Issue #66: Toast Is Listing, Khatabook Secures The Bag, And Amazon Partners With Affirm To Offer BNPL

👋 Hi, FR fam. I hope you’ve all had a great start to the week.

Thanks as always for being a subscriber 🙌 Also, welcome to all the new subscribers — glad to have you here and welcome to the FR fold.

If you like what I’m up to here at FR, please forward it to a friend or colleague. I’d really appreciate it.

Ok, without any further ado, let’s get into this week’s news from the world of fintech.

📣 The News Grab Bag

Mastercard swipes left on magnetic stripes ⚬ US Bank is dropping some dollars into VC ⚬ Israel’s fintech ecosystem is growing ⚬ Visa apes in and buys a jpeg for $150k ⚬ Bank North nabs a UK banking licence ⚬ Brazil’s central bank eyes regulation for digital currencies ⚬ Google Pay to let users open fixed deposits on its platform ⚬ Afterpay introduces an ad platform ⚬ OnlyFans says it will no longer ban porn in a stunning U-turn after user backlash ⚬ Nick Molnar: the next generation is powering the fintech disruption

📈 Notable Funding Announcements

Yep, we’re back. It was another big week of funding announcements in the world of fintech. In total, 50 funding rounds were announced, totalling $2b.

🧾 Khatabook Raises A $100m Series C ⇢

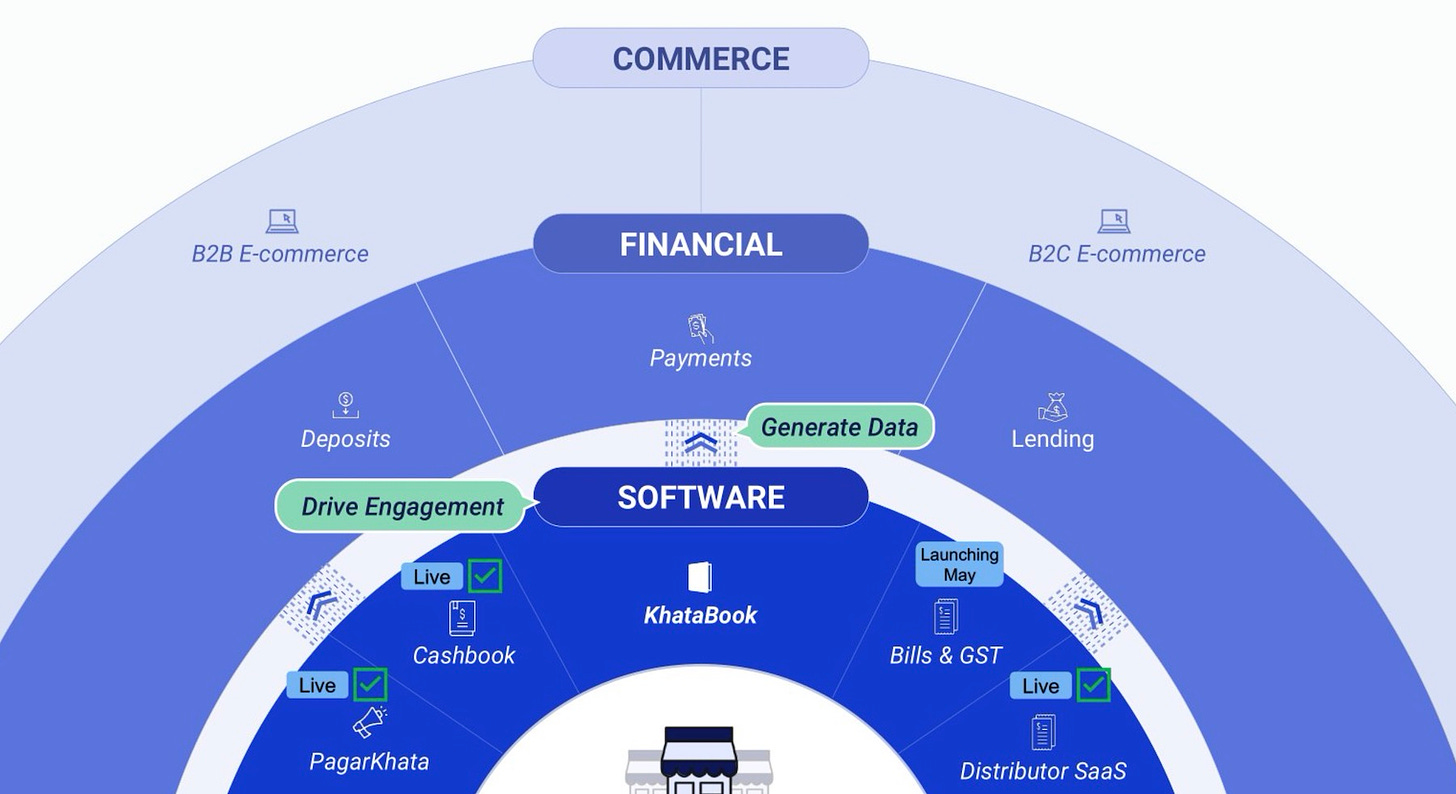

This week Indian digital bookkeeping and payments company, Khatabook announced they’d closed a $100m Series C round led by Tribe Capital and Moore Strategic Ventures. This latest round brings the two-and-a-half-year-old Bangalore-headquartered startup’s valuation to ~$600 million.

🤓 My Take: Whether you’re in Bangalore or Boston, the heart of commerce in every city is SMEs. In many parts of the subcontinent, small merchants are still offline operations that have been slowly coming online, with COVID19 being another tailwind that has seen a dramatic uptick in the number of SMEs building some form of digital presence.

As we’ve seen in other parts of the world, fintech startups that build digital tools for business owners can be incredibly impactful and turn out to be great businesses — with Square being the canonical example of what things look like when it works out. In the case of Khatabook, they’ve started by offering software for merchants to run their business in a more streamlined and digitally native way, providing them with tools that move their businesses from being run with pen and paper to being run digitally.

In the world of fintech, this classic strategy of “come for the tools and stay for the payment processing” works really well and is one that fintech investors can grock. More specifically, providing merchants with the tools they need to run their business and monetising through payments, then laddering up to lending and eventually deposits on accounts is the virtuous cycle investors love betting on.

If you’ve been an FR reader for a while, you know that one of the big themes I write about is the rise of fintech everywhere (not just in the US and UK). Khatabook is a great example of what a playbook in high growth regions of the world looks like. By cleverly building a set of sticky tools that users live in daily and then monetising through payments (and eventually lending), they’re showing that although the solution might look different in other regions, the mechanics of building an acquiring side business are fairly universal — and with over 10m monthly active users, it’s clearly a playbook that is working for Khatabook.

🤑. Ramp Raises a $300m Series C Funding Round ⇢

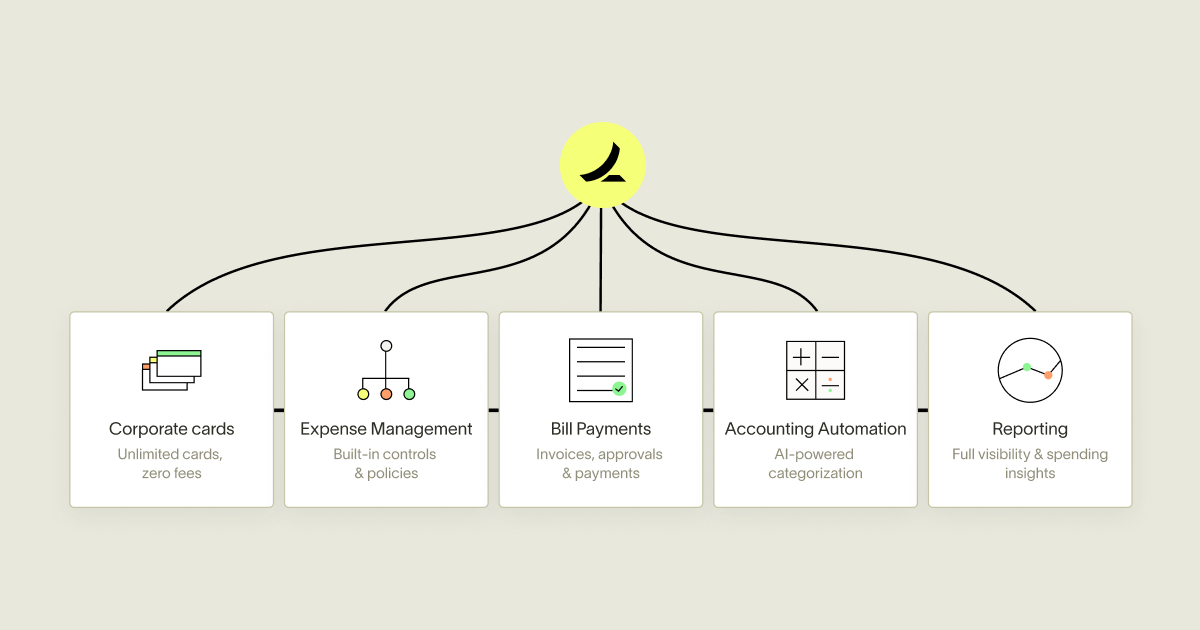

Last week corporate card focused fintech startup Ramp announced they’d closed a $300m Series C round of funding, which values the company at $3.9b. Founders Fund led this latest round of funding.

🤓 My Take: In previous issues of FR, I’ve written about the opportunity that exists in the world of SME banking. In fact, I still believe it’s one of the best places to be building a fintech in 2021. I’m obviously not the only person who thinks this, with companies being founded and pumped with the capital required to really shake the segment up.

Having said this, the SME charge card space is getting really crowded. Those who realise this are rapidly moving up the stack to figure out how they upsell more lending based products to SMEs.1 This totally makes sense — after all, lending is where the money is at. Right? Undoubtedly, having a lending product to augment the primary offering of a charge card (whose excellent economics are sometimes underrated) is important, but what makes Ramp so interesting is its positioning around automation of business processes and a focus on saving money for its customers.

As they note in the press release announcing the raise:

…a complete solution is a finance automation platform that does three things in tandem for you: eliminate busywork, identify savings opportunities, and actively secure those savings for you. This last piece is critical—most companies don’t go far enough to help businesses actually realize savings.

In a market where most players are still trying to lure customers across with points and funky card designs, it’s interesting to see Ramp focused on automating all the disparate systems across a business. Which, in the long run, is where I think the big business in SME banking will be built. More specifically, it’ll be the company (or maybe companies?) that work out how to be the Zapier for money movement and reporting for SMEs that’ll win this segment.

As awesome as this sounds, it’ll be interesting to see how companies like Ramp navigate the growing number of other financial tools a business uses — importantly, their accounting/financial advisors preferred ‘stack’. One thing that goes massively under-discussed in the financial operations space is that most of the decisions a company makes, especially early on, are dictated by their accountant. In fact, what you tend to find is that there is a delicate balance between being a value-added tool for a company and an annoying new tool that the accountant who holds the financial keys to the company has to interface with. It’s a fine line, and it’ll be interesting to see if Ramp can continue to walk it.

☝️ Things You Should Know About

🍞 Toast Is Listing ⇢

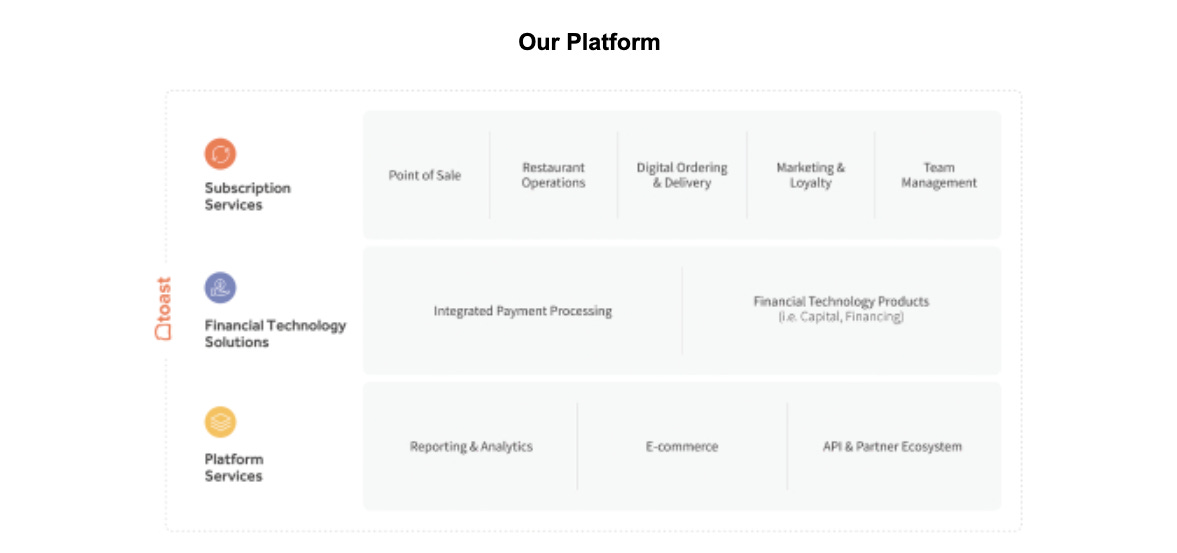

Embedded fintech example de jour, Toast, last week filed to go public via an IPO that could value the point-of-sale (PoS) company at close to $20b.

Toast, the restaurant focused PoS player, has long been an example of embedded finance in the wild. Much like Squire for barbershops, and Shopmonkey for car repair business, Toast is an example of how most B2B SaaS companies will monetise in the future — through financial services.2 The pattern for companies transforming from SaaS companies to fintech companies is that they start by reselling financial services and then eventually embed products that go well beyond payments — this could be everything from loans to insurance.

In the case of Toast, looking at their P&L, it’s clear that this transition is well and truly in full swing. In fact, most of their revenue is derived from payment processing and other financial products (i.e. capital and financing products). According to their filing, around 80% of their revenue for the first half of this year comes from “financial technology solutions”.

Toast is a fascinating company and one of many navigating the path from SaaS company to fully-fledged fintech will be watching closely as it goes public. It’ll be interesting to see if the public markets take to Toast’s proposition.

💵 BNPL Earnings Results ⇢

Last week, Aussie BNPL heavy hitters, Afterpay and Zip, both announced their full-year results. At the same time, Klarna announced its Q2 results for 2021. On all three fronts, numbers were weaker than most expected.

In Klarna’s case, operating losses increased in Q2 2021 from $10M to $111M as the Swedish BNPL player continued to scale ahead of a potential IPO. More interestingly, credit losses more than double in Q2 for Klarna. While both Zip and Afterpay also reported larger losses, they continue to expand their respective footprints with relatively light credit losses.

Afterpay reported a $156.3m net loss which was 689% worse than its $19.8m loss for the last financial year. On the upside, they grew both customer and merchant numbers substantially — 63% for customers and 77% for merchants. While Zip also grew its top-line numbers substantially with revenue up 150% YoY to $403.2m, it also sustained some heavy losses compared to the prior year — up 3,159% compared to last year.

It’s clear a land grab is on and all the BNPL players are spending big to acquire customers. In part, they’re hoping that Gen Z will be what the Baby Boomers were to the credit card industry 40 years ago. It’s a bold bet but one definitely worth making.

🛒 Amazon Partners With Affirm To Offer BNPL ⇢

Speaking of BNPL, late last week, Amazon and Affirm announced they’d partnered up to provide Amazon customers with the ability to split their purchases (over $50) into monthly payments using Affirm.

Many have wondered when Amazon would go all-in on BNPL, and it seems that they’re testing the waters out with Affirm. One view could be that Amazon has paired back its aspiration in the world of fintech and decided to outsource/partner with a company that, in this case, lives and breaths BNPL. Having said this, I think the better view is that Amazon is likely just dipping its toe in the water before diving in with its own BNPL offering. As a side note, it’d be cool if they called it Amazon Now, Pay Later (ANPL) 😆

🎧 Podcast Recommendations

Here are this week’s podcast recommendations. Enjoy👂

Insights: Is Buy Now Pay Later The Future Of Credit? ⇢ Continuing the BNPL theme, here is another great pod from the team over at 11FS on what’s happening in this super hot segment.

Why The Launch of Brex Cash Nearly Cost The Company Everything ⇢ Brex is running hot, but it hasn’t been smooth sailing. In this podcast, Brex founder Henrique Dubugras speaks candidly about the challenges when trying to launch its second product, Brex Cash. Well worth a listen.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful

Take, for example, Brex’s announcement this week that they’re jumping into venture debt (i.e. revenue-based lending).

As Matt Harris of Bain Captial refers to it, “the fourth platform”.