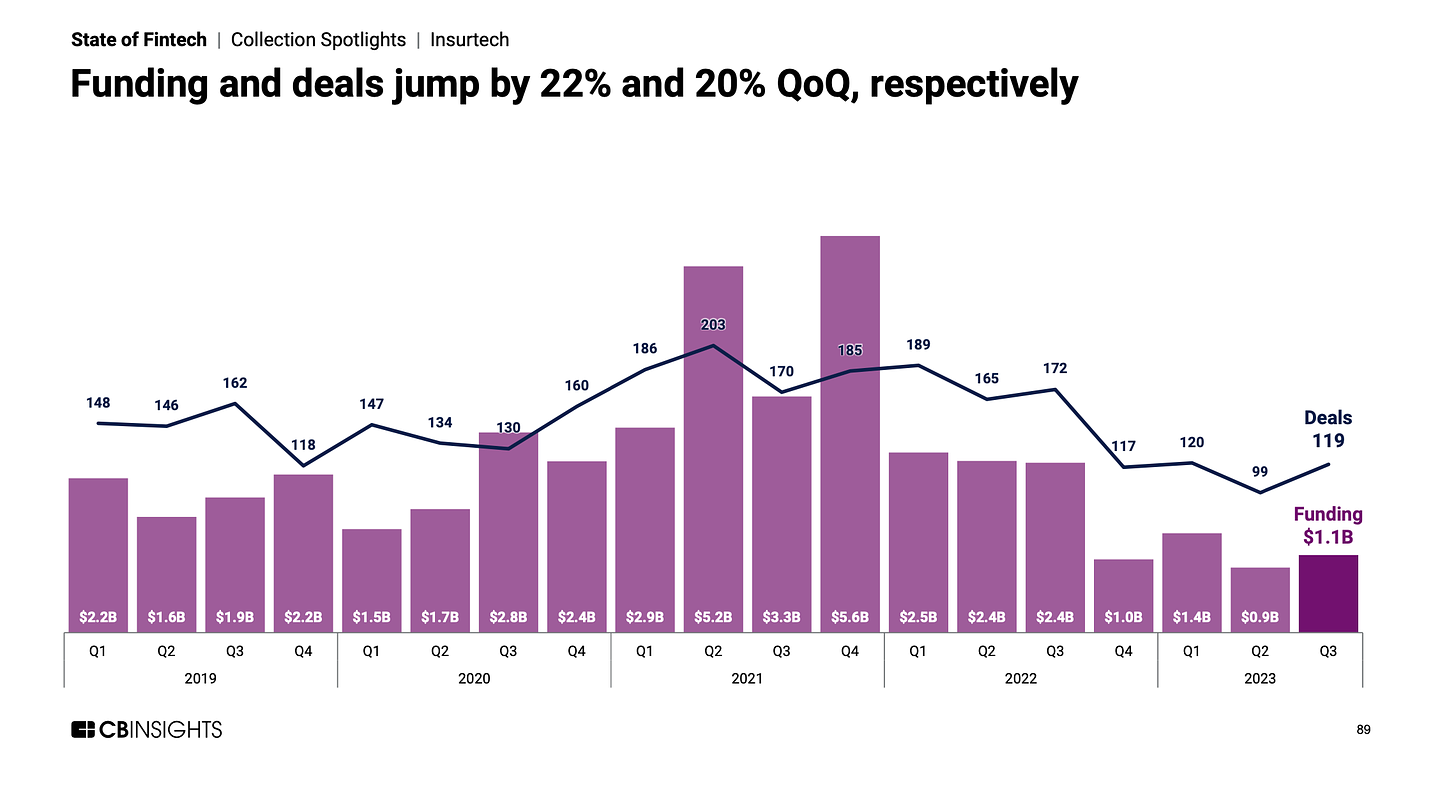

🥡 Takeaway: Compared to the rest of the fintech market, Insurtech saw an uptick in activity in Q3, according to CBInsights’ recent State of Fintech report (see below). It seems there’s been a resurgence in investor interest in insurtech startups.

It's quite a move to see an old-school insurance company like Travelers aiming to carve out a bigger slice of the mid-market SME cyber insurance sector—widely seen as one of the trickiest areas to navigate. And they're not just edging in; they're expanding through acquisition. This likely isn't a spur-of-the-moment decision; Travelers might have had this in the pipeline for a while as they’d announced plans to provide Corvus with capacity in the US from October 1st, with an eye to mirror the approach they had taken with them in the EU.

The trend here? It looks like insurers are hunting for opportunities to beef up their cyber insurance offerings. It's a smart move to balance the books, especially when the P&C segment is taking hits left, right, and centre. Keep an eye on this space—cyber insurance offerings are where I think we’ll continue to see investment flowing into insurtech.

