Issue #83: Revolut & Softbank Come To Agreement, Visa Launches $100m GenAI Fund And Paypal Faces An Antitrust Class Action

👋 Hey, all! I trust you’ve had a fantastic weekend.

As always, a hearty salute to our steadfast subscribers and a warm welcome to the newcomers — we're thrilled to have you on board!

A quick ask: Do you know someone who shares your passion for fintech? Don't hesitate to share this with them. It's a gesture that I’m sure they'll appreciate!

It’s been another big week for fintech, so without further ado, let's delve into the major happenings from last week.

📣 The News Grab Bag

Stripe grows international FY 2022 revenue, costs, amid layoffs

This is a nice piece of analysis from the team at FXCintelligence on the recently released Stripe Dublin (more specifically, Stripe Payments International Holdings) full-year 2022 accounts. As the piece notes, this entity covers Europe, the Middle East, and Asia-Pacific.

According to their analysis, it revealed slower revenue growth and increased pre-tax losses compared to previous years. The division's revenue for FY 2022 was $2.85b, a 27% increase from the previous year — but the slowest growth rate in recent years. Pre-tax losses for the division also grew significantly, reaching $189.5m, a 757% increase from the previous year. Despite layoffs announced in 2022, the company reported a sharp rise in employee numbers, with engineering accounting for the most significant percentage of employees.

This analysis offers an insightful examination of Stripe's financial performance within its EMEA operations. However, it's worth interpreting these findings cautiously, considering there could be a broader international tax structuring overlay that might be skewing some of the numbers.

Visa Launches $100 million Generative AI Ventures Initiative

Visa has launched a $100m generative AI ventures initiative to invest in companies focused on developing generative AI technologies and applications that will impact the future of commerce and payments.

The initiative will be led by Visa Ventures, the CVC arm of Visa, and aims to expand the focus to invest in some of the “most innovative and disruptive venture-backed startups building across generative AI, commerce, and payments”. Visa considers this initiative an extension of the company's leadership in AI use to drive innovation in payments, create value for partners and clients, and enable and empower global commerce.

This might hint that we've hit the peak of the generative AI cycle, or maybe (and fingers crossed) it's just a sign that the big corporate guns are finally grabbing the AI opportunity by the horns. Either way, it likely means we'll continue to see generative AI refs in fintech startup slide decks.

Experian launches digital checking account and debit card for US consumers

In what falls into the ‘what the…?’ basket of announcements this week, Experian has launched digital checking account and debit card products for customers in the US.

The new digital checking account allows customers to pay their bills and includes “Experian Boost”, which adds the payments to their credit files to boost their credit scores. According to the announcement, sign-up is quick and easy, with no fees and access to a virtual debit card. The product targets consumers new to credit or looking to improve their credit profiles. Additional features include early access to paychecks, access to ATMs worldwide, and Experian membership benefits.

According to the press release announcing the product’s launch, Experian’s group president of Consumer Services notes, “This offering is a natural next step in how we are using our technology to provide consumers greater credit-building power and financial control.” Although I understand the logic (sort of), I’m not sure consumers are going to be rushing to a credit bureau to open a checking account. In fact, it’s giving Levi Strauss introducing a line of three-piece suits energy.

Revolut strikes share deal with SoftBank to remove barrier to UK licence

Revolut has reached an agreement with its largest investor, SoftBank, to simplify its ownership structure, removing one obstacle to winning a long-delayed banking license from the Bank of England. The central bank has made the collapse of Revolut's six classes of shares, which stem from multiple funding rounds since its founding in 2015, a condition for granting a license.

The agreement, internally codenamed "Project Swan," does not include any new issuance of "top-up" shares for SoftBank and will not have a financial impact on the company. The FT piece notes that SoftBank had initially demanded twice the amount of common stock in exchange for giving up some preferential rights it received for leading a fundraising round in 2021. According to the article, other investors, including Tiger Global Management and Balderton Capital, have either agreed to transfer their shares into a single class or are in final talks to do so.

PayPal is facing a class action lawsuit alleging that its anti-steering rules unfairly stifle competition with lower-cost payment platforms like Stripe and Shopify. The lawsuit claims that PayPal's merchant agreements result in consumers paying more for purchases and prevent merchants from offering discounts or presenting other payment methods earlier in the checkout process.

