Issue #43: Public Raises $220m To Take On Robinhood, Ikea Wants To Be A Fintech And Brex Wants To Be A Bank

👋 Hi, FR fam. I hope you’ve all had a great week.

As we dive into this week’s issue of FR, please spare a thought for the Robinhood treasury team as they no doubt nervously watch the Lazarus like return of $GME stock this week. You’re in our thoughts and prayers 🙏

📣 The News Grab Bag

India Surpasses China In Fintech Deals ◌ Here comes Kenya ◌ Why is Mastercard getting into crypto? ◌ Shopify Pay comes to Instagram, and Facebook ◌ The current state of US faster payments ◌ Paytm’s insurance aspirations are in limbo ◌ Once a laughable way to go public, now it’s the hippest way to join a stock ticker ◌ The latest musing from the A16Z fintech team ◌ Red-lining in the US ◌ Balancing profits and ethical data usage.

📈 Notable Funding Announcements

It was another billion-dollar week for fintech, with exactly $1bn in funding announced last week across 48 deals.

📈 Public Raises $220m In Series D Funding →

Public last week announced a fresh round of funding. The stock trading app raised $220m in a Series D funding round, which Tiger Global Management led. The round also had participation from existing investors Accel, Greycroft, and Lakestar.

This latest round of funding comes just two months after the company’s $65 million Series C and now values the Public at $1.2b.

🤓 My Take: It must have been a tough week over at Robinhood, first with the co-founder of the company, Vlad Tenev, having to testify before the House Committee on the madness that was the $GME run up and then the announcement that one of their competitors just added $220m to its war chest.

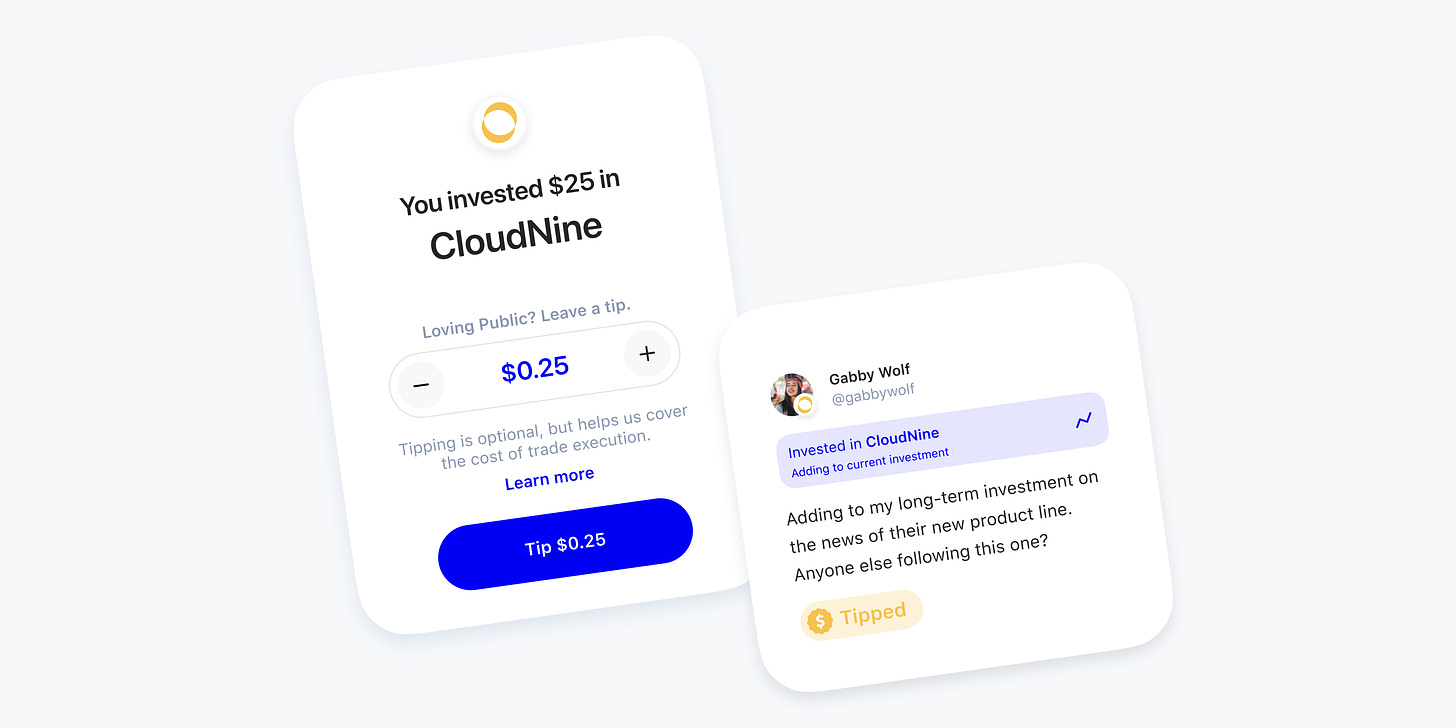

For those who haven’t heard of Public, they’re yet another player in the commission-free brokerage space. Having said this, in many ways, they’re trying to run a different race from their competitors. Recently, they made the bold decision to go PFOF-Free (which might end up becoming the equivalent of being non-GMO in fintech land). Instead of taking money from the HFT peeps, they’ve pivoted to tipping. Yep, Patreon style, you’ll be able to tip Public after a trade. I actually can’t wait to see data on how many people will actually tip. Regardless of how this turns out for Public, it’ll be a fascinating natural experiment into the psychology of tipping.

Beyond halting the sale of order flow to Citadel and co, they’ve differentiated by being more focused on stock trading's social elements — sort of WSB meets Robinhood.

In their funding announcement, Public disclosed that they’ve recently hit a million users and, according to a recent TechCrunch article, have been steadily growing at a 30% MoM. This is a far cry from Robinhood’s 13m users but shows that this might not end up being a one-horse race.

I’m fascinated to see which approach ends up being the one that wins in this ‘winner takes most’ market — is its transparency and customer alignment or free gamified trading? 🤷♂️

🎲 Kalshi Raises $30m In Series A Funding →

Last week, Kalshi, a regulated prediction market, announced they’d closed a $30m Series A funding round. Sequoia Capital led the round, with participation from Charles Schwab, Henry Kravis, SV Angel, and YC Continuity Fund.

🤓 My Take: The whole alternative asset space has been blowing up of late. Whether it’s Rally Rd IPO’ing trading cards, people buying up fractional stakes in Warhols or the latest NFT bonanza, it’s clear that there is a growing demand for alternative assets. Along with the growing interest, several platforms have sprung up trying to aggregate demand and make it easier to trade alts (i.e. OpenSea for NFTs).

What makes Kalshi interesting is that it’s not only building a place where an alternative asset can be traded but is also pioneering a new asset class that hasn’t traditionally been directly tradable: event contracts.

You’re probably wondering what “event contracts” are. According to the press release announcing the funding round:

Event contracts are structured as questions about future events. Investors buy either "Yes" or "No" contracts based on whether they think the event will happen or not, allowing them to hedge everyday risks and capitalize on their opinions.

We’ve seen similar products in the crypto space, like Augur, which operates a prediction market and token. What really differentiates Kalshi from others in the prediction market space is that they’ve recently received regulatory approval from the Commodity Futures Trading Commission (CFTC) to operate as a Designated Contract Market (DCM), making them one of just 16 DCMs in the U.S.

The appetite for more exotic assets is only growing. We can hypothesise about the exact reason, but no doubt, low-interest rates and the ongoing search for alpha have something to do with the growing hunger for these alts. More interestingly, we’re not only seeing growing interest from institutional investors but also increasingly retail investors.

☝️ Things You Should Know About

🏦 Brex Applies For A Banking Charter →

It’s fascinating observing the banking charter debate evolve in the US. Some staunchly reject the idea that you need to hold your own banking charter while others have bitten the bullet and become a licensed bank — to be honest, it almost feels like a religious debate when asking people about their view on it.

Brex has added itself to the list of fintech startups that have decided to be a chartered bank. According to the Techcrunch article, Brex has established a wholly-owned subsidiary to apply with the Federal Deposit Insurance Corporation (FDIC) and the Utah Department of Financial Institutions (UDFI) to become a charted bank.

It’ll be interesting to see how this shapes where Brex heads next as a company. There’s no doubt becoming a bank would offer the fast-growing corporate card issuer a distinct advantage when it comes to the cost of capital and the variety of products it’ll be able to offer SMEs. However, what I’m interested in is whether we see Brex venture into the world of consumer banking; now, that would be a bold move.

🛋️ Ikea Is Getting Into Banking →

There are so many jokes I could drop about Ikea getting into banking, but I’ll just say: “everything and everyone is becoming a fintech”.

Ikea’s move to acquire a 49% stake in Ikano Bank means that we might soon be seeing more financial services products offered by the Swedish meatball and furniture maker. Currently, Ikano powers Ikea’s consumer finance product, like its store card, in-store interest-free credit, and loans in the UK.

Although I don’t imagine Ikea will be opening banking kiosks in the store anytime soon (but you never know), this could signal them moving into more interesting financial services products like BNPL and a co-branded card. Let’s just hope no assembly is required by consumers (I know, but I couldn’t help myself).

💳 Marqeta Expands Into Credit Cards →

Issuer processor, Marqeta last week announced they were moving into the world of credit cards. The launch means that Marqeta will now offer the full suite of card types on its issuing platform — credit, debit, and prepaid.

For the uninitiated, the world of credit is vastly different from debit and prepaid. When it comes to credit card products, program management is complex — things like underwriting, compliance, and risk management are all complexities that many of the issuer processors have traditionally steered clear of.

To help with their move into credit, Marqeta is partnering with Deserve, who’ll be their first “strategic partner”. More specifically, they’ll be providing the program management capabilities for Marqeta users.

Although Marqeta is the first out of the gates with a credit offering, expect its competitors to follow suit quickly. Beyond credit, I think we can also expect players in this space to be looking at ways to provide more value adjacent to issuing; things like BNPL-as-a-Service springs to mind. More broadly, I think we’ll continue to see many issuers venturing outside of the world of simply being the infrastructure that allows you to spin up cards.

🎧 Podcast Recommendations

Alright, let’s get into this week’s podcast recommendations.

Jason Gardner from Marqeta → Marqeta looks to be planning a listing at a $10bn valuation. If you’re keen to learn more about the unicorn prior to its much anticipated IPO, add this podcast to your playlist.

Dissecting the Free Stock Trading Industry with Freetrade → We’ve all heard about Robinhood's issues during meme stock madness week. If you’re interested in hearing how others in the fractional share trading game coped during the crazy run-up, this is a great listen — especially if you’re interested in the UK experience.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

📸 As always, our cover image is provided by Death To Stock Photos. You should get your stock images from them too.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌It’s Awful