Issue #101: Capital One To Buy Discover For $35.3b, Monzo Eyes £4b Valuation, And FairMoney In Talks To Buy Umba

👋 Hi all, I hope you’ve had a great week.

A big shout-out to our loyal subscribers and a hearty welcome to the new faces — we're ecstatic to have you here.

If you’re new to Fintech Radar, this is what you can expect from each issue:

A curated round-up of the most interesting and relevant news from the world of fintech. In each issue, I focus on what caught my eye from the previous week — so don’t expect a weekly smorgasbord of press releases and partnership announcements. The aim is to serve the meaty bits in a neat, nibble-worthy package. It's all about spotlighting the head-turners and giving you the nitty-gritty without the fluff.

Also, if you enjoy this issue, please share it with a friend. I’m sure they'll appreciate it!

Before we dive into this week’s news, a quick PSA: I’m travelling next week, so I’ll be taking a short hiatus from writing. FR will be back to its regular cadence starting the week of March 10th. Looking forward to being back in your inboxes then!

📣 The News Grab Bag

⤷ Capital One to buy Discover Financial in $35.3 billion all-stock deal

Capital One plans to acquire Discover Financial Services for $35.3b in an all-stock deal, creating a global payments giant that would rank as the sixth-largest U.S. bank by assets. The transaction, offering Discover shareholders a premium, aims to boost competitiveness in the payments network.

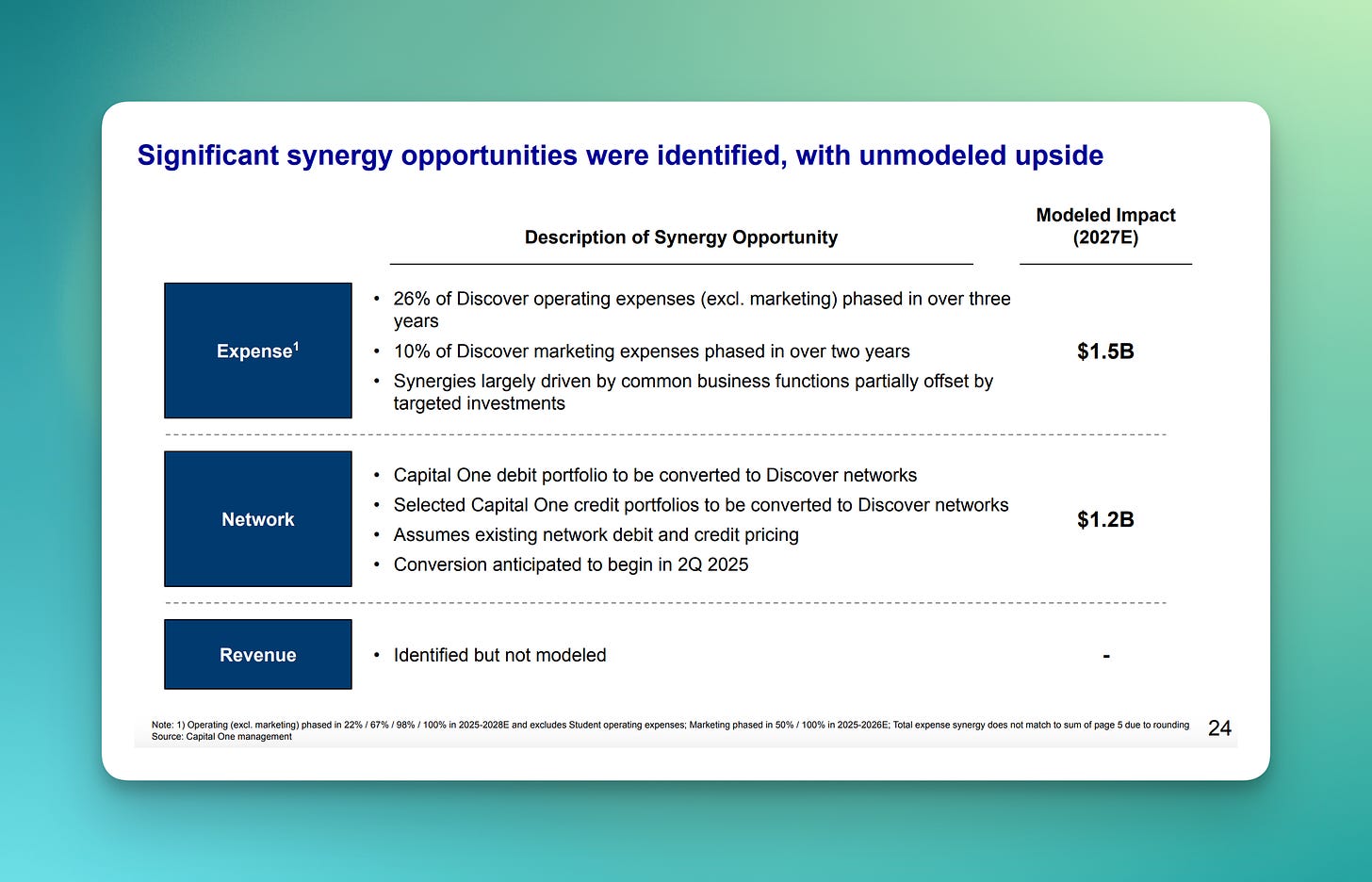

The deal is expected to face intense antitrust scrutiny and regulatory challenges, reflecting broader concerns about bank consolidation and competition in the credit card market. The new combined entity aims for significant synergies by 2027, focusing on cost efficiencies and network optimisation.

🥡 Takeaway: This was the talk of fintech Twitter last week, and for good reason. It’s a bold move from Capital One.

As one might expect, the discourse around the transaction has centred on what this means from an issuing perspective for Capital One. The obvious upside comes from them moving volumes off Visa and Mastercard onto Discover’s network. According to Capital One, they plan to move debit transactions across and some of their credit volumes to the Discover network. Capital One’s math shows that this should provide around $1.2b in upside (see below).

Also, given that the interchange caps under the Durbin Amendments aren’t intended to apply to card networks like Discover and AmEx, there’s an opportunity for Capital One to take more debit transaction margin, which they could use to incentivise their customer base to drive transaction volumes further.

I have no doubts that many bank executives dream of adding a card network to their issuing business. In many ways, it sounds like the holy grail, right? It’s so much so that Discover went the other way and added a bank to their business. As many found out this week, Discover is both a payments network and a digital bank. Wow, so they already did what Capital One is planning to do? Yep, pretty much. To be fair, Capital One is larger, more tech-forward, and better positioned to make this work, but it does beg the question of how much more juice they’ll be able to squeeze from the network/issuer play.

But what about the actual network? Let’s not forget that the big play here is buying one of the few payment networks out there. After all, that’s what the $35b price tag is really for. As you can see from Discover’s Q4 results, it’s not exactly a high-growth business. Specifically, pay close attention to the Discover Global Network (DGN) and Network Partner numbers.

As Capital One noted in the presser announcing the deal, “This is a key foundation in Capital One's quest to build a global payments company.” I don’t think anyone doubts this, and it’s the big ‘what if’ of this deal. Specifically, what if Capital One can make Discover a real player in the card scheme space?

However, to make Discover (and thus Capital One) a serious player amongst the card schemes will require them to grow Discover’s international reach — whether that be through DGN and/or their network partners. To be honest, I’m not sure Capital One is the best positioned to do this.

My guess is this deal won’t age well, and Capital One will end up doing what Morgan Stanley did in 2007 and spin this back out to market. Having said this, if (and it’s a big ‘if’) Capital One can make this work, I’m sure the market will regard it as a GOAT play by Richard Fairbank.

⤷ Sequoia abandons effort to oust Michael Moritz from Klarna board

Sequoia Capital has abandoned its attempt to remove Michael Moritz from the board of Klarna, stating that it now fully supports him "upon a fuller assessment".

The move to oust Moritz was initiated by Sequoia partner Matthew Miller, who will now leave his post. The U-turn leaves a vacant seat on Klarna’s board and questions over what originally motivated the company’s largest shareholder to act against its chair. Klarna has been preparing for an IPO, with Siemiatkowski repeatedly speaking about his intention to take the company public.

🥡 Takeaway: As Omar Little famously said on The Wire, "If you come for the king, you best not miss" — in this case, Sequoia missed badly.

Although nothing new, board drama is always fascinating (as we recently saw with OpenAI). As embarrassing as this incident is for this much respected VC firm, it highlights how the pressures most investors are currently feeling are manifesting in “strategic differences” between them, boards and the CEOs of their portfolio companies.

⤷ Monzo eyes £4bn valuation in landmark funding round

Monzo is in talks to secure a funding round that could value the company at approximately £4bn. According to reports, they plan to raise up to £350m from new and existing investors, with Alphabet's investment arm, CapitalG, leading the round. Other investors include China's Tencent, Ribbit Capital, and HongShan. Monzo serves over 9m customers and over 380,000 business accounts and has expanded into the US market.

🥡 Takeaway: Despite all the discussion around consumer fintech being dead and people worrying about the state of the segment (thanks, Fortune, for your concern; we all appreciate it), there still seem to be those who are willing to fund even the most out of fashion fintech segment there is, neobanks. But why?

The obvious reason is that most of the players still alive and kicking have adjusted to the macro environment, tightened their belts and focused on moving from ZIRP economics to being *gulp* profitable businesses that are still growing at a healthy clip. I also suspect that astute investors also realise that we’re still early when it comes to building a new model for consumer banking.

As much as the criticism of many neobanks being nothing more than a wrapper on someone else banking license is a valid criticism (I’d argue this is more the case in the US), we’re still early in numerous markets, and Monzo might yet end up being a poster child of what a neobank can be.

⤷ Nigerian digital bank FairMoney in talks to buy Umba in $20M all-stock deal, sources say

Nigerian digital bank FairMoney is in discussions to acquire credit-led digital bank Umba in a $20m all-stock deal. Umba provides payroll and financial services to customers in Nigeria and Kenya, and the acquisition would signal FairMoney's interest in expanding into new countries.

The move also highlights the challenges facing fintechs in Africa. While acquisition negotiations are in the early stages, a deal could streamline FairMoney's entry into Kenya and provide potential synergies between the two companies' fintech capabilities.

🥡 Takeaway: This isn’t as big a deal at the Capital One/Discover acquisition, but it does point to a trend I think we’ll see in many once-hot fintech regions like Africa.

The African fintech market ran hot during ZIRP times, with many fintech-focused (and not so focused) funds deploying dollars on the continent. The hypothesis many laid out was that as key markets across the expansive African market became more digitally reliant, so too would we see rising demand for digital financial services, and this new breed of digitally native fintech would be there ready to serve this market.

Having worked at one such unicorn, the hypothesis is in many ways correct. There is a rising demand for access to digital financial services right across Africa. Many of the same financial products a person takes for granted in Western markets are in high demand. Whether it’s cards they can use to subscribe to Spotify or access to exchanges to buy crypto — to protect against rapid inflation— the market is ready to be served.

The reality is that some have been able to carve out a real business. Those who have not been able to cut through the noise and (importantly) find an economic model that works in these notoriously hard markets will emerge as big winners in the years to come.

I genuinely think some high-value startups will be snapped up during this period of consolidation. Specifically, for astute acquirers, there’ll be significant opportunities to snap up consumer offerings that have figured out the tricky financial plumbing challenges but couldn’t quite scale while cheap capital was available.

⤷ Google Pay app is shutting down in the US later this year

Google Pay, which was largely replaced by Google Wallet in 2022, will be discontinued in the US on June 4, 2024, as part of Google's effort to streamline its payment methods. After the shutdown, Google Pay will only be accessible in Singapore and India.

Google will remove peer-to-peer payments, balance management, and offers, suggesting users use the new deals destination on Search instead. Despite the Google Pay app ending, the service will still be accessible through Google Wallet globally.

🥡 Takeaway: It looks like we can add P2P payment in the US to the “Killed by Google” list. In all seriousness, it wasn’t that long ago that some thought the ‘big tech’ was coming for financial services. It’s always been seen as the lurking competitor preparing to pounce. Whether it’s Google launching and then relaunching their pay/wallet product, X getting money transmitter licenses, or Apple launching new features for their wallet product, the tech giants always seem to be on the cusp of being a threat. But (unsurprisingly) they never really are.

Regulatory scrutiny, organisational complexity, or simply focus are all reasons why we haven’t seen a tech giant crack the nut on financial services. When you combine this with the narrative mirage of having a huge customer base = distribution (the key is actually being able to activate the customer base), you have a story of big tech failing to make a meaningful splash in the space.

As I’ve said before, financial services will always be a white whale for the tech giants — one that they’ll always think they can harpon only to realise FS is hard, damn hard. RIP techfin.

💸 Notable Funding Announcements

Last week was slower for fintech financing, with 45 funding rounds completed and companies collectively securing $447m in investment.

⤷ InsurTech Juniper raises £1.5m to launch comprehensive reproductive health cover

InsurTech Juniper has raised £1.5m in pre-seed funding to launch a reproductive healthcare insurance service aimed at providing comprehensive coverage for reproductive health issues.

Juniper targets medium to large enterprises seeking to improve employee well-being, streamline processes, and support ESG initiatives. The company aims to fill a gap in the health insurance market by offering coverage for various reproductive health conditions and tests, including those related to gender dysphoria, menopause, and more.

This funding will support Juniper in enhancing product development, expanding the team, and conducting pilot phases to prepare for its official launch.

🥡 Takeaway: It’s always great to see startups tackling socially important issues, and reproductive healthcare ranks right up there. According to the WHO, around 1 in 6 people globally suffer from infertility issues. When you combine this with the high cost of treatments and the country-specific dynamics around healthcare coverage, there is undoubtedly a big market to serve for startups like Juniper.

As you might expect, several startups are going after this segment. Most have tended to the benefits side of the market (i.e. reselling a product vs being an MGA), offering ways for employers to include coverage for specific infertility treatments. These include startups like Apryl, Fertifa, Carrot and Kindbody — so there’s no shortage of players looking to service this growing segment.

Having said that as with all companies that straddle the insurance/benefits space, selling into corporates (and more so SMEs) can be challenging — especially in a tightening job market where employers aren’t battling as intensely for talent.

It sounds like Juniper is trying to position itself more in the insurance segments (as many see this as a core part of the total compensation package) to differentiate from the pure-play benefit providers. It’ll be interesting to see how they fare against the benefits players.

⤷ Napier AI lands £45m backing from Crestline Investors

London-based RegTech Napier AI last week announced that they’d raised £45m from Crestline Investors to accelerate its growth and development of screening and monitoring solutions for financial institutions.

Napier AI offers AI-powered anti-money laundering and financial crime compliance software across banking, payments, and wealth and asset management industries, helping customers screen, monitor and identify criminal or suspicious activities while providing regulatory reporting.

According to the press release announcing the round, they’ve seen strong top-line growth, with revenue up more than 30% year-on-year since 2021.

🥡 Takeaway: As I’ve noted in previous issues of FR, the fintech segment most rife for disruption (or maybe evolution) from Gen AI is compliance. Having said this, the open question is how this will manifest.

In the short term, we’ll continue to see startups go after opportunities to improve the compliance workflow. Specifically, helping risk and compliance analysts reduce the number of screens they have to jump between by providing a conversational interface to query information will be the first area where most take aim. Think ChatGPT, but for compliance quieres.

However, as attacks get more sophisticated (like this crazy one), we’ll see a new generation of compliance products enter the fray. The Gen AI offence vs Gen AI defence game will only intensify as deep fakes of images (e.g. IDs), video (e.g. liveness testing), and audio (e.g. fake call confirmations) become more sophisticated. Products that cater to these compliance challenges will only become more prevalent in the overall compliance stack of fintech startups. Watch this space.

🎧 Resources & Recommendations

⤷ The Bank Sponsor Crackdown, and Lessons from Stripe and Airwallex with Jas Randhawa

In this instalment of the Fintech Layer Cake podcast, host Reggie Young chats with Jas Randhawa from StrategyBRIX, a consultancy specialising in risk and compliance within the fintech sector.

They chat about Jas' time working at Stripe and Airwallex, dive into the nitty-gritty of fintech risk and compliance, and Jas shares some tips on how fintech startups can stay on the right side of the law. They also touch on the changing world of fintech and bank partnerships and why keeping up with compliance tech is more important than ever. As always well worth a listen.

⤷ The Fintech OG Series Debut: Matt Harris and Steve McLaughlin

In the debut episode of The Fintech OG series, Matt Harris from Bain Capital Ventures and Steve McLaughlin from FT Partners share their extensive fintech experience dating back to the 90s (that’s genuinely OG).

They discuss the current state of the fintech space, areas (still) ripe for growth, and whether fintech actually remains a promising sector for development. Another pod well worth a listen and sub for future episodes.

❤️ Show Some Love For FR

📧 Feel free to reach out if you want to connect — I'm @alantsen on Twitter.

Ps. If you like what I'm doing with FR, please share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend who might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌ It’s Awful