Klarna Establishes UK Holding Company in Step to Listing

According to Bloomberg, Klarna is establishing a new British holding company to prepare for a potential listing. This administrative change has been in progress for over a year and will not impact Klarna's operations or roles in Sweden.

The holding company will be registered in the UK while being overseen by Sweden's financial regulator and holding a Swedish banking license. Klarna's valuation for an initial public offering could exceed $15b, although the company has yet to confirm where it will list its shares.

🥡 Takeaway: Okay, let’s start with the obvious — there is no way Klarna goes out at $15b. Whatever the final figure, it's clear that all fintech eyes will be on this listing — if it happens. I’m sure everyone is watching with bated breath; this could be the tell-tale of the BNPL's real market temperature.

Notable Funding Announcements

Last week was a big one for fintech financing, with 39 funding rounds completed and companies collectively securing $1b in investment.

Tabby secures USD 200 million in Series D funding round

Tabby, a BNPL platform serving customers in the Middle East, has secured $200m in Series D funding, giving it a valuation of $1.5b. This makes Tabby the first fintech unicorn in the Gulf region. The platform works with over 30,000 brands and has over 10m users across Saudi Arabia, UAE, and Kuwait.

Unlike buy now, pay later providers in the US and Europe, Tabby claims to be profitable in the GCC region due to factors such as low credit card penetration and high consumer purchasing power. The company plans to invest more extensively in its current markets and expand its product offerings to encompass a broader range of financial services.

🥡 Takeaway: This isn’t just another BNPL narrative; it's a pointer towards North Africa and MENA’s burgeoning fintech sector. Africa has long been pegged as a land of untapped financial potential, primarily focused on banking the unbanked. Yet, the emerging story is about a young, tech-savvy population eager for comprehensive financial services, from flexible online payment options to cryptocurrencies.

While Africa's fintech buzz often centres on a few key markets, the North African and tightly connected MENA fintech scene is quietly flourishing. Despite global economic headwinds and a potential credit crunch, MENA's unique market—characterised by low credit penetration and a digitally connected youth—presents a prime opportunity for growth. Within this landscape, BNPL services stand out as a sector poised for significant expansion as startups tap into a market hungry for new financial solutions.

Charlie’s senior-focused banking puts new funding toward stopping fraud

Charlie, a startup providing banking services to Americans over the age of 62, has raised $16m in Series A funding and $7m in debt financing to roll out a suite of personalised fraud protections designed specifically for its target customers, add to its 15-person team, and develop new products and features.

According to the article, Charlie has acquired several thousand customers in all 50 states since its launch in May. The company makes money through interchange fees and lets customers withdraw their Social Security benefit up to four weeks early. Charlie's mission is to "transform" financial services for the 62+ community and address the unique financial needs this community faces, such as rampant financial fraud, shifting from accumulating assets to deaccumulation, and a lack of transparency, control, and trust with most financial services products they encounter.

🥡 Takeaway: The grey dollar’s allure is drawing more investor interest. A few weeks back, I touched on Carefull's $16.5m funding round — a company which targets elder financial protection. Hot on its heels is Charlie, stepping into the fray with a banking solution for the same demographic.

My view remains optimistic about startups that cater to this group, given the clear need. However, the critical question is how these players will stand out in a crowded market. It’s reminiscent of the initial surge of neobanks targeting the HENRY (High Earners, Not Rich Yet) segment — we may witness a similar scenario here, where many undifferentiated services vie for the attention of a niche yet lucrative audience.

🎧 Resources & Recommendations

Missed out on fintech_devcon? Not to worry, you're not alone! I'm already counting down to next year’s event. Meanwhile, check out this playlist of talks from the event – it’s the complete roundup of all the presentations and panels from the conference.

The presentations span a spectrum of topics, from banking and payments to investing and compliance. So, why not pour yourself a coffee (or perhaps a few), get comfortable, and dive into the wealth of insights from the talks? Enjoy the learning spree!

Fintech Fuels Global Payments [Podcast]

This is another excellent pod from the A16Z fintech team. In it, they cover the complexity associated with moving money globally and what’s changing to make it a little less painful.

One of the more interesting discussion points in this pod worth keeping an ear out for is how companies are rapidly accelerating their global expansion (especially internet-native ones) and, thus, their need for financial infrastructure that can support them. This podcast is a treasure trove of knowledge and is highly recommended for your playlist.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect — I'm @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful

*Correction: This initially said January 1, 2024. The correct closure date per the article is January 1, 2024.