Issue #80: Europe Sees Fintech Funding Drop, JPMorgan Chase Partners With Gusto And Adyen Secures A UK Banking License

👋 Hey, FR Family! I trust you all had a productive week!

As always, a hearty salute to our steadfast subscribers and a warm welcome to the newcomers — we're thrilled to have you on board!

Know someone who shares your passion for fintech? Don't hesitate to share this with them. It's a gesture they'll appreciate!

It’s been another big week for fintech, so without further ado, let's delve into the major happenings from last week.

📣 The News Grab Bag

European fintech funding drops as investment discipline returns

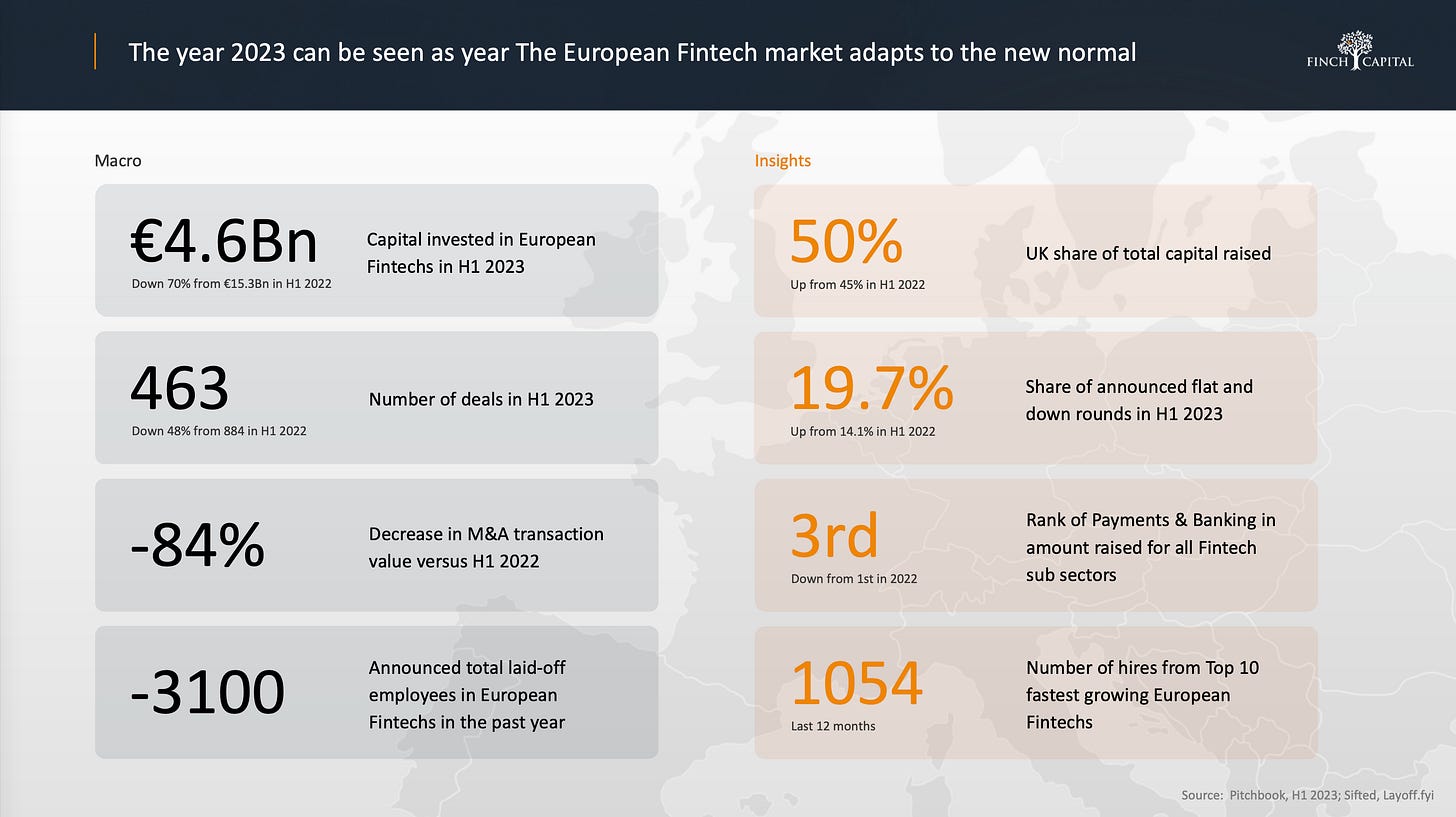

European fintech funding dropped significantly in the first half of 2023 as investment discipline returned to the sector. According to a report by Finch Capital, fintechs in Europe raised €4.6b in funding across 463 deals, compared to €15.3b across 884 deals in the first half of 2022.

As you might expect, funds raised were concentrated among a small number of funding rounds, with the top 20 funding rounds accounting for over 60% of total deal volume. The report also noted that seed rounds continued to attract funding.

Interestingly, on the M&A front, activity decreased by only 5% — indicating a willingness for some players to do deals ( if they’re at the right price that is).

Despite layoffs, according to the article, the sector is still hiring, with the ten fastest-growing fintech companies having hired over 1,050 people in the past year. The UK showed more resilience compared to other countries in the EU, accounting for over 50% of the funding across the continent.

Unicorn fintech/HR startup Deel got itself a bit of unwanted PR last week when it was revealed that it had facilitated over $72m in payments in less than a year on behalf of prop trading business MyForexFunds, a platform accused of operating a Ponzi scheme, according to a report by The Information. The transactions were made across over 40,000 trades, serving 15,664 MyForexFunds customers during the period.

Most know Deel for its EOR-related products, but according to The Information report, the prop trading firm used Deel’s invoicing product. This is a clever way to effect the transaction as it likely means that the prop firm and customer entered into a contract, and then payments were made using the invoice payment methods to settle the transaction. A senior executive at Deel said they did not know it was a problematic industry and immediately ceased working with MyForexFunds when informed of its status and collaborated with the CFTC to comply with all their requests and needs. As might be expected, Deel paused servicing other prop trading firms pending a compliance review.

It’s unfortunate Deel has been caught up in a tricky situation and a reminder of how challenging compliance is in the global money movement game.

JPMorgan Chase to offer online payroll services as it steps up fight with Square, PayPal

JPMorgan Chase plans to offer digital payroll processing for small businesses to compete with fintech players like Square and PayPal. The bank has partnered with San Francisco-based fintech Gusto to provide the underlying technology for this service.

By integrating payroll processing into its existing banking platform, JPMorgan is attempting to create a more seamless customer experience — clearly to rival the likes of Square. The service will be available by the end of 2024 and will handle salary disbursement, tax documents, pay stubs, and filing to local and national agencies. JPMorgan has 5 million small business customers and over 200,000 users of its payments solutions, a vast base of potential customers for its new offering to target.

Anyone who’s had to work through a partnership like this knows they are fraught with challenges — integrations with legacy systems, culture misalignments, differing expectations, and that’s to get the product to market! Hopefully, this partnership delivers for both incumbent and startup, as it’s a category still with a ton of opportunity.

PayPal Introduces On and Off Ramps for Web3 Payments

Last week, PayPal announced the integration of On and Off Ramps for Web3 payments, allowing wallets, dApps, and NFT marketplaces to facilitate the buying and selling supported cryptocurrencies in the United States. This integration will enable web3 merchants to connect with PayPal's payments experience while also benefiting from the company's fraud management and dispute resolution tools.

Previously, PayPal launched On-Ramps, which allowed US consumers to buy crypto directly through integrations with Metamask and Ledger. Now, with the addition of Off Ramps, crypto wallet users can convert their cryptocurrency into USD directly into their PayPal balance, providing more flexibility in how they use their digital assets.

Here, we all thought it was a bear market for crypto. Instead, we’re seeing (checks notes) incumbents accelerate their adoption of crypto solutions. Looking forward, it wouldn't be too far-fetched to think that the groundwork laid by these legacy fintechs could potentially be the foundations needed for the next bull run in the crypto space.

PayPal, Venmo, and Zelle: What Americans Want Out of Digital Payment Apps

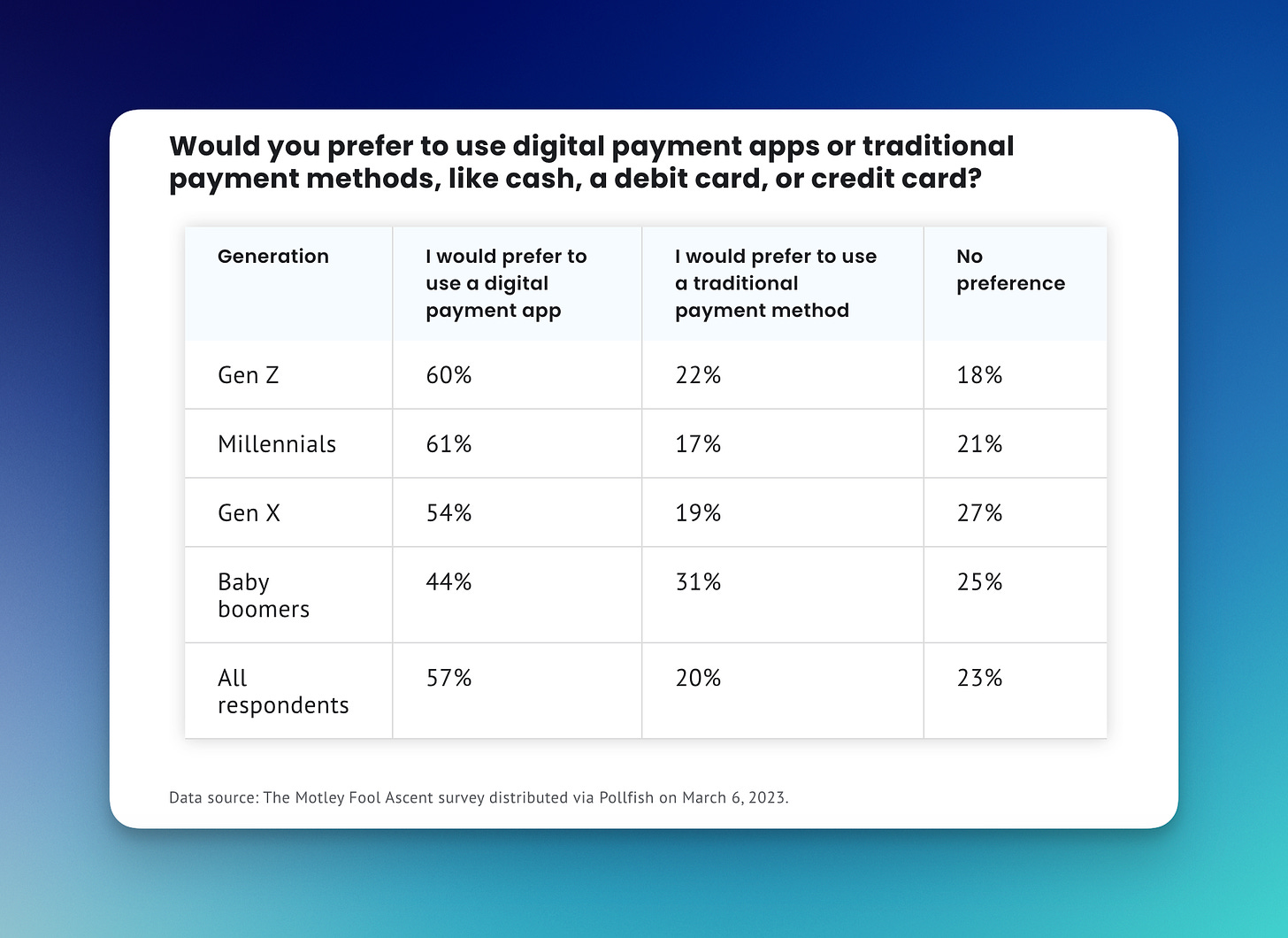

A survey conducted by The Motley Fool Ascent found that three-quarters of Americans trust digital payment apps as much as they trust cash or credit and debit cards. The majority of Americans prefer to use apps for purchases and to pay back friends and family.

As you might expect, views towards digital payment apps vary by generation, with younger generations more inclined to use them. The survey also found PayPal is the most popular payment app, followed by Cash App and Venmo.

The survey also found that the speed of transferring funds from the app to a bank account is the most important feature when choosing a digital payment app — which might get a boost in the US with the introduction of FedNow. Again, as you might expect, transfer fees and brand trust are also significant factors, according to the survey.

Stripe rival Adyen secures banking license in the UK

Dutch payments giant Adyen announced it had secured a banking license in the UK last week. This authorisation allows Adyen to continue its UK operations and replaces its temporary post-Brexit permission under the Temporary Permission Regime. The approval from the PRA and FCA allows the Dutch company to continue operating its UK branch and, importantly, its embedded finance offering. For context, their current embedded offering allows UK merchants to offer customers bank accounts, virtual or physical cards, cash flow and expense management.

Although it’s a small part of their overall business, the trend towards PSPs offering a full stack offering for merchants (including embedded finance solutions) is nothing new, and I’m sure we can expect to see more from Adyen — as their CFO, Ethan Tandowsky, recently noted at the Goldman Sachs conference in San Francisco.

“Platforms is the smallest piece of our business today, but we have a very strong belief that SMBs will get their payments and broader financial services from platforms over the next years.”

📈 Notable Funding Announcements

Last week was a big week for global fintech financing, with 53 funding rounds completed with companies collectively securing $2.6b in investment.

Swan defies fintech funding slump with €37m Lakestar-led Series B

Swan, a French fintech company, has raised €37m in a Series B funding round led by Lakestar despite the slowdown in fintech funding in Europe. Swan is part of the brigade of startups offering embedded finance solutions — providing infrastructure for e-commerce and software platforms to offer financial services without building them from scratch. More specifically, Swan currently provides local IBAN accounts for its customers and plans to expand its product offering to include payment execution, lending, and payments collection.

According to the article, Swan’s customer base has handled transactions surpassing €7b. They plan on utilising the fresh capital to enhance their current offering, including incorporating a broader array of payment collection methods and potentially exploring lending avenues.

The raise not only seems to buck the trend in terms of funding for more mature fintech startups in Europe (see above story) but also shows there is still an appetite from investors to back embedded offerings in an already crowded EU market.

Treasury4 Raises $20 Million to Support Changing Role of CFO

Treasury4 has raised $20 million in Series A funding to expand its software platform for treasury and finance practitioners. The company notes it plans to use funds to enhance Entity4, its legal entity management solution, and Cash4, its global cash management tool.

According to Steve Helmbrecht, Treasury4's president and CEO, treasurers and CFOs are experiencing a transformation in their contribution and influence, and modern digital technologies will enable them to gain deeper insight into their organisations and guide them more effectively. He also notes in the press release that the role of the CFO has evolved significantly in recent years, with CFOs at the forefront of navigating systemic changes and leveraging technology such as AI and ML to drive operational and cost efficiencies.

This is a segment that is quietly going through a renaissance. Treasury and finance teams are (slowly) ditching spreadsheets for modern, streamlined platforms that offer real-time data insights, marking a shift towards more efficiency (which is what most companies are chasing at the moment) and further empowering them to focus on what matters — helping to grow a company. I expect we’ll continue to see investors doubling down on this segment in 2023.

🎧 Resources & Recommendations

Secrets from the Founder of the Fastest-Growing SaaS Startup (Eric Glyman of Ramp)

In the premiere episode of their new podcast “1 to 1000”, Jack Altman and Erik Torenberg chat with Eric Glyman, CEO and founder of Ramp.

In this episode, they dissect the journey of building a fintech startup — from conceptualising the initial segment for the product and what product two should look like through to executive recruitment. This discussion offers rich insights into the tactics and strategy of building an early-stage fintech startup. Another great listen from the Turpentine podcast network.

Peter Johnson on the Relentless Rise of Stablecoins

In this episode of the On the Brink podcast, Peter Johnson of Brevan Howard Digital discusses his latest insights on the evolving stablecoin landscape.

The discussion unpacks the growth of USDC and USDT. More specifically, they discuss the current stablecoin trends in the BSC and TRON ecosystems (which are generally under-discussed), the advent of interest-bearing and synthetic USD stablecoins and what this might mean for the market, and they touch on some predictions for the future interplay between stablecoins and the Eurodollar market. It's well worth a listen, especially given all the recent activity in the stablecoin space.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect — I'm @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful