Issue #72: Coinbase hit with a fine, KreditBee secures the bag, and Wyre is reportedly shutting up shop

👋 Hi, FR fam. I hope you’ve all had a great start to the week.

Thanks as always for being a subscriber 🙌 Also, welcome to all the new subscribers— glad to have you here and welcome to the FR fold.

We’re always trying to grow the FR community, so please forward this issue to a friend or colleague. I’d appreciate it!

Ok, without any further ado, let’s get into this week’s news from the world of fintech.

📣 The News Grab Bag

Fintech stocks did worse than fin or tech in 2022 ⚬ Humm scales back its ambitions in the UK ⚬ Robbers give up on Danish banks ⚬ It looks like my prediction regarding AI in fintech is already coming to fruition ⚬ This battle rages inside every consumer-facing fintech start-up too 🤭 ⚬ Mastercard launches a new accelerator, and it’s not what you might expect ⚬ Fintechs call for clarity over open banking reforms ⚬ Bye, Jack ⚬ SBF wants to keep his Robinhood shares, lol ⚬ RIP Diem ⚬

📈 Notable Funding Announcements

As you might expect, it was a slightly slower week for funding announcements in fintech land. In total, 11 funding rounds were announced, totalling $198m.

KreditBee, an Indian-based digital lender, last week announced a $100m funding round. The additional funds are part of a larger series D round announced in early December. According to reports, this values the company at close to $700m. Advent International led the latest tranche of funding.

🤓 My Take: This year will be interesting for many digital consumer lenders. The headwinds of a deep economic downturn combined with a rising level of inflation could mean we continue to see consumer debt levels rise. The question will be how sustainable these levels are, especially if we see an even sharper economic pullback through the year's second half.

