Discover more from Fintech Radar

Issue #36: Why It’s So Hard To Make The Bear Case For Stripe, Why Klarna Is Throwing Elbows In Australia And Why Banks Are Being Booted Out Of Schools

👋 Hi, FR fam. I hope you’re all having a great week, and welcome to another issue of Fintech Radar.

When I was thumbing through previous issues of FR, I realised I haven’t written about Stripe. So to ensure I don’t have my fintech newsletter license revoked, I thought I remedy that in this issue.

Also, if you’ve had this forwarded to you and you’re not yet part of the FR fam, subscribe below and get this newsletter delivered straight to your inbox weekly.

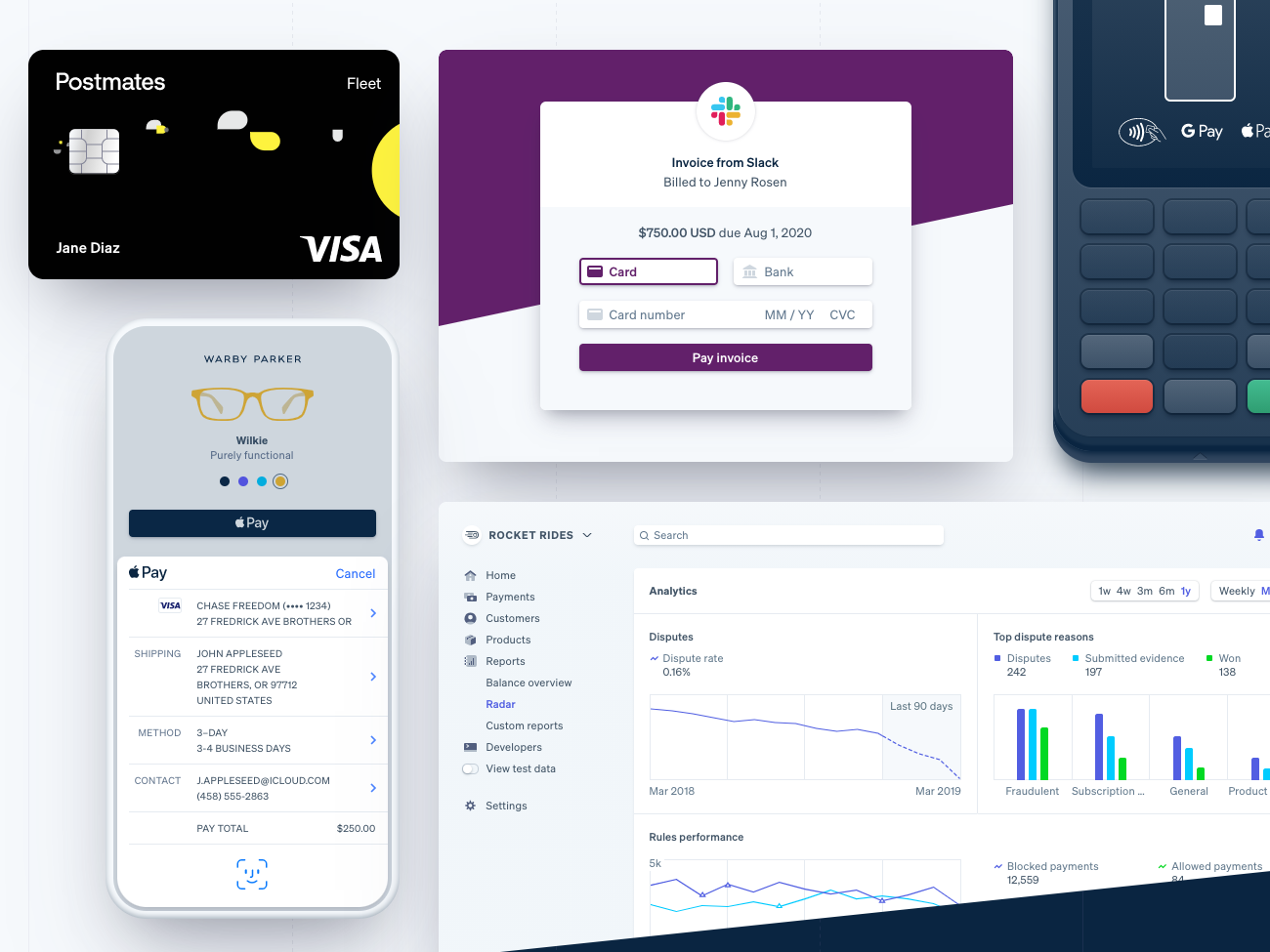

🐻 Why It’s So Hard To Make The Bear Case For Stripe

Last week Bloomberg wrote that Stripe is looking to raise a fresh round of capital at a $70b - $100b valuation. If they did manage to raise at ~$70b, this would be an almost doubling of the April valuation of $36b and would make them the most valuable venture-backed startup in the US.

There’s no doubt, any investor would sell their own grandmother to get into a Stripe round — at nearly any valuation. For the sake of every VCs’ grandmother, I’d love to be able to make a cogent argument that Stripe is overvalued. However, it’s hard.

I mean, there are the low-hanging fruit critiques regarding payments being a commoditised business, Stripe (probably) being “top-heavy” in terms of revenue concentration, their still lacking international reach, and their rates being fairly expensive for payment processing — especially when you start to do significant volumes.

Then there is probably a bucket of more existential threats. They’re not relevant in China and have had little success in India — arguably the two most important markets for payments in the next decade. There’s also how their biggest customers are being hunted by player likes Finix who are empowering companies to be their own PayFac.

But when talking about Stripe, these feel too...well, insignificant.

It’s actually amazing that a company that started as a payment gateway in an industry where the players fight for basis points has been able to transcend the competition and the segment in such a significant way.

At this point in a piece on Stripe, it’s customary to turn to their strategy and discuss how they’ve masterfully jujitsued their way up from the smallest startups into the largest companies. Also, maybe how they’ve masterfully timed the rise of SaaS companies and leaned into to be their payment provider of choice, which are both true. However, what usually gets lost in this discussion is how Stripe has relentlessly been able to open the aperture on who can be an entrepreneur.

This feels obvious, and it is. After all, every B2B fintech is opening the range of financial opportunities for an end consumer. Sometimes that is buried a few layers deeper than it is in payments — but ultimately, the companies that matter most in the space are enablers for consumers and entrepreneurs through those who service them. Stripe’s latest offering, Capital for platforms is a great example of how they continue to empower end-users with the tools to build their business (or, in this case, their customer’s customer).

Again, just to underscore this point — in B2B fintech, it’s incredibly hard to be Stripe level focused on the end outcome you’re empowering through your product.

For the most part, B2B fintechs are fighting to make sure the pipes they’ve built connect properly into the old copper pipes of the financial system and that the water is flowing. It really is under-discussed how hard it is being a plumbing company in fintech — after all, you’re interfacing with the cruft so others don’t have to.

It also means you rarely get any of the love, and when things go down, you get all the hate mail. However, this is where all the magic happens. Being relentlessly focused on executing for the end consumer for most B2B fintechs usually gets lost somewhere between sales meetings and dealing with FSI procurement processes, but it feels this is never the case at Stripe. They just continue to relentlessly open that aperture of what can be done for the builder and how big they can go. This is what makes the bear case hard to form — it’s hard to be a bear on a company that is empowering the next big company.

Sorry to all the grandmother out there who’s grandchildren are VCs. I tried.

📣 The News In Brief

Ahead of its listing, here is a great teardown of the Affirm’s S-1. Plaid and Jack Henry partner up to enable Open Finance. Cash is still queen for sex workers. UBS now offers a credit card made from corn. PNC’s takeover of BBVA’s American assets might start a trend. Coinbase is back in the news, and not in a good way. Libra might be launching in January 2021, and the ECB has some views. Get ready for another insurtech SPAC. Alipay and Shopify buddy up to support merchants with cross-border payments.

📈 Notable Funding Announcements

On the back of a few mega deals, fundraising numbers were up this week. Fintech startups globally raised a total of $927m across 26 deals.

🏦 Current Raises $131m In Their Series C Funding Round→

Challenger Bank, Current, last week announced they’d closed a $131m in Series C funding round led by Tiger Global Management. This latest round of funding values Current at $750m.

🤓 My Take: The US challenger banking market continues to run hot, this time with Current securing the bag from growth-stage investor TGM.

According to their press release, Current has been on a bit of a tear, with customer numbers up from one million in June this year to over two million. Also, revenue is up by 500% year-over-year — which is super impressive. It’s also telling that they discussed their revenue growth at a time when the market is more focused on which neobanks can get to profitability.

I really like what Current is doing. As I noted in my interview with Current’s CEO and founder, Stuart Sopp, I think they’re doing things differently to many of their peers. In a market filled with Millennial-focused challenger banks, it’s good to see a neobank reaching into Middle America to fill the needs of the many, not the coastal few.

🏗️ HMBradley Raises $18.25m In Their Latest Round Of Funding →

HMBradley last week announced they’d closed their $18.25m Series A round of financing. The round was led by Acrew Capital and means the Challenger bank has raised $22m in funding since its founding back in 2019.

🤓 My Take: HMBradley is focused on savers. Yep, it’s a narrowly defined customer they’re after — which I love. They’re all about those people who love squirreling away their acorns, and they reward them with a high-interest rate. For example, the super savers who put away up to 20 percent of their earnings receive up to a 3% interest rate. This then ratchets down to 2%, 1%, and 0.5% as you save less of your earnings.

At first blush, this might feel like a less valuable customer set than the spenders — those people who feel like their credit card is burning a hole in their pocket. However, the savers are valuable customers every bank wants. These are responsible Ronalds and Rachels you want banking with you, as they’ll likely be a low-risk lending customer when they’re ready to borrow. The trick here is to convert these people into your lending customers and, more broadly, to cross-sell them other financial products to make that yummy 3% APY worth it. In this regard, HMBradley also launched a credit card with some hefty rewards and also one-click credit.

In many ways, it’s old school banking being executed extremely well with technology from 2020 (not 1920), some great marketing sitting alongside it, and a customer-centric approach. Maybe, what’s old is new in challenger banking?

☝️ If you want to read more about HMBradley, you should definitely check this piece from the Moov.io blog.

☝️ Things You Should Read About

🔪 Afterpay's fees make it an 'extortion scheme': Klarna CEO (Paywall) →

The Aussie BNPL market is crowded. As mentioned last week, there are now 7 companies listed on the ASX, BNPL buttons are swallowing up e-commerce pages, and you can now even pay for fast-food in 4 installments. So as you can imagine, the competition is heating up.

Klarna is the new kid in town and earlier this year partnered with Australia’s biggest bank, CBA, for distribution and an equity deal that made the Aussie bank a 5.5% shareholder.

So far it’s fair to say it’s been a slow start for the Swedish Unicorn with, according to the article, 400,000 app downloads and ~500 merchants signing up. To be fair, Klarana doesn’t need a merchant to sign up for a consumer to shop with them (they spin up disposable cards in their app to allow BNPL purchases anywhere). Regardless, I’d be guessing this is below expectations given they have a bank with ~15m customers helping with distribution. So it’s probably not surprising that Siemiatkowski is throwing some elbows.

Having said this, that sharp elbows could also be seen as a smart nudge to push the Reserve Bank of Australia (RBA) to cap BNPL merchant fees.

Earlier this year, the RBA ran a review of the Australian retail payments regulation environment. During the review, questions were raised about the potential capping of BNPL merchant fees and/or removing BNPL players restricting merchants from passing on the cost to customers. Although I doubt the RBA will want to regulate fees in the BNPL sector this early in the segment’s lifecycle, it’s most definitely an issue worth keeping an eye on when the RBA releases its findings next year.

🧾 Cash App Acquires Acquire Credit Karma Tax →

It’s official, Cash App has acquired Credit Karma’s tax product.

As you may recall, earlier this year, Intuit acquired Credit Karma for ~$7b in cash and stock. However, the DOJ wasn’t having any of it and filed suit against Intuit (and Credit Karma) to block the deal unless they sold off Credit Karma’s free tax preparation product. The concern from the DOJ was that the roll-up of the free tax product into Intuit would “…substantially lessen competition for digital do-it-yourself (DDIY) tax preparation products…” Interestingly, according to the DOJ, Credit Karma’s DDIY tax preparation product has approximately two million users who file they federal and state tax through the product. This would make it the fifth-largest provider of DDIY tax preparation services in the US.

So what does Cash App do with a tax preparation product?

I’d be guessing this turns into another top of funnel acquisition tool for Cash App. For example, you could imagine returns processed via the free tax return tool and refunds issued directly to a Cash App account. Given that Credit Karma’s DDIY tax preparation product already processes two million returns a year, it wouldn’t take too much to turn this into a really profitable channel fairly quickly — and that’s without Square’s product magic being applied to it.

At $50m, this feels like it could end up being a great value deal for Square.

🛑 The Victorian Government Bans School Banking Programs →

This story probably feels a little “provincial” for most FR readers, but in the context of financial health being such a popular topic, I thought it might be worth discussing.

For some context to this story, the Victorian government here in Australia this week announced that they’d be banning banks and financial institutions from delivering school banking programs in government schools from 2021. According to the announcement, they’d be replaced with “quality school-led programs to improve students’ financial skills.”

Let’s start with the obvious; this was an amazing customer acquisition channel for the banks — and specifically the CBA (who dominate these school programs). According to Choice magazine, 46 percent of Australians open their first bank account with CBA, with a large portion opening them through the Dollarmite Club program. Further, from a CAC perspective, it was revealed by the ABC back in 2018 that the CBA spent $400,000 in QLD to buy their way into schools. They offered schools $200 a year for being part of the program, an additional $100 for every 100 students who signed up, and $5 for every 10 deposits made by a student. Amazing, if only all customer acquisition in fintech could be this cheap.

However, the writing has been on the wall for a while that state governments (k-12 education is a state issue in Australia) were going to get tough on these types of programs after an ASIC inquiry back in 2018 noted there was “limited evidence” school banking programs had a lasting impact on savings behavior.

It’s an interesting issue that probably has landed correctly in terms of banks being shown the door at school. Having said this, it’ll be interesting to see if the government-run program becomes like most sex education classes at schools— where it turns an important topic into a giant cringe feast.

🎧 Podcast Recommendations

As always, here is this week’s podcast playlist refill. Enjoy.

Building the Marcus brand: Goldman’s 2021 vision for its consumer banking product → Marcus is crushing it, and in this pod Melissa Manne, vice president and head of product at Marcus Digital Storefront, talks about what’s next for Marcus and she also chats about her time at Clarity Money (which GS acquired back in 2018). Well worth a listen.

Building a Global Payments Powerhouse – Kamran Zaki, COO of Adyen → I’m a massive fan of Adyen and how they’ve quietly been crushing it. In this podcast Kamran Zaki, COO of Adyen, talks about all things Adyen and the challenges that come with building a global payments company. Another great listen to load up for your next run.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

📸 As always, our cover image is provided by Death To Stock Photos. You should get your stock images from them too.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌It’s Awful