Issue #51: Zebra Secures The Bag, Tinkoff Gets In On BNPL And Apple Does Something A Banks Should've Done A Long Time Ago

👋 Hi, FR fam. I hope you’ve all had a great week. It’s been a busy one in the world of fintech, so without any further ado, let’s get into this issue’s grab bag.

📣 The News Grab Bag

Why is crypto growing in Africa? ◌ Robinhood goes on the offensive ◌ Has money gone crazy? ◌A look at the Hong Kong neo bank scene ◌ What’s holding UK neo banks back in the US? ◌ So how much do finfluencers make? ◌ How Stripe became Silicon Valley’s hottest company ◌ Tide eyes off India ◌ Solarisbank mulls a SPAC ◌ The UK is exploring a CBDC

🚀 Highlighted Jobs: FrankieOne Is Hiring!

You might have seen FrankieOne in the news recently when it was announced that they’d be providing the identity platform for Wetspac’s BaaS product offering.

As you can imagine, they're looking to grow their team and are on the hunt for amazing people to join them. They’re looking for talented product managers, engineers, operations people and so much more.

These guys are doing some of the coolest stuff in the identity space and are a rocketship you’ll want to find a seat on 🚀

Check out all their job listings HERE!

📈 Notable Funding Announcements

It was another massive week for financings in the world of fintech. In total, 54 funding rounds were announced, totaling $1.2b.

💰 ConsenSys Raises $65 Million →

Ethereum innovator, ConsenSys, last week announced a $65m “formation” round of funding. The round included participation from J.P. Morgan, Mastercard, and UBS, Protocol Labs, the Maker Foundation, Fenbushi, The LAO, and Alameda Research. Additional investors include CMT Digital, Greater Bay Area Homeland Development Fund, SNZ Holding, NGC Ventures, Quotidian Ventures, and Liberty City Ventures.

🤓 My Take: Ok, firstly, they did call this a “formation” round in the press release — which is either a newfangled name for a seed round or something they just made up for the reportedly unpriced round. Regardless of what they called it, the round was a hefty one for the 7-year-old (which is about 50 years in crypto land time) Ethereum focused company.

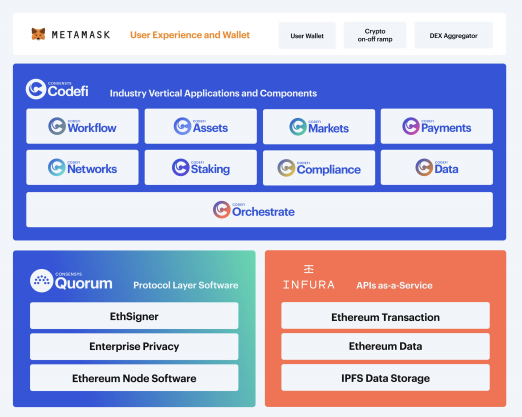

ConsenSys is a company that I’ve personally always found hard to understand. They’ve dabbled in several areas across the Ethereum ecosystem, doing everything from incubation and product building to venture investing, which has made it hard to pin down the core of their business. Having said this, along the way, ConsenSys has created some of the most important tooling and some foundational products in the Ethereum ecosystem — products like Metamask and the default smart contract tooling suite Truffle have both come from the startup.

This chaordic approach to company building is being consolidated into two separate arms with ConsenSys forming the core software business and ConsenSys Mesh being the investment arm, incubator, and portfolio.

Although the round seems to be a fairly strategic one, with most of the round being taken up by FSIs, it’ll be interesting to see if ConsenSys can turn its nack for building useful tooling into a venture-scale business.

🦓 The Zebra Raises $150m →

Last week insurtech startup, The Zebra announced a $150m Series D funding round. The round had participation from Weatherford Capital and Accel.

🤓 My Take: Insurtech continues to run hot and last week was no exception, with two startups securing big bags of fresh funding. Beyond The Zebra’s $150m raise, full-stack auto insurance carrier, Clearcover secured a $200m round of funding.

In previous issues of FR, I’ve discussed various segments in the insurtech space — everything from dental insurance through to auto insurance. As you might expect, all have their own industry quirks. Having said this, they all tend to be structured very similarly from a distribution perspective — with the market usually segmented into carriers who go direct, captive agents who work with a single carrier, and independent brokers who will sell any insurance (and usually more) product they can.

The interesting thing that’s emerged in the insurtech space is the approaches startups have taken to working with (or against) these channel partners which have proven to be successful. For the most part, we hear about the Roots and Lemonades who have gone down the carrier route and generally elected to go direct to their customers. However, others have instead elected to work as aggregators through comparison-style sites essentially playing at the intersection of the various channels. This is what The Zebra does. More specifically, they’re trying to be the trusted advisor to people figuring out what coverage to take out.

In some ways, this pushes The Zebra more into the broker quadrant. However, the reframing around being an “advisor to the consumer” drags them up into a slightly different space than that occupied by your traditional broker or comparison site.

It’s an interesting play that seems to be working for The Zebra. According to the press release announcing the funding round, they’ve seen impressive growth with net revenue up from $37M in 2019 to $79M in 2020 and an annual run rate of $150M for 2021. Along with this, monetisation unit economics continues to rise 100% year over year. Not bad at all.

It’ll be interesting to see whether we continue to see a variety of approaches in how insurtech startups work with the range of distribution channels available to them or whether this is a case of all roads leading to becoming a carrier.

☝️ Things You Should Know About

There’s no doubt that last week belonged to the Coinbase team and their historic IPO. As many expected, the company went out to massive pop and traded at a high of $429.54 before ending its first day on the Nasdaq at $328.28 a share. Regardless of what you think about Coinbase, they have created some great optics for the industry by doing what few thought was possible for a cryptocurrency exchange, listing directly on the Nasdaq.

It’ll be interesting to see if this tempts other big exchanges to list or whether they continue to toil away as privately held companies. Given how profitable, according to reports, other exchanges are I’d be surprised if many others at the Coinbase tier of exchanges will be tempted to go public. Besides, why list on the Nasdaq when you can mint your own ERC-20 token?

🏦 Tinkoff Launches Russia’s First BNPL Product →

At this point, if you don’t have a Buy, Now Pay Later (BNPL) product, are you even a consumer fintech? Although in the case of Tinkoff, I’m just surprised they hadn’t got to a BNPL product earlier.

Tinkoff is one of the most interesting neo banks globally and one that is incredibly under-discussed in most fintech discourse. This Russian challenger bank breaks the mold on what a challenger bank should look like. The Tinkoff offering is wide-reaching and includes brands in industries like telecoms, entertainment, and travel. Tinkoff has built a super app in a market few would have thought it’d be possible to. In fact, outside of Asian markets, few have built a real super app, and no one besides Tinkoff has been able to build one from banking as the starting point.

A BNPL offering makes total sense for Tinkoff — given they already offer lending products and have a merchant acquiring business. Having said this, it’ll be interesting to see whether a BNPL offering resonates in the Russian market.

🍎 Apple Launches Apple Card Family →

It’s sometimes easy to forget about Apple’s card offering. Given the big year, Apple has had with the launch of new silicon (I’m writing this on a Macbook Air M1, and I can confirm it’s awesome!) and a slew of upgrades, it’s easy to lose Apple’s fintech offerings in the mix. However, somewhere in that spaceship campus of theirs is a team that’s been innovating on a fairly simple concept that is rarely executed well by FS incumbents.

The Apple family card is simple in concept. As Apple put it in their presser announcing the product:

[it’s a] new way for people to share their Apple Card, track purchases, manage spending, and build credit together with their Family Sharing group.

Turning finance from a single-player experience to a multiplayer one is really intuitive as a concept; after all, no person is a financial island. In the family context, it’s self-evident that a financial services product should cater to a multiplayer experience. Yet, this concept doesn’t exist in incumbent FS land. Yes, you can hack a solution together, but that’s not where Apple is coming from. Apple has built a product with family at the centre of the offering. Some of the family-friendly features include:

allowing families to add up to five people to their Apple Card — with the age limit being 13 or above; and

allowing customers who are over 18 years to be co-owner. Meaning they can build credit history with their family, get the flexibility of combined limits, share the responsibility of making payments, and deliver the convenience of a single monthly bill to pay.

In classic Apple style, it’s elegant in its execution and something someone else should’ve made — but didn’t.

🎧 Podcast Recommendations

Chris Dixon - The Potential of Blockchain Technology → Chris Dixon is one of the clearest thinkers in the blockchain industry. In this podcast, he thoughtfully navigates the opportunity space in the segment. Well worth a listen if you want to hear real talk about what’s actually exciting in blockchain land and why.

Programmable Payments and The CEO Chair with Brady Harris, CEO @ Dwolla → As a quick reminder, Dwolla started in 2008 and has been trying to solve problems in the payment segment for way longer than most. They’re sometimes forgotten in fintech infrastructure conversations, in part due to their entrance and then quick exit from the P2P consumer space. Still, they continue to pump out exciting products. In this podcast, their CEO talks about the past and future of this OG fintech startup. It’s a highly recommended listen.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

📸 As always, our cover image is provided by Death To Stock Photos. You should get your stock images from them too.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌It’s Awful