Issue #86: Musk Wants X To Replace Your Bank, JPM Coin Is Now Handling $1b In Daily Transactions Volume And Catch Relaunches

👋 Hi, FR Fam! I hope you all had a great start to the week.

A big shout-out to our loyal subscribers and a hearty welcome to the new faces — we're ecstatic to have you here!

If you are new to Fintech Radar, this is what you can expect from each issue:

A curated round-up of the most interesting and relevant news from the world of fintech. In each issue, I focus on what caught my eye from the previous week — so don’t expect a weekly smorgasbord of press releases and partnership announcements. The aim is to serve the meaty bits in a neat, nibble-worthy package. It's all about spotlighting the head-turners and giving you the nitty-gritty without the fluff.

Also, if you enjoy this issue, please share it with a friend. I’m sure they'll appreciate it!

It’s been another busy week for fintech, so without further ado, let's delve into the major happenings from last week.

📣 The News Grab Bag

Elon Musk gives X employees one year to replace your bank

According to the Verge, Elon Musk is still plotting to make X (née Twitter) the centre of people's financial lives, handling everything related to money, from payments to securities. The article quotes an all-hands meeting last week in which Musk noted that he expects the features to launch by the end of 2024, and X CEO Linda Yaccarino sees this becoming a "full opportunity" during that year.

As reported by many outlets back in August, X is slowly obtaining money transmitter licenses across the US. This move had people (re)speculating about Musk’s fintech vision for X. Last week’s all-hands seems to confirm that it’s still Musk's goal to turn X into an "everything app" that provides access to financial services products, shopping, news, and more.

🥡 Takeaway: We’ve known for a while that Musk has aspirations to take X from a social media app to a super app. Some might recall the meme “Buy Twitter, copy WeChat, Profit” that did the rounds last year after an interview in which he discussed his plans for the bird app.

There are a lot of obvious questions to ask here: will people trust X enough to use their financial services offering? Is Twitter even capable of building and maintaining a financial product? Imagine Musk trying to do compliance troubleshooting on X like he does so many other things.

So, where will X begin? Honestly, that’s what I’m most interested in. Will they first offer a wallet service to creators who are already receiving payments from them? Will they launch a peer-to-peer product for all users (i.e. Paypal 2.0), or perhaps they’ll try to resurrect Twitter Shop? Regardless, watching the clown car drive through fintech land should be entertaining.

Digital bank Monzo in talks to sell new £300m stake

Digital bank Monzo is in talks to sell a stake in the company worth over £300m, which would further solidify its position as the most highly valued digital bank in the UK. The talks are ongoing with a group of blue-chip investment funds, and the share sale is expected to value Monzo at more than £3.5bn.

According to the report, the details of the stake sale are expected to be finalised by the end of the year. This fundraising round will likely be the final one before Monzo goes public with an IPO. Monzo has shown strong growth, with 8.5m customers now using their products.

🥡 Takeaway: Monzo looks to be bouncing back after some time in the fintech wilderness. Under its new CEO, Monzo seems to have laid the foundations to become profitable this year, reaccelerated its product offering (like its recently launched stock product in partnership with Blackrock) and also looks to be having a second crack at the US market.

The company’s £300m raise signals a significant juncture in the digital bank’s story. It's not merely about filling the coffers with money; it's the broader signalling to the market from such a significant raise — namely, Monzo inching closer to an IPO (as I’m sure many of their investors are quietly pushing for some capital returns). It’s worth keeping an eye on this deal as it could be an important bellwether for the industry.

JPMorgan's JPM Coin payment system handles $1 billion in daily transactions

JPMorgan's JPM Coin payment system handles $1b in daily transactions for large companies, according to Takis Georgakopoulos, the company's global head of payments.

While this represents a small fraction of the $10t in payments processed daily by JPMorgan, it demonstrates the significant traction gained by JPM Coin.

Since its launch in 2020, JPM Coin has processed over $300b in transactions and is on track to achieve even more significant amounts in the coming year. While currently only available to wholesale or corporate clients, there are plans to expand JPM Coin to retail consumers in the future.

🥡 Takeaway: The world of blockchain/crypto/web3 has been deep in a bear market for over a year, which has provided more air to ‘boring’ projects that have been slowly building momentum.

As the article notes, this JPM Coin’s volumes are a drop in the ocean compared to the overall payment volumes JPMorgan handles daily. Regardless, it’s a great example of a ‘boring’ piece of financial infrastructure slowly gaining momentum. Wouldn’t it be ironic if tradfi creating mainstream products on crypto rails served as a catalyst for the next crypto bull market? Fintech horseshoe theory at its finest.

