Issue #75: Nigeria’s Central Bank Launches AfriGo, Hawk AI Secures The Bag and Is Stripe Going Public?

👋 Hi, FR fam. I hope you’ve all had a great start to the week.

Thanks as always for being a subscriber 🙌 Also, welcome to all the new subscribers— glad to have you here and welcome to the FR fold.

We’re always trying to grow the FR community, so please forward this issue to a friend or colleague. I’d appreciate it!

Also, don’t forget to join the 🆕 FR group chat! Download the Substack app — it’s even available on Android for all you green bubblers — and follow this link to enter the conversation. See you there!

Ok, without any further ado, let’s get into last week’s news from the world of fintech.

📣 The News Grab Bag

American banks club together to take on Apple ⚬Brazil and Argentina are preparing to launch a common currency ⚬ How community banks are fuelling the growth of fintech ⚬ It’s time to comment on the Kenyan fintech sandbox ⚬Atlantic Money dobs on Wise to the CMA ⚬ A huge mistake ⚬Commerzbank sues EY over €200m Wirecard loss ⚬ Here comes Revolut Ultra ⚬German cartel office initiates proceedings against PayPal ⚬ Amazon NFT initiative is coming soon. ⚬

📈 Notable Funding Announcements

It was another solid week in fintech financing, with 52 funding rounds announced, totalling $518m.

⤷ Hawk AI scoops $17 million in Series B financing

Last week, Hawk AI, a German fintech startup that develops AML and fraud prevention tech for financial institutions, announced a $17m Series B round of funding. The company offers various products such as payment screening, customer screening, transaction monitoring, transaction fraud, and customer risk rating. The round was led by Sands Capital, with participation from DN Capital, Coalition, BlackFin Capital Partners, and Picus Capital.

🤓 My Take: Regardless of the jurisdiction in which you do business, as a consumer fintech business, you’re faced with a battery of regulatory requirements that only seem to grow each year. Fun fact, when the Dodd-Frank Act was introduced, it added more than 20,000 federal restrictions on banking and insurance securities in the US.

Moreover, the diversity of government agencies policing the sector is diverse, and the breadth of areas they cover is vast — everything from consumer protection and money laundering to international sanctions. The scariest part is that getting it wrong can have significant financial implications, as we recently saw with Coinbase reaching a $100m settlement with the NYSDFS for violating anti-money laundering laws. It’s no surprise that compliance teams are generally the largest in most consumer-facing startups.

Beyond throwing bodies at the problem, most startups run a host of software solutions to monitor activity on their platform. The vast number of products frontline compliance analysts have to use in their daily work is astonishing. It’s not uncommon for them to be bouncing between multiple pieces of software and screen as they hunt for information in databases across different products — think Tom Cruise in Minority Report. It’s a workflow challenge that every fintech startup faces, and few manage it well.

As a result, more vendors are trying to unify the compliance stack and build a command centre that taps all the sources an analyst might need to run a check. Along with this, bundling — a classic revenue expansion strategy of incumbents in this segment — has become the norm among startups offering compliance solutions. The days of being a point solution are rapidly coming to an end, with many customers realising that thoughtful packaging of solutions and workflows can be a massive time saver for frontline compliance teams.

I anticipate we’ll continue to see more products in this segment that focus on improving customer workflows and bundling more offerings to streamline the compliance function.

⤷ Method raises a $16M Series A

Last week, Method announced a $16m Series A funding round led by Andreessen Horowitz. The startup offers an API to developers to make it easier to embed repayment, balance transfers, and bill pay automation into their fintech apps. The round also had participation from Truist Ventures, Y Combinator, Abstract Ventures, and SV Angel.

🤓 My Take: Ok, time for a bit of a rant. I currently have a post that is in draft with the working title, “Get over it, you’re an integration company”. The gist of the article is that every consumer fintech startup is basically an integrations business with a brand — the punch line being that you better be damn good at those two things if you want to succeed.

The “as-a-servicification” of financial infrastructure has meant that it’s never been easier to stand up complex financial products by jigsawing together a range of providers and connecting them to your front end. It’s been a boon to the sector and has meant that we now have neobanks for pet owners and EV lovers. Also, it’s reduced the technical magic of building a financial services product to having a team of exceptional integrations engineers.

I know I’m radically oversimplifying things here. However, it’s closer to the truth than you might think. If software is eating the world, APIs are eating financial services.

That’s all fine and dandy, but it’s also resulted in some interesting second-order effects.

Building a stack that is solely a collection of financial lego blocks means development is sped up. Not needing to build balance transfer functionality means you can concentrate on… well, other more important things like influencer campaigns.

Interestingly, this has resulted in consumer fintech startups with incredibly similar cost structures. If you look at a particular fintech segment in a market, the chances are that nearly all the players are using the same financial tech stack — the same pay-in and pay-out provider, the same KYC solution, the same card provider and all with similar (if not the same) pricing. In fact, the pendulum has swung so far the other way that it’s now a contrarian take to build your own tech at a fintech startup. Why build when you can buy?

The challenge is that with an undifferentiated cost structure, you cannot push the boundaries on the pricing side. Effectively, meaning that your economics are dictated to you by your vendors. Speed is one hell of a drug in startup land, but the cost in consumer fintech is that you’re potentially stuck with a high cost to serve and few options to bend the cost curve in your favour.

There’s a balance to be struck between being too “close to the metal” (also likely meaning you’ll trigger new licensing requirements — which is a significant challenge that can’t be understated) and being nothing more than an integration shop. One company that seems to toe this line incredibly well is Wise.

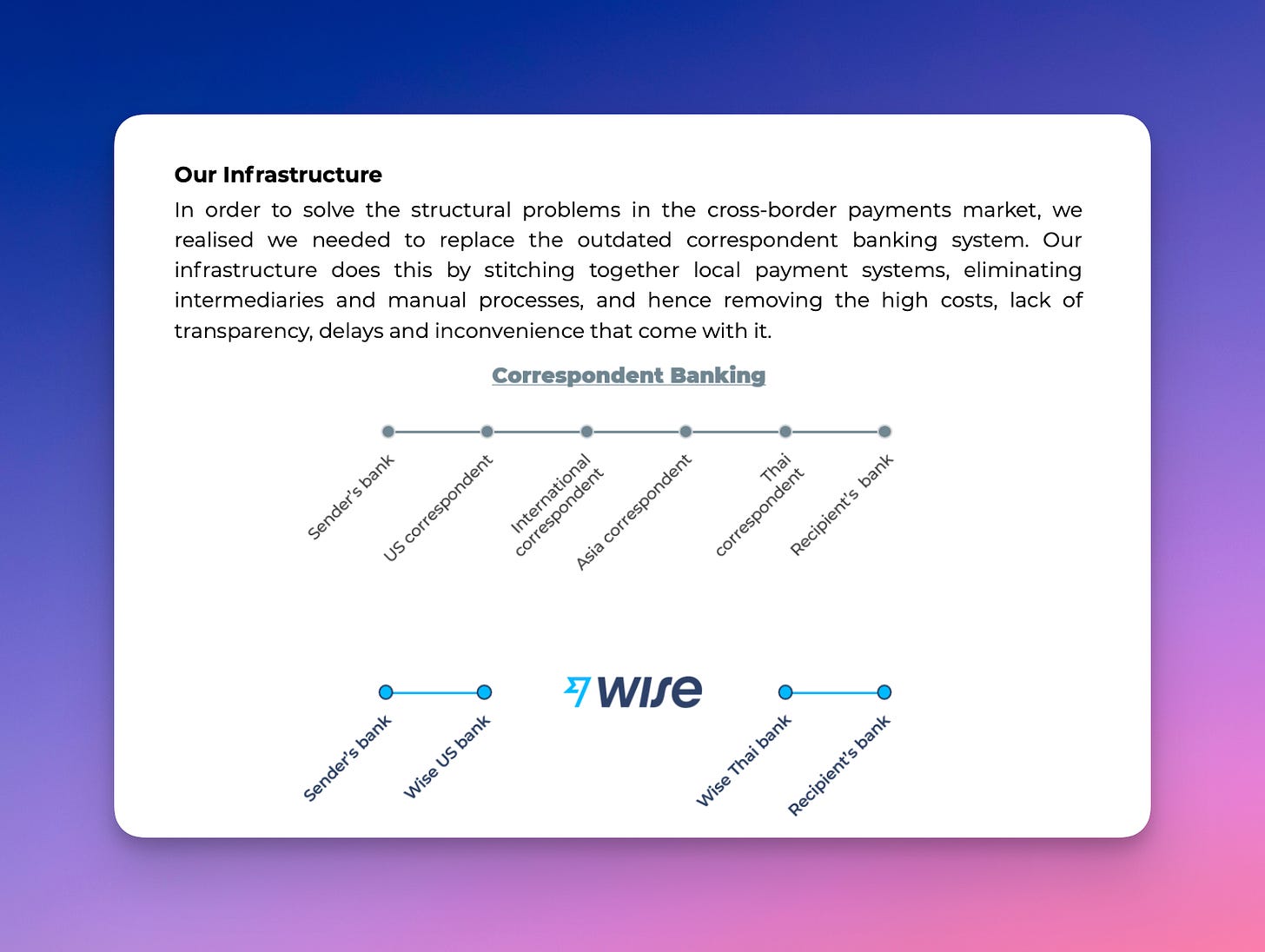

Wise’s focus on getting close to the metal and building the most critical parts of the money movement supply chain means they can offer highly competitive pricing on money movement across the corridors they cover. The ‘laddering’ approach they take when entering a market — starting off by using local aggregators and then moving to their own local stack — is something many consumer fintech have on their roadmap, but few ever get there. Moreover, they’ve also been able to spin their technology out (which is super rare in the context of consumer products) and turn it into a standalone offering à la Amazon AWS — thus moving it from a pure cost centre to a revenue generator.

Given the cost pressures that many fintech startups are facing in the current market, it’ll be interesting to see whether some will innovate on the technology side of things this year and thus radically reduce their cost to serve.

☝️ Things You Should Know About

⤷ Nigeria’s central bank launches AfriGo, a national domestic card scheme

Last week, the Central Bank of Nigeria (CBN) and the Nigeria Inter-Bank Settlement System (NIBSS) unveiled a new national card scheme called AfriGO. The article notes that:

The card, which will function like other international payment cards, is aimed at boosting financial inclusion in the country and reducing dependence on foreign cards.

Regional card schemes are a fascinating niche in card land that is under discussed. Although the duopoly of Visa and Mastercard dominates the world of card networks, many countries have their own, often state-sponsored, card schemes. For example, Russia has Mir, which operated as an escape valve for payments in the country last year when both Visa and Mastercard exited the country.

In the case of Nigeria, the scheme could radically improve both debit and credit card penetration. As the article mentioned:

This ranks Nigeria as the 75th in the world in debit card to population ratio and 114th in the world in credit card to population ratio.

Also, it’ll be interesting to see how startups and incumbents alike take advantage of this new payment rail in the ever-growing Nigerian fintech market.

⤷ Stripe Sets One-Year Timetable to Decide on Going Public

According to reports, Stripe is looking to go public in 2023. The post also notes that they’ve engaged Goldman Sachs and JP Morgan to help determine the next steps on their journey to becoming a public company 🤑

Stripe has long been the IT fintech startup. However, the last twelve months have seemingly been a little rockier for the vaunted YC startup. Layoffs and cuts in valuation have signalled that even the money-printing machine that is Stripe was not immune to the macroeconomic headwinds.

It’ll be interesting to see whether Stripe pulls the trigger and goes public in 2023 and what this means for the other fintech startups waiting in the wings, ready to ring the NYSE opening bell.

🎧 Podcast Recommendations

Here are this week’s podcast recommendations. Enjoy👂

⤷ Being the steady hand in market uncertainty with Sebastian Siemiatkowski from Klarna: In the carnage that was last year’s fintech down rounds, Klarna was one company that coped a walloping on the valuation front. In this podcast, Klarna’s founder, Sebastian Siemiatkowski, talks about the highs and lows of the company’s journey so far.

☝️One tidbit worth listening out for in this pod is the story of how Sebastian tried to hardball his way to an acquisition of Adyen — let’s just say the approach he took didn’t work out.

⤷ Lee Taylor, OnlyFans: OnlyFans, the leader in simp tech, has to be one of the most interesting stories in the world of payments. I’ve previously written about their payments business model and the wild amounts of revenue the business throws off (projected to be around $2.2b in 2022). In this pod, their CFO talks about some of the challenges of running a business that is always at risk of being debunked, how they’ve improved their relationship with financial institutions and also content moderation policies (which is fascinating). Overall a super interesting pod that’s well worth adding to your playlist.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful

The classic manufacturing of financial products vs distribution of financial products dilemma! Both have their pros and cons; ensuring long-term defensibility requires an assessment of where you sit on that spectrum!