The article notes that the attorneys compare PayPal's anti-steering rules to those imposed by Visa and Mastercard before they were sued by the Department of Justice in 2010. The lawsuit asserts that if consumers could see the price difference between PayPal and its competitors, they would pay lower all-in prices. It's certainly worth monitoring this case as it progresses.

Acorns launches first post-acquisition product

Acorns, the savings and investing app, has launched its first product following its acquisition of UK neobank GoHenry. The new product, Acorns Premium Tier, is a $9-a-month subscription focused on family money management. It includes features such as Acorns Early, which allows family and friends to invest for a child from birth, and GoHenry, which provides a branded debit card and budgeting skills for kids starting at age 6.

According to the article, this is just the start of the Acorns product revamp. They aim to promote financial wellness for the whole family and plan to introduce additional tools for couples, parents, and families in the future.

Providing a comprehensive lifecycle banking solution is what many in the teen neo-banking segment have been striving towards (e.g. Step, GreenLight, and Copper). It will be intriguing to see if Acorns can leverage the GoHenry acquisition to catalyse this ambition, especially in the context of their current product offering.

Notable Funding Announcements

Last week was a big week for fintech financing, with 52 funding rounds completed and companies collectively securing $1.9b in investment.

Rainforest raises $8.5M to help software companies embed financial services, payments

Rainforest, a payments-as-a-service platform (PaaS), last week announced they’d raised $8.5m in seed funding. The round was led by Accel, with participation from Infinity Ventures, BoxGroup, The Fintech Fund, Tech Square Ventures, Ardent Venture Partners and several strategic angels. Rainforest plans to use the funds to expand into new industries and partner with banking-as-a-service and lending-as-a-service companies.

Rainforest is built specifically for software platforms, offers low-code integration technology, merchant portability, handles the risk management and compliance burden for their customers — in other words, a very complete PaaS offering. According to the press release announcing the round, the company secured client commitments representing more than $500m in processing shortly after launch and is seeing traction in industries including healthcare, non-profit, field and professional services, niche retailers, trucking and logistics, construction and association management.

Many see online payments as a 'done deal', primarily thanks to big players like Stripe, Adyen, Braintree, et al. Yet, there's a bunch of nimble payment providers picking away at the edges, helping out those who aren’t entirely on the automated payments bandwagon yet. By offering up portability and taking care of compliance, Rainforest is aiming to give merchants a flexible full-stack PaaS solution, which is actually harder to come by than you'd think. Although it’s less contrarian than it might have been only a few years ago, I think now is the best time to build a vertically focused PaaS product.

Stitch raises $25M Series A extension led by Ribbit Capital, increasing the round’s total to $46M

South African fintech Stitch has raised $25m in an extension round of funding led by Ribbit Capital, bringing its total Series A funding to $46m. Stitch focuses on providing an end-to-end payments solution for enterprise clients, enabling businesses to build, optimise, and scale financial products. The company plans to use the funding to develop its platform further, expand its customer base, and explore opportunities in new markets.

Launched only two years ago, the company is now processing over 50m payments annually, worth over $2b for some of the largest businesses in South Africa. Stitch has expanded from a single pay-in method to an end-to-end payments solution provider with eight pay-in methods and comprehensive payout capabilities — which is super impressive in the complex African market. I’m looking forward to seeing what's next from Stitch.

Bonus: Check out this interview with Kiaan Pillay, the Co-founder and CEO of Stitch, where he discusses the latest funding round and Stitch’s future plans.

🎧 Resources & Recommendations

Build it and they will come: Talking with Marqeta’s Jason Gardner

In this podcast interview with Jason Gardner, Marqeta's founder, he discusses the company’s journey to becoming a listed company, emphasising how it disrupted the payment industry with its open-API infrastructure for card issuance. He also shares his transition from CEO to Executive Chair and the company's focus on solving unique market challenges for their customers — like that of on-demand delivery services. He also chats about Marqeta's strategic acquisition of Power Finance and the logic behind the $275m deal. Well worth a listen.

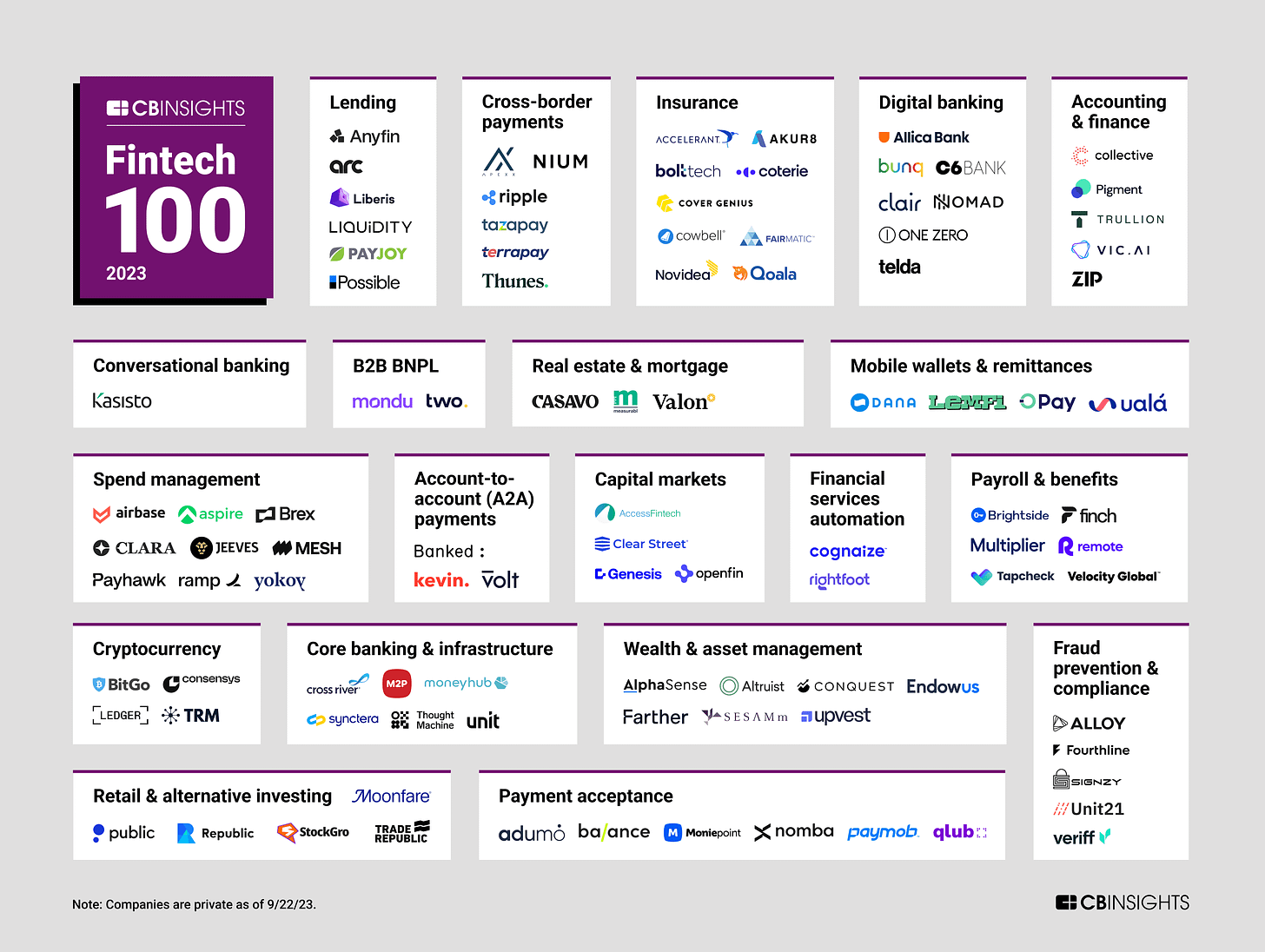

Fintech 100: The most promising fintech startups of 2023

Last week, CBInsights unveiled their Fintech 100 list for 2023, spotlighting the crème de la crème of the fintech world (at least according to them). Here are some summary stats from this year’s list:

🇺🇸 The US takes the cake, making up 43% of the list. The UK wasn’t too far behind, accounting for 12% and don't sleep on Singapore, it represented 7%.

🛡️ Insurance and Spend Management were out in front with nine companies each. Digital Banking and Wealth & Asset Management were also making noise, with seven companies each.

🚀 Y Combinator and Tiger Global led the way on the investor front, each backing about 11% of the listed companies. Accel came in next, with stakes in roughly 9%, followed by Lightspeed Venture Partners and Endeavor, each coming in at around 8%.

💸 The average total funding for this year’s 100 was a hefty $279m. C6 Bank from Brazil has raised the most money to date. Conversely, Cognaize and Rightfoot raised the least, each having taken in $20m in funding.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect — I'm @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful