Break Down #5: Why Square Acquired Afterpay

It's a big deal, both figuratively and literally. So why is Square betting 25% of the company's market cap on this buy now, pay later player from Australia?

👋 Hi, FR fam. I hope you’ve all had a great start to the week.

I was almost done with this week’s issue of FR, and then the news of Square’s acquisition of Afterpay dropped, and I obviously had to write about it.

Apologies for again deviating from the usual program. Having said this, I’m sure you’re all keen to hear more about this blockbuster transaction. So let’s get into it.

“You Know What's Cool? $29b”

Both figuratively and literally, this is a big deal. The acquisition is a $29b all scrip deal and is a massive bet by Square on the Buy Now, Pay Later (BNPL) segment. For context, this deal is worth approximately 25% of Square’s current market value. This is a ‘bet the farm’ play by Jack and Square on a segment they clearly have strong conviction in.

Beyond being massive from a deal size perspective, it’s a complex deal from a mechanical standpoint, showing just how bullish Square is on the Aussie BNPL juggernaut they’re acquiring. As part of the deal, Square will set up a secondary listing on the Australian Stock Exchange (ASX) to allow Afterpay shareholders to trade Square shares locally. Beyond being a win for local Afterpay shareholders who will be able to easily trade their new shares in Square on the local board, it’s also a massive windfall for all the bankers and lawyers involved — a round of applause to the bankers who suggested that deal structure.

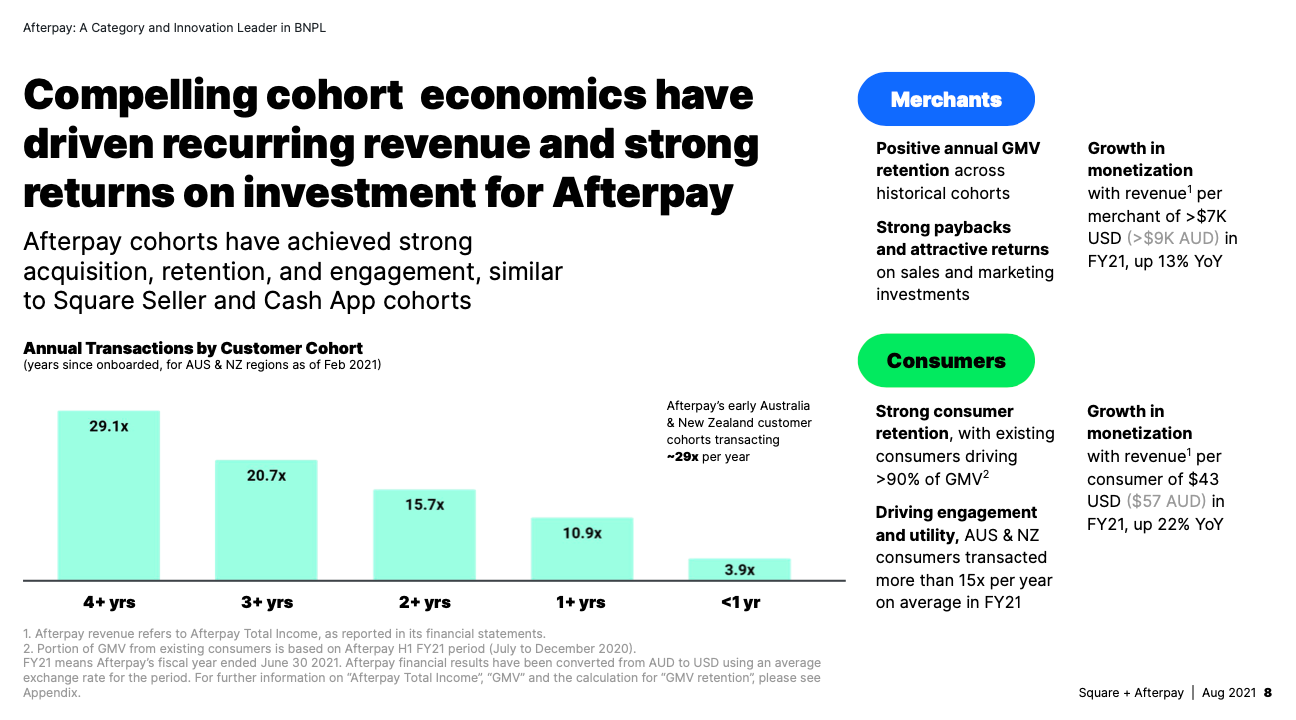

On the face of it, $29b seems like a lot to pay to enter a segment that they are well placed to compete in. After all, Square has all the distribution power it needs on both the consumer and merchant side, with its Cash App attracting more than 36m monthly active users and their merchant business servicing millions of businesses. When you combine this with the recent banking charter they acquired in the US (which means that they’ve now bent the cost of the capital curve in their favour), some might be scratching their heads at the acquisition.

When you throw into the mix the standard Wall Street analyst argument about the BNPL space being a race to the bottom segment, it makes the deal that much harder to reconcile. Although the investor presentation highlights several apparent reasons why this deal makes sense for Square (and Afterpay shareholders), it misses what I think is the key reason this ends up being a tactical masterstroke.

BNPL Is A Feature. The Flywheel Is Where The Value Is

One thing that Square has never been able entirely to figure out is how to bridge the amazing ecosystems they’ve been able to build on both the consumer and merchant side. In many ways, it sometimes feels like they’ve built two separate breakout businesses under one roof.

Bridging the divide between these two businesses would be the holy grail in consumer fintech. It’s what every consumer fintech startup dreams of — being at the intersection of consumers and merchants and, more importantly, being able to clip the ticket. It’s the fintech equivalent of perpetual motion.

To be fair, it’s not been through a lack of effort. As you may recall, back in 2013, Square released Square Wallet, which was their first attempt at a consumer offering. In the video below, a beardless Jack hints at the grand plan of building out a consumer offering that is closely coupled with their merchant business — with the endgame being to make it a seamless experience to transact with merchants who use Square and thus fueling a consumer business.

Square Wallet didn’t quite work out. Having said this, it eventually morphed into the beast that is now Cash App, and we all know how that story played out. What must have been obvious to Square at the time was that building a strong consumer business would eventually buy them the right to come back around and have another crack at building a bridge between consumers and merchants.

Fast forward to 2021, and you’d be hard-pressed to find a fintech that has built a business that is closer to this end state of integrating the consumer and merchant side better than Afterpay. To some, this might be non-obvious, especially to those who haven’t experienced it first-hand in Australia. The way the consumer experience and merchant value (and vice versa) are intertwined is the real magic to the Afterpay product — not the consumer lending element.

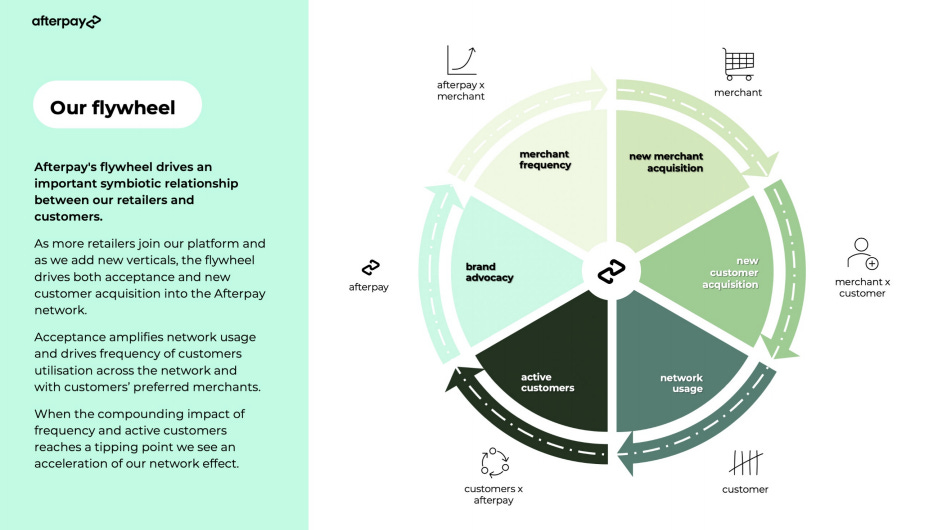

It’s easy to lose sight of the flywheel that Afterpay has created in its product — as more merchants provide Afterpay, more consumers use it (and then demand it), more merchants provide it to meet customer demands, and more usage keeps the flywheel spinning. It’s easy to get lost in the consumer lending narrative. However, the genius of the Afterpay distribution strategy has been centred around ensuring that they focus on the intersection of the consumer and merchant experience.

In markets like the US, it’s not as obvious, in part because the flywheel is only just starting to spinning. However, it’s apparent in Australia when you walk through any shopping centre (or browse online during covid times) that the flywheel is spinning. Again, it’s easy to look at the feature that is BNPL and conclude that it’s a race to the bottom product — and to be honest, if you see it simply as another way to facilitate payments, you’d be 100% correct. However, where Afterpay differs from its competitors is they’ve been able to finely balance the consumer and merchant sides of the business to ensure the flywheel continues to spin.

The scary thing about Afterpay is that they’re just in the first innings when it comes to extracting value from the flywheel they’ve created. In fact, beyond their soon to launch consumer account offering, they’ve stuck to their knitting and been razor-focused on their BNPL product — and they’ve been bloody good at it, as the data shows.

Square is acutely aware of the opportunity that sits at the intersection of the consumer and merchant businesses they’ve created. They’ve tried to bridge the gap but haven’t been able to find a way to get there. However, with the acquisition of Afterpay, they now have the opportunity to offer a product from a company that has built an amazing flywheel to their range. If anything, this acquisition is a $29b bet that Afterpay will provide a way for them to bridge their two businesses.

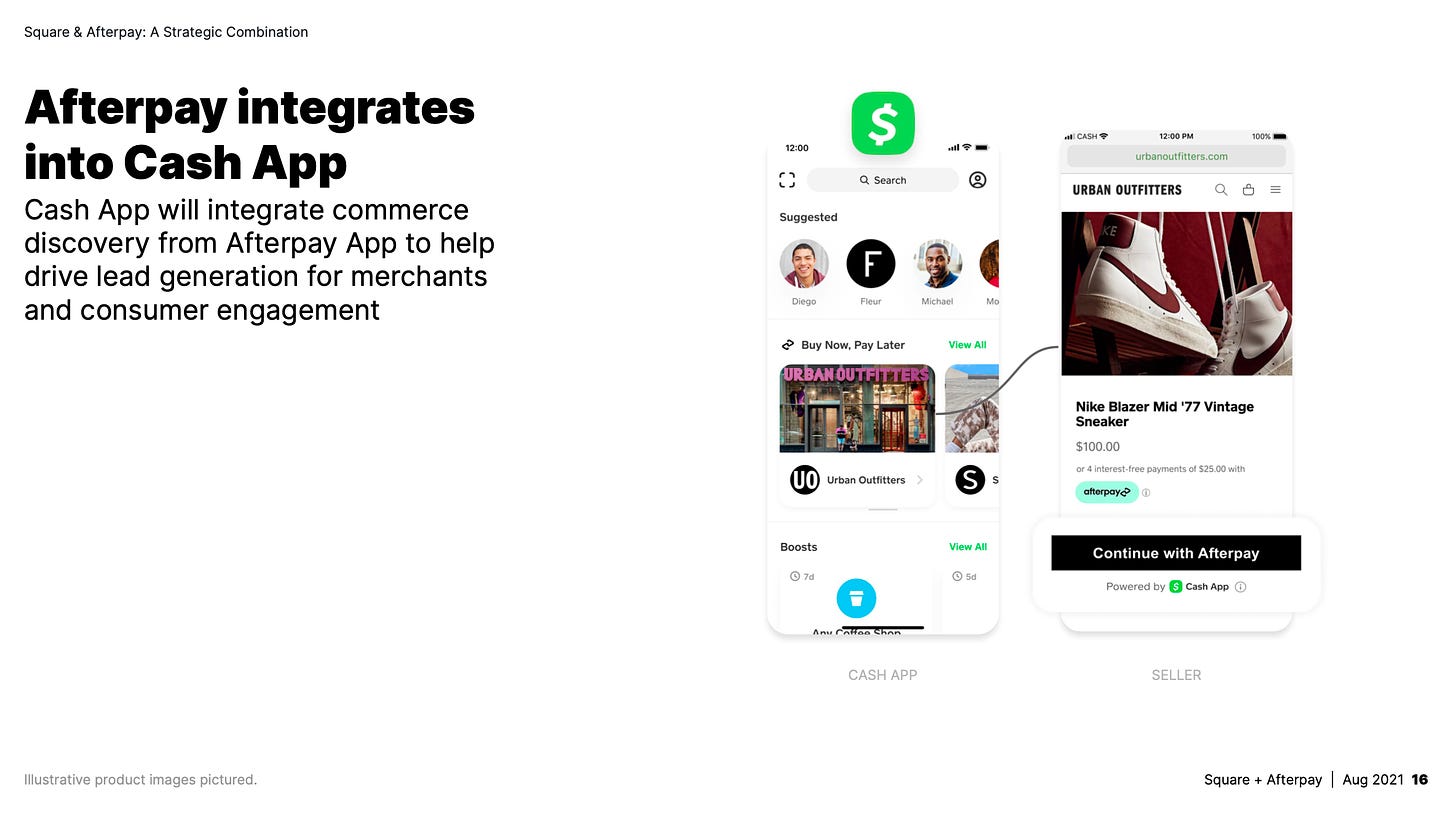

It Goes Well Beyond Cash App

In the investor presentation, the integration of Afterpay into the Cash App is emphasised. This is obvious and easy to understand (and why I’m guessing it features so predominately) — display some modals offering BNPL to 36m Cash App users, and Afterpay’s numbers go up and to the right. However, where the real synergies (yes, I shuddered a little after writing that) lie is on the merchant side.

It’s easy to forget that Square has built an impressive and enduring merchant acquiring business. This tends to gets lost in the mix, as the golden child during investor calls is now Cash App. While on the Afterpay side, the same is true, with most of the exciting upside discussion focusing on their upcoming consumer offering. However, both companies roots (and arguably where their staunchest champions tend to be) are on the merchant side of their respective businesses. I find it hard to imagine how any merchant acquiring business competes with the distribution reach and feature set that a combined Square and Afterpay will be able to offer. To be honest, if they only get the integration 50% correct, they’re going to be unstoppable on the merchant acquiring side.

Interestingly, Afterpay also provides Square with some further firepower when it comes to its push into e-commerce. If you’ve been paying close attention to Square’s more recent moves, they’ve been very focused (which makes sense in the current environment) on getting better penetration with their e-commerce tools. The powerful and ubiquitous ‘Pay with Afterpay button’ is sure to help with their push into the online merchant payment flow.

But seriously, $29b?

Yes, it’s a massive price tag for a BNPL company. Having said this big plays, cost big dollars, and this could end up being a big piece of the puzzle for Square. Whether it’s on the consumer or on the merchant side, this deal has a bunch of potential upside for Square. It also helps when you have the scrip to pay for it.

What will be interesting to see over the coming years, as Afterpay is integrated into Square, is whether they can pull the merchant and consumer sides of the market together. If they’re able to take the flywheel that Afterpay has created and grow it through Square’s channels, the combined company could end up being one of the most dominant companies not only in financial services but in tech.

Disclosure: I obviously hold shares in both Square and Afterpay. I mean, how could I work in fintech and not have purchased shares in both companies.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌It’s Awful

Hi Alan, why doesn't Square build its own BNPL feature? It seems it's well positioned to build as they already have the merchant and consumer network. what's stopping them?