Lemonade S-1 Teardown 🍋

Lemonade, the insurtech sector darling, is going public and the filing tells an interesting story well worth reading.

I usually don’t do S-1 ‘teardowns’, mainly because it reminds me of a time long ago when I worked in professionals services. However, this was an S-1 I couldn’t wait to read - so why not share the notes I took with the FR fam?

For those who want to follow along at home, you can find Lemonade’s S-1 filing to go public HERE.

First, Some Background

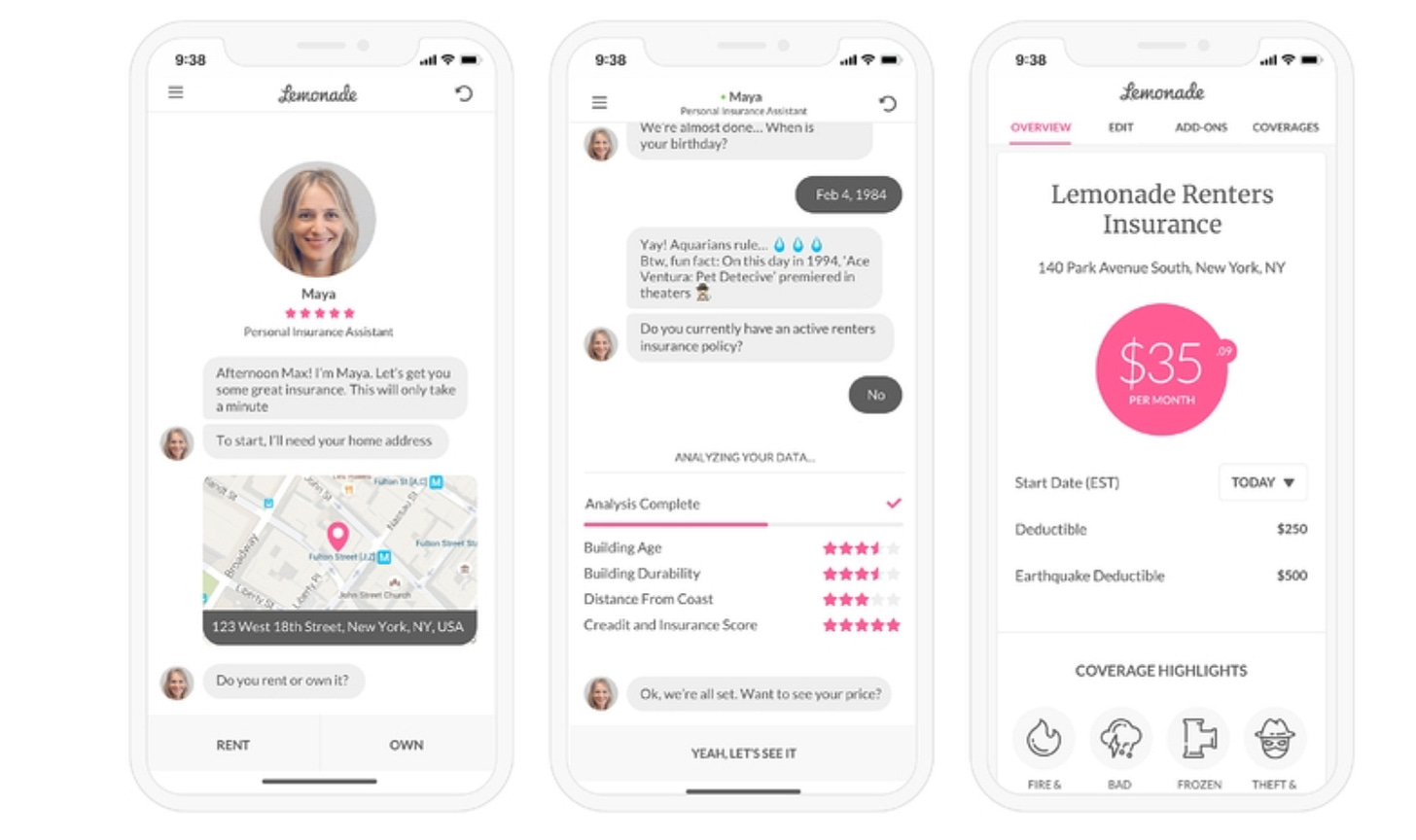

Lemonade is the poster child for the insurtech sector - and with good reason. The four-year-old startup ticks all the boxes in terms of being the antithesis of incumbent insurance companies. It’s a for-profit Benefit Corporation; it gives excess premiums to the community and, according to its website, pays out insurance claims to customers in 3 minutes. I mean, what isn’t there to like about them?

Further, Lemonade famously runs a radically transparent business model, which is very different from that of its competitors. Specifically, they retain a fixed fee of premiums (currently 25%), with all excess claims being offloaded to reinsurers. But they don’t stop there, with excess premiums donated to nonprofits selected by their customers as part of their annual Giveback. As you’d expect, from a business model perspective this reduces a considerable amount of volatility in their and results in a more stable gross margin - but more on this later.

More broadly, the insurtech space is super hot at the moment. This is driven by the size of the industry, how fragmented it is, and just how sleepy the incumbents have been. For some context, and as Lemonade notes in the filing, here is some market size data.

Insurance is one of the largest industries in the world. Property, casualty, and life insurance premiums amount to approximately $5 trillion globally, and account for 11% of gross domestic product in the United States.

This market dynamic has translated into the creation of some of the most enduring companies of the last two centuries.

In the United States, 12 of the Fortune 100 companies are insurance companies, and their average age is about 125 years old. More remarkably, while the world's top insurance companies each generate over $100 billion in revenue, no single company has a market share greater than 4%, underscoring the sheer scale of the industry.

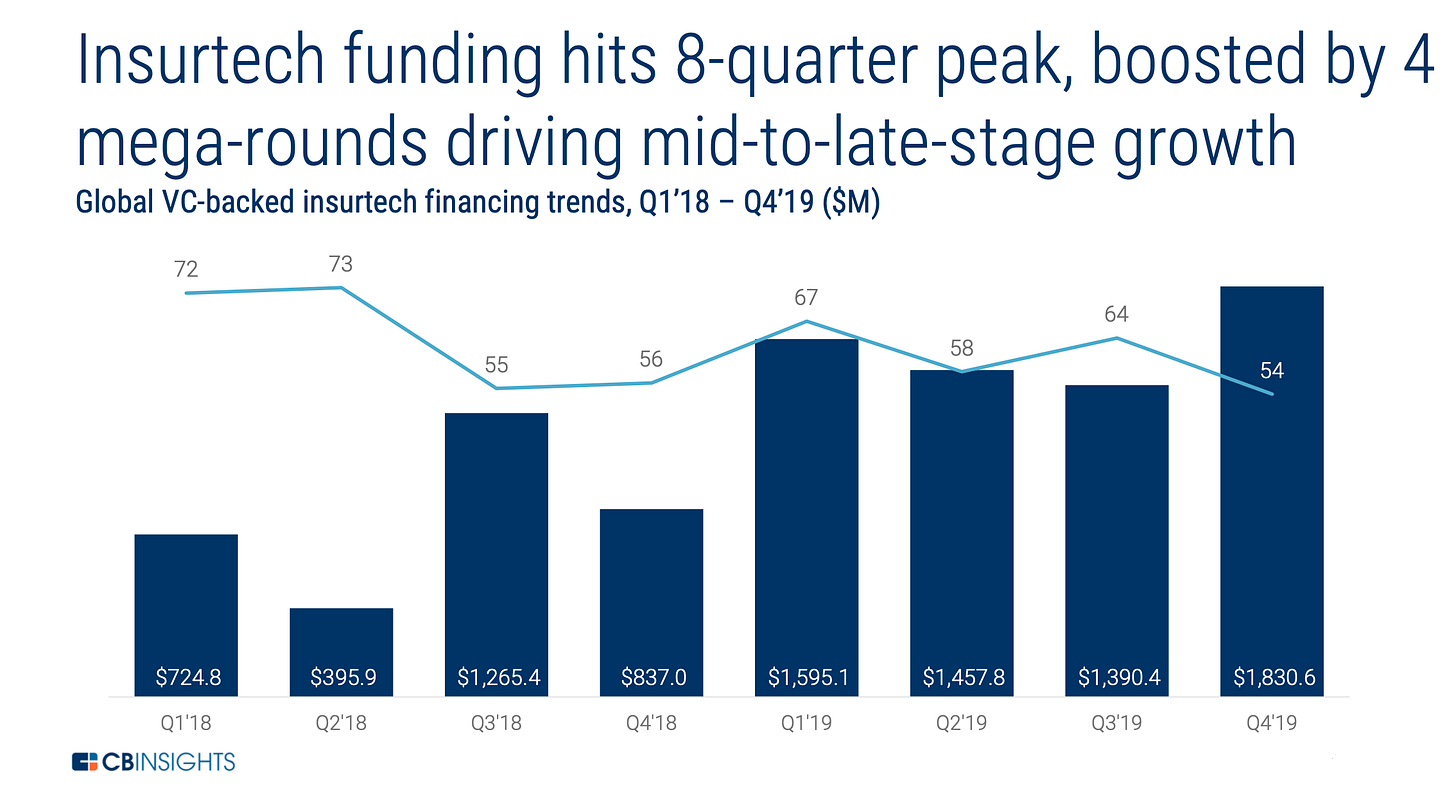

Unsurprisingly, VCs have rushed into the sector and dropped bags of cash into the laps of startups disrupting the incumbents.

One of the primary beneficiaries of this influx of capital has been Lemonade. To date, they’ve raised an impressive $480m across five rounds of funding and reached a valuation of more than $2b in the process. Also, they have some impressive names on their cap table (and Softbank) who will no doubt be pleased with them deciding to list.

So let’s dig into the numbers and see what all that capital has bought them.

Let’s Dig In On The Numbers

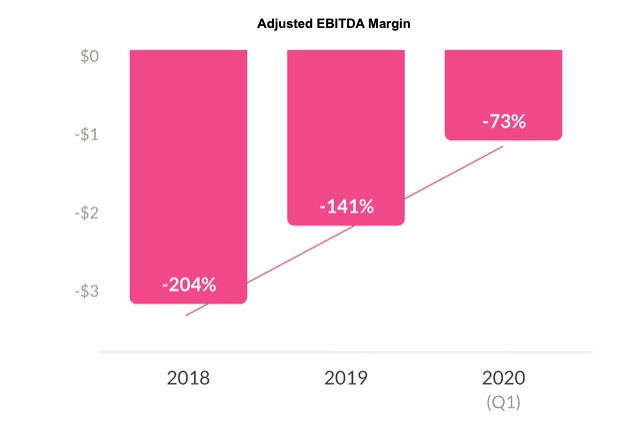

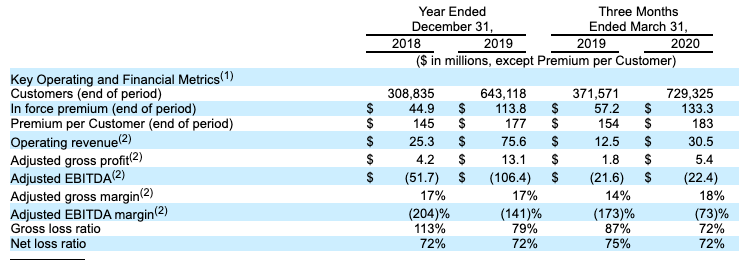

The summary bar graph that everyone is talking about from the filing is probably an appropriate place to start.

Gross Written Premium (GWP) is the “…amount received, or to be received, for insurance policies written by us during a specific period of time without reduction for premiums ceded to reinsurance.” Broadly, this is expected revenue from the premiums Lemonade writes, including some reductions for costs associated with commissions, amongst other things - but not taking into account the reinsurer premium. As you’d expect, the bar is up and to the right. It has gone from $9m to $116m since 2017 - which is impressive growth for a startup. However, just to put that into perspective, Aussie insurer Suncorp (who has about 27% of the Australia market) did $8.2b in GWP in 2019. Yes, I know that’s an ‘apples and oranges’ comparison - but it does give you a sense of Lemonade’s scale in contrast to local Aussie insurers.

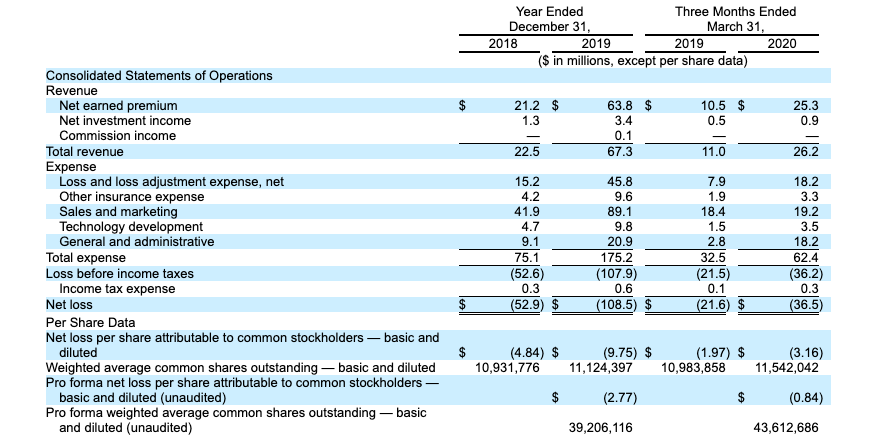

On the revenue side of things, they posted $63.8m in total revenue, which was up from $21.2m in 2018. They also had some investment income (basically, income generated on the float) and third party commission income, which increased over 2018 → 2019 (but only marginally, as this isn’t core to their business). To be honest, revenue is lower than what I would have expected, given the valuation of $2b they had coming into the listing.

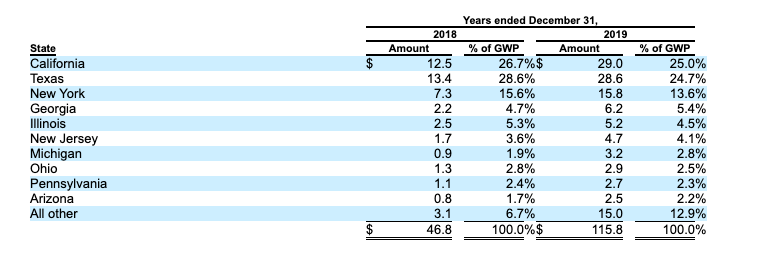

In terms of where geographically their GWP is being derived from, the following table highlights how that revenue is split across the states they write policies in.

As you’d expect, most of their premiums are written in California. Interestingly, Texas is also in the mix at number two, with 24.7% of GWP as of 2019. Although most of their GWP seems to be bi-coastal (CA and NYC), there are some good signs that they’re expanding into middle America. Hopefully, pointing to the growing popularity of the Lemonade proposition.

Lemonade has also been able to reduce the net losses per dollar of GWP over the 2017 → 2019 period. They’re down from an eye-watering -$3.12 to -$0.94 in 2019. Having said this, and as you’re probably expecting based on their net losses, they are still in negative margin territory with an adjusted EBITDA Margin of -73%, which has decreased from -$204% in 2018. This is also the case for the gross loss ratio, which has fallen from 161% in 2018 to 79% in 2019 - but is still firmly in the red.

Ok, to be fair, it isn’t uncommon for a tech company to list with negative EBITDA margins. I mean Slack listed with a -38% EBITDA margin. These types of numbers at the EBITDA margin line tend to reflect the expansion in marketing costs designed to drive customer acquisition ahead of revenue. In this regard, it’s also worth looking at the gross margin line to see how the unit economics stack up.

In Lemonade’s case, it’s been stable at 17% across the 2018 → 2019 years. This is driven in part by their fixed-percentage revenue model, which creates a relatively stable top line. What this means is that one of the main drivers of gross margin is the efficiency with which they acquire customers. According to their S-1, this seems to be improving at a rapid clip.

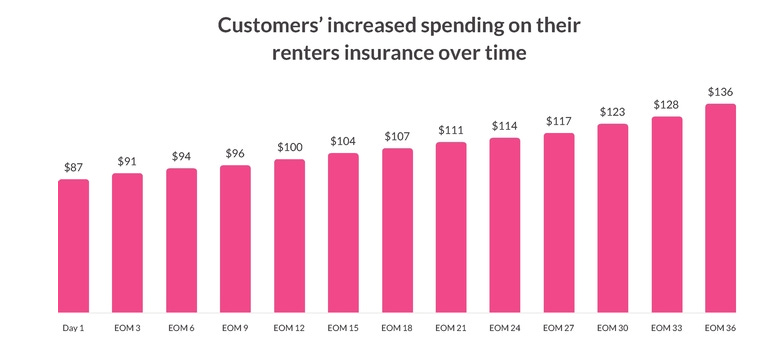

…since March 31, 2019, our marketing efficiency roughly doubled, such that we are currently able to acquire more than $2 of in force premium for each $1 of marketing investment. Given our predictable gross margins, strong retention rates and the propensity of our customers to spend materially more with us over time, we believe that the lifetime value of our customers is significantly higher than our cost of acquiring them. Applying a roughly 20% gross margin, we would earn back the cost of acquiring our customers in just over two years.

Although it’s tough to work out what the actual customer acquisition cost (CAC) is based on the filling, a payback period of two years tends to imply a CAC of >$354 based on the 2019 premium per customer numbers (yes, I agree this is imprecise but is probably in the right ballpark).

At this point, the S-1 might feel a little “blitzscale’ish”, and you probably want to know where Lemonade proposes to go from here.

Where to next?

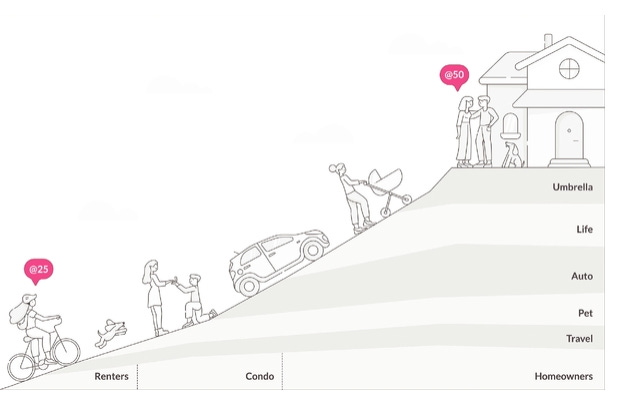

Lemonade’s game plan can best be summed up by the following diagram from their S-1.

That’s right, it’s expansion revenue or as Lemonade puts it:

Any annual coverage increases, graduation of renters to homeowners or new product introductions, pet insurance for example, further shorten the payback period and drive up lifetime value.

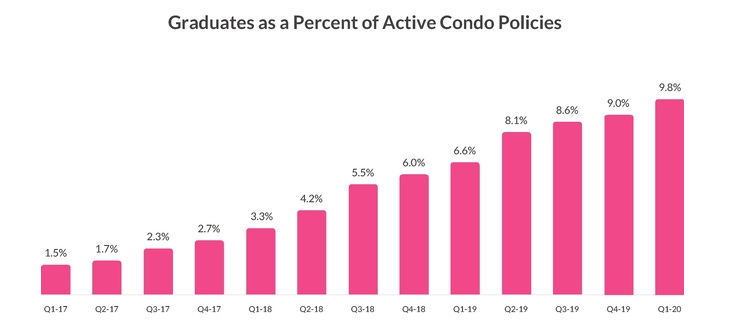

So the next question you’re probably going to ask is how well are they actually upselling their customers? According to the S-1, it’s slowly happening. The following two diagrams illustrate some of the ‘graduation’ they’re seeing in their current customer cohorts.

This is some robust growth in revenue across its customer base. Still, you’d imagine that this might be hard to keep up if people aren’t buying homes due to the economic climate or, for example, we continue to see a secular shift away from home and car ownership.

The other growth lever they highlight in the S-1 is based on operational efficiencies. At this point, it’s worth noting that Lemonade has taken a very different route to other consumer propositions in the insurtech space. Most of their competitors have gone down the insurance marketplace model path (i.e., reselling for other insurers). In contrast, Lemonade has instead become a full-service insurance provider, which means they are more vertically integrated than most in the sector. In the S-1, Lemonade refers to this as their ability to “Capitalize On Our Closed-Loop System”:

We operate our own full-stack P&C insurance carriers in both the United States and Europe, built on top of a unified, proprietary, state-of-the-art technology platform. This vertical integration not only affords us an advantage in cost and speed, but creates a system that learns as it goes, extending these advantages with every rotation of the flywheel.

This is an advantage that I think is too often drowned out in conversations regarding digital competitors in the fintech space. Having the business built on a digital foundation with data centricity at its core from day 0 is incredibly valuable and can’t be underestimated as a competitive advantage. Further, it can be a key driver of gross margin expansion once you have product-market fit. Again, you only need to look at an insurance incumbent’s website to see the difference.

Wait And See

As is the case with all listings, the market will decide (fairly or unfairly) where this lands, and I’ll be watching closely (as will the rest of the fintech ecosystem) to see whether this listing pops or flops at the opening bell.