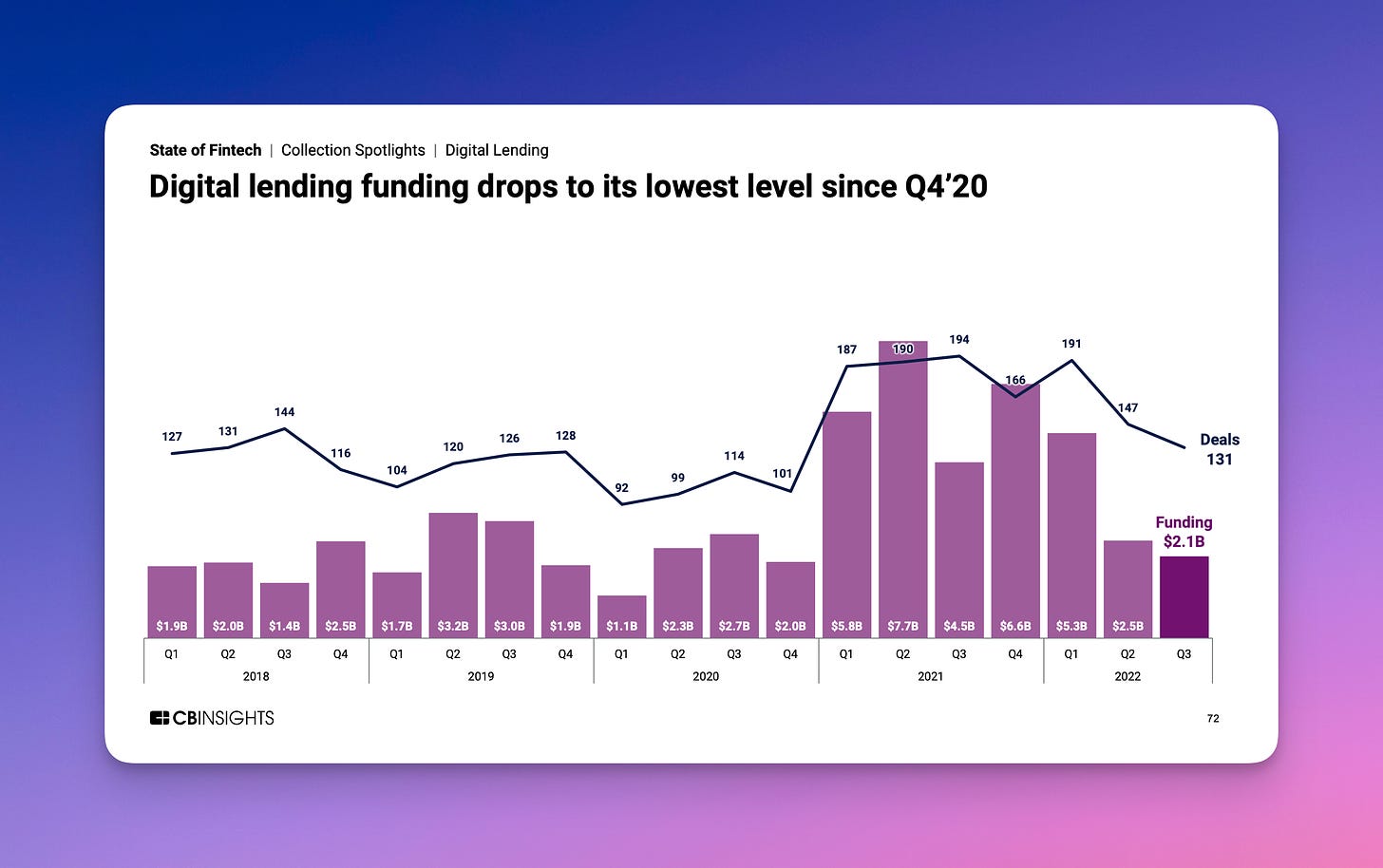

From a funding perspective, the heat of the 2021 market cooled off in Q3 of 2022 for those trying to secure the bag in the digital lending space. I’m sure most investors are concerned about the above-mentioned macro headwinds, but more generally, we’ve seen the digital lending space lose its lustre with investors. The view is this is one of the fintech segments that has played out, and the lesson being that it’s proven hard to build a sizeable business in the space — this is more so the case now that BNPL has lost its halo in public markets.

Many have tried their hand at building consumer lending businesses. For a while, there was a view that ‘Super Apps’ (née neobanks) could make the economics work. After all, they already had engaged users clamouring for a better way to lend — or so the hypothesis went.

If you’ve worked on a consumer lending product, you’ll know how hard it is to build a product in this segment. It’s one where you’re fighting fires on every imaginable front. Whether it’s trying to bend the cost curve on your cost of capital, figuring out how to acquire customers at a reasonable CAC or endlessly tuning your underwriting engine — it’s a segment that requires a lot of capital, patience and executional excellence. And it’s for these reasons that, in practice, neobanks have struggled to build sizable lending books. The hypothesis of cross-selling lending products in super app style propositions has also not turned out to be valid.

Despite this, we continue to see a steady uptick in early-stage consumer lenders being funded in growth regions like the Subcontinent, Africa and South East Asia, with a number looking to go multi-product from the get-go. It’ll be interesting to see if the market dynamics in these regions mean that this traditionally challenging segment pans out differently from what we’ve seen play out in more mature fintech markets.

⤷ Dutch insurtech Alicia raises €7m

Last week, Dutch freelancer-focused embedded insurance provider, Alicia, announced they’d closed a €7m seed round. The round had participation from Volta Ventures, Randstad Innovation Fund, and Achmea Innovation Fund.

🤓 My Take: As noted in my 2023 predictions, I think this year will be a breakout one for embedded finance. Having said this, how it plays out will differ from what many might expect.

The current wave of embedded finance kicked off with non-financial companies focused on reducing friction around payments (while picking up some additional revenue for facilitating these transactions 😉). The canonical examples being companies like Shopify layering payments on top of their SaaS offering or MindBody offering yoga studios the ability to take payments directly in their scheduling software. Moreover, these offerings seemingly had a positive impact on those businesses brave enough to venture into embedded finance. According to Plaid:

88% of companies that implement embedded finance report increased engagement, and 85% say that it helps them acquire new customers.

The aperture around offerings has continued to expand, with providers like Cover Genius serving up the infrastructure for brands to offer insurance at checkout and Deserve providing the ability for companies to offer co-branded cards, this is to name but two of the now hundreds of embedded finance providers out there.

So what’s coming down the pike this year? I think we’ll see more targeted player emerging (like Alicia) and a new wave of embedded offerings that are even more subtle — but will help brands deepen their relationship with their customers and provide more ways to monetise that relationship. These will go beyond just getting people to sign up for another card and will be even more focused on reducing friction during the customer journey. For example, I think we’ll see more proactive offers being served on the back of data generated during the customer journey — and they’ll be ones actually aligned with a customer’s needs.

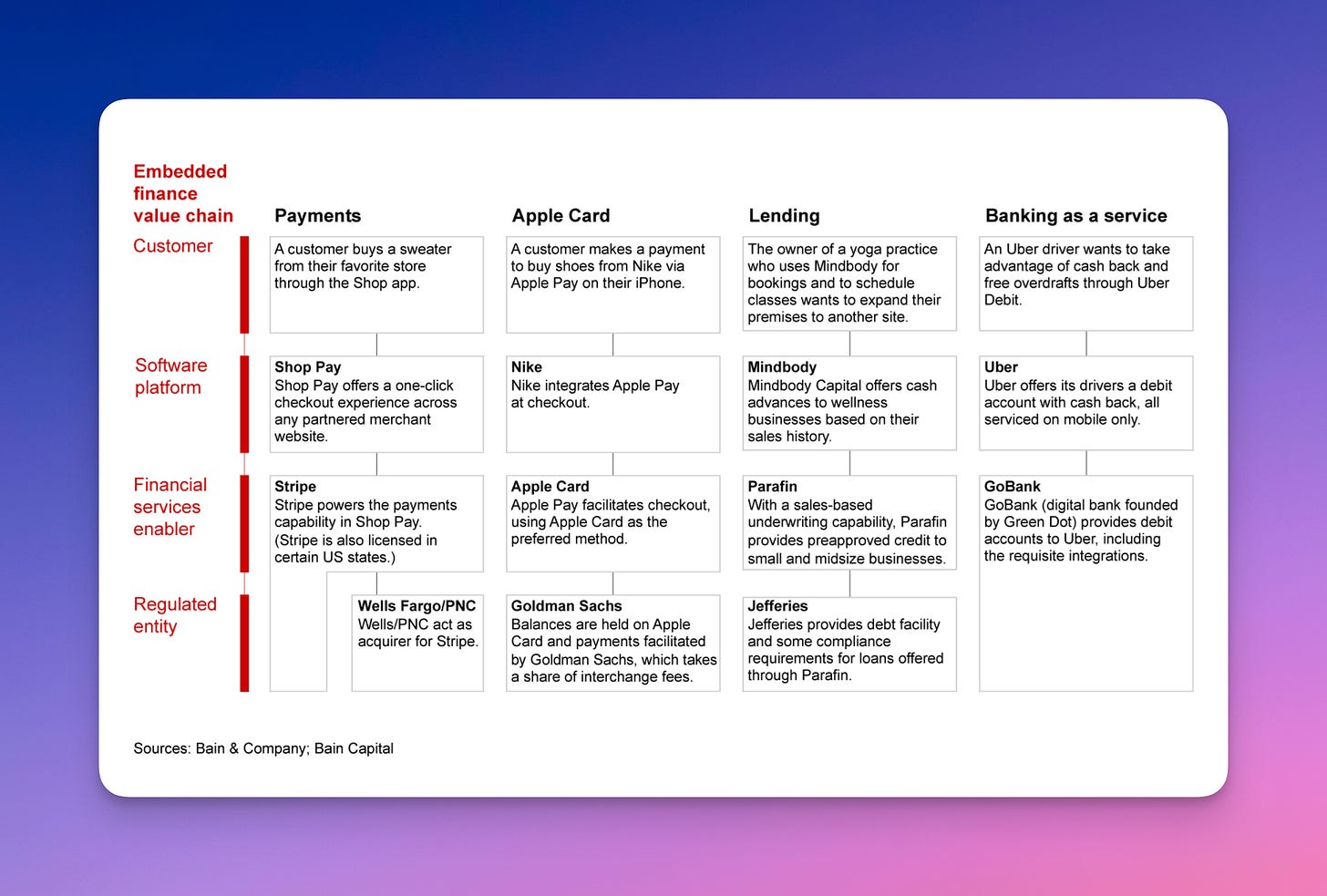

On a related topic, one of the questions I’ve recently been thinking through when it comes to embedded finance is the role incumbents play. In some formulations of embedded finance, incumbents play a central role. Take, for example, this one from Bain & Company.

I’m not sure that incumbents are ultimately the foundation of every offering, after all, we are seeing more and more players look to go “full stack”. Having said this, it reminds me of a tweet by Benedict Evans on the battle of “software v supply chains”.

In many ways, financial services is a supply chain problem that is as complex as moving atoms in meatspace. Still, embedded finance is a more curious beast as it really goes to the heart of what incumbents believe their true competitive advantage is — orchestrating the financial supply chain. Curiously, few have been able to move up the stack (yes, I know slow incumbents who can’t innovate etc.). It’ll be interesting to see if we see one or two break the shackles this year and finally do something meaningful further up the stack (where there’s a ton of value to extract). My guess is that we’ll see them continue to flounder, and none will execute in a meaningful way — even though they have the strategic advantage in this segment.

☝️ Things You Should Know About

⤷ Wyre “…still operating but will be scaling back to plan our next steps.”

According to reports surfacing last week, crypto payments company Wyre looks to be shutting up shop. In an Axios article reporting on the news, it was noted that CEO Ioannis Giannaros sent an email to employees saying:

We'll continue to do everything we can, but I want everyone to brace themselves for the fact that we will need to unwind the business over the next couple of weeks

In the same article, Axios noted that Giannaros told them, “We’re still operating but will be scaling back to plan our next steps." So there’s clearly more news to come from Wyre in the coming weeks that’ll explain the sudden closure.

In many ways, it’s a stunning turn of fortunes for a company that was set to be acquired by Bolt earlier this year and had become a crypto industry favourite for fiat-to-crypto on and off-ramp offerings.

I think the thing that many will be surprised by here is that their core payments business seemingly made sense — which is rare in the world of crypto. Although it’s unclear what exactly happened, it’s clear the crypto market has hit an iceberg and that even business models that seemingly made sense from the outside are not safe.

Crypto winter is getting chilly, and unfortunately, I think this won’t be the last casualty in the crypto payments space.

⤷ New York regulator hits Coinbase with $50m fine

Yes, it’s another crypto-related piece of news. Apologies to those who’ve developed a crypto allergy during the bear market.

Although this was a case related to subpar KYC, transaction monitoring system, suspicious activity reporting, and sanctions compliance, I think regulatory actions will be a significant part of the fintech landscape in 2023 — and it’ll go beyond crypto as regulators overrotate on compliance obligations for all startups that touch customer funds. Moreover, I think we’ll see this play out in several jurisdictions. Buckle up for an interesting year in the world of regulatory actions.

🎧 Podcast Recommendations

Here are this week’s podcast recommendations. Enjoy👂

⤷ Two CEOs are better than one with Henrique Dubugras from Brex: It’s been an interesting year for fintech unicorn Brex. After showing SMB customers the door earlier in the year and repositioning the business to focus on their core demo of high-growth start-ups, they also had (like many other fintech start-ups) a big round of layoffs.

In this podcast, co-CEO Henrique Dubugras talks openly about both and provides insight into the tough decisions Brex had to make this year. Well worth a list.

Ps: listen out for the Concur potshots during the pod. I have to admit they made me laugh, as I’ve certainly had the same experience with the product 🤭

⤷ Principles of Financial Regulation with Lawrence H. Summers of Harvard University: This is a short one, but well worth a listen to hear Larry Summer’s views on regulatory principles in financial services. He’s on point, as always.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful