🎉 Issue #50: Plaid Jumps To A ~$13b Valuation, Active Trading Comes Roaring Back And Bitcoin ATMs Are Apparently A Thing

👋 Hi, FR fam. I hope you’ve all had a great week!

Welcome to issue #50! 🥳 🎉

Let me start by saying thank you for being a subscriber and reading my weekly musing/ramblings on the world of fintech. It means a lot to me that you take the time to read FR 🙏 Now, sit back and get ready for another jam-packed week of fintech news.

📣 The News Grab Bag

Central banks hired more fintech staff in 2020 ◌ Add Crypto to the IndiaStack ◌ The NFT canon (according to A16Z) ◌ MFS Africa Now Reaches 320 Million Mobile Wallets ◌ The fintech uprising is coming ◌ The FTC shutters Beam ◌ Goldman Sachs is close to offering Bitcoin to its wealth management clients ◌ An overview of fintech in Poland ◌ MTN targets $5b for mobile money expansion ◌ Dwolla launches RTP solution in the US.

📈 Notable Funding Announcements

It was another massive week for financings in the world of fintech. In total, 38 funding rounds were announced, totaling $2b.

🏗️ Plaid Raises $425m Which Value The Company At ~$13b→

Last week Plaid announced a $425m Series D financing round led by the incredibly active late-stage fund, Altimeter Capital. Silver Lake and Ribbit Capital also participated in the round as did a range of existing investors, including A16Z, Index Ventures, Kleiner Perkins, Spark Capital, and Thrive Capital.

🤓 My Take: Imagine being one of the investors who pushed for Plaid to sell for measly $5b less than a year ago to Visa? Ouch.

I imagine it’s hard to say no to a $5b payday and the ability to return some serious capital to investors. Having said this, it’s clear that Plaid is really only getting started with their vision of “…creating a single, integrated platform focused on helping innovators build digital financial products.”

Luckily, the DoJ stepped in and fixed that error.

What’s most interesting about Plaid is just how much opportunity they still have in front of them. Everyone knows that they’ve built the most complete platforms when it comes to accessing bank account-level data in the US, but in many ways, this is just scratching the surface of what Plaid could be offering to its customers. In other markets, we’re already seeing some players in the open banking space go beyond being the “dumb pipes” for bank account data and offering deep enrichment services (see, for example, Tink’s Money Manager product), which are designed to make it easier for their customers to offer value-added service to their end customer through a single API call.

In some respects, Plaid seems to be taking a slightly different approach. Instead of going deep, they seem to be going wide and offering solutions in several different verticals (e.g. investments and the newly rolled out payroll). Inevitably, I’m certain they’ll look to go deep and offer enrichment options for each segment they're currently cover — providing the ability to tap data and do all the heavy lifting on insights in one neat API call.

Beyond data enrichment, the big play for Plaid is in payment initiation services (PIS). In the UK, they already offer PIS (as do Tink, Bud, and Truelayer, for that matter), but the ability to do that across their network in the US is where the real opportunity lies — and where the next massive valuation jumps will likely come from. As you may recall, this was one of the key arguments made by the DoJ in their action to stop the Visa acquisition. Specifically, the concern that Vise acquiring Plaid might impact competition in the market for payment services.

As I’ve noted in the previous issuer of FR, I’m still lukewarm on PIS. In spite of the promise it holds, its adoption still seems to be fairly flat in markets where it is available. However, just the sniff of the opportunity to be a new set of payment rails in the US (let alone the world) will be a key driver for Plaid as it now eyes off bigger opportunities in the emerging world of open finance.

Overall the independent route for Plaid seems to be still paved with gold, and I’m excited to see what they release next. In fact, I’m going to put it out there; I’m actually more bullish about Plaid than I’am about Stripe. There I said it, just don’t @ me.

🏦 Ramp Closes $115 million Series B Funding Round →

Last week, SME neo bank Ramp announced a $115m Series B round of funding. The fresh round of funding values the company at $1.6b. The latest round of funding was co-led by D1 Capital Partners and Stripe.

🤓 My Take: I’ve said it before, and I’ll say it again; the SME challenger banking segment is one of the best places to be building a company in fintech at the moment. If you’ve ever had to interact with an incumbent bank business banking product, you’ll know how bad it is — it’s actually consistently one of the worst experiences in the world of banking. Beyond this, it’s one of the rare segments in fintech where people will happily throw money at you to solve the problem.

According to the press release announcing the round, Ramp has been on a tear, with transactions volume growing by ~400% over the past 6 months and all while closing in on annualised transaction volumes of $1 billion. Not bad at all for a company that was founded in 2019.1

Interestingly, Stripe co-led the round. As I’ve noted in previous issues of FR, I don’t get Stripe’s investment strategy. In some respects, it’s arguable that they have a competing product in Stripe corporate cards. I assume that it isn’t, given Ramp took their money, but the value proposition looks really similar when you look at Ramp’s website and Stripe’s landing page for their corporate card product. My guess would be that Stripe is probably going to scuttle their corporate card experiment (which has been in beta for close to 2 years) and might instead focus on supporting the likes of Ramp.

☝️ Things You Should Know About

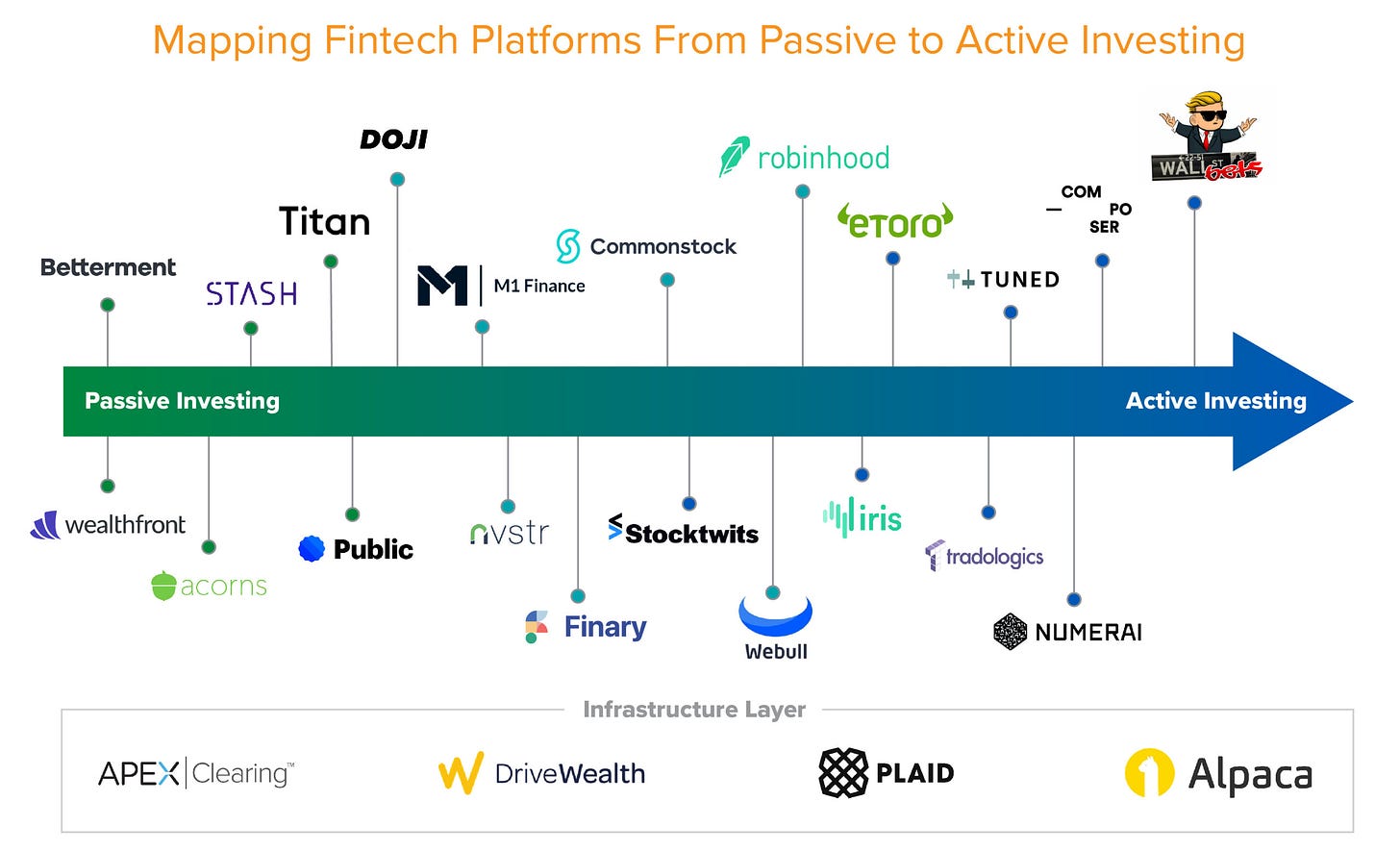

💎🙌 “Buy and Hold” No More: The Resurgence of Active Trading →

In September 2019, the great flippening finally happened in the world of investing. As the article notes, that was when passive equity funds overtook active investing for the first time. As most who have even a passing knowledge of portfolio theory know, a passive long-term approach that is pegged to an index is the winning strategy for accumulating long-term wealth.

However, over the last 18 months, we’ve seen active trading come roaring back. The narrative that’s developed around this trend has tended to centre around Robinhood, enabling a new generation of investors by offering free (and gamified) trading. I think it’s hard to argue that free trading hasn’t been a gamechanger, but as the post points out, there also seems to be a generational shift occurring with investing as Gen Z faces an uncertain path to financial progress.

It’ll be interesting to see where the market heads over the coming years and whether the lessons that many investors learnt after the last financial meltdown will be learnt again — but this time by a new generation.

👨⚕️ KeyBank and Laurel Road Launch Digital Bank for Doctors →

One of the major neo banking trends that has been bubbling up in most western markets is hyper verticalisation. In part, this is being driven by the need to differentiate in what’s quickly becoming a crowded market. Most new entrants are realising that being focused on a specific segment (in this case, doctors) is a great way to differentiate their offering. It also allows them to tailor their product to the ‘job to be done’ for their very specific customer base.2

In many ways, this is the promise of fintech — turning what was once a big box store-like experience into a hyper perosnalised and tailored financial experience for everyone. As the cost structure of running a neo bank continues to fall, I think we can expect to see this trend continue.

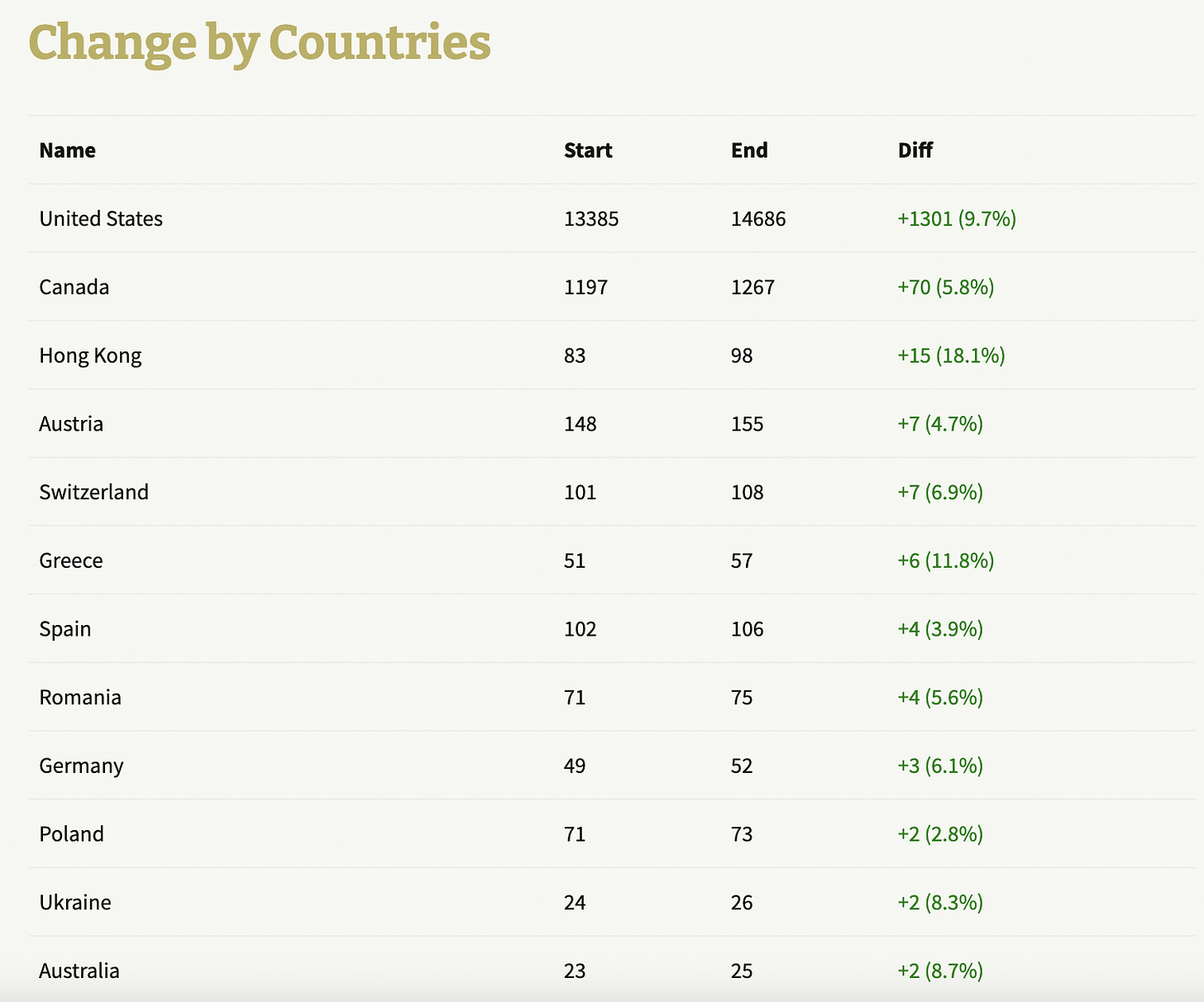

🏧 Bitcoin ATM Market Dynamics March 2021 →

According to Coin ATM Radar, there are 17,591 bitcoin ATMs globally, and the number of ATMs grew by 8.9% (net) in March. I have to say this data surprised me a little. I really didn’t think there’d be that many bitcoin ATMs globally, mainly because I can think of very few legal use cases for them. But here you have it, bitcoin ATMs are a (growing) thing.

If you’re interested, here is where ATM installs grew the fastest in March.

🎧 Podcast Recommendations

20VC: Revolut Founder Nikolay Storonsky → It’s fairly rare for Revolut’s enigmatic co-founder to make an appearance on a podcast, so that alone is a reason you should load this episode up for your next run. I particularly found it interesting to hear Nikolay talk about Revolut’s approach to global expansion and the patience they show in getting to market. It really feels that Revolut is playing the long game (all while moving extremely fast) as it plots its path to global domination.

Moov Founder Wade Arnold - Building for Developers at the Core of Fintech! → Moov is the poster child for the fintech infrastructure segment and has been able to secure the bag from some really notable investors along the way, including A16Z and Bain Capital Ventures. In this episode of the Wharton Fintech Podcast, Moov’s CEO chats all things fintech plumbing and also discusses why Moov went took an open-source approach to its product. This is a highly recommended listen.

❤️ Show Some Love For FR

📈 You can check out Radar, an open database of Australia's fintech ecosystem. You can find it here → 📡 SideFund Radar

📧 Feel free to reach out if you want to connect. I'm me@alantsen.com and @alantsen on the Twitters.

📸 As always, our cover image is provided by Death To Stock Photos. You should get your stock images from them too.

Ps. If you like what I'm doing with FR, please feel free to share it on your social disinformation network of choice. I'd also appreciate it if you forwarded this newsletter to a friend you think might enjoy it.

🙏 What did you think of this week's issue of FR?

I love it! ◌ I Like It ◌ Not Bad ◌ I Don’t Like It ◌It’s Awful

Also, I found this neat breakdown of why companies are choosing Ramp (posted by a member of Ramp’s growth team)