Expensify Unveils Personal Payments and Bill Splitting for Everyone

Business expense management startup Expensify last week announced that it’s expanding into the consumer payments space by launching personal payments and bill-splitting functionality in its app. The app allows users to send and receive money, split bills, and chat, combining features from popular platforms like WhatsApp, Venmo, and Splitwise.

This move looks to position Expensify as a financial super app (yep, there’s that word again) that seamlessly transitions between personal and work-related finances. The company also tested bill splitting at the Money20/20 conference and offered free features for individuals and businesses, such as expense tracking and next-day reimbursement — neat little activation.

🥡 Takeaway: Adding a B2C offering is the holy grail for enterprise-focused expense management/HR startups. The logic usually goes: if consumers already use us at work, they’ll surely want to use us in their personal lives — after all, it’ll mean they’ll be able to do everything in one app (sound familiar?).

It turns out this isn’t really how things play out. Many have tried, and few have been able to get any meaningful traction — it just turns out that no one wants to mix work and their personal financial lives to that extent. I’m fascinated to see if Expensify will be able to succeed where others have failed.

Catch, offering health insurance for gig workers, relaunches with new owners

Catch, a company that offers health insurance for gig workers and self-employed individuals, is relaunching under new ownership. The company was previously shut down in March by its original co-founders but has now been acquired by new co-CEOs Alexa Irish and Laura Speyer.

Catch will focus on offering health, dental, and vision insurance but will no longer provide retirement benefits. The company aims to address the need for affordable health insurance among independent workers and believes that providing this safety net can fuel entrepreneurship and change how people work.

🥡 Takeaway: Having raised $18m and secured insurance licenses across 47 states, Catch's original founder closed down operations in March of this year. Despite this, the core concept introduced by the company in 2019 continues to hold relevance—decoupling benefits from employers and ensuring their portability. Given the surge in independent workers (the article mentions a figure of ~60m in the US), this concept is likely gaining even more importance.

It will be intriguing to watch how the new management team tries to rejuvenate Catch. The article indicates that the focus will now solely be on the employee insurance offering, with plans to discontinue the retirement product as the starting point.

Notable Funding Announcements

Last week was a tepid one for fintech financing, with 43 funding rounds completed and companies collectively securing $409m in investment.

YouTrip raises $50m as travel bounces back

Singapore-based fintech YouTrip last week announced they’d raised $50m in a Series B funding round led by Lightspeed, bringing its total raised to $100m since its launch in 2018.

The company plans to use the funding to expand into new SEA markets, including Indonesia, Malaysia, the Philippines, and Vietnam. YouTrip offers a multicurrency wallet for consumers and business accounts with corporate cards for SMEs and is licensed by the Monetary Authority of Singapore. According to the raise announcement, the company has seen significant growth in its consumer multicurrency spending and user base — having processed close to $10b in annual TPV.

🥡 Takeaway: If you believe the BCG data, APAC (specifically, Asia) will emerge as the largest fintech region over the next decade, with 42% of incremental revenue in financial services revenue coming from this part of the world. Additionally, the burgeoning SME sector, faced with distinct challenges in this complex and interconnected region, presents intriguing possibilities for companies like YouTrip.

Youtrip’s unfolding expansion in SEA will be well worth keeping an eye on, given the historical challenges encountered by others who have run this playbook in the diverse SEA market. For example, Singapore is a very different market to the Philippines — culturally, socially and economically — which has traditionally been a genuine hurdle for fintech startups in SEA when they’ve tried to expand into neighbouring countries.

Aleph debuts with $16.7m to revolutionise financial planning platform

Aleph, a financial planning platform that consolidates varied data sources into a centralised hub, has raised $16.7m in its latest funding round led by Bain Capital Ventures. The round also had participation from Khosla Ventures, Picus Capital, Y Combinator, angel investors, and current clientele.

Aleph offers a tool that combines the flexibility of spreadsheets with modern real-time collaboration and deep two-way spreadsheet integration. Aleph aims to make it easier for finance teams to make better decisions by providing integrations to 150+ data sources, deep two-way spreadsheet integration, and modern real-time collaboration.

🥡 Takeaway: Despite the influx of modern tools into the finance side of a modern company’s org chart, we're far from bidding adieu to good ol’ Excel (insert meme of the world’s financial system being held up by a spreadsheet) — sad but very much a reality for startups selling products to this part of a company.

Here's where Aleph steps in with a savvy move. They're saying, "Why ditch the old friend?" They're letting finance teams stick with Excel while jazzing up their operations, plus throwing in a central hub for a quick peek at crucial financial insights. This blend of the familiar with a dash of the new is a route I think many will trot down when aiming to sell into FP&A teams.

🎧 Resources & Recommendations

On this episode of the Wharton Fintech Podcast, John MacIlwaine, Co-Founder & CEO at Highnote, discusses a wide range of topics related to embedded finance — including the complexities of payments processing, Highnote's approach to embedded finance, insights into their latest Credit Issuing product and the future of issuer processing. Add it to your playlist; it’s well worth a listen.

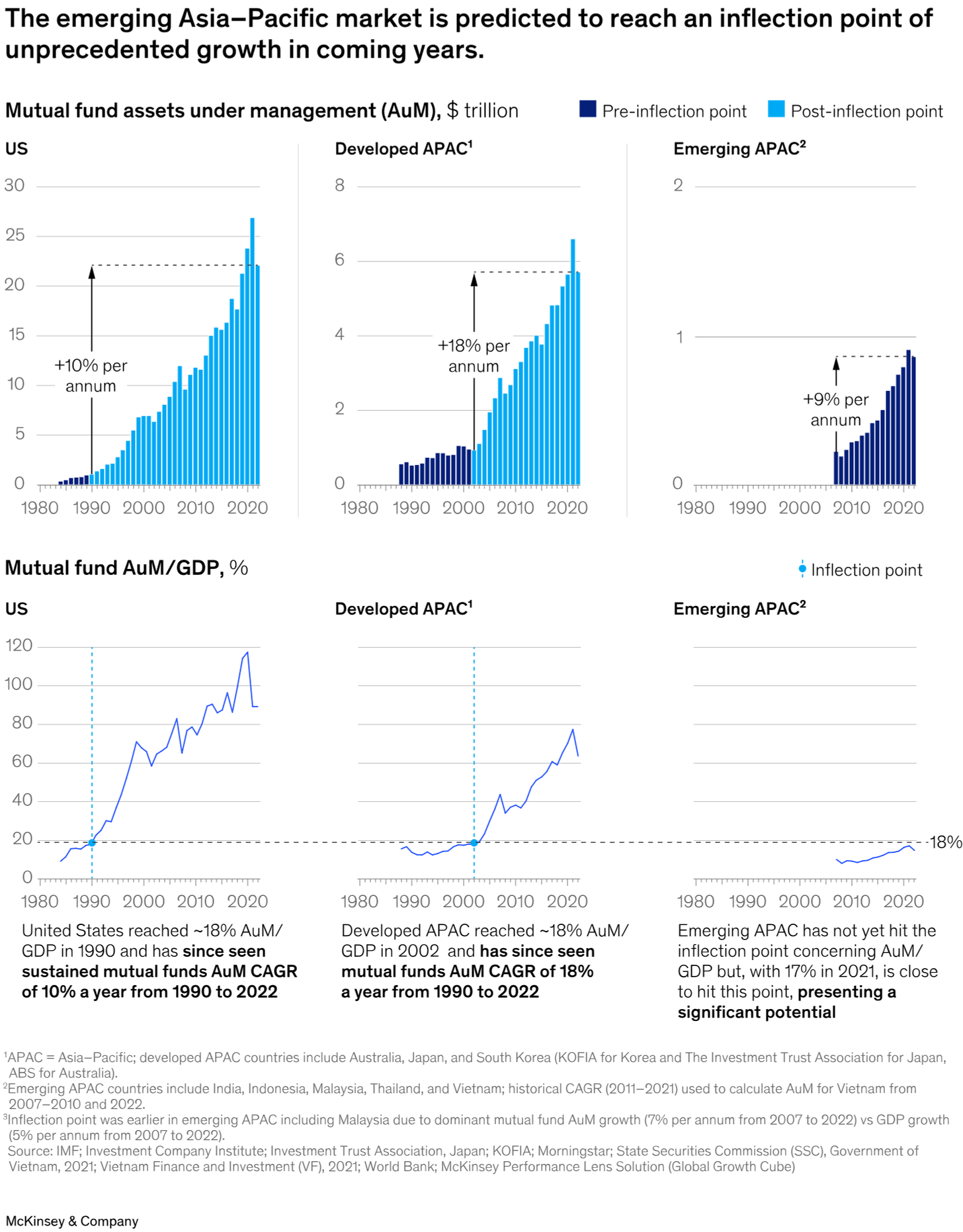

Calculating the upside of WealthTech in Asia–Pacific [Report]

This McKinsey report is a deep dive into Asia-Pacific's growing wealth management industry. With its growing economy, the region presents fertile ground for WealthTechs to drive meaningful growth.

The article touches on the evolving dynamics in wealth in APAC and how the segment is heading towards an inflection point where cost-effective offerings can address increasing cost pressures and revenue shrinkages while delivering "advice for all”.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect — I'm @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful