Issue #76: The UK Wants To Drop £1b On Late Stage Fintech Startups, Nubank Posts Record Revenue And BitGo Secures The Bag

👋 Welcome back, FR Family!

I've returned, and the world of fintech hasn't slowed down for a second while I’ve been away! 😄 I trust you've all been keeping pace without me.

You'll spot a fresh twist to the usual FR format in this issue. Since we're all swamped these days, I'm trimming it down to a punchier, bite-sized read - but don't worry, it's still packed with all the usual punch.

As always a big shout-out to our loyal subscribers 🙌 and a warm welcome to the newcomers. We're glad to have you in the FR fold. I’m always trying to grow the FR community, so please forward this issue to a friend or colleague who is a fellow fintech nerd. I’d appreciate it!

Ok, without any further ado, let’s get into last week’s news from the world of fintech.

📣 The News Grab Bag

UK launches £1 billion fintech fund to compete with Silicon Valley: A million dollars isn’t cool. You know what’s cool? A billion dollars. Yep, the UK has gone all Justin Timberlake in the Social Network and created a fintech £1b fintech-focused growth fund. The fund is backed by Mastercard, Barclays, and the London Stock Exchange Group, and aims to invest between £10m to £100m into fintech companies. It aims to back growth-stage financial technology companies until they can go public, in a bid to bolster Britain's global image as a fintech investment hub. The Fintech Growth Fund is gearing up to make its first investment by year's end, and I bet a heap of cash-hungry UK fintech startups are rubbing their hands together in anticipation.

FinTech vertical sluggish as investors worry over economy, KPMG report says: The global economy and fears of a recession are contributing to investors' wariness when it comes to valuing FinTech companies, according to a report from KPMG Canada. The first half of 2023 was one of the weakest for valuations since the outbreak of the COVID-19 pandemic in the first half of 2020, with the VC investment deal count in Canadian tech firms having fallen steadily since Q2 2022. Despite the slowdown, there have still been major Canadian funding rounds this year, with blockchain (lol), AI (#buzzword), and machine learning offering some pockets of activity in the space.

Monzo on top of banking satisfaction rankings: Monzo has topped an official league table of banking satisfaction in the UK with a satisfaction rating of 80%. Monzo, which has eight million customers, scored higher than all its rivals and was praised for its customer-centric approach in the survey. Nicely done, Mozo👏 Starling Bank came in second place, with First Direct in third. The league table, introduced by the Competition and Markets Authority (CMA) six years ago, aims to encourage switching and improve customer service in the banking industry.

Mastercard to purchase a minority stake in MTN’s $5.2B fintech business: Mastercard continues its march across the continent in a recent deal where they’ve agreed to purchase a minority stake in the fintech division of MTN Group. The investment is structured as a commercial partnership to develop payments and remittances throughout Africa using Mastercard’s technical infrastructure. The investment values MTN’s mobile money business at $52b, translating to 16x trailing EBITDA (👀), compared to Airtel Africa’s 10x valuation in a similar deal in 2021, in which Mastercard also participated in.

Buffett-backed Nubank posts record revenue on strong user growth: Nubank continues to buck the challenger bank narrative with another strong earnings result. Last week they reported record revenue for the second quarter. This was attributed to a surge in new customers. Nubank added an eye-watering 4.6m customers in the quarter, reaching 83.7 million globally. This helped total revenue increase by 60% to $1.9b from the previous year. The bank also saw a rise in monthly average revenue per active customer.

Fun fact, according to CEO David Vélez, "…one in every two adults is a Nu customer, and we have become the fourth largest financial institution in [Brazil]… in the number of customers" Wow.

Adyen H1 results wipe €12bn off market value: European payments processor, Adyen, saw a 28% drop in its shares as it reported lower-than-expected revenue growth and defended a costly recruitment drive. The disappointing results wiped more than €12b off its market value. Adyen attributed the lacklustre North American market growth to strong competition from companies like Stripe and PayPal (via Braintree) as a reason for the bad miss.

For those interested, Chamath Palihapitiya tweeted/X’ed his take on Adyen’s H1 results. Tthe tl;dr:

Middlemen business models are eventually forced to compete on price, leading to a race to the bottom. These models typically have two paths: compete for big contracts and play lowball on price or overcharge small customers to make up for losses. Both paths lead to eventual market efficiency catching up with them and forcing them to compete their profits away to keep growing. This can lead to a "value trap" in reverse, where marginal growth rates seem healthy and infinite, but margins are eventually competed away.

My quick rebuttal, Chamath is a directionally correct take but misses some nuance at the edges. Yes, for most businesses, payments are a commodity. But for an increasing number of merchants (at least the savvy ones), things like unifying their checkout across disparate but linked markets — the EU being the prime example — and better acceptance rates are worth the few extra bps they pay. Also, for the most part, Adyen is an incredibly capital-efficient business and arguably momentarily took its eye off the ball as it tried to penetrate a saturated US market. I’d be guessing this ends up being a blimp for the company as the market wraps them across the knuckles for the lapse in judgement. Also, as a side note, people are sleeping on the Braintree as it continues to gobble up market share in the US quietly.

Singapore rolls out new regulatory framework for stablecoins: It continues to be a big month for stablecoins. Last week the Monetary Authority of Singapore (MAS) launched a new regulatory framework for single-currency stablecoins (SCS) issued in Singapore and pegged to the Singapore Dollar (or any G10 currency). The framework requires SCS issuers to fulfil requirements related to value stability, capital, redemption, and disclosure rules. It’ll be interesting to see which country will be next to release regulatory guidance.

Coinbase Finally Wins Approval to List Crypto Futures in U.S.: In other major news from Crypto land, Coinbase received approval from the National Futures Association (NFA) to list crypto futures in the U.S. — nearly two years after applying for approval. This makes Coinbase the first crypto-focused platform in the U.S. to offer regulated and leveraged crypto futures alongside traditional spot trading. The approval allows Coinbase to operate as a Futures Commission Merchant (FCM), enabling them to buy or sell futures contracts. Also, I love that in a tweet announcing the approval, Brian Armstrong threw some subtle shade at other US regulators noting, “When there is a clear path to register, we do.” 👑

📈 Notable Funding Announcements

Last week was another solid week in fintech financing, with 30 funding rounds announced, totalling $429m.

Teamshares Raises $245 Million in Venture Capital to Scale Small Business Employee Ownership: Teamshares is an employee ownership platform for small businesses. It raised $245m in a Series D round led by QED Investors, with participation from an existing all-star investor bench including Inspired Capital, Khosla Ventures, Slow Ventures, Spark Capital, and Union Square Ventures. Interestingly the company buys traditional small businesses from retiring owners to make them 80% employee-owned within 20 years — providing the companies with new leadership, financial education, equity management software, and financial products. This ‘LBO-as-a-service’ concept has proved popular, with Teamshares growing from 4 companies with $10m in revenue in January 2021 to 84 companies with over $400 million as of July 2023.

ClassWallet draws $95M in funding: ClassWallet, a digital wallet-based platform for public funds, has closed a $95m funding round led by Guidepost Growth Equity. The company offers government agencies a quick and compliant fund disbursement product, automating the purchasing and reimbursement process. State government agencies and school districts already use the platform across 32 states for various education and government programs in the US. Another great example of ‘Concur for X’ — in this case, teachers.

Crypto Custodian BitGo Hits $1.75B Valuation After Latest Funding: In this week’s biggest raise, Crypto custodian BitGo pulled in $100m in a Series C financing round, bringing its valuation to $1.75b. According to reports, the funding will be used for strategic acquisitions (hopefully, these go better this time) and to expand the company's custody, wallet, and infrastructure solutions globally. BitGo serves over 1,500 institutional clients in 50 countries and, according to their press release, processes 20% of all on-chain Bitcoin transactions by value. The company has launched institutional-grade staking, DeFi, NFT, and Web3 services. Some notable clients include Nike, Swan Bitcoin, and Mysten. It just goes to show that even in a bear market (and after a failed acquisition), there’s always someone willing to drop a few shekels into a crypto company.

🎧 Resources & Recommendations

Modern Fraud and Compliance Needs with Soups Ranjan: I stumbled upon this podcast recently, and trust me, it's a must-add to your rotation. In this episode, Reggie Young chats with Sardine CEO, Soups Ranjan, and they get into the nitty-gritty of modern fraud detection tools, discuss emerging fraud patterns, talk about SardineX — their real-time fraud data consortium — and share some hard-earned lessons from Soups' time at the helm of risk at Revolut and Coinbase. Grab your headphones, compliance nerds 🤓 – this one's well worth a listen!

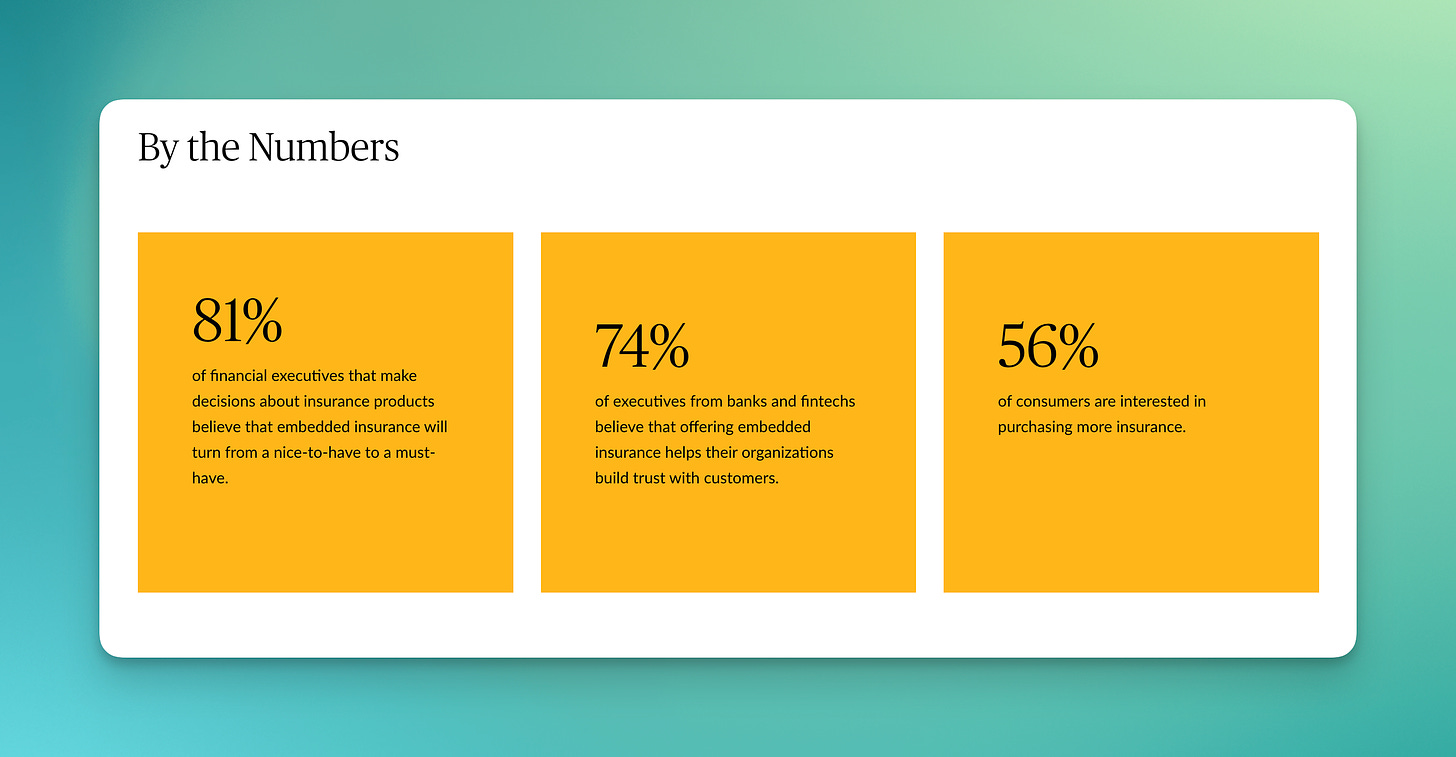

Banks and the Digital Wallet Race: The Embedded Insurance Strategy: Embedded finance is the buzziest of buzzwords in fintech, and it’s continuing to gain traction in the insurance world. This survey by Chubb pulled in views from big banks, fintech founders, and consumers. They found that (surprise, surprise) most see it as a “must have” offering.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect. I'm @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful