Issue #79: Visa Gets In On Stablecoin Summer, Monzo Takes On Scam Callers, And ThetaRay Secures $57M To Fight Money Laundering

👋 Hey, FR Squad! How's everyone doing? Had a killer week, I hope!

Big virtual hugs to our ride-or-die subscribers, and welcome to the newbies joining the FR tribe. We're jazzed you're here!

Got a friend who geeks out over fintech as much as you do? Go on, hit that forward button. Sharing is caring, and trust me, they'll thank you for it!

Alright, let's dive straight into what's been making waves in fintech over the past week.

📣 The News Grab Bag

Visa Expands Stablecoin Settlement Capabilities to Merchant Acquirers

It’s Stablecoin Summer, and here come (more) incumbents to the party. Last week, Visa announced that it had expanded its stablecoin settlement capabilities by partnering with merchant acquirers WorldPay and Nuvei to launch pilots on the Solana blockchain. This move allows Visa to facilitate instant payment authorisations between consumers and merchants by providing more seamless value movement between banks.

You might recall that in 2021, Visa tested the use of USDC in its treasury operations and successfully conducted settlement payments for a card program in Australia using Ethereum. Now, Visa is piloting settlement payments (via Circle) on the Solana blockchain — a real boost to the once-hyped L1. According to the press release, Visa has already settled millions of dollars of USDC over Ethereum and Solana and remains committed to innovating and providing modern settlement options. For more details, check out Cuy Sheffield’s Tweet announcing the launch.

Temenos rolls out first generative AI tool

Swiss core banking provider Temenos has developed a generative AI tool that automatically classifies customer banking transactions. The solution allows banks to classify and label customer transactions accurately and automatically in different languages, and it can be seamlessly integrated into existing core systems.

It’s been tested in a pilot with BlueShore Financial, where it provided personalised insights on income and expenses to customers within their banking app. Temenos are also exploring further use cases for the technology, such as in chatbots and customer interfaces.

It’ll be interesting to see how the core banking providers play in the generative AI space. In many ways, it makes a ton of sense for an AI toolchain to sit in banking liminal space — between the core and localised services across the business — and, importantly, all within the virtual walls of a bank. Having said this, the question will be whether companies like Temenos, Mambu, Thought Machine et al. are actually going to have the chops to provide the very best in class AI models to banks — or are they just going to become AWS SageMaker resellers?

Flutterwave Announces Expansion to Indian Market

Flutterwave, Africa's highest-valued startup, has announced its expansion into the Indian market through a partnership with IndusInd Bank. The partnership will enable Flutterwave to offer its remittance product to IndusInd Bank's 35m customers. Flutterwave's CEO, Mr Olugbenga Agboola, noted that this move will make the company the first African firm to enable seamless and quick remittances from India to Africa. The company's expansion into India is part of its ongoing growth strategy, as it continues to experience significant success in the African market. It’ll be interesting to see where Flutterwave expands to next.

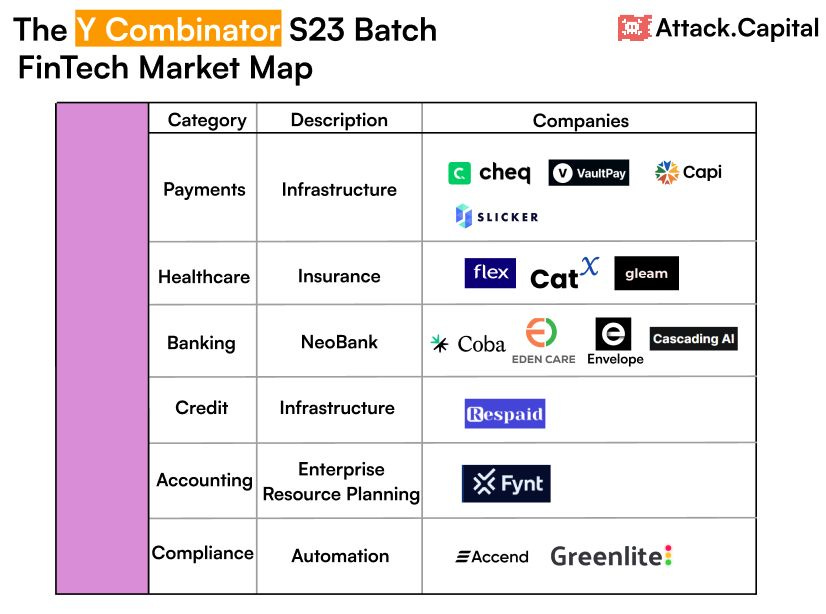

If you listen to Twitter or any of the broadsheets that cover startup land, you might think that YC demo day has lost its lustre. Regardless, it still provides a great barometer of what segments are hot and which are not.

This brings us to YC’s 200-strong 2023 summer batch, and as you might have guessed, it skewed heavily towards AI. The latest batch is a testament to the heat of the AI sector, with a noteworthy surge in representation — 57 AI companies were part of the cohort, more than double the count from the winter 2022 batch, which had 28 AI startups. Also worth noting was YC’s reversion back to its early-stage investing roots. This batch consists of the usual very early startups, with 75% starting with no revenue and 81% having never raised funds.

On the fintech front, representation remained strong, with 10% of the cohort being fintech-focused startups (see the diagram above from YC Alum Attack.Capital). It’s worth noting that even in the depths of crypto winter, YC dipped its toe into the segment, backing 4 blockchain companies in this batch.

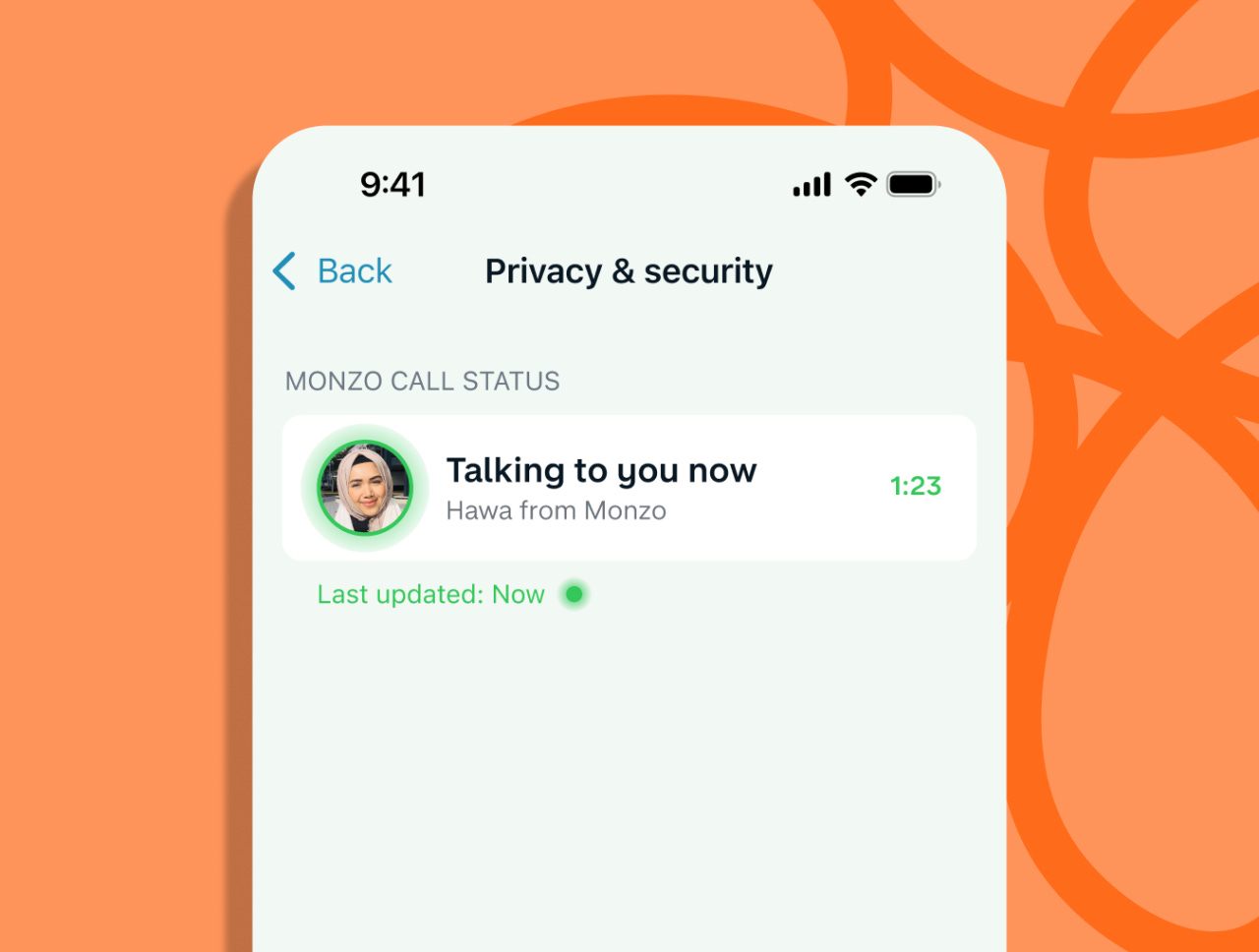

Making it clear when we’re on a call with you to protect you from fraud

Monzo steps up in the battle against fraud with a timely new feature in their app, designed to shield customers from scam calls. According to the blog post announcing the new safety feature, users can now readily verify the authenticity of incoming calls claimed to be from Monzo through the "Monzo call status" in the app — a reliable tool that remains trustworthy even in cases where the caller mentions technical issues or states they belong to a specialist team.

I don’t usually cover new feature releases from fintech startups in FR, but this is a really clever one (and timely, for that matter) from the team over at Monzo. With the rise in robo-scam calls, it'd be great to see other banks do more than just send emails telling customers not to hand over their credentials. Bravo, Monzo 👏

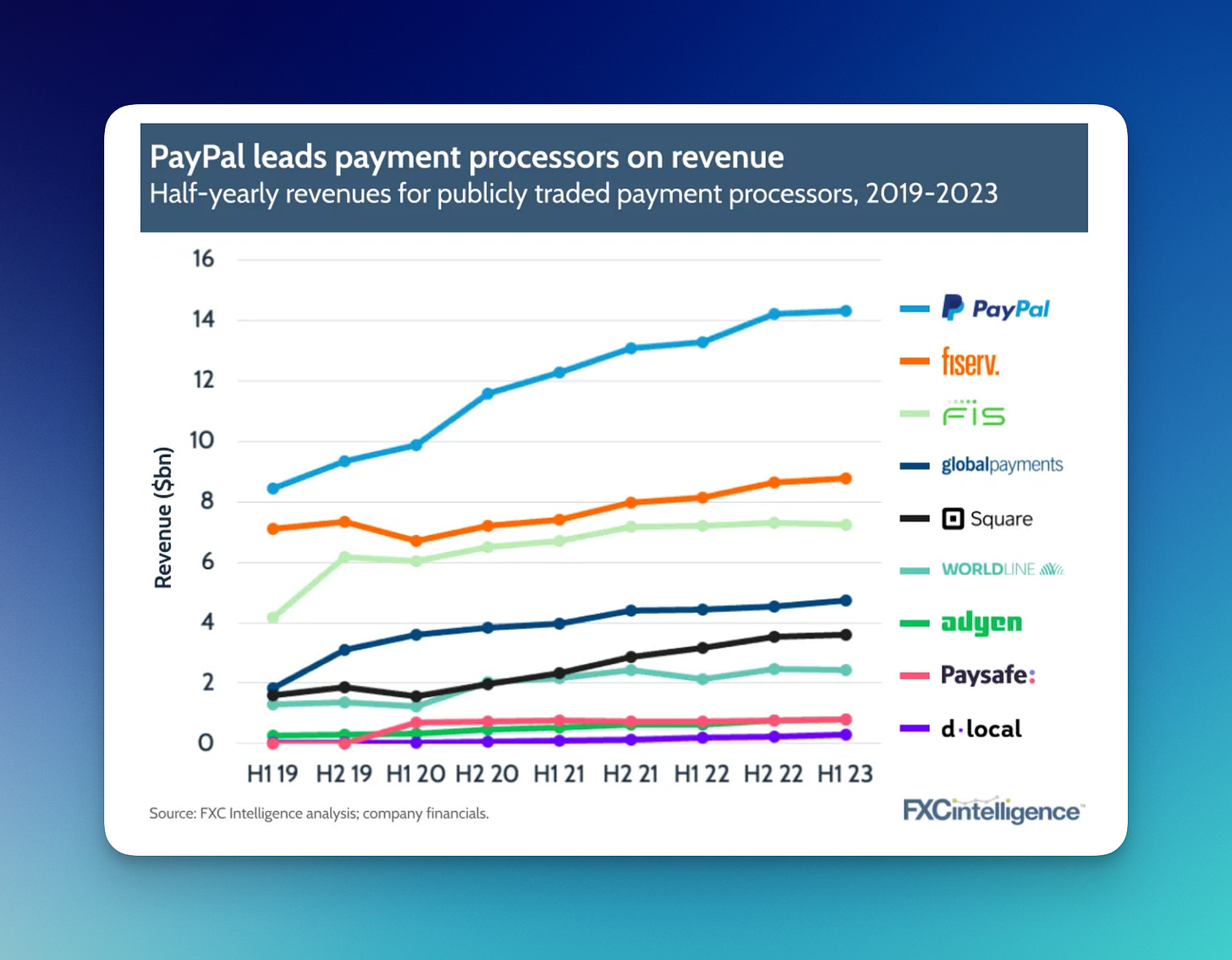

Key trends in Q2 2023 for payment processors: Insights following earnings season

It’s been an interesting time for the big boys in payment over the last quarter. Despite tough market conditions, many have continued to grow, and some (discussed in previous issues) have hit some speed bumps. Having said this, overall, the Q2 2023 earnings season for payment processors has been generally positive, indicating that we may be entering a new period of normalcy in the industry.

In this report from FXC Intelligence, they provide a detailed breakdown of how the major listed players faired in Q2. It’s a great summary and well worth a read.

📈 Notable Funding Announcements

Last week was a more upbeat week for fintech financing, with 39 funding rounds completed with companies collectively securing $452m in investment.

ThetaRay nabs $57M for AI tools to fight money laundering

Israeli startup ThetaRay has raised $57m in funding for its AI-based AML platform. The round was led by Portage, with investments by existing investors JVP, OurCrowd and others.

ThetaRay’s platform automatically scans and identifies illicit transaction activity at banks and financial institutions. More specifically, their platform scrutinises SWIFT traffic, risk indicators, and details about clients, payers, and payees to pinpoint abnormalities that could indicate money laundering or sanction violations in detailed cross-border transaction chains.

ThetaRay's customers include Santander Bank, Travelex, Mashreq Bank, MFS Africa, and ClearBank. According to an overview of the transaction from FT Partners, the company has seen significant growth in its customer base and annual recurring revenue. Specifically, ThetaRay has reported a tenfold increase in its customer base over the past two years and achieved more than 180% in net dollar retention rate, translating to five-fold growth in ARR.

In 2023, the spotlight is firmly on compliance-focused startups in the fintech sector (see below for another company in the space that secured the bag last week), with the uptick in regulatory demands for FIs fuelling a vibrant investment landscape. These emerging players likely see this as a new ‘why now’ (along with investors) for the segment, which I think will only intensify in the coming years.

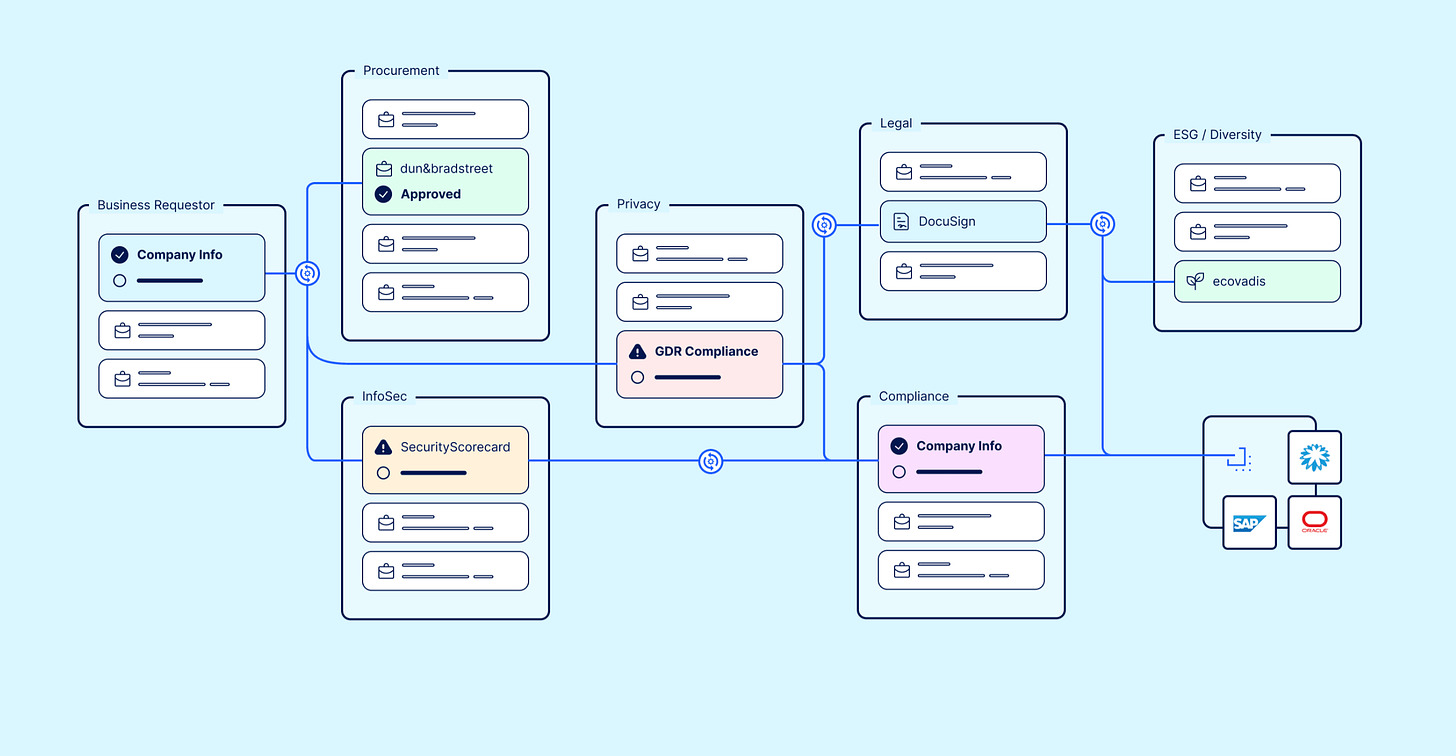

Compliance and risk management startup Certa raises $35M

Certa, a compliance and risk management platform, raised $35m in a Series B funding round last week. The investment was led by Fin Capital and Vertex Ventures Southeast Asia and India, with participation from other investors, including Tru Arrow Partners, Point72 Ventures, Mantis, and GOAT Capital.

Certa's platform helps organisations manage their relationships with suppliers, partners, and clients efficiently and safely. According to their press release regarding the raise, the platform offers comprehensive solutions for procurement, compliance, ESG, and legal and has already helped onboard and monitor millions of companies across 120 countries. Part of Certa's value is that it offers an “orchestration engine” that brings stakeholders involved in risk-exposed business processes onto the platform. More specifically, it provides risk-scoring reports, templates, and modules, as well as third-party validations and questionnaires to analyse risk and keep up with regulations.

Procurement and vendor management have become more complex, and tools that work cross-functionally in a more seamless way are experiencing some serious tailwinds as more companies look to modernise their approach and growing companies move beyond spreadsheets. Indeed, the upward trajectory in adopting these more modern, integrated tools indicates a promising future for this segment. It's a dynamic and rapidly evolving field that holds significant potential for innovation and growth, making it a hotbed for opportunities for new players looking to displace more vertically focused incumbents.

🎧 Resources & Recommendations

ChatGPT makes payments inroads

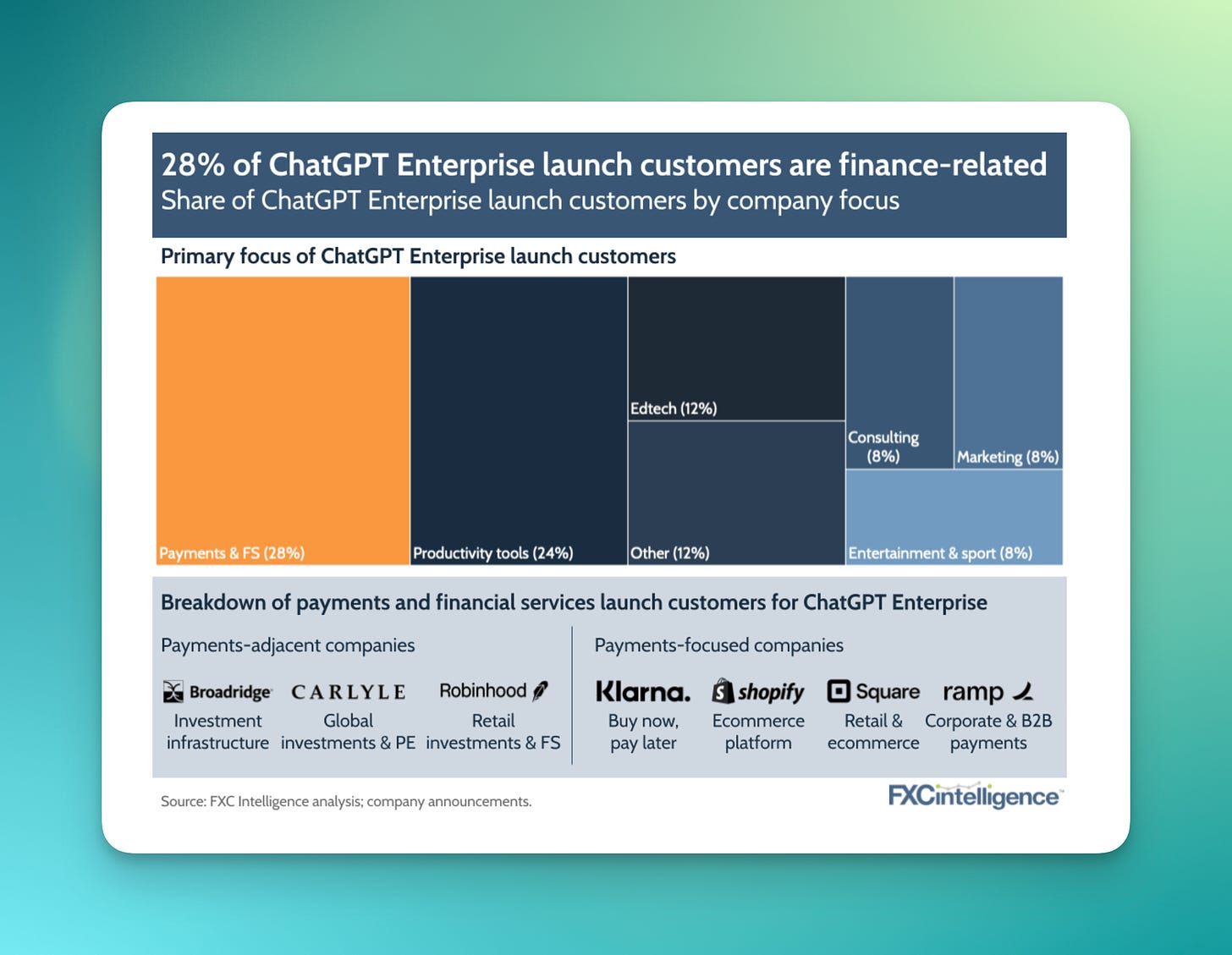

As you may have heard, OpenAI recently released an enterprise version of ChatGPT — promising enterprise-grade security and privacy, along with faster and more nuanced customisation options. The release is likely a direct response to the strong interest from enterprise companies — with individuals from a whopping 80% of the Fortune 500 firms registering to use OpenAI's existing products.

And surprise, surprise, a significant share of the launch customers for ChatGPT Enterprise come from the financial services and payment sectors. In fact, according to FXC Intelligence, one-third are rooted in financial services-related fields, with 16% specifically in payments. Leading the charge in adoption are companies like Square, Robinhood, Shopify, Klarna and Ramp.

In this episode of the Business Breakdowns podcast, Zack Fuss of Irenic Capital does a deep dive into the meteoric rise of Nubank, the standout Brazilian neobank that, in just a decade, has garnered a staggering 46% of Brazil's adult population as its customers and now valued at ~$33b. Joined by Daniel Bakalarz, a managing partner at Unison Asset Management, they dissect the various elements that have propelled Nubank to its current standing as Latin America's largest fintech. Whether you're curious about Nubank's impressive customer economics or keen to understand the competitive landscape of banking in South America, this episode offers a rich, insightful discussion that is not to be missed. A highly recommended listen!

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect — I'm @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful