Issue #52: Current Hits A $2.2b Valuation, Crypto M&A And Solving T+2

👋 Hi, FR fam. I hope you’ve all had an awesome week!

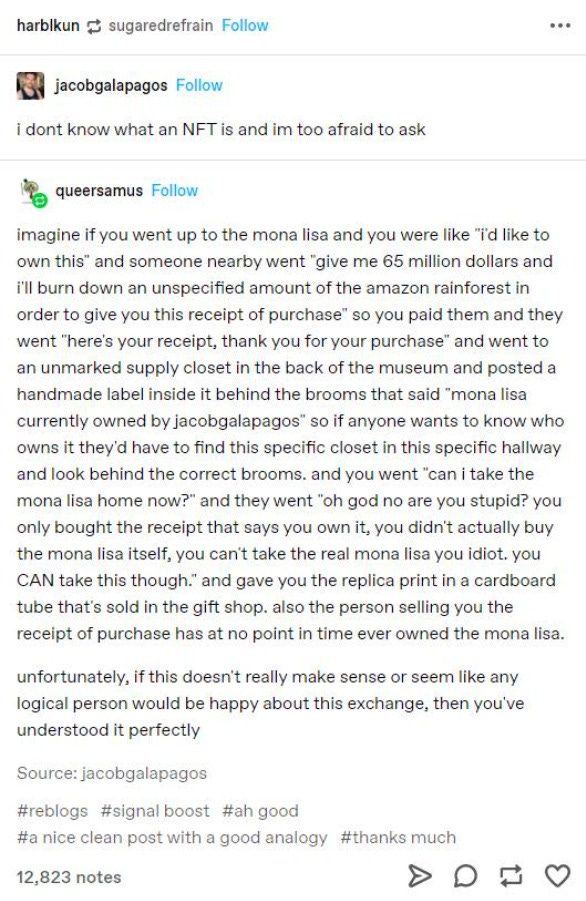

Alright, let’s get things going this week with the perfect explanation of what an NFT is.

📣 The News Grab Bag

Afterpay goes up the stack ◌ Stripe acquires TaxJar ◌ GoCardless jumps into the world of open banking ◌ Need to buy an NFT with your inheritance money today? There’s a lender for that ◌ Barclays partners with Amount to expands PoS financing options to include BNPL ◌ Another Marcus exec flees ◌ Paypal’s uphill battle in China ◌ China’s tech clampdown intensifies ◌

📈 Notable Funding Announcements

🏦 Current Raises $220m In Series D Funding →

Last week challenger bank Current announced that they’d raised a $220m Series D round of funding, valuing the company at $2.2b. Andreessen Horowitz led the round, which had participation from existing investors Tiger Global Management, TQ Ventures, Avenir, Sapphire Ventures, Foundation Capital, Wellington Management and EXPA.

🤓 My Take: I’ve been a fan of what Stuart Sopp and the team over at Current have been building for a while. Back in October last year, I actually had a chance to interview Stuart for a piece I’d wanted to write about the challenger bank. As I noted in the title of that piece, I think Current really is “doing it differently.”

From afar, Current looks and feels like any other challenger bank. They’ve got a shiny debit card, a slick app and lots of influencers shouting their praises on all the right social media channels. So it’s fair to ask, what’s so different about Current?

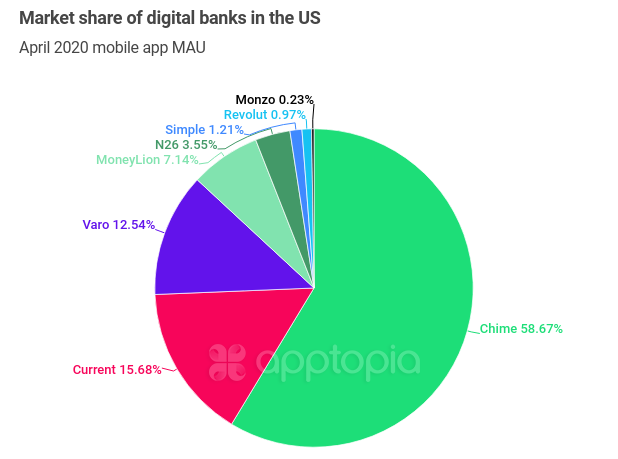

In the same way, Cash App really found its people, Current has figured out that the challenger banking model doesn’t work all that well when it’s built and marketed to just the one-percenters of SF and NYC.

Those who’ve been able to get some degree of escape velocity in the US challenger banking segment have figured out that the demand for basic banking services really is coming from those who the modern financial system has left behind. The 1% don’t need another card (even if it’s metal), yet the bottom 20% are calling out for the ability to have a bank account. The ability to have wages (not to mention stimmy cheques) deposited into an account and thus avoiding the exurbanite fees associated with cheque cashing is a real feature that many who have been left behind by incumbents FSIs need.

It also turns out that this segment has many other financial services needs that they’ve traditionally been locked out of. The segments and markets that many FSIs have traditionally stayed clear of (or have served poorly) are the ones that are forming the core customer base of the Chimes and Currents of the world.

Also worth noting, as it goes chronically under-discussed, is the approach Current has taken in building out their infrastructure. As is well-documented, Current has elected to build vs. to buy their core banking infrastructure. This has resulted in Current being able to bring the cost of opening a bank account down to a staggeringly low $0.15 per account.

In the world of challenger banking, a lot of time is spent talking about CAC and LTV. Yet, little time is spent in popular discourse talking about the cost structure many challenger banks have ended up with (yes, it usually is a case of “ended up with” as they cobble together vendor after vendor when they add new features). In fact, I think there’s almost a SaaS business that should be built that monitors a fintech’s vendor list and advises them on how to consolidate that list down — or at the very least sends a passive-aggressive Slack message to the PM who’s added yet another vendor to the integration list.

I’m a fan of Current, and I think they’ve gone under the radar in fintech thinkboi discussions. I’m sure that won’t be the case going forward now that they have the Andreessen Horowitz badge of approval. So now the bigger question for Current is ‘what next?’

🌏 Deel Raises $156M Round Of Funding →

Deel last week announced they’d closed a $156m round of funding, which values the startup at $1.25b and makes them the latest addition to the fintech unicorn club. The round was led by YC Continuity Fund and existing investors Andreessen Horowitz and Spark Capital.

🤓 My Take: I know this round was announced a while ago now, but I thought I’d throw it into the mix this week as Deel is a prime example of how I think we’ll see challenger banks wedge their way into the market from now on. Let me explain.

For some context, let’s quickly talk about what Deel actually does. On the face of it, Deel is a tech-enabled employer of record (EOR). In other words, they’re a third-party organisation that hires and pays a company’s employees on their behalf — all while ensuring they're compliant from an employment and tax law perspective. As you can imagine, in a world where knowledge work has basically gone fully remote and global in the space of a year, they’ve seen some seriously growing demand for their services. More specifically, according to the TechCrunch article, Deel says they’ve seen a “20x” increase in revenue in 2020.

As you can probably guess, the tough parts in setting up a global EOR is going market to market, understanding the local laws, setting up a presence and running a very localised compliance program to ensure you’re meeting regulatory requirements in the market. Beyond this, if you’re handling the actual payment of wages in a market, you’ll also need to figure out disbursement methods in each country you operate in. To anyone who’s done global expansion for a fintech startup, this probably all sounds very familiar.

Now, you’ve probably guessed where I’m going with this. But let me take this in a slightly different direction for a second.

Deel is what I refer to as an “x disguised as y” company. To date, the mode of competition we’ve seen in the fintech industry is generally “head-on.” More specifically, we’ve tended to see companies come into a market with essentially a digitised version of what an incumbent has traditionally offered and just done it cheaper/better/more conveniently (or maybe even all of those) — whether it’s challenger banks or online lenders they’ve basically tried to compete directly with the legacy players.

However, we’re now starting to see fintech startups come at the competition (and the customer wallet) from an orthogonal direction. Great examples of this are the likes Afterpay and Klarna.

The majority of banks have been concerned about BNPL companies eating away at their credit card business. However, this has ended up being the least of their concerns as most BNPL players are now thinking well beyond this and are trying to abstract away the whole banking relationship by offering bank accounts alongside their core BNPL offering. In many ways, BNPL companies are challenger banks disguised as microlenders.

In the case of Deel, one could easily see them moving into the SME banking segment — but at a global scale. They have a primary relationship with the treasury function in an organisation, they have a compliance culture, not to mention they’ve done a fair amount of the heavy lifting on the compliance front in every market (yes, there is more work to be done there), and they’ve solved the disbursement problem in each market they operate in — which likely means they have a local banking relationship too. Further, when you add a ton of capital to the mix (and I’m sure the ability to raise more), a company like Deel could end up being the SME challenger bank that most incumbents missed.

☝️ Things You Should Know About

📊 Four Charts On Crypto M&A And Funding →

We all know the crypto market has been running hot lately. Last year was an absolute cracker of a year for the industry, and this year has been even better with the likes of Coinbase listing. But what’s going on with funding and M&A in the sector?

This article breaks down PwC’s recently released Global Crypto M&A and Fundraising Report and highlights some of the big trends.

As you might expect, much like the rest of the industry, funding and M&A were up and to the right. Having said this, one of the more interesting pieces of data that came from the report was that most VC funding in the space is still coming from traditional VCs and incubators with crypto-focused funds trailing just behind them. Interestingly, corporate balance sheet investors and CVCs were still a fairly low percentage of total invested into the sector.

Affirm last week announced that they’d entered into an agreement to acquire Returnly, a return experience and post-purchase payment company.

I thought this was an interesting play by Affirm. Most players in the BNPL space, as part of their M&A strategy, have tended to acquire other BNPL companies to assist with their geographical expansion. Yet this acquisition by Affirm might hint at their product line expansion aspirations. In many ways expanding into returns could be a great value add to their customer base and, more importantly, an easy upsell to the merchants they serve.

I’ll be keeping an eye on this one, as it could end up being a clever little move into an adjacency that other BNPL companies have missed (or potentially ignored).

🤔 Solving T+2 →

This is a great short piece from Ben Milne (co-founder of Dwolla) that covers how new payment methods (specifically RTP) will help solve some of the issues associated with T+2.

I don’t want to steal Ben’s thunder on this one — also, there are some good drawings in there — so I’m just going to recommend you read the piece.

🎧 Podcast Recommendations

This week’s recommendations both come from The Wharton Fintech Podcast, which was on fire last week with these two awesome episodes 👏 👏

ARK Invest’s Fintech Analyst Max Friedrich → Do you even fintech if you haven’t read one of Max’s awesome pieces on Square’s Cash App? I’d say no. His analysis of the fintech behemoth that is Cash App is some of the best stuff going around and a must-read in my opinion (you can find all his pieces on the ARK website). In this episode of The Wharton Fintech Podcast, Max talks all things Ark, fintech and obviously Cash App. Load this podcast up for your next run — I promise you won’t regret it.

Petal CEO/Co-Founder, Jason Gross – Democratizing Credit Access & Transforming an Industry! → Beyond their slick design, I have to admit I didn’t know much about Petal before this podcast. It was really cool to hear about how they’re targeting customers who have traditionally struggled to gain access to the US banking system (e.g., immigrants and ‘thin file’ customers) and how they’re thinking about open banking. I’d definitely recommend this episode to a friend or colleague 👍

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

📸 As always, our cover image is provided by Death To Stock Photos. You should get your stock images from them too.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌It’